Table of Contents

External Users of accounting Information

External Users of accounting Information?

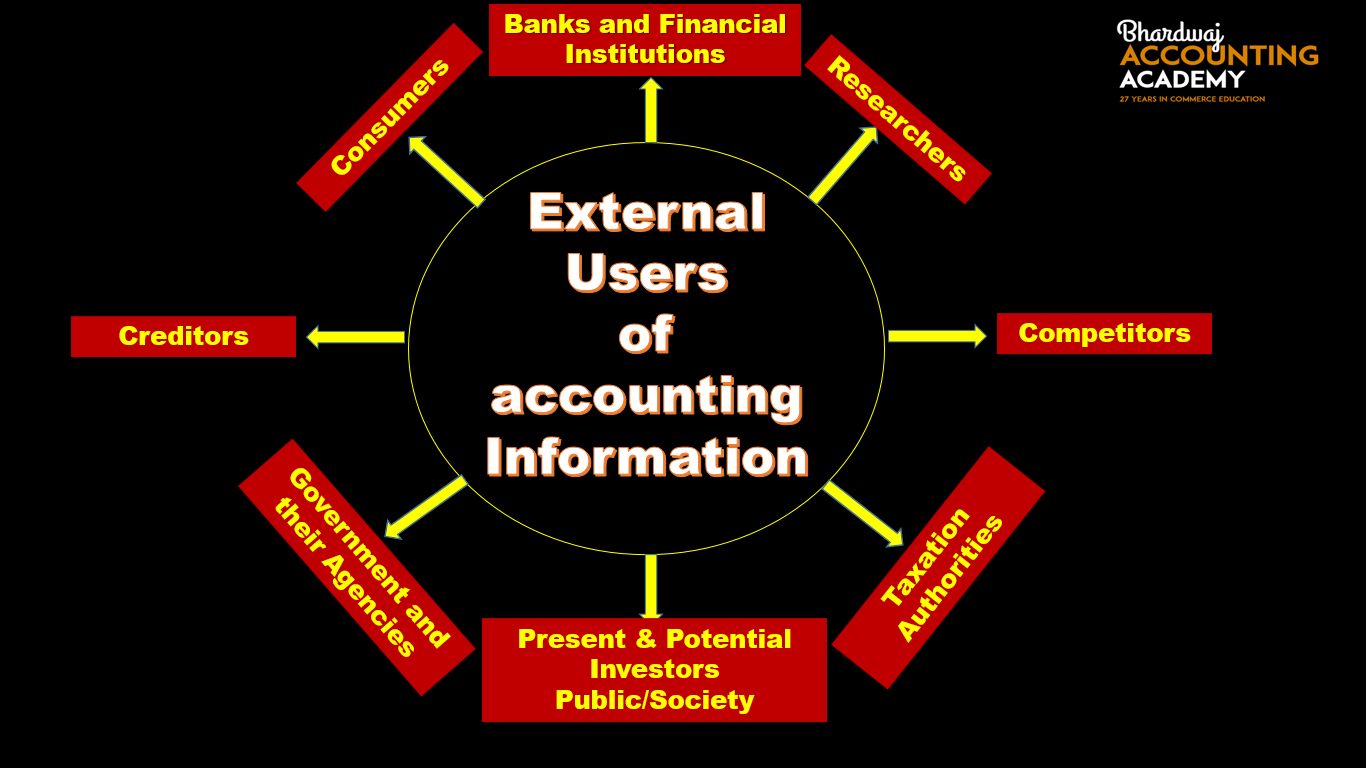

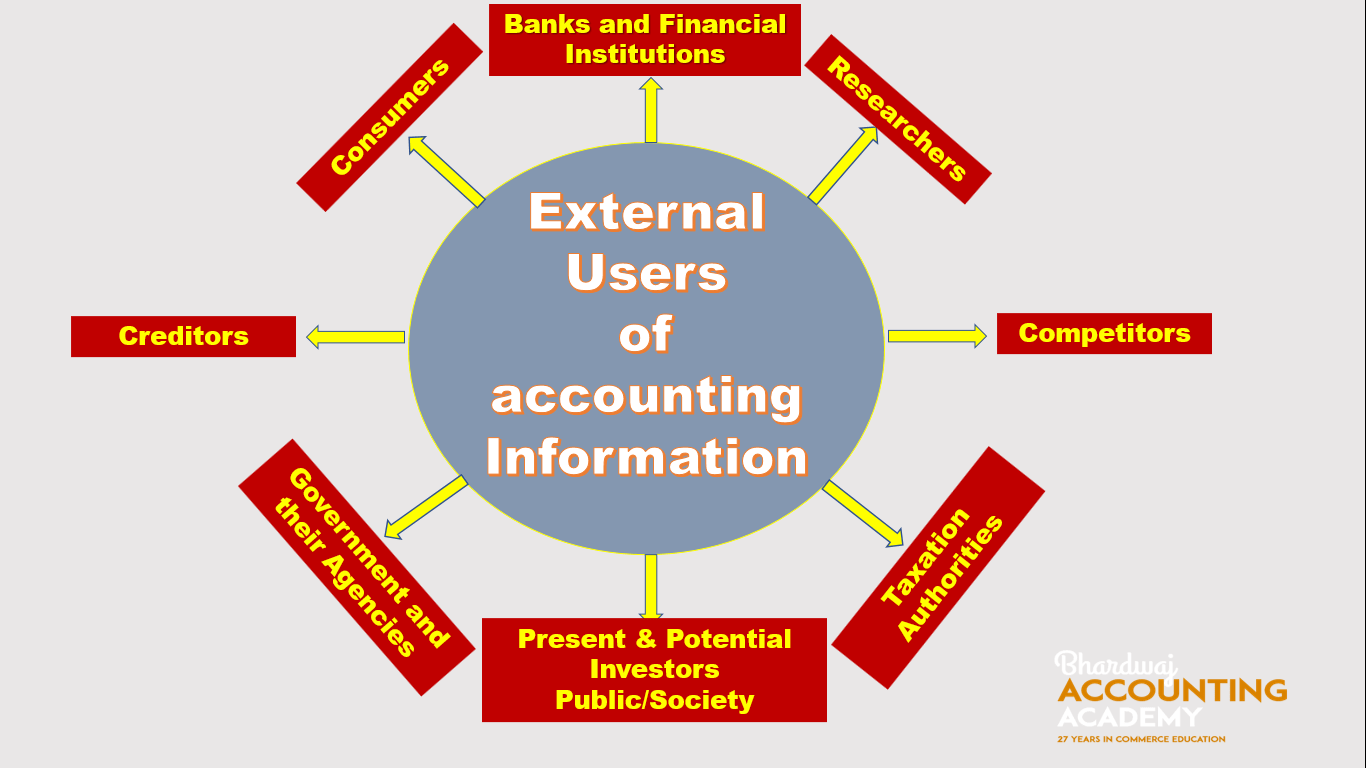

External users of accounting Information are those individuals or groups who are outside the business enterprise/organisation.They must have direct and indirect interest in accounting information. like creditors, investors, banks and other lending institutions, present and potential investors, Consumers , Public,Government, tax authorities, regulatory agencies and researchers.

The basic objective of accounting is to provide information which is useful for persons and groups inside and outside the organisation.

Accounting Information?

An accounting information refers to the information disclosed in financial statements, the use of which enables the users to arrive at the correct decision.

In the other words-An accounting information means an information which is primarily financial in nature about economic entities that is intended to be useful in making economic decisions.

The External users of accounting Information and their need for information are as follows:

1. Banks and Financial Institutions- Banks and other financial institutions provide loan to the business enterprise. So, they need accounting information to ensure the safety and recovery of the loan advanced and regularity of the interest amount.

2. Present Investors- Present investors use accounting information as they are interested in knowing the earning capacity of the business and safety of the investment.

3.Potential Investors- Prospective/Potential investors use the accounting information to assess whether or not to invest their money in the organisation/business enterprise. To decide whether to invest in the

business or not.

4. Creditors- They provide goods on credit to the business enterprise. So, they need accounting information to ascertain financial soundness of the firm and to ensure credit worthiness of the firm.

5. Government and their Agencies- On the basis of financial statements, government authorities determine the progress of various industries and the need for financial help. Sometimes government restricts the trade which is using unfair trade practices and charging more prices for essential commodities. The Government authorities collect various taxes from the business. So, government need accounting information to assess the tax liability of the business entity. They also need accounting information to regulate the activities of enterprise and to compile national income accounts.

