ISC 12 Admission of partner questions (previous papers)

ISC 12 Admission of partner questions (previous papers)

Questions 1.

Benu and Leena are partners in a firm sharing profits and losses in the ratio of 5:3. They admit Deepa and Erica as two new partners.

The new profit-sharing ratio is decided to be 3:2:2:3.

Both the new partners introduce ₹ 1,00,000 each as capital.

Deepa pays 40,000 in cash for her share of goodwill but Erica is unable to contribute any amount for her share of goodwill.

At the time of Deepa’s and Erica’s admission, the firm had an Advertisement Suspense Account of 56,000 which is written off.

You are required to pass necessary journal entries to record the above adjustments at the time of admission of Deepa and Erica. (ISC 2023)

ISC 12 Admission of partner questions (previous papers)

Questions 2.

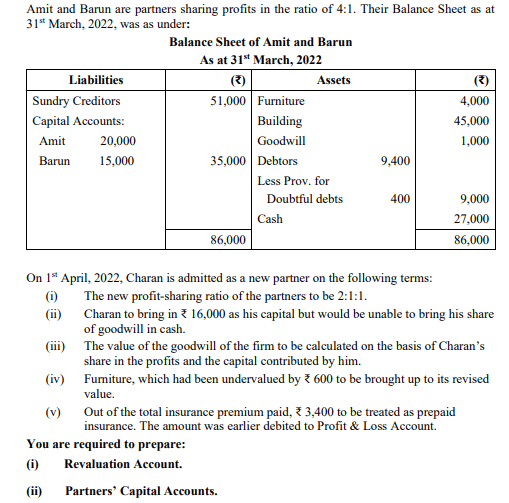

(ISC 2023)

ISC 12 Admission of partner questions (previous papers)

Questions 3.

Veena and Soma are partners in a firm. They admit Sara on 1st April, 2022, for 1/4 share in

the profits of the firm.

On an average, the profits earned by Veena and Soma are ₹ 21,000. The average capital

employed by the firm is ₹ 1,50,000.

The normal rate of return in the industry is 10%.

It is decided to value goodwill on the basis of four years’ purchase of profits in excess of

profits @ 10% on the money invested.

You are required to:

(i) Calculate the goodwill of the firm.

(ii) Pass the journal entries in the books of the firm if Sara brings into the firm her

share of goodwill in cash. (ISC specimen paper 2023)

ISC 12 Admission of partner questions (previous papers)

Questions 4.

(ISC specimen paper 2023)

ISC 12 Admission of partner questions (previous papers)

ISC 12 fundamentals of partnership questions (previous papers)

ISC 12 Admission of partner questions (previous papers)

Questions 5.

Karan and Vijay are partners in a firm sharing profits and losses in the ratio of 4:3. They

admit Shrey for 𝟏/3 share in the profits.

On the date of Shrey’s admission:

(a) The capitals of Karan and Vijay are: ₹ 40,000 and ₹ 30,000 respectively.

(b) Profit and Loss Account has a debit balance of ₹ 7,000.

(c) General Reserve shows a balance of ₹ 21,000 which is not to be disturbed.

(d) Goodwill of the firm is valued at ₹ 42,000.

(e) The cash at bank is ₹ 15,000.

(f) Shrey brings in proportionate capital and his share of goodwill in cash.

You are required to prepare:

(i) Partners’ Capital Accounts.

(ii) Cash at Bank Account of the reconstituted firm on the date of Shrey’s admission. (ISC specimen paper 2023)

ISC 12 Admission of partner questions (previous papers)

Questions 6.

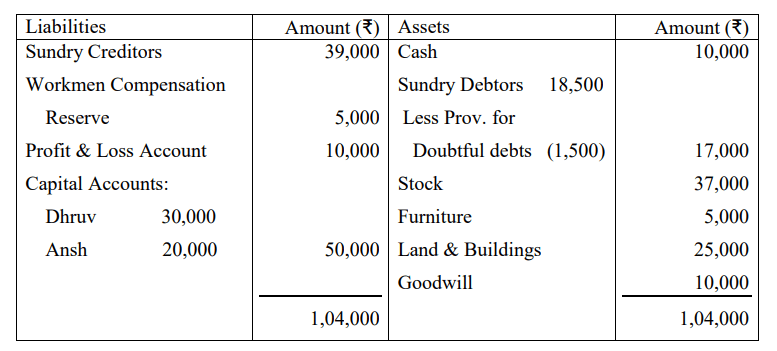

Dhruv and Ansh are partners in a firm sharing profits and losses: Dhruv 75% and Ansh 25%

respectively.

Their Balance Sheet as at 31st March, 2016 is given below:

On 1st April, 2016, Kavi is admitted as a new partner on the following terms:

(i) The value of stock is to be increased to ₹ 42,000.

(ii) Land and building is to be reduced by 20%.

(iii) Bad debts amounting to ₹ 1,800 are to be written off.

(iv) Creditors include an amount of ₹ 5,000 received as commission from Amar. The

necessary adjustment is required to be made.

(v) The liability on Workmen Compensation Reserve is determined at ₹ 3,000.

