Table of Contents

Issue of Debentures for Consideration other than Cash

Issue of Debentures for Consideration other than Cash?

Sometimes a company purchases assets from vendors (on Credit) and instead of making

payment in cash issues debentures for consideration thereof. Such issue of

debentures is called debentures issued for consideration other than cash.

Example: Suppose a company wants to acquire a piece of land on credit. Instead of paying cash, it can issue debentures to the landowner, it is said to be the issue of debentures for consideration other than cash.

In that case, the debentures may be issued at par, at a premium, or at a discount.

Accounting Entries In The Books Of Company:

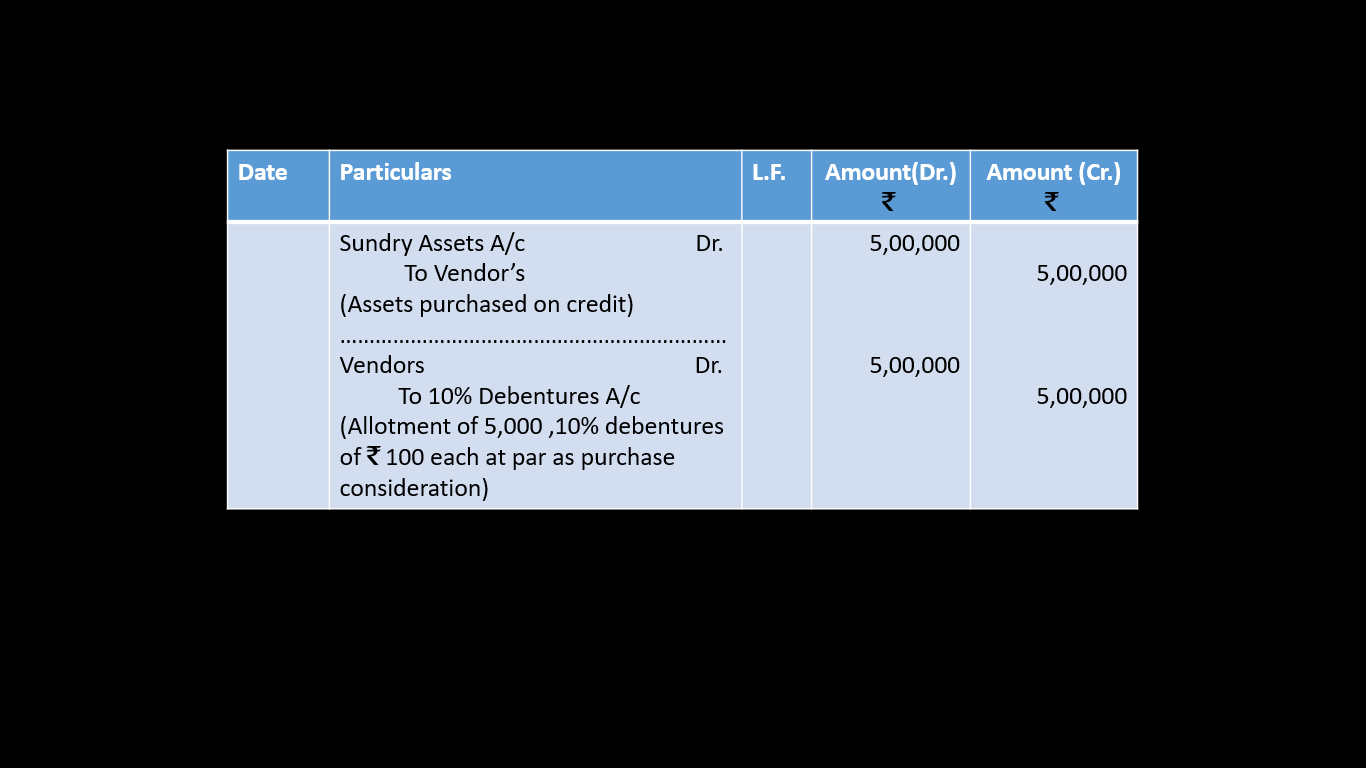

1. For purchase of assets on credit

Sundry Assets A/c Dr.

To Vendor’s

(Assets purchased on credit)

2. On the issue of debentures

(a) When Debentures Issued At par

Vendors Dr.