6. Researchers- They use accounting information to undertake research in various economic, business enterprise and other related areas.

7. Consumers-They are interested in getting good quality goods at reasonable prices. So, they require accounting information for establishing good accounting control, which will reduce cost of production and less price is to be paid by them.

8.Competitors – For knowing the relative strengths and weaknesses of their competitors and for strategic purposes, business enterprises examine and analyse the financial statements of other business enterprises, their credit policies and debt collecting procedures. In this connection, business enterprises regularly keep a constant touch with the accounting information of their competitors.

9.Taxation Authorities – Various taxes and excise duties are levied by the government after analysing the financial statements. Taxation authorities viz Income Tax Department, Sales Tax Department and Customs and Excise etc analyse the financial statements to make sure that the financial statements are prepared as per the legal provision and that various figures relating to sales and income are correct in order to assess the tax liability of the business enterprise

10. Public/Society- Society is that part of business environment in which business enterprise is born and grows. Business enterprise helps the society by protecting environment, generating employment, providing residential accommodation and low cost education to the weaker sections of the society etc .The general public/society is interested in its accounting information to know the contribution of business towards the welfare of the society.

External Users of accounting Information

Ready to test yourself? Perfom live quiz here.

Hi there,

I need to promote the above video on your website. Let me know your quote for the same. Please watch the video and see it is okay for you to add the same on your site. Cool.

Thank you.

$100 is the charge for promotion

$100 will be charged for promotion

Here you share your best knowledge with us. I highly appreciate your work.

click here

click here

It’s in point of fact a nice and helpful piece of information. I am glad that you shared this helpful information with us. Please keep us up to date like this. Thank you for sharing.

The guidelines you provided listed below are extremely precious. It proved this