Table of Contents

Circular Flow of Income

Circular Flow of Income

Circular flow of income refers to the cycle of the generation of income in the production process, and its distribution among the factors of production(Land, Labour, Capital, Entrepreneur).

- Households ( Owners) provided factor services ( Factors of production) to firms (Producers) for the production of goods and services.

- Firms (Producers) produced goods and services with the help of factors of production.

- Factors payments by the firms (Producers) to households ( Owners) for uses of factors of production.

- Payments by the households (Owners) to firms (Producers) for purchase of goods and services.

Circular flow of income is defined as the flow of payments and receipts for goods, services, and factor services between different sectors of the economy.

Circular Flow of Income

Phases of Circular flow of income

1- Generation Phase – In this phase, Production of goods and services by the firms (Producers) with the help of factors of production.

2- Distribution Phase – In this phase, Flow of factor income (Rent, Wages, Interest and Profit) from firms (Producers) to households ( Owners).

Land = Rent

Labour = Wages

Capital =Interest

Entrepreneur =Profit

3- Disposition Phase – In this phase, Income received by households ( Owners), spent on the goods and services produced by firms (Producers).

Flow

Flow is the quantity of an economic variable, which is measured during the period of time. Flow has time dimension- like per hr, per day, per month, per year etc.

* Flow is a dynamic concept.

* It has time dimension.

Stock

Stock is the Quantity of an economic variable that is measured at a particular point of time. The stock has no time dimension. Eg: National wealth, National capital, water in a tank etc.

* Stock is a static concept.

* It does not have a time dimension.

Sectors of An Economy

For the purpose of a proper and systematic study of the circular flow of income, we can divide an economy into four sectors. These are:

- Households Sector

- Firms Or Business Sector

- Government Sector

- Foreign Sector Or Rest of the world

Households Sector- Households, as a group, are the owners of factors of production, i.e., (a) land, (b) labour, (c) capital and (d) enterprise. Households supply their factor services to the production sectors of the economy and earn income. They make use of this income to meet their consumption requirements in the present and also save some income for use in the future.

Forms Sector- Firms constitute the production sector of the economy. Firms hire services of factors of production from households to produce goods and services and sell to households, other firms, government or to foreign countries.

Government Sector- Economic activities are regulated by the government. It also performs different functions in every country. These may be in the form of different social, political, and economic activities. These involve expenditures by the government. To meet this expenditure, a government collects revenue from varied sources, including taxes, etc. Taxes are paid both by the households and firms.

Foreign Sector- Today, every economy in the world is an open economy, i.e., every economy receives goods, services, and capital from other countries. Against these inflows, payments are made to those countries. Likewise, an inflow of receipts takes place against the goods, services, and capital sent abroad by one country to another country.

Circular Flow of Income

Types of Circular Flow

There are two types of circular flows:

- Real Flow

- Money Flow

Real Flow

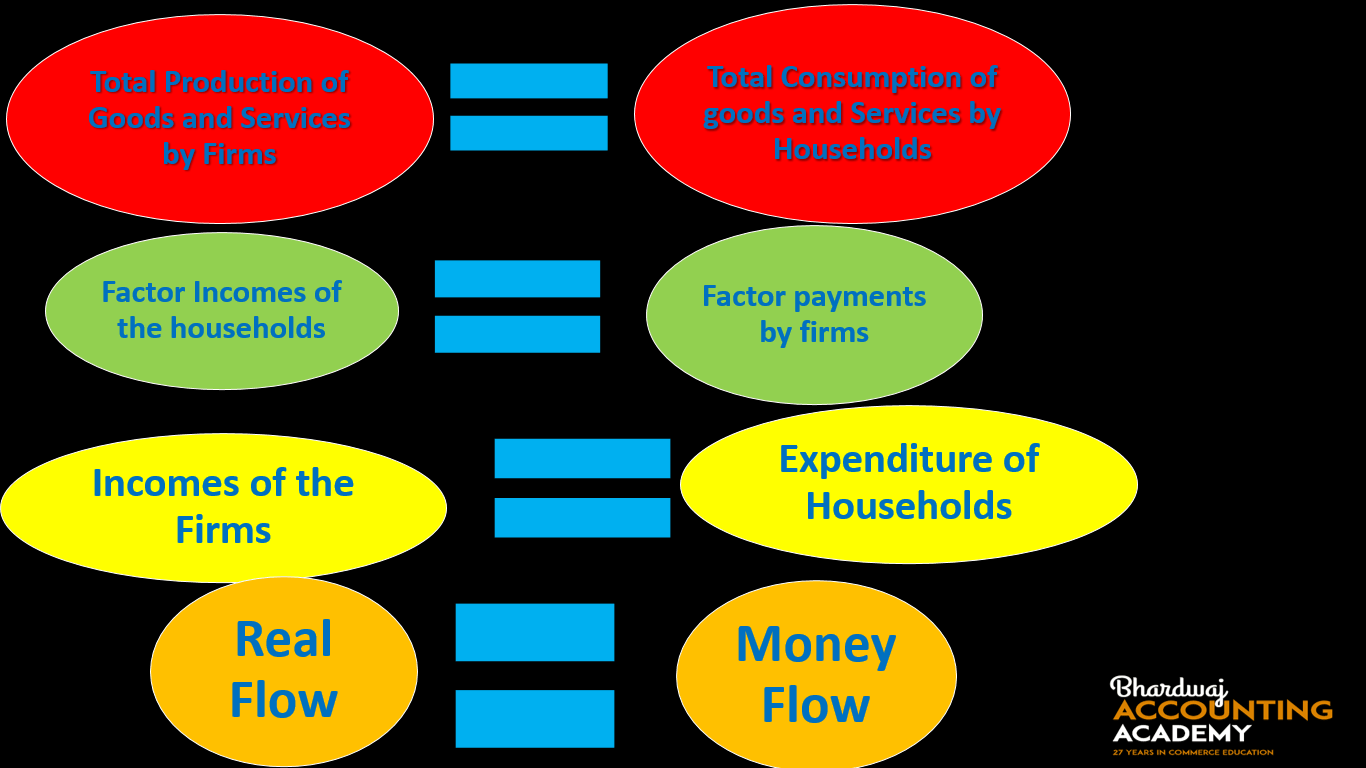

Real flow refers to the flow of factor services, goods and services between different sectors of the economy.

Or

Real flow refers to the flow of factor services from households( Owners) to firms(Producers) and the flow of goods and services from firms to households.

* It involves the exchange of goods and services.

* It is also known as Physical flow.