(vi) Kavi is to pay ₹ 15,000 to the existing partners as premium for Goodwill for 20% of the

future profits of the firm. He is also to bring in capital equal to 1/4th of the combined

capitals of Dhruv and Ansh.

You are required to:

(i) Pass journal entries on the date of Kavi’s admission.

(ii) Prepare the opening Balance sheet of the new firm on the completion of the

transactions. [ISC SPECIMEN QUESTION PAPER – 2017]

ISC 12 Admission of partner questions (previous papers)

Hidden Goodwill at the time of Admission of A New Partner

Questions 7.

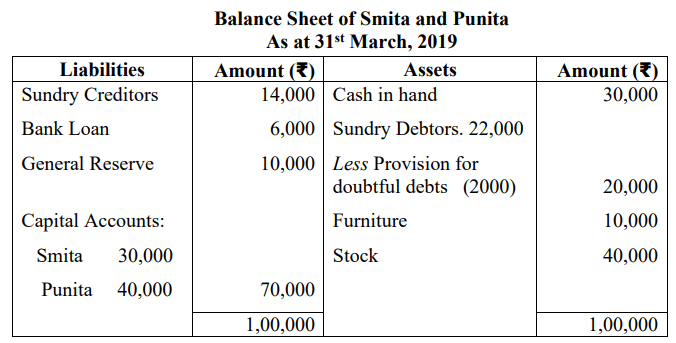

Smita and Punita are partners in a firm sharing profits and losses in the ratio of 3:2.

Their Balance Sheet as at 31st March, 2019, is as follows:

On 1st April, 2019, Mita is admitted as a new partner on the following terms:

(a) The new profit sharing ratio of Smita, Punita and Mita to be 5:3:2.

(b) Provision for doubtful debts to be raised to 10% of the debtors.

(c) Punita to take over the firm’s investments (not recorded in the books) at ₹ 3,000.

(d) Goodwill of the firm to be valued at ₹ 50,000. Mita to bring in cash for her share

of goodwill.

(e) 50% of the goodwill is to be withdrawn by the old partners.

(f) Mita to pay off the Bank Loan on behalf of the firm. The amount due to her by

the firm is to be considered as part of her capital contribution.

(g) Mita to bring in the balance of her capital in cash, so as to make her capital equal

to 1/5th of the total capital of the firm.

You are required to:

(i) Pass journal entries at the time of Mita’s admission.

(ii) Prepare the Balance Sheet of the reconstituted firm. (ISC 2020)

ISC 12 Admission of partner questions (previous papers)

Important questions of fundamentals of partnership-5

Questions 8.

Aditi and Parul are partners in a firm with capitals of ₹ 35,000 each. They

shared profits and losses in the ratio of 3:1.

On 1st April, 2017, they admit Chanda into their partnership with 1/5th share in the profits.

Chanda brings in ₹ 40,000 as her capital and her share of goodwill in cash.

Her share of goodwill is calculated on the basis of her capital contribution and her share of profits in the firm.

At the time of Chanda’s admission:

(a) The firm had a Workman Compensation Reserve of ₹ 60,000 against

which there was a claim of ₹ 20,000.

(b) Creditors of ₹ 8,000 were paid by Aditi privately for which she is not to

be reimbursed.

(c) There was no change in the value of other assets and liabilities.

You are required to, on the date of Chanda’s admission:

(i) Calculate the goodwill of the firm. (Show the workings clearly).

(ii) Pass the necessary journal entries to record the above transactions.(ISC 2019)

ISC 12 Admission of partner questions (previous papers)

Admission of a partner-Important Questions-1

Questions 9.

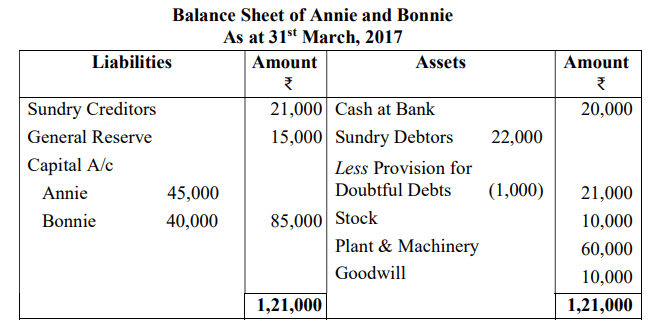

Annie and Bonnie are partners in a firm, sharing profits and losses equally. Their

Balance Sheet as at 31st March, 2017, was as follows:

Carl was to be taken as a partner for 1/4 share in the profits of the firm, with effect

from 1st April, 2017, on the following terms:

(a) Bad debts amounting to ₹ 1,500 to be written off.

(b) Stock to be taken over by Annie at ₹ 12,000.

(c) Plant and Machinery to be valued at ₹ 50,000.

(d) Goodwill of the firm to be valued at ₹ 20,000.

(e) Carl to bring in ₹ 50,000 as his capital. He was unable to bring in cash, his share

of goodwill.

(f) General Reserve not to be distributed. For this, it was decided that Carl would

compensate the old partners through his current account.

You are required to:

(i) Pass journal entries on the date of Carl’s admission.

(ii) Prepare the Balance Sheet of the reconstituted firm.(ISC 2017)

ISC 12 Admission of partner questions (previous papers)