Table of Contents

Debtors Turnover Ratio

Debtors Turnover Ratio (Trade Receivable Turnover Ratio)

Debtors Turnover Ratio establishes a relationship between net Credit revenue from operations (Net Credit Sales) and average trade receivables (Average Debtors). This ratio is also known as the Ratio of Credit Revenue from Operations (Net credit Sales) to Average Trade Receivables.

Note- The Debtors or Sundry Debtors and Bills Receivable are known as Trade Receivables.

Significance of Debtors Turnover Ratio

The debtors turnover ratio is an indication of the speed with which a company collects its debts. The higher the ratio, the better it is because it indicates that debts are being collected quickly and a low ratio indicates a longer collection period which implies delayed payment for debtors.

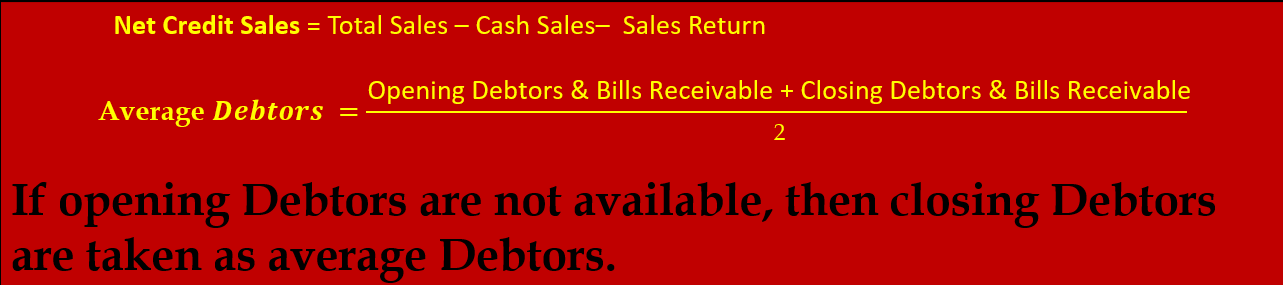

Formula For Debtors Turnover Ratio (Trade Receivable Turnover Ratio)

