Table of Contents

Accounting Treatment of Investment Fluctuation Reserve on the retirement of a partner

An Investment Fluctuation Reserve (IFR) is a financial provision created to absorb potential losses arising from fluctuations in the market value of investments. This helps prevent a decline in the entity’s net worth.Or

Investment Fluctuation reserve is created out of the firm’s profits to meet the fall in the market value of Investments.

*The difference between the book value and market value of the Investment (The market value of the investment is lower) is adjusted against the Investment Fluctuation reserve.

*Excess of Investment Fluctuation reserve is credited to all partner’s capital Accounts in their old profit-sharing ratio.

*The Investment Fluctuation reserves have a credit balance and appear in the liability side of the Balance Sheet and Investments will be shown on the assets side of the Balance Sheet.

At the time of retirement of a Partner, the accounting treatment of Investment Fluctuation reserve is as follows:-

There are three situations arise when such reserves appear in the Balance Sheet:

1. When the Investment made has a market value equal to book value:-

When the market value of investments is equal to the value of investments shown in the books, then there is no loss or gain on the valuation of the investment.

Hence, no adjustment for valuation shall be investment need to be made. Therefore, the Investment fluctuation reserve in the Balance Sheet should be treated as free reserves and shall be distributed among all partners in the old profit sharing.

Investment fluctuation reserve A/c Dr

To All Partner’s Capital/ Current A/c (in old ratio)

(Being the amount of Investment fluctuation reserve credited to all Partner’s Capital Accounts in their old profit sharing ratio)

2. When the market value of investments is less than the book value of such investment shown in Balance Sheet:-

When the market value of the investment made is less than the carrying value of the investment shown in the Balance Sheet, there is a loss on revaluation of such investment. Such losses will be adjusted against the investment fluctuation reserve.

a. When the loss on revaluation of investment is equal to the balance of Investment Fluctuation reserve shown in the Balance Sheet.

Investment fluctuation reserve A/c Dr.

To Investments A/c

(Being loss on revaluation of investment adjusted against Investment fluctuation reserve)

b. When the loss on revaluation of investment is less than the balance of Investment Fluctuation reserve shown in the Balance Sheet.

Investment fluctuation reserve A/c Dr.

To Investments A/c

To All Partner’s Capital/ Current A/c (in old ratio)

(Being loss on revaluation of investment adjusted against Investment fluctuation reserve and Balance credited to all partner’s capital/Current a/c)

c. When the loss on revaluation of investment is more than the balance of Investment Fluctuation reserve shown in the Balance Sheet.

Investment fluctuation reserve A/c Dr.

Revaluation A/c Dr.

To Investments A/c (in old ratio)

(Being loss on revaluation of investment adjusted against Investment fluctuation reserve and shortfall charged to revaluation Account)

All Partner’s Capital/ Current A/c Dr.

To Revaluation A/c

(Being loss on revaluation transferred to All partner’s capital/current account)

3. When the market value of investments is more than the book value of such investment shown in Balance Sheet:-

Investment fluctuation reserve A/c Dr.

To All Partner’s Capital/ Current A/c (in old ratio)

(Being the amount of Investment fluctuation reserve credited to All Partner’s Capital Accounts in their old profit sharing ratio)

Investment A/c Dr.

To Revaluation A/c

(Increase in the value of investment)

Revaluation A/c Dr.

To All Partner’s Capital/ Current A/c (in old ratio)

(Being Profit on revaluation transferred to All partner’s capital/current account)

ALSO READ : REVALUATION ACCOUNT/ PROFIT & LOSS ADJUSTMENT ACCOUNT

For Example- A, B, and c are partners as they share profits in the proportion of 3:2:1. As on 31st March Balance sheet shows an Investment fluctuation reserve of Rs 30,000 and an Investment of Rs. 50,000. On the same date, C is retired from the firm. Pass accounting Entries from the following cases-

- The market value of the Investment is Rs. 50,000.

