Table of Contents

ISC ACCOUNTS SEMESTER 1 EXAMINATION SPECIMEN QUESTION PAPER WITH SOLVED ANSWERS

ISC ACCOUNTS SEMESTER 1 EXAMINATION SPECIMEN QUESTION PAPER WITH SOLVED ANSWERS

SEMESTER 1 EXAMINATION SPECIMEN QUESTION PAPER

—————————————————————————————————————-

Maximum marks: 80

Time allowed: One and a half hours

(Candidates are allowed additional 15 minutes for only reading the paper)

All questions of Section A are compulsory.

All questions from either Section B or Section C are Compulsory.

Each correct answer carries 2 marks.

Select the correct option for each of the following questions.

————————————————————————————————————–

SECTION A

Answer all questions.

Question 1

Pick the odd one out from the following:

- Interest allowed on a loan taken by the firm from a partner

- Rent due to a partner of the firm for using his premises for business purposes

- Salary due to the manager of the firm

- Salary due to a partner of the firm

Answer: Salary due to a partner of the firm

Question 2

If the operating cycle of a company cannot be identified, it is assumed to be:

- 18 months

- 12 months

- 10 months

- 15 months

Answer: 12 months

Question 3

Which of the following is not shown as a Current Liability in the Balance Sheet of a company prepared as per Schedule III of the Companies Act, 2013?

- Trade Payable

- Short term Borrowings

- Deferred Tax Liabilities

- Short term Provisions

Answer: Deferred Tax Liabilities

Question 4

The Interest on Calls-in-arrears Account is closed by:

- Crediting it to Statement of Profit & Loss

- Crediting it to Profit & Loss Appropriation Account

- Debiting it to Profit & Loss Appropriation Account

- Debiting it to Statement of Profit & Loss

Answer: Crediting it to Statement of Profit & Loss

Question 5

The formula for valuing goodwill under the Capitalisation of Super Profits method is:

- Super profit made by the firm multiplied by the normal rate of return

- Capital Employed by the firm multiplied by the normal rate of return

- Capitalised profit of the firm divided by the rate of return

- Super profit made by the firm divided by the normal rate of return

Answer: Super profit made by the firm divided by the normal rate of return

ISC ACCOUNTS SEMESTER 1 EXAMINATION SPECIMEN QUESTION PAPER

Question 6

Ronaldo Ltd. forfeited 300 equity shares of ₹ 10 each, fully called up, on which ₹ 5 per share (including premium of ₹ 1 per share) was received. It later reissued these shares at a discount. The maximum discount per share, which the company could have given on their reissue would be:

- ₹ 6 per share

- ₹ 5 per share

- ₹ 4 per share

- ₹ 3 per share

Answer: ₹ 4 per share

Question 7

Veena and Soma are partners in a firm. They admit Sara on 1st April, 2020, for 1⁄4 share in the profits of the firm. Sara acquired her share as 1⁄12 from Veena and the remaining from Soma. The sacrificing ratio of the old partners will be:

- 11:12

- 1:1

- 1:2

- 1:11

Answer: 1:2

Question 8

Arif, Ravi and Ben are partners in a firm sharing profits and losses in the ratio of 6:4:1. Arif guaranteed a minimum profit of ₹ 16,000 to Ben. The trading profit of the firm for the year ending 31st March, 2021, was ₹ 1,32,000.Arifs share in the profits of the firm will be:

- ₹ 72,000

- ₹ 68,000

- ₹ 69,600

- ₹ 16,000

Answer: ₹ 68,000

Question 9

Simi, Manu, and Beena are partners in a firm sharing profits and losses in the ratio of 2:2:1. The balances of their fixed capital accounts on 1st April, 2020, were: Simi ₹ 1,00,000, Manu ₹ 1,00,000 and Beena ₹ 80,000 After the accounts for the year ended 31st March, 2021, were prepared, it was discovered that interest on capital @ 10% per annum had been credited to the partners’ current accounts even though it was not provided in the partnership deed.

The error in Simi’s capital account / current account will be rectified by:

- Debiting her capital account with ₹ 1,200

- Crediting her current account with ₹ 1,200

- Debiting her current account with ₹ 1,200

- Crediting her capital account with ₹ 1,200

Answer: Crediting her current account with ₹ 1,200

Fundamentals of partnership MCQs and Answer

ISC ACCOUNTS SEMESTER 1 EXAMINATION SPECIMEN QUESTION PAPER

Question 10

Runa and Ria were partners in a firm sharing profits and losses in the ratio of 3:1. On 1st April, 2020, Uday is admitted as a new partner in the firm for 3/8th share in the profits on various terms, one of them being his contribution of ₹ 42,000 as capital.