Circular Flow of Income

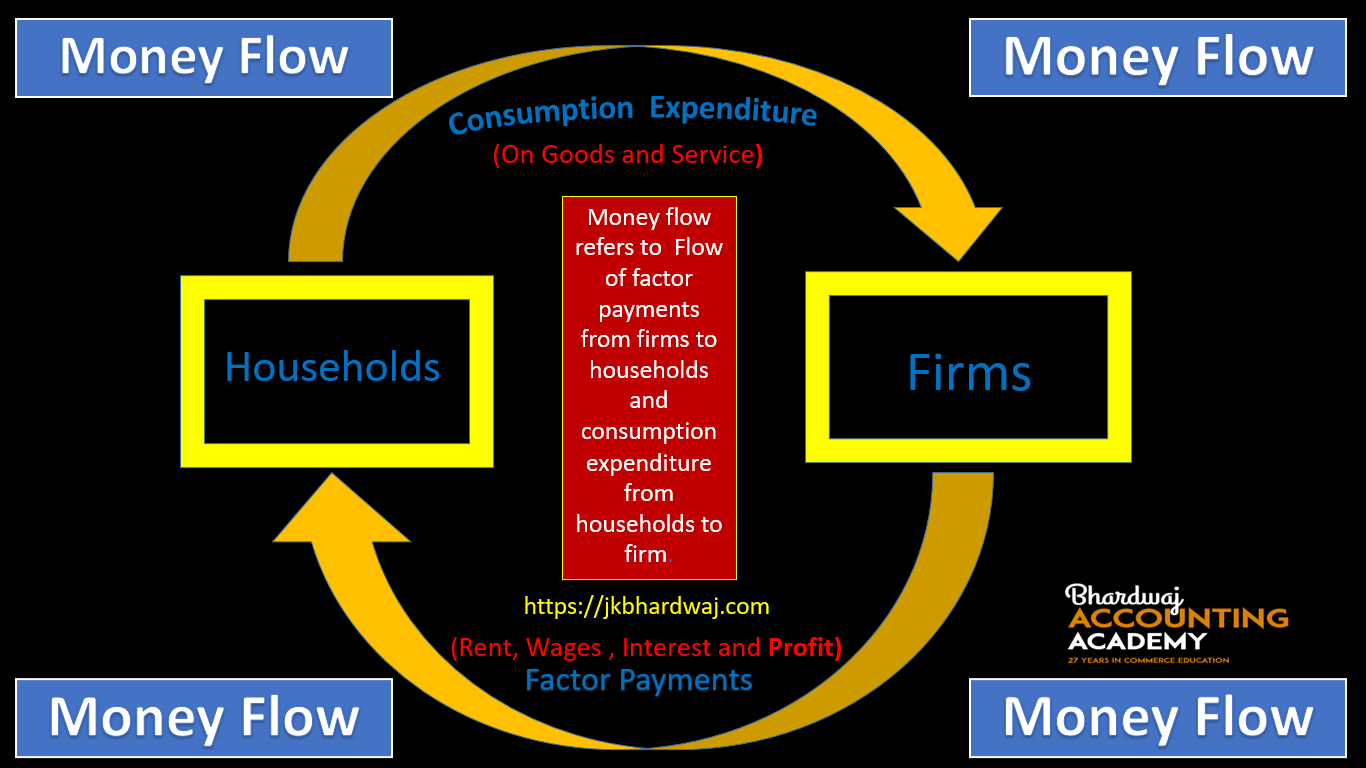

Money Flow

Money flow refers to the flow of money between different sectors of the economy. Eg. Flow of factor income from firms to households and consumption expenditure from households to firms.

* It is the flow of money between firms and households.

* It involves the exchange of money.

* It is also known as Nominal flow.

Circular flow of income (Two Sector Model without saving and Investment )

The two-sector model of circular flow of income consists of households and firms which interact with each other through factor markets and product markets. In this model real flows consist of flow of factor services from households to firms and flow of goods and services from firms to households. Money flows comprise flow of factor incomes from firms to households and flow of money expenditure on goods and services from households to firms.

In the Two Sector Model without saving and Investment, we have assumed that there is no saving either by the households or by the firms. We have assumed that the household sector spends the entire income on the goods produced by firms, and firms distribute all their receipts to the households as factor incomes.

*Households- Households are the owners of factors of production and consumers of goods and services.

*Firms- Firms produce goods and services and sell them to households.

*Factor markets- Factor markets are those markets where factor services are bought and sold.

*Product markets-Product markets or goods markets are the markets where goods and services are bought and sold.

Two-sector economy is the simplest form of closed economy**, in which there is no government sector and foreign trade. **Closed Economy is an economy that has no economic relations with the rest of the world. Open-Economy is an economy that has economic relations with the rest of the world.

The two-sector model without saving and investment can be understood properly with the help of the diagram given below-

Conclusions of circular flow in Two Sector Model without saving and Investment

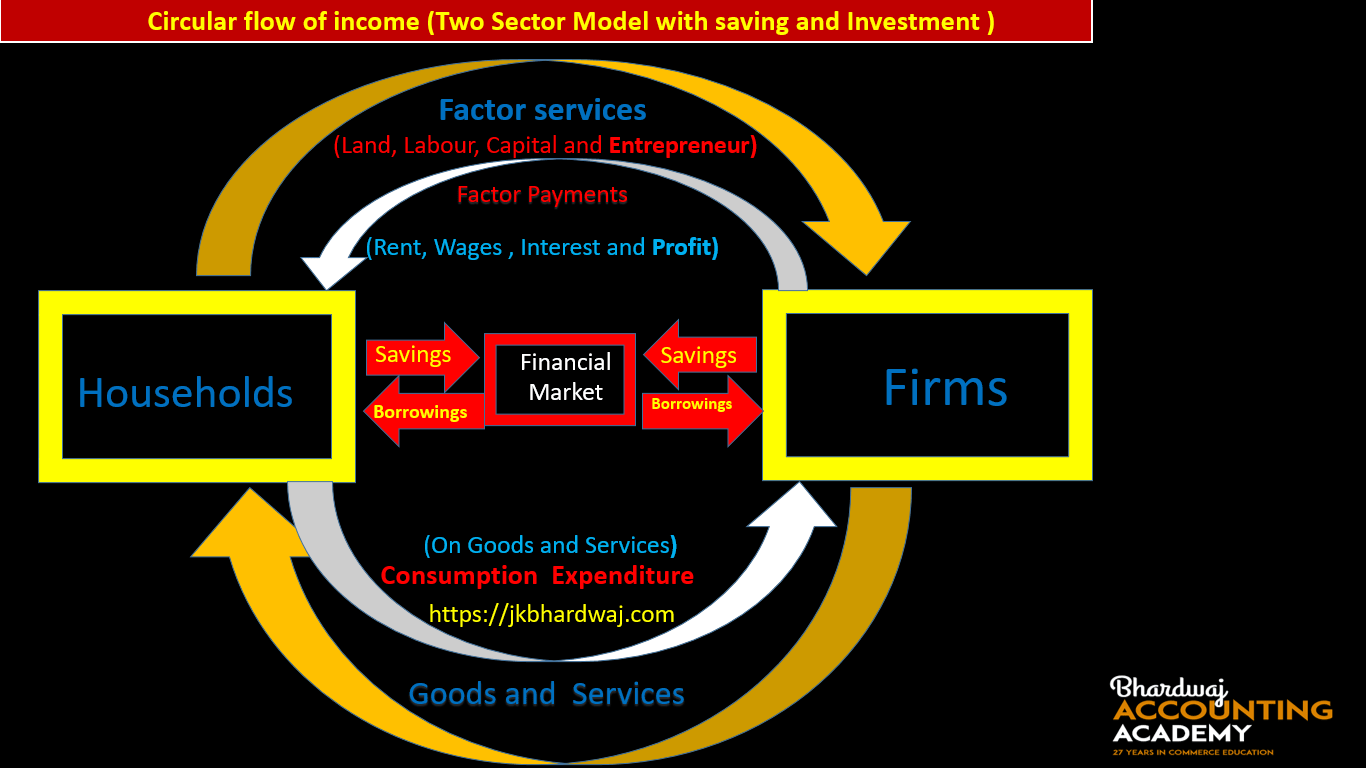

Circular flow of income (Two Sector Model with saving and Investment )

In the Two Sector Model with saving and Investment, We have assumed that the household sector does not spend the entire income on consumption, which means a part of their income is saved.

Firms do not distribute all their receipts to households as factor incomes, firms also save some part of their receipts for expansion. All savings and borrowings are channelized through a financial market.

Savings- Savings refers to a part of income that is not spent by households on the consumption of goods and services.

S = Y- C

Investment- Investment refers to that part /stock of man-made goods which are used for further production to increase the stock of capital.

Financial Market- Financial market is a market, or an arrangement, or an institution that facilitates the exchange of financial instruments and securities.

Leakage- Leakage refers to the withdrawal of money from the circular flow of income.

Or

Leakage or withdrawal refers to that part of income, which does not pass through the circular flow of income. Leakage reduces the flow of income.

Injections- Injection refers to the amount of money /income which is added to the circular flow of income. Injection increase the flow of income.

The two-sector model with saving and investment can be understood properly with the help of the diagram given below-

Very useful 👍

Informative 👍