To Debentures A/c

(Allotment of debentures at par as purchase consideration)

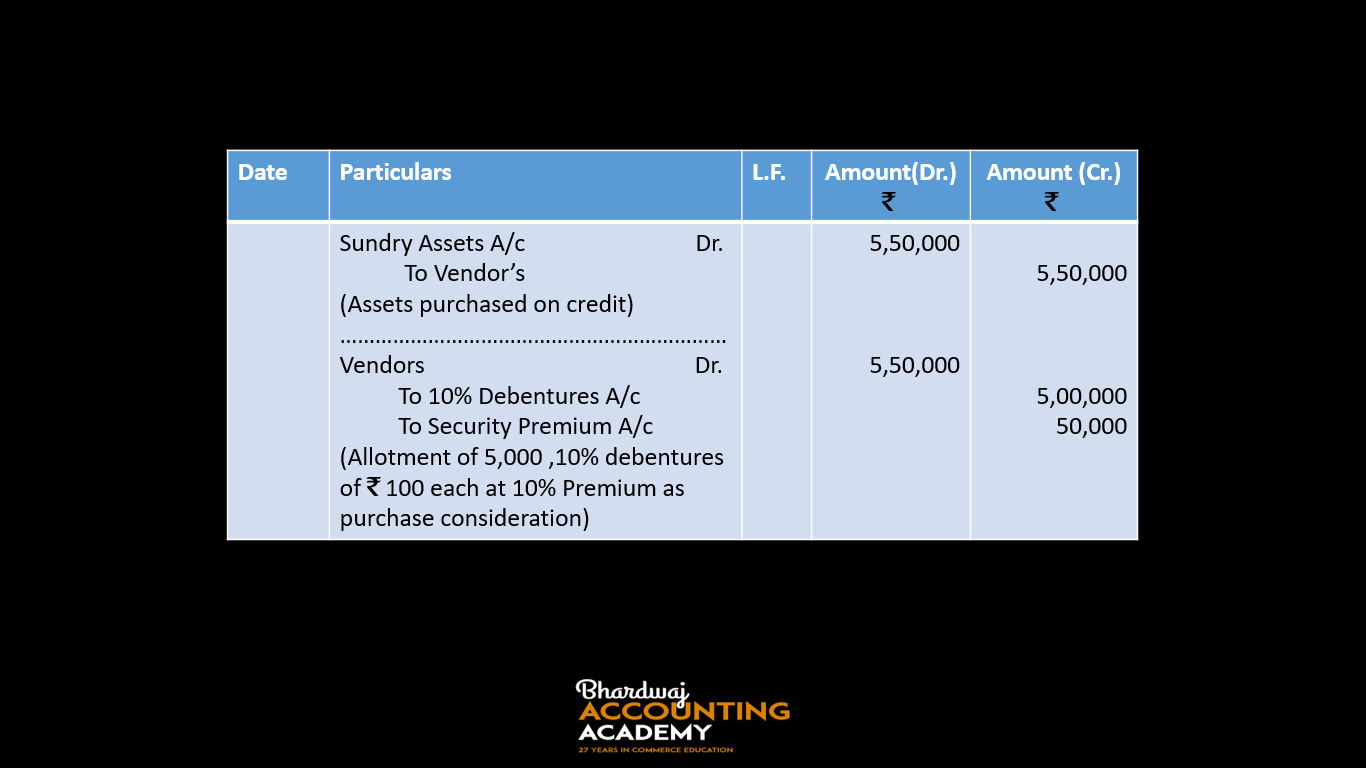

(b) When Debentures Issued At Premium

Vendors Dr.

To Debentures A/c

To Securities Premium A/c

(Allotment of debentures at a premium as purchase consideration)

(c) When Debentures Issued At a discount

Vendors Dr.

Discount on Issue of Debenture A/c Dr.

To Debentures A/c

(Allotment of debentures at a discount as purchase consideration)

Mohit Company Limited purchased assets of the book value of Rs 5,00,000 from another company and agreed to make the payment of purchase consideration by issuing 5,000, 10% debentures of Rs 100 each. Record the necessary journal entries.

In The Books Of Mohit Company Limited

Rachit Company Limited purchased assets of the book value of Rs 5,50,000 from another

company and agreed to make the payment of purchase consideration by issuing

5,000, 10% debentures of Rs 100 each at a premium of 10%.

Record necessary journal entries.