The new profit-sharing ratio amongst all the partners to be 3:2:3.

The capitals of Runa and Ria, after taking into account all the terms of admission were ₹ 61,625 and ₹ 25,375.

It is decided that the Capital Accounts of Runa and Ria be adjusted in the ratio of their respective share in the profits after admission, any surplus to be adjusted through the Current Account while any deficiency through the Cash Account. The surplus capital adjusted through current account will be:

- Ria’s debit capital balance of ₹ 2,625

- Runa’s credit capital balance of ₹ 2,625

- Ria’s debit capital balance of ₹ 19,625

- Runa’s credit capital balance of ₹ 19,625

Answer: Runa’s credit capital balance of ₹ 19,625

ISC ACCOUNTS SEMESTER 1 EXAMINATION SPECIMEN QUESTION PAPER WITH SOLVED ANSWERS

Question 11

On 1st April, 2020, Pixie, Nixie and Gypsy entered into a partnership with fixed capitals of ₹ 60,000, ₹ 50,000 and ₹ 30,000 respectively.

On 1st October, 2020, Pixie gave a loan of ₹ 12,000 to the firm.

The partnership deed contained the following clauses:

- Interest on drawings to be charged @ 4% per

- Pixie to be entitled to a rent of ₹ 2,000 per annum for allowing the firm to carry on the businessin his Nixie withdrew ₹ 1,000 at the end of the month for the first six months.

Net Profit of the firm for the year ending 31st March 2021 (before any interest but after rent on Pixie’s premises) was ₹ 1,21,000.

(A) The Net Profit of the firm will be:

- ₹ 1,21,000

- ₹ 1,20,640

- ₹ 1,18,640

- ₹ 96,640

Answer: ₹ 1,20,640

(B) Interest on Drawings charged from Nixie will be:

a. ₹ 340

b. ₹ 220

c. ₹170

d. ₹ 18·33

Answer: ₹170

Question 12

Dev, Gautam and Kamal were three partners sharing profits and losses in the ratio of 2:1:2. On 1st April, 2020, their capital account balances stood at ₹ 90,000, ₹ 80,000 and ₹ 20,000 (Dr) respectively.

On this date they admitted Naveen into the partnership with a capital of ₹ 50,000.

Naveen is to have 1⁄4 share of the profits with a guaranteed minimum share of distributable profit of ₹ 40,000.

The new profit-sharing ratio among the partners being Dev: Gautam: Kamal: Naveen = 6:2:7:5.

The profit of the firm for the year 2020-21 was ₹ 1,60,000 before the following adjustments were made:

- Interest on Capital @ 10% per annum to be allowed to the

- Interest on Drawings: Dev: ₹ 3,000; Kamal: ₹ 6,000.

- Salary to Partners: Gautam ₹ 7,000; Naveen: ₹ 10,000.

(A) The sacrificing ratio of Dev, Gautam and Kamal will be:

- 2:1:2

- 2:2:1

- 2: -2: 1

- 2: -1:2

Answer: 2:2:1

(B) The total interest on capital allowed by the firm to the partners will be:

- ₹ 22,000

- ₹ 23,000

- ₹ 21,400

- ₹ 23,100

Answer:₹ 22,000

(C) Deficiency in Naveen’s profits will be:

- ₹ 8,000

- ₹ 7,500

- ₹ 12,500

- ₹ 12,000

Answer: ₹ 7,500

Question 13

Ritesh and Somesh are partners in a firm sharing profits and losses equally. They admit Satvik on 1st April, 2021 for 1⁄5 share in the profits of the firm, future profit-sharing ratio between Ritesh and Somesh would be 3:2.At the time of reconstitution of a partnership firm, goodwill was valued at two years’ purchase of the average profits of the preceding four years which were as follows:

| Year | Profit / Loss | |

| 2017-18 | Profit ₹ 70,000 | (after debiting loss of stock by fire ₹ 15,000) |

| 2018-19 | Profit ₹ 50,000 | (including insurance claim of ₹ 5,000) |

| 2019-20 | Loss ₹ 40,000 | (after debiting voluntary retirement compensation paid

₹ 20,000) |

| 2020-21 | Profit ₹ 60,000 | (excluding insurance premium of ₹ 10,000 on insurance

of assets) |

(A) The average profits of the firm from the year 2017-18 to the year 2020-21 were:

- ₹ 30,000

- ₹ 60,000

- ₹ 37,500

- ₹ 40,000

Answer:₹ 40,000

(B) The value of goodwill of the firm on Satvik’s admission was:

- ₹ 60,000

- ₹ 80,000

- ₹ 75,000

- ₹ 1,20,000

Answer: ₹ 80,000

(B) Satvik is unable to bring in cash his share of goodwill. The account to be debited to record his goodwill compensation will be:

- Satvik’s Capital A/c

- Satvik’s Current A/c

- Premium for Goodwill A/c

- Old Partners’ Capital A/c

Answer: Satvik’s Current A/c

ISC ACCOUNTS 12 Fundamental of Partnership MCQs With solved Answers

ISC ACCOUNTS SEMESTER 1 EXAMINATION SPECIMEN QUESTION PAPER

Question 14

Dhruv and Ansh are partners in a firm sharing profits and losses: Dhruv 75% and Ansh 25%. Their Balance Sheet as at 31st March, 2021 is given below:

Balance Sheet of Dhruv and Ansh As at 31st March, 2021

| Liabilities | (₹) | Assets | (₹) |

| Sundry Creditors

Workmen Comp. Reserve Capital A/c: Dhruv 30,000 Ansh 20,000 |

49,000 5,000

50,000 |

Cash

Sundry Debtors 18,500 Less: Prov for Doubtful debts (1,500) Land and Building |

62,000

17,000 25,000 |

| 1,04,000 | 1,04,000 |

On 1st April 2021, Kavi is admitted as a new partner on the following terms:

- Land and building is found to be valued at 25% above It is decided to bring it to its cost.

- Bad debts amounting to ₹ 1,800 are to be written The remaining debtors are good.

- Creditors include an amount of ₹ 5,000 received as commission from The necessary adjustment is required to be made.

- The liability on Workmen Compensation Reserve is determined at ₹ 3,000.

- Kavi is to pay ₹ 15,000 to the existing partners as premium for Goodwill for 20% of the future profits of the He is also to bring in ₹ 25,000 as capital.

(A) At the time of Kavi’s admission, the Workmen Compensation Reserve of:

- ₹ 5,000 will be credited to the capital accounts of all the partners

- ₹ 3,000 will be credited to the capital accounts of all the partners

- ₹ 2,000 will be credited to the capital accounts of the old partners

- ₹ 2,000 will be debited to the capital accounts of the old partners

Answer: ₹ 2,000 will be credited to the capital accounts of the old partners

(B) The value of Land & Building in the Balance Sheet of the reconstituted firm will be:

- ₹ 20,000

- ₹ 31,250

- ₹ 5,000

- ₹ 6,250

Answer:₹ 20,000

(C) To adjust the creditors in adjustment (iii):

- Commission A/c will be credited with ₹ 5,000.

- Creditors A/c will be credited with ₹ 5,000.

- Amar’s A/c will be debited with ₹ 5,000.

- Creditors A/c will be debited with ₹ 5,000.

Answer: Creditors A/c will be debited with ₹ 5,000.

(D) The provision for doubtful debts in the reconstituted firm will be:

- ₹1,500

- ₹1,800

- Nil

- None of the above

Answer: Nil

(E) The date of the Balance Sheet of the reconstituted firm will be:

- Balance Sheet for the year ending 31st March,2022

- Balance Sheet as at 31stMarch,2021

- Balance Sheet for the year ending 1st April,2021

- Balance Sheet as at 1st April,2021

Answer: Balance Sheet as at 1st April,2021

Question 15

ABC Ltd. forfeited 4,000 shares of ₹ 10 each, fully called up, on which application money of ₹ 3 had been paid. Out of these 2,000 shares were re-issued as fully paid up. Upon their reissue, the company transferred ₹ 4,000 to capital reserve. The rate at which these shares were reissued were:

- ₹ 10 per share

- ₹ 4 per share

- ₹ 9 per share

- ₹ 8 per share

Answer: ₹ 9 per share

ISC ACCOUNTS SEMESTER 1 EXAMINATION SPECIMEN QUESTION PAPER

Question 16

Xylo Ltd. was formed on 1st April, 2018, with an authorized capital of ₹ 12,00,000 divided into equity shares of ₹ 10 each.

It invited applications for 30,000 shares to be issued at par, in the year of its formation, all of which were subscribed for and the amount due on them fully received.

