Hidden Goodwill at the Time of Retirement of A Partner

Hidden Goodwill?

When a partner retires from a firm and the value of goodwill is not explicitly provided or mentioned,

it is referred to as hidden or inferred goodwill.

Or

At the time of retirement of a partner, when the value of goodwill is not given or mentioned, it is called hidden or inferred goodwill.

At the time of retirement of the partner, the excess of the amount paid to the concerned retiring partner to the amount due to him is the hidden goodwill of his share in the firm’s goodwill.

Amount due to him/her is the adjusted capital, i.e. capital, revaluation of assets and reassessment of liabilities, share in reserves, undistributed profit, accumulated loss, etc.

The remaining partner decides and agrees to pay the retiring partner in full settlement of his/her claim in excess including his share in goodwill of the firm without specifically mentioning the amount as his goodwill share.

This is done either as a way of appreciation for his work and dedication to the firm or as a treatment of goodwill in a hidden form.

Calculation of Hidden Goodwill:

Hidden Goodwill = Amount agreed to pay the retiring partner in full settlement – Adjusted capital of retiring partner (after adjustment of reserves, undistributed profit, accumulated loss, and Gain or Loss on Revaluation and Reassessment of liabilities)

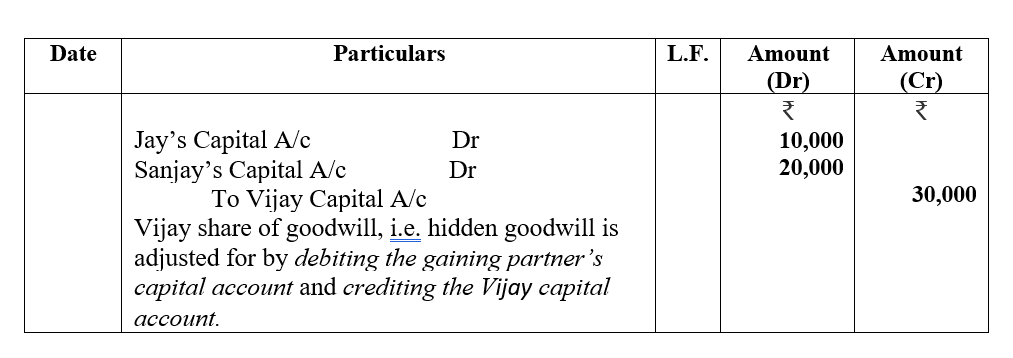

Retiring partner’s share of goodwill, i.e. hidden goodwill is accounted for by debiting the gaining partner’s capital account and crediting the retiring partner’s capital account.

Note: The amount of hidden goodwill equals the goodwill of the retiring partner.

Example:

Jay, Vijay, and Sanjay are partners in the firm sharing profit and loss in the ratio of 5:3:2. Vijay retires, and his capital stood at ₹3,70,000, after adjustments related to reserves, undistributed profits, and profit on revaluation.

Jay and Sanjay agreed to pay Vijay ₹4,00,000 in full settlement of Vijay’s claim. Jay and Sanjay agree to share the profits in the future in the ratio of 6:4. Pass the necessary journal entry.

Solution:

The old Ratio of Jay, Vijay, and Sanjay is 5:3:2

The new Ratio of Jay, and Sanjay is 6:4

Gaining Ratio = New Ratio – Old Ratio

Jay’s Gaining Ratio = 6/10-5/10 = 1/10

Sanjay’s Gaining Ratio = 4/10-2/10=2/10

Gaining Ratio = 1:2

Hidden Goodwill = Amount agreed to pay the retiring partner in full settlement – Adjusted capital of retiring partner (after adjustment of reserves, undistributed profit, accumulated loss, and Gain or Loss on Revaluation and Reassessment of liabilities)

Hidden Goodwill = ₹4,00,000 – ₹3,70,000

Hidden Goodwill = ₹30,000 (Vijay Share)

Note: The retiring partner’s share in goodwill, i.e., hidden goodwill, is accounted for by debiting the gaining partner’s capital account and crediting the retiring partner’s capital account.

JOURNAL ENTRY

Hidden Goodwill at the time of Admission of A New Partner

Questions For Practice:

1. A, B, and C are partners in the firm sharing profit and loss in the ratio of 3:2:1. C retires, and his capital stood at ₹4,75,000, after adjustments related to reserves, undistributed profits, and profit on revaluation.

A and B decided and agreed to pay him ₹5,35,000 in full settlement of C’s claim. Pass the necessary journal entry for Hidden Goodwill.

Hidden Goodwill: ₹5,35,000 – ₹4,75,000 = ₹60,000

The old Ratio of A, B, and C is 3:2:1

C retires from the firm

The new Ratio of A and B is 3:2

Gaining Ratio = New Ratio – Old Ratio

A’s Gaining Ratio = 3/5-3/6 = 3/30

B’s Gaining Ratio = 2/5-2/6=2/30

Gaining Ratio = 3:2

A’s Capital A/c Dr 36,000

B’s Capital A/c Dr 24,000

To C’s Capital A/c 60,000

C’s share of goodwill, i.e. hidden goodwill is adjusted for by debiting the gaining partner’s capital account and crediting the C’s capital account.

Important questions of fundamentals of partnership-5

2. A, B, and C are partners in the firm sharing profit and loss in the ratio of 3:2:1. C retires, and his capital stood at ₹2,80,000, after adjustments related to reserves, undistributed profits, and profit on revaluation.

A and B decided and agreed to pay him ₹3,00,000 in full settlement of C’s claim. A and B agree to share the profits in the future in the ratio of 1:1 Pass the necessary journal entry for Hidden Goodwill.

Hidden Goodwill: ₹20,000

B’s Capital A/c Dr 20,000

To C’s Capital A/c 20,000

C’s share of goodwill, i.e. hidden goodwill is adjusted for by debiting the gaining partner’s capital account and crediting the C’s capital account.

3. A, B, and C are partners in the firm sharing profit and loss in the ratio of 3:2:1. C retires, and his capital stood at ₹4,10,000, after adjustments related to reserves, undistributed profits, and profit on revaluation.

A and B decided and agreed to pay him ₹4,50,000 in full settlement of C’s claim. A and B agree to share the profits in the future in the ratio of 1:1 Pass the necessary journal entry for Hidden Goodwill.

4. A, B and Care partners sharing profits in the ratio of 1:2:3 C retires and his capital after making adjustments for reserves and profit on revaluation stands at Rs 2,40,000.A and B agreed to pay him 3,00,000 in full settlement of his claim. Record necessary journal entry for the treatment of goodwill if the new profit sharing is decided at 1:3.

Admission of a partner-Important Questions-1