Table of Contents

Accounting Treatment of Reserves And Accumulated Profit/Loss At the time of Admission Of A Partner

Accounting Treatment of Reserves And Accumulated Profit/Loss At the time of Admission Of A Partner

If, at the time of admission of A partner, there are Reserves or Accumulated profits/losses existing in the books of the firm, these should be transferred to the Old Partner’s Capital Accounts (if capitals are fluctuating) or to the Old Partner’s Current Account (if capitals are Fixed). As a principle, the new partner should not be put to an advantage or disadvantage.

Any accumulated profit or reserve appearing in the balance sheet at the time of admission of a new partner, is credited in the existing partner’s capital account in existing profit sharing ratio. If there is any loss, the same will be debited to the existing partner in the existing ratio.

Accumulated profits: Accumulated profits include credit balance of Profit and Loss Account, General Reserves, Reserve Fund, Workmen Compensation Reserves, Investment Fluctuation Reserve etc.

Accumulated Losses: Accumulated Losses include the debit balance of Profit and Loss Account, Deferred Revenue Expenditure i.e., Advertisement Suspense A/c, Exceptional Losses, Research and Development Cost.

Accounting Treatment of Reserves And Accumulated Profit/Loss At the time of Admission Of A Partner

Accounting Treatment of Accumulated profits At the time of Admission Of A Partner:

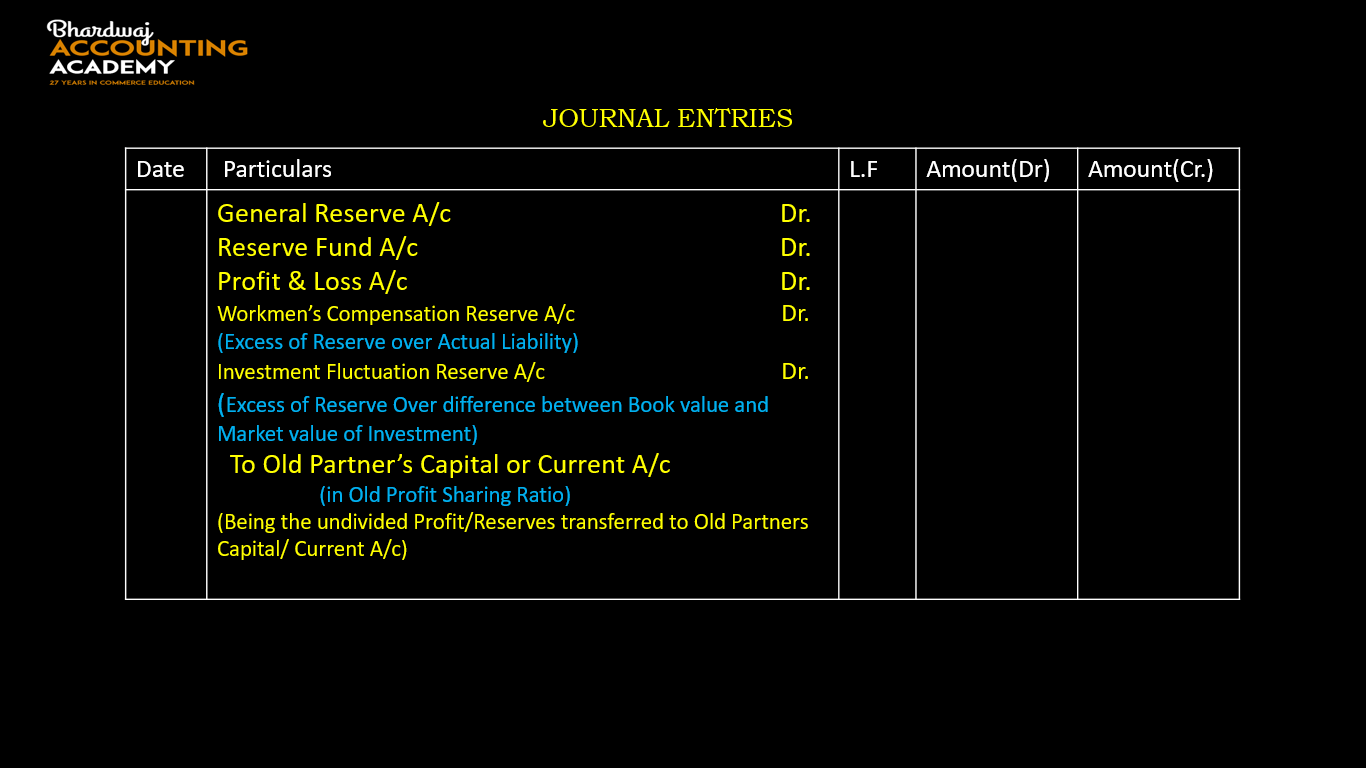

For Transfer of credit balance of Profit and Loss Account, General Reserves, Reserve Fund, Workmen Compensation Reserves, Investment Fluctuation Reserve, Contingency Reserve appears on the liabilities side of the Balance sheet should be Credited to the Old Partner’s Capital Accounts (if capitals are fluctuating) or to the Old partners Current Account (if capitals are Fixed). For this, the following entry will be passed in the books of the firm:

Accounting treatment of Workmen Compensation Reserves

Accounting Treatment of Accumulated Losses At the time of Admission Of A Partner:

For Transfer of Profit and Loss (Debit balance) or any other loss and Deferred Revenue Expenditure that appears on the assets side of the Balance sheet should be Debited to the Old Partner’s Capital Accounts (if capitals are fluctuating) or to the Old partner’s Current Account (if capitals are Fixed). For this, the following entry will be passed in the books of the firm:

Accounting treatment of Investment fluctuation Reserves

Accounting Treatment of Reserves And Accumulated Profit/Loss At the time of Admission Of A Partner

Example 1:

A, B and C are partners sharing profits in the ratio of 5 : 3 : 2. From April 1, 2022, they admit D as a new partner for 1/5 share of profit. On that date, their books showed a credit balance of ₹1,00,000 in the Profit and Loss Account. Record the necessary journal entry for the distribution of profits.

Accounting Treatment of Reserves And Accumulated Profit/Loss At the time of Admission Of A Partner

Example 2:

A, B and C are partners sharing profits in the ratio of 5 : 3 : 2. From April 1, 2020 they admit D as a new partner for 1/5 share of profit. On that date their books showed a credit balance of ₹1,00,000 in the Profit and Loss Account and General Reserve ₹ 40,000 . Record the necessary journal entry for the distribution of profits and General Reserve.

Accounting Treatment of Reserves And Accumulated Profit/Loss At the time of Admission Of A Partner

Example 3.

R and S are partners sharing profit in the ratio of 4:3. On lst April 2022

they admit M as a new partner for 1/4 share in profits. On that date the balance

sheet of the firm shows a balance of ₹ 70,000 in general reserve and debit balance

of Profit and Loss A/c of ₹ 28,000. make the necessary journal entries in the books of the firm.

Accounting Treatment of Reserves And Accumulated Profit/Loss At the time of Admission Of A Partner

Question for Practice:

1. A, B and C are partners sharing profits in the ratio of 5 : 3 : 2. From April 1, 2022 they admit D as a new partner for 1/5 share of profit. On that date their books showed a credit balance of ₹ 6,00,000 in the Profit and Loss Account and a balance of ₹2,00,000 in the General Reserve. Record the necessary journal entry for the distribution of profits and the general reserve.

2. Rohit and Soniya are partners sharing profit in the ratio of 4:3. On lst April 2022 they admit Sanjay as a new partner for 1/4 share in profits. On that date the balance sheet of the firm shows a balance of ₹ 91,000 in general reserve and debit balance of Profit and Loss A/c of ₹42,000. make the necessary journal entries.

3. Rohit and Soniya are partners sharing profit in the ratio of 4:3. On lst April 2022 they admit Sanjay as a new partner for 1/4 share in profits. On that date the balance sheet of the firm shows a balance of ₹ 63,000 in general reserve and debit balance of Profit and Loss A/c of ₹21,000 and Advertisement suspense Account ₹14,000. make the necessary journal entries.