On 1st April, 2020, the company issued another 60,000 shares at a premium of ₹ 2 per share to be received with allotment. It received applications for 55,000 shares which were duly allotted. All amounts due on the allotted shares was received except the final call of ₹ 2 per share on 1,000 shares. The company forfeited these shares and later reissued 800 of the forfeited shares @ ₹ 7 per share fully called up.

The Balance Sheet of the company was prepared as at 31st March, 2021, as per Schedule III of the Companies Act, 2013.

(A) The issued capital of the company to be shown in Notes to Accounts as at 31st March, 2021, under ‘Share Capital’ will be:

- ₹ 12,00,000

- ₹ 9,00,000

- ₹ 8,50,000

- ₹ 8,49,600

Answer: ₹ 9,00,000

(B) The subscribed shares of the company at the end of the year 2020-21 will be:

- 1,20,000

- 90,000

- 85,000

- 84,800

Answer:84,800

(C) The amount of Share Capital to be shown in the Balance Sheet of the company as at 31stMarch, 2021, will be:

- ₹ 12,00,000

- ₹ 9,00,000

- ₹ 8,50,000

- ₹ 8,49,600

Answer:₹ 8,49,600

(D) The net gain made by the company on reissue of the 800 shares will be transferred to:

- Reserve Capital Account

- Capital Reserve Account

- Securities Premium Reserve Account

- Statement of P/L

Answer: Capital Reserve Account

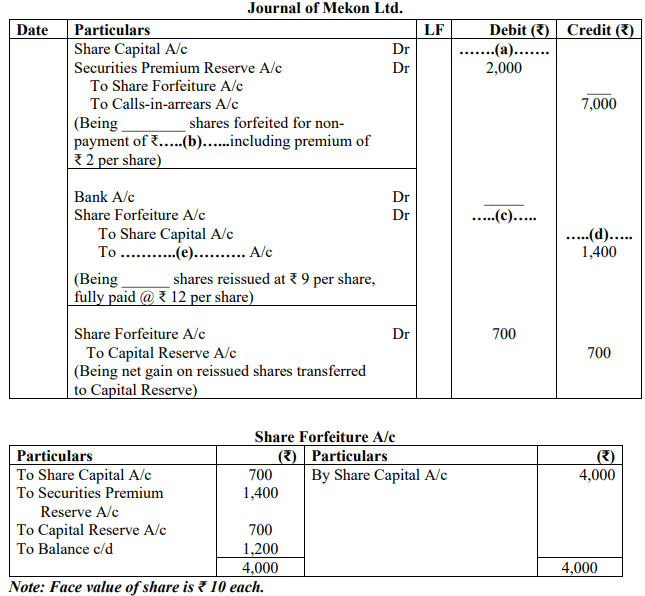

Question 17

(A) The Share Capital A/c was debited with:

- ₹ 10,000

- ₹ 9,000

- ₹ 12,000

- ₹ 7,000

Answer: ₹ 9,000

(B) The shares were forfeited for non-payment of:

- ₹ 10 per share

- ₹ 9 per share

- ₹ 12 per share

- ₹ 7 per share

Answer:₹ 7 per share

(C) At the time of reissue of shares, the Share Forfeiture A/c was debited with:

- ₹ 6,300

- ₹ 7,000

- ₹ 2,100

- ₹ 1,400

Answer:₹ 2,100

(D) At the time of reissue of shares, the Share Capital A/c was credited with:

- ₹ 6,300

- ₹ 7,000

- ₹ 2,100

- ₹ 1,400

Answer:₹ 7,000

(E) At the time of reissue of shares, the account credited with ₹ 1,400 was:

- Calls-in-arrears A/c

- Capital Reserve A/c

- Securities Premium Reserve A/c

- None of the above

Answer: Securities Premium Reserve A/c

ISC ACCOUNTS SHARES MCQs with solved Answers

ISC ACCOUNTS SEMESTER 1 EXAMINATION SPECIMEN QUESTION PAPER WITH SOLVED ANSWERS

SECTION B

Answer all questions.

Question 18

The net revenue from operations of Gama Ltd. is ₹ 14,00,000. Its Gross profit is ₹ 9,00,000;

Operating expenses are ₹ 75,000; Commission received is ₹ 5,000;

Profit from sale of fixed assets is ₹ 10,000.

The Operating Profit Ratio of Gama Ltd will be:

- 59·29%

- 58·29%

- 60%

- 58·93%

Answer:59·29%

Question 19

Which of the following four companies is not deriving the benefit of ‘trading on equity’?

- Mars Ltd., which has a Debt-Equity Ratio of 0·49:1

- Venus Ltd., which has a Debt-Equity Ratio of 1·54:1

- Saturn Ltd., which has a Debt-Equity Ratio of 1·62:1

- Pluto Ltd., which has a Debt-Equity Ratio of 2·32:1

Answer: Mars Ltd., which has a Debt-Equity Ratio of 0·49:1

Question 20

The particulars of Alpha Ltd are given below:

| Particulars | (₹) |

| Equity Share Capital | 2,00,000 |

| 5% Preference Share Capital | 60,000 |

| General Reserve | 1,20,000 |

| Fixed Assets | 5,05,000 |

| Current Assets | 1,20,000 |

| Current Liabilities | 40,000 |

| Loan @ 10% interest | 5,00,000 |

| Tax provided during the year | 30,000 |

| Profit for the current year after interest and tax (available for the shareholders) | 90,000 |

(A) The Interest Coverage Ratio of the company will be:

- 1·8 times

- 2·8 times

- 3·4 times

- 2·4 times

Answer: 3·4 times

(B) The Proprietary Ratio of the company will be:

- 0·47:1

- 0·75:1

- 0·61:1

- 0·38:1

Answer: 0·47:1

ISC ACCOUNTS SEMESTER 1 EXAMINATION SPECIMEN QUESTION PAPER

Question 21

From the given particulars of Zee Ltd., the Trade Receivables Turnover Ratio of the company will be:

| Particulars | (₹) |

| Revenue from Operations | 12,00,000 |

| Cash Revenue from Operations | 25% of Credit Revenue from Operations |

| Gross Debtors | 1,90,000 |

| Bills Receivable | 50,000 |

| Provision for Doubtful Debts | 10,000 |

- 3·75 times

- 4 times

- 4·17 times

- 8 times

Answer: 4 times

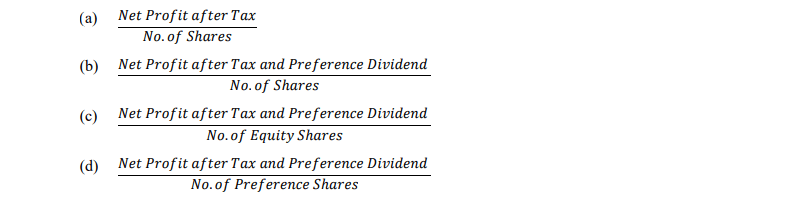

Question 22

The correct formula for computing Earning per share is:

Answer: 𝑁𝑒𝑡 𝑃𝑟𝑜𝑓𝑖𝑡 𝑎𝑓𝑡𝑒𝑟 𝑇𝑎𝑥 𝑎𝑛𝑑 𝑃𝑟𝑒𝑓𝑒𝑟𝑒𝑛𝑐𝑒 𝐷𝑖𝑣𝑖𝑑𝑒𝑛d/𝑁𝑜. 𝑜𝑓 𝐸𝑞𝑢𝑖𝑡𝑦 𝑆ℎ𝑎𝑟𝑒

Question 23

The Current Ratio of a company is 1·8:1 and its Quick Ratio is 1·6:1.

From the following transactions, pick out the transaction which involves an increase in both the Current Ratio and Quick Ratio:

- Goods worth ₹ 10,000 sold at a loss of ₹ 2,000.

- Insurance premium of ₹ 3,000 paid in Advance

- Plant and Machinery purchased for ₹ 9,000.

- Bills Payable of ₹ 2,000 honoured on the due date.

Answer: Bills Payable of ₹ 2,000 honoured on the due

ISC ACCOUNTS SEMESTER 1 EXAMINATION SPECIMEN QUESTION PAPER WITH SOLVED ANSWERS

ISC SEMESTER 1 EXAMINATION SPECIMEN QUESTION PAPER ACCOUNTS WITH SOLVED ANSWER

Concept of Goodwill MCQs with Solved answers 12

ISC ACCOUNTS SEMESTER 1 EXAMINATION SPECIMEN QUESTION PAPER

ISC ACCOUNTS 12 Interest On Capital MCQs with solved answers

ISC ACCOUNTS 12 shares MCQs with solved answers

ACCOUNTANCY Issue Of Shares MCQs With Solved Answers

Concept of Goodwill MCQs with Solved answers 12 ISC

Concept of Goodwill mcqs with Solved answers 12 cbse

ISC ACCOUNTS SEMESTER 1 EXAMINATION SPECIMEN QUESTION PAPER