In The Books Of Rachit Company Limited

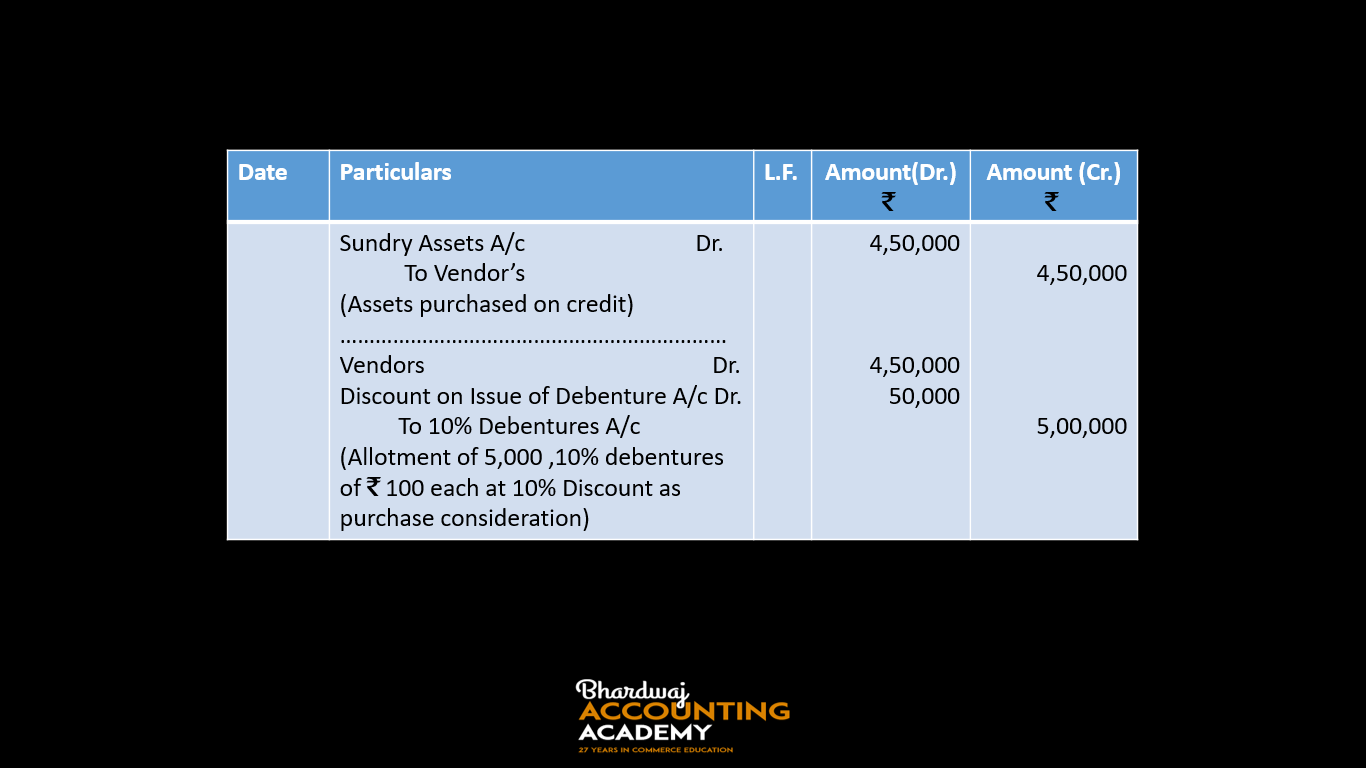

Sarita Company Limited purchased assets of the value of Rs 4,50,000 from another company and agreed to make the payment of purchase consideration by issuing 5,000, 10% debentures of Rs 100 each at a discount of 10 %. Record necessary journal entries.