Or

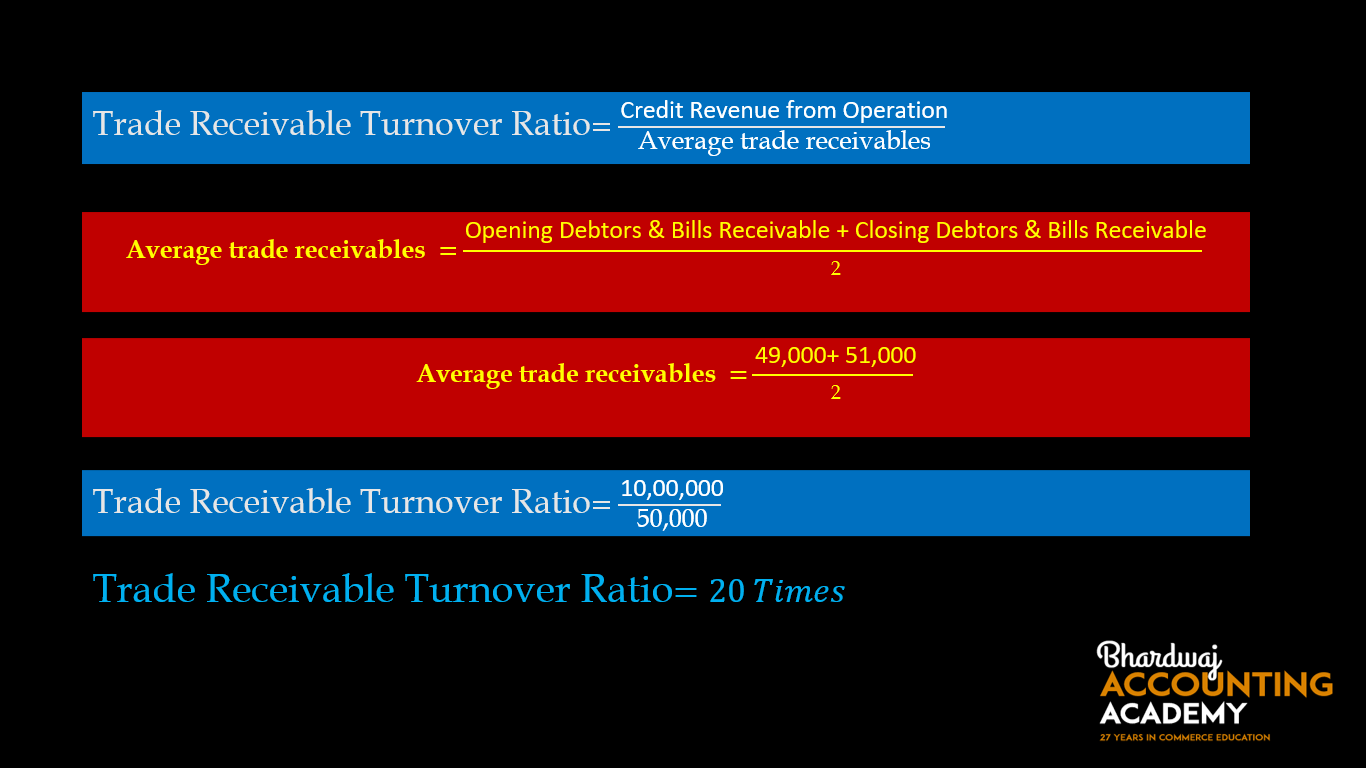

1. Example:

Calculate Trade Receivable Turnover Ratio from the following information:

Opening Trade Receivable ₹49,000

Closing Trade Receivable ₹ 51,000

Credit Revenue from operations. ₹ 10,00,000

Solution:

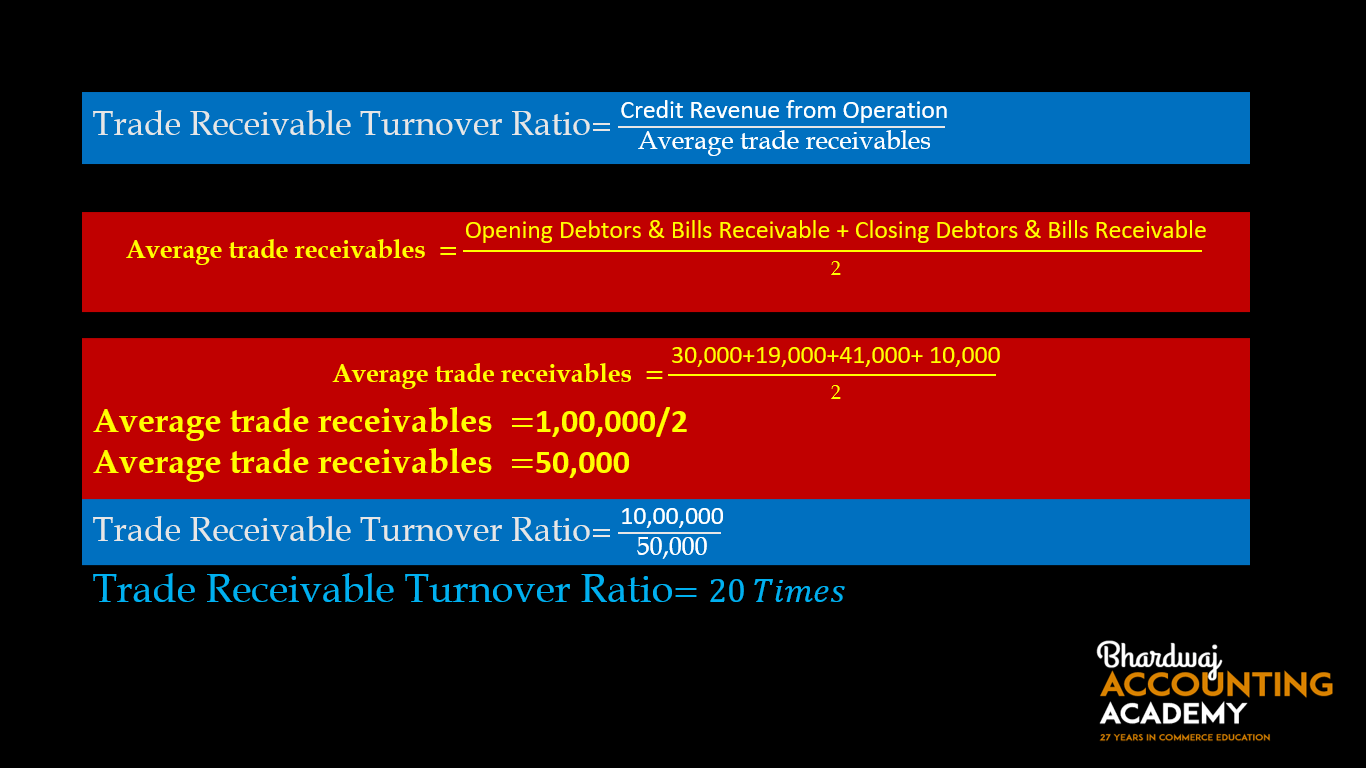

2. Example:

Calculate Trade Receivable Turnover or Debtors Turnover Ratio from the following information:

Opening Debtors ₹30,000

Opening Bills Receivable ₹19,000

Closing Debtors ₹ 41,000

Closing Bills Receivable ₹10,000

Credit Revenue from operations. ₹ 10,00,000

Solution:

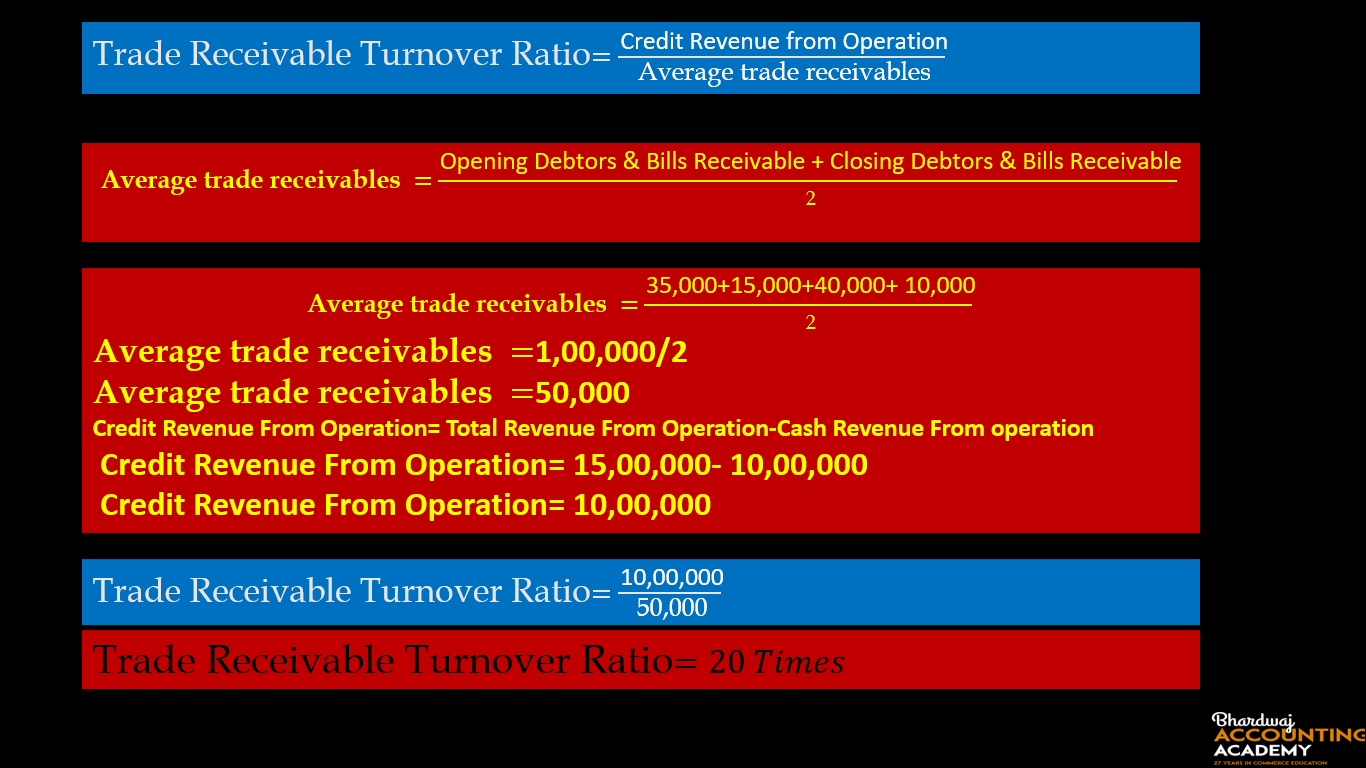

3. Example:

Calculate Trade Receivable Turnover Ratio or Debtors Turnover Ratio from the following information:

Opening Debtors ₹35,000

Opening Bills Receivable ₹15,000

Closing Debtors ₹ 40,000

Closing Bills Receivable ₹10,000

Total Revenue From Operation₹ 15,00,000

Cash Revenue From Operation₹ 5,00,000

Solution:

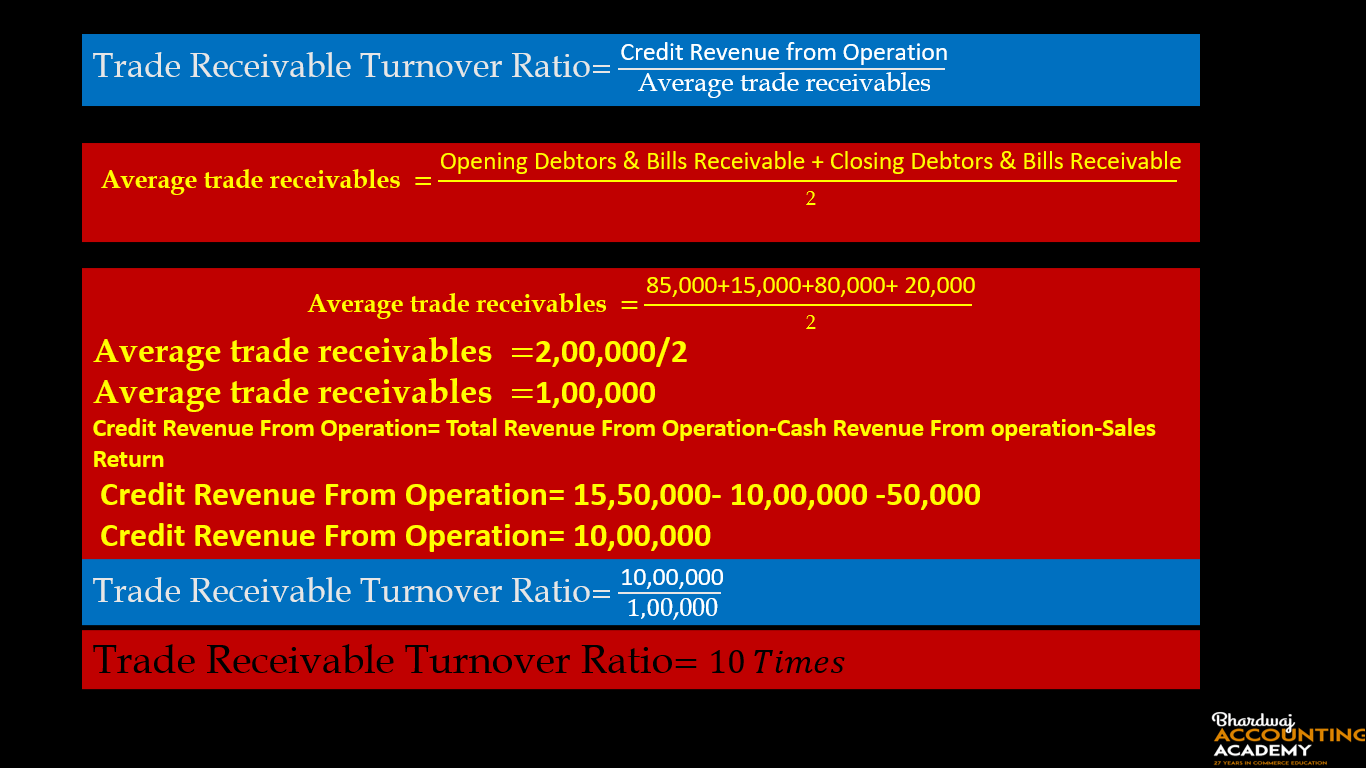

4. Example:

Calculate Trade Receivable Turnover Ratio or Debtors Turnover Ratio from the following information:

Opening Debtors ₹85,000

Opening Bills Receivable ₹15,000

Closing Debtors ₹ 80,000

Closing Bills Receivable ₹20,000

Total Revenue From Operation₹ 15,50,000

Cash Revenue From Operation₹ 5,00,000

Sales Return ₹ 50,000

Solution:

Working Capital Turnover Ratio

Question For Practice

Question 1

Calculate Trade Receivable Turnover Ratio from the following information:

Opening Trade Receivable ₹49,000

Closing Trade Receivable ₹ 51,000

Credit Revenue from operations. ₹ 8,00,000

Question 2

Calculate Trade Receivable Turnover or Debtors Turnover Ratio from the following information:

Opening Debtors ₹50,000

Opening Bills Receivable ₹30,000

Closing Debtors ₹ 60,000

Closing Bills Receivable ₹20,000

Credit Revenue from operations. ₹ 8,00,000

Question 3

Calculate Trade Receivable Turnover Ratio or Debtors Turnover Ratio from the following information:

Opening Debtors ₹35,000

Opening Bills Receivable ₹15,000

Closing Debtors ₹ 40,000

Closing Bills Receivable ₹10,000

Total Revenue From Operation₹ 10,00,000

Cash Revenue From Operation₹ 2,00,000

Question 4

Calculate Trade Receivable Turnover Ratio or Debtors Turnover Ratio from the following information:

Opening Debtors ₹85,000

Opening Bills Receivable ₹15,000

Closing Debtors ₹ 80,000

Closing Bills Receivable ₹20,000

Total Revenue From Operation₹ 12,30,000

Cash Revenue From Operation₹ 2,00,000

Sales Return ₹ 30,000

Question 5

Calculate Trade Receivable Turnover Ratio or Debtors Turnover Ratio from the following information:

Opening Debtors ₹82,000

Opening Bills Receivable ₹18,000

Closing Debtors ₹ 87,000

Closing Bills Receivable ₹13,000

Total Revenue From Operation₹ 12,30,000

Cash Revenue From Operation₹ 2,00,000

Sales Return ₹ 30,000

Provision For Doubtful Debts ₹ 10,000

Question 6

Calculate Trade Receivable Turnover Ratio or Debtors Turnover Ratio from the following information:

Closing Debtors ₹ 87,000

Closing Bills Receivable ₹13,000

Total Revenue From Operation₹ 12,30,000

Cash Revenue From Operation₹ 4,00,000

Sales Return ₹ 30,000

Provision For Doubtful Debts ₹ 10,000

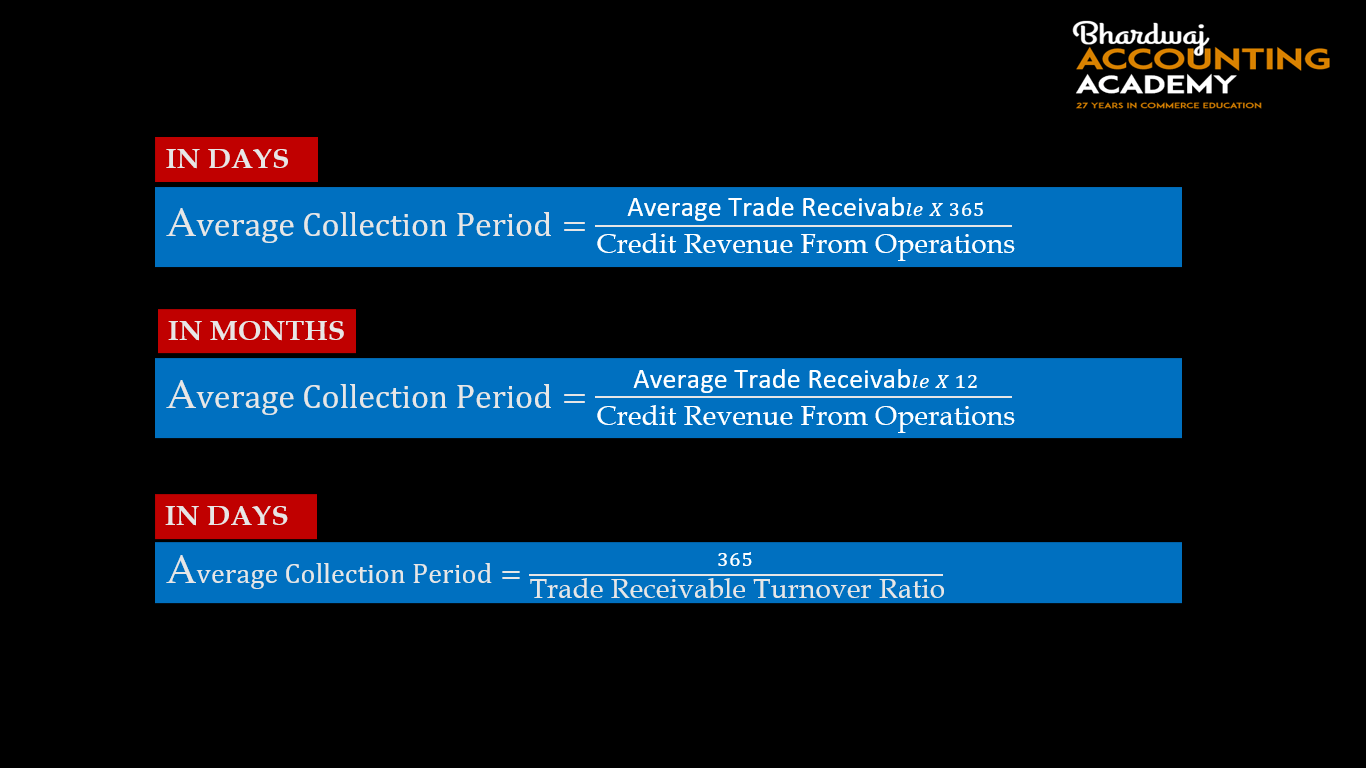

Average Collection Period

Average Collection Period indicates the average time at which money is collected from Debtors.

Or

The average collection period ratio measures the average number of days clients take to pay their Debts.

Formula For Average collection period

Example:

Calculate the Average Collection Period from the following information:

Opening Trade Receivable ₹49,000

Closing Trade Receivable ₹ 51,000

Credit Revenue from operations. ₹ 10,00,000

Solution:

Average Trade Receivable= (Opening Trade Receivable +Closing Trade Receivable)/2

Average Trade Receivable= (49,000+51,000)/2

Average Trade Receivable= 50,000

Average Collection Period=(50,000X365)/10,00,000

Average Collection Period=18.25 Days Or 18 Days

Question 7

Calculate the Average Collection Period from the following information:

Closing Debtors ₹ 87,000

Closing Bills Receivable ₹13,000

Total Revenue From Operation₹ 12,30,000

Cash Revenue From Operation₹ 4,00,000

Sales Return ₹ 30,000

Provision For Doubtful Debts ₹ 10,000