- The market value of the Investment is Rs. 38,000.

- The market value of the Investment is Rs. 20,000.

- The market value of the Investment is Rs. 14,000.

- The market value of the Investment is Rs. 62,000.

1. Market value of Investment Rs. 50,000

The market value of investments is equal to the value of investments shown in the books, then there is no loss or gain on the valuation of the investment. In this case entire amount of Investment fluctuation reserve is distributed among the partners in their old ratio. The following entry will be made-

Investment fluctuation reserve A/c Dr 30,000

To A’s Capital A/c 15,000

To B’s Capital A/c 10,000

To C’s Capital A/c 5,000

(Being the amount of Investment fluctuation reserve credited to All Partner’s Capital Accounts in their old profit sharing ratio 3:2:1)

2. Market value of Investment Rs. 38,000.

Book value of Investment Rs. 50,000

Market value of Investment Rs. 38,000

Loss on revaluation of investment Rs. 12,000 adjusted against Investment fluctuation reserve and Balance of Investment fluctuation reserve credited to all Partner’s Capital Accounts in their old profit sharing ratio.

Investment fluctuation reserve A/c Dr. 30,000

To Investments A/c 12,000

To A’s Capital A/c 9,000

To B’s Capital A/c 6,000

To C’s Capital A/c 3,000

(Being loss on revaluation of investment adjusted against Investment fluctuation reserve and Balance credited to all partner’s capital/Current a/c in their old ratio 3:2:1)

3. Market value of Investment Rs. 20,000.

Book value of Investment Rs. 50,000

The market value of Investment Rs. 20,000

Loss on revaluation of investment Rs. 30,000 adjusted against Investment fluctuation reserve.

Investment fluctuation reserve A/c Dr. 30,000

To Investments A/c 30,000

(Being loss on revaluation of investment adjusted against Investment fluctuation reserve.)

4. Market value of Investment Rs. 14,000.

Book value of Investment Rs. 50,000

The market value of Investment Rs. 14,000

Loss on revaluation of investment Rs. 36,000.

Rs. 30,000 was adjusted against the investment fluctuation reserve and shortfall, and Rs. 6,000 was charged to the revaluation account.

Investment fluctuation reserve A/c Dr. 30,000

Revaluation A/c Dr. 6,000

To Investments A/c 36,000

(Being loss on revaluation of investment adjusted against Investment fluctuation reserve and shortfall charged to revaluation Account)

A’s Capital A/c Dr. 3,000

B’s Capital A/c Dr. 2,000

C’s Capital A/c Dr. 1,000

To Revaluation A/c 6,000

(Being loss on revaluation transferred to all partner’s capital/current account in their old ratio 3:2:1)

5. Market value of Investment Rs. 62,000.

Book value of Investment Rs. 50,000

Market value of Investment Rs. 62,000

Profit on revaluation of investment Rs. 12,000 credited to the revaluation Account and the entire amount of the Investment fluctuation reserve was distributed among all the partners in their old ratio.

Investment fluctuation reserve A/c Dr 30,000

To A’s Capital A/c 15,000

To B’s Capital A/c 10,000

To C’s Capital A/c 5,000

(Being the amount of Investment fluctuation reserve credited to all Partner’s Capital Accounts in their old profit sharing ratio 3:2:1)

Investment A/c Dr. 12,000

To Revaluation A/c 12,000

(Profit on revaluation of investment Rs. 12,000 credited to revaluation Account)

Revaluation A/c Dr. 12,000

To A’s Capital A/c 6,000

To B’s Capital A/c 4,000

To C’s Capital A/c 2,000

(Being profit on revaluation transferred to all partner’s capital/current account in their old ratio 3:2:1)

Question For Practice

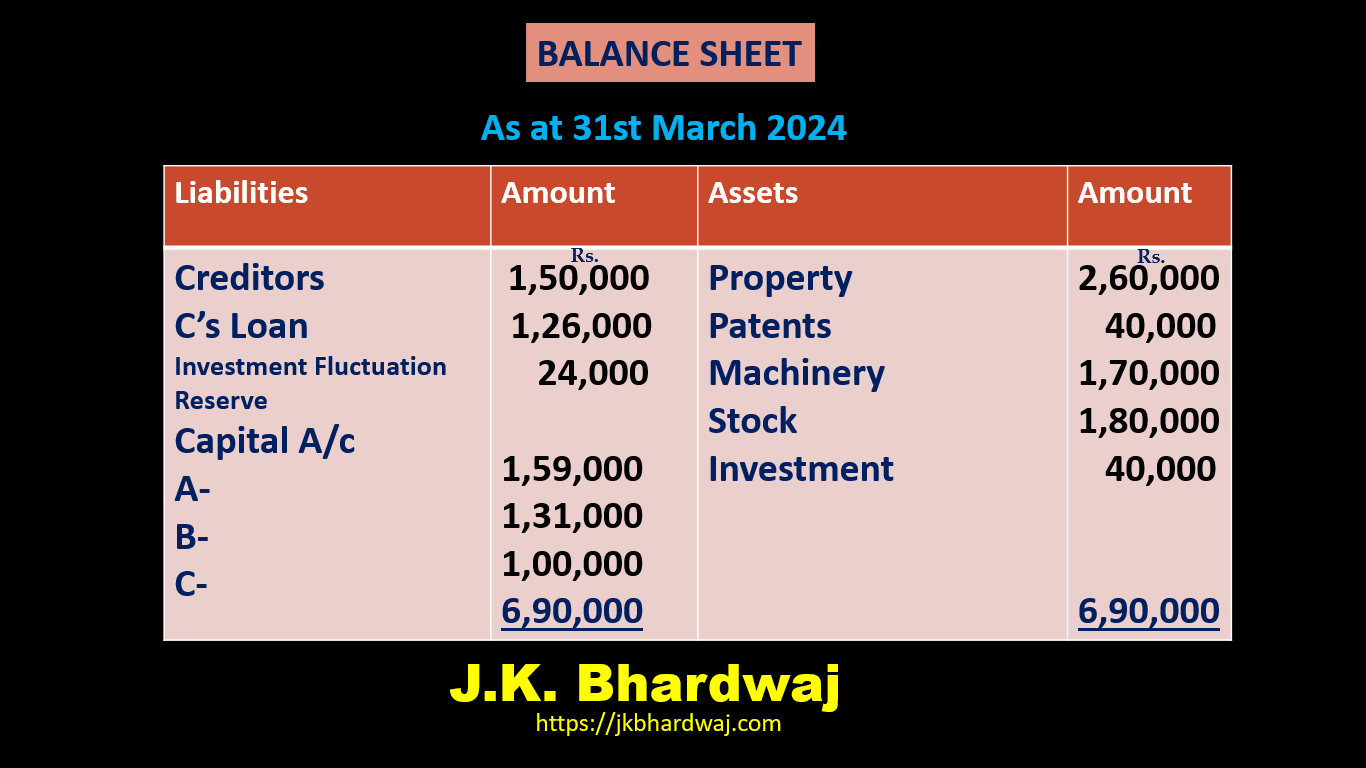

A, B, and C were partners sharing profits and losses in the ratio of 5:3:2. On 31st March 2024 their Balance Sheet was as under:

On 1st April 2024, C is retired from the firm. Pass accounting Entries from the following cases-

- The market value of the Investment is Rs. 40,000.

- The market value of the Investment is Rs. 25,000.

- The market value of the Investment is Rs. 16,000.

- The market value of the Investment is Rs. 10,000.

- The market value of the Investment is Rs. 50,000.

ISC 12 Admission of partner questions (previous papers)

Hidden Goodwill at the time of Retirement of A Partner

ALSO READ : ACCOUNTING TREATMENT OF GOODWILL AT THE TIME OF ADMISSION OF A NEW PARTNER