In The Books Of Sarita Company Limited

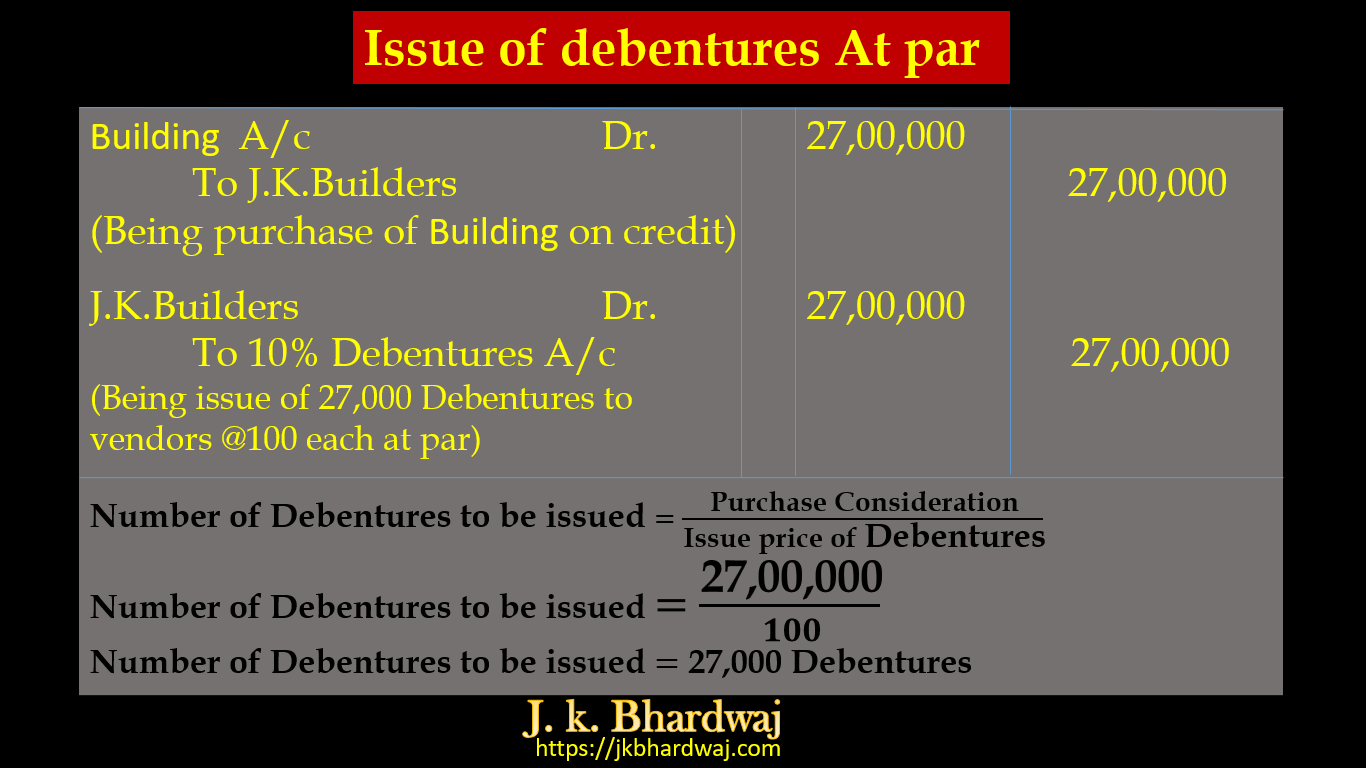

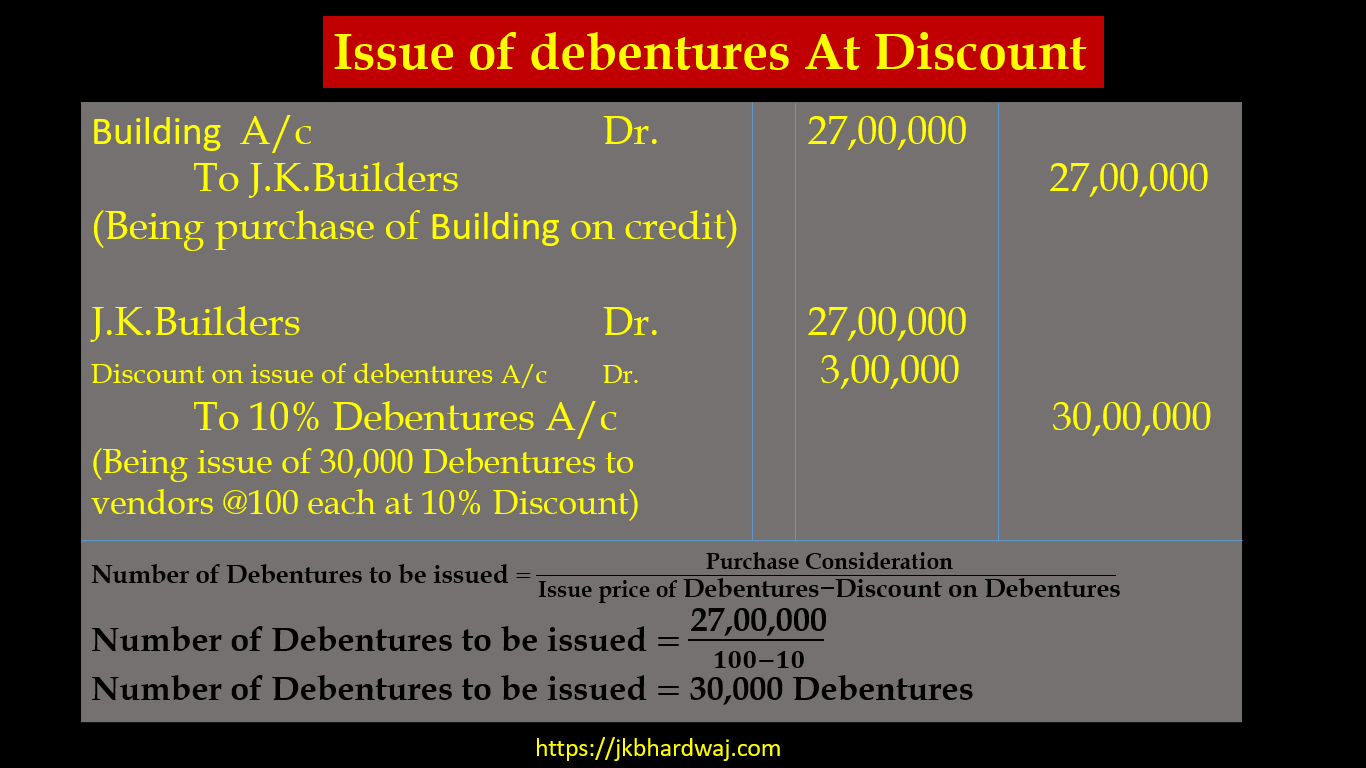

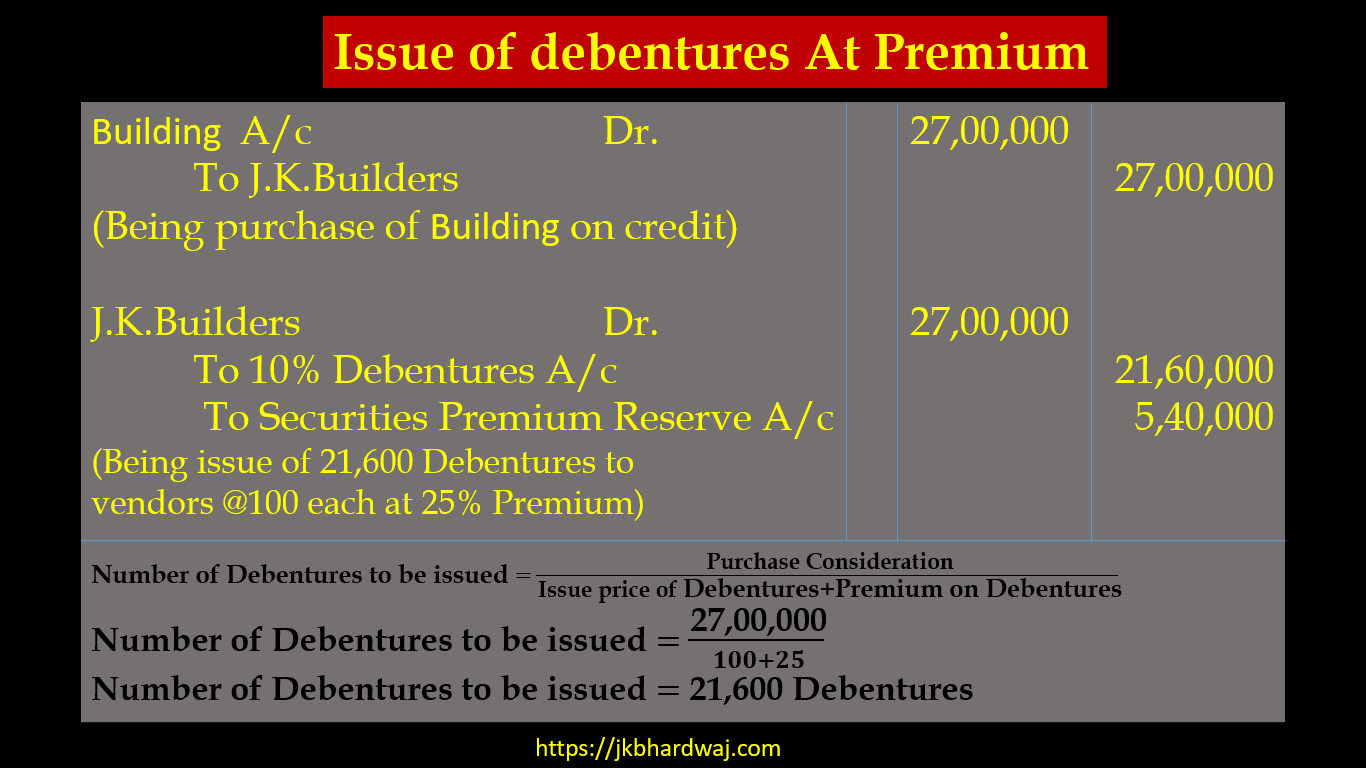

The Hindustan Limited purchased Building on credit from J. k. Builders Rs. 27,00,000 and issued 10% Debentures of Rs. 100 each as purchase consideration . pass Journal Entries form the following cases –

(a)If debentures issued at par.

(b)If debentures issued at 10% Discount.

(c)If debentures issued at 25% Premium.

(a)If debentures issued at par:

(b)If debentures issued at 10% Discount:

(c)If debentures issued at 25% Premium:

Sometimes a company may purchase the assets as well as take over its liabilities of another concern. It happens usually in the case of the purchase of the whole business of the other concern.

On Purchase of Whole Business:

*In such a situation, the purchase consideration will be equal to the value of net assets (Assets – Liabilities) taken over, and if the whole amount of the consideration is paid by issue of debentures, the journal entry will be:

Sundry Assets A/c Dr.

To Sundry Liabilities A/c

To Vendors A/c

(Purchase of the Vendors’ business)

*In such a situation, the purchase consideration will be more than the value of net assets (Assets – Liabilities) taken over, and if the whole amount of the consideration is paid by issue of debentures, the journal entry will be:

Sundry Assets A/c Dr.

*Goodwill A/c Dr.

To Sundry Liabilities A/c

To Vendors A/c

(Purchase of the Vendors’ business)

* Goodwill = purchase consideration – value of net assets

*In such a situation, the purchase consideration will be Less than the value of net assets (Assets – Liabilities) taken over, and if the whole amount of the consideration is paid by issue of debentures, the journal entry will be:

Sundry Assets A/c Dr.

To Sundry Liabilities A/c

To Vendors A/c

*To Capital Reserve A/c

(Purchase of the Vendors’ business)

* Capital Reserve = value of net assets- purchase consideration

On the issue of debentures

(a) When Debentures Issued At par

Vendors Dr.

To Debentures A/c

(Allotment of debentures at par as purchase consideration)

(b) When Debentures Issued At Premium

Vendors Dr.

To Debentures A/c

To Securities Premium A/c

(Allotment of debentures at a premium as purchase consideration)

(c) When Debentures Issued At a discount

Vendors Dr.

Discount on Issue of Debenture A/c Dr.

To Debentures A/c

(Allotment of debentures at a discount as purchase consideration)

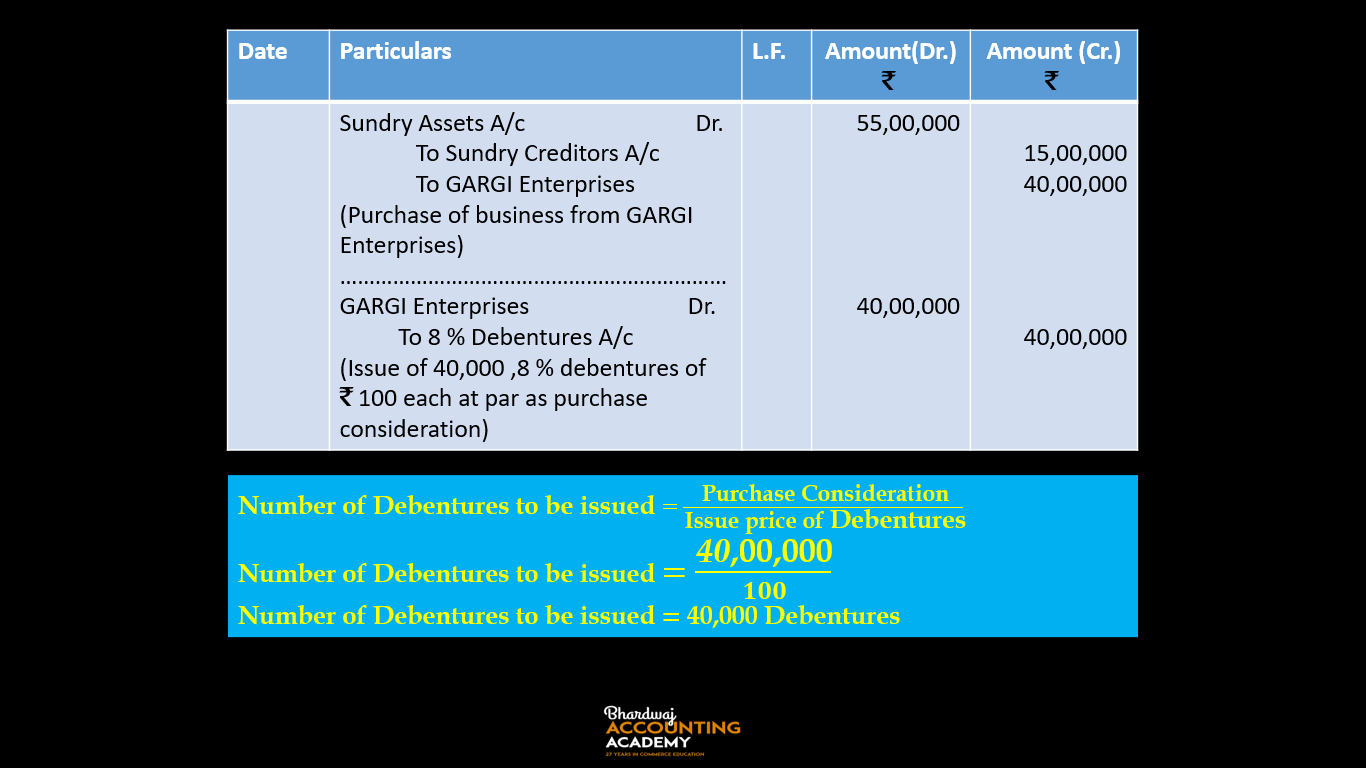

SNEHA Ltd. acquired assets of Rs 55,00,000 and took over creditors of Rs 15,00,000 from GARGI Enterprises. purchase consideration Rs. 40,00,000. SNEHA Ltd. issued 8% debentures of Rs 100 each at par as purchase consideration. Record necessary journal entries in the books of SNEHA Ltd.

Journal entries in the books of SNEHA Ltd:

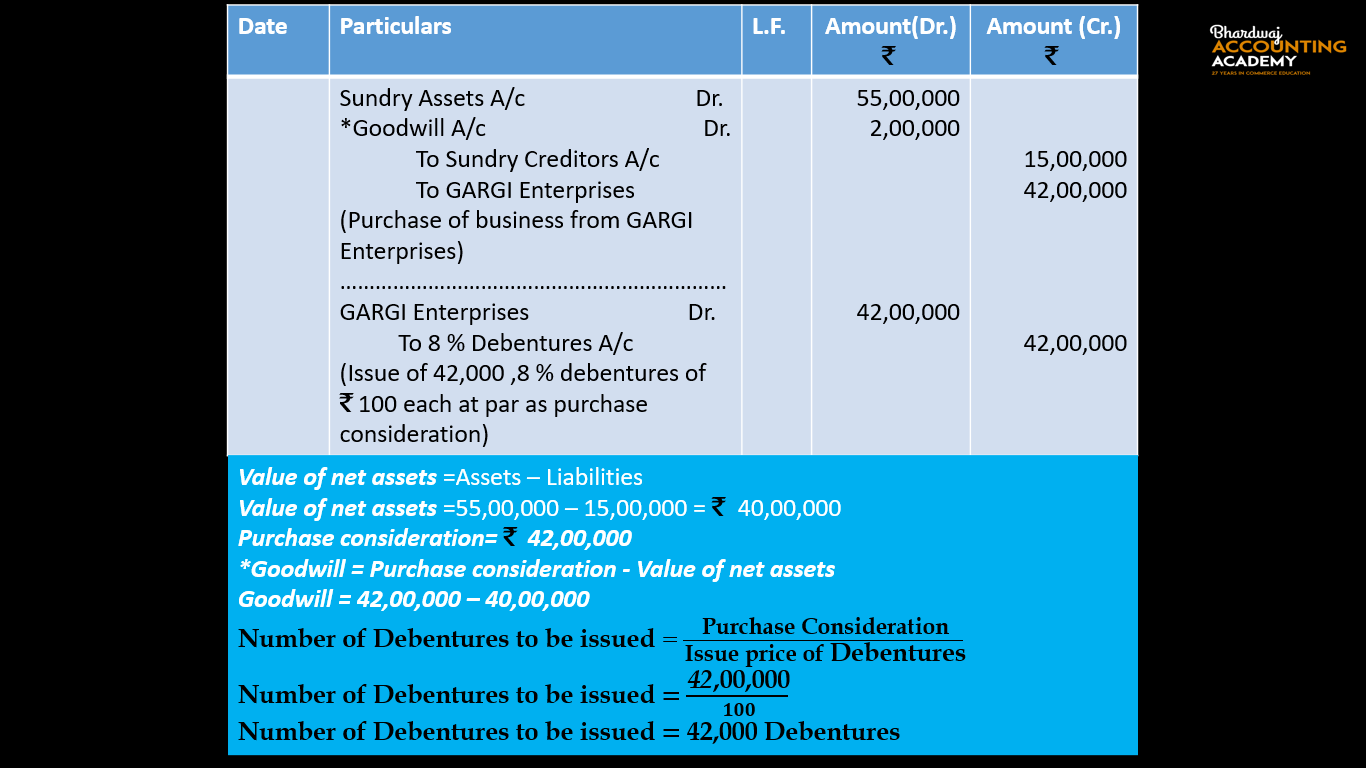

IN CASE OF GOODWILL:

SNEHA Ltd. acquired assets of Rs 55,00,000 and took over creditors of Rs 15,00,000 from GARGI Enterprises. purchase consideration Rs. 42,00,000. SNEHA Ltd. issued 8% debentures of Rs 100 each at par as purchase consideration. Record necessary journal entries in the books of SNEHA Ltd.

Journal entries in the books of SNEHA Ltd:

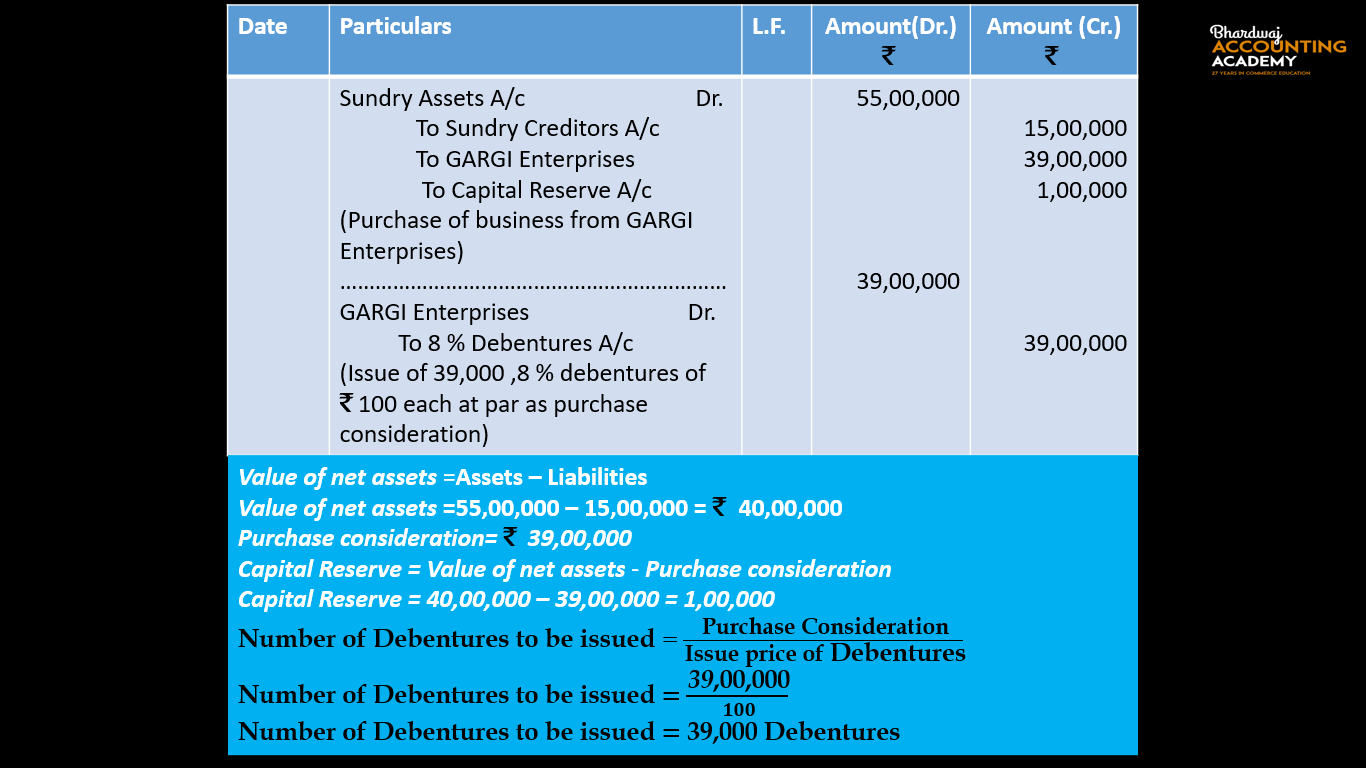

IN CASE OF CAPITAL RESERVE:

SNEHA Ltd. acquired assets of Rs 55,00,000 and took over creditors of Rs 15,00,000 from GARGI Enterprises. purchase consideration Rs. 39,00,000. SNEHA Ltd. issued 8% debentures of Rs 100 each at par as purchase consideration. Record necessary journal entries in the books of SNEHA Ltd.

Journal entries in the books of SNEHA Ltd:

Issue of Debentures for Consideration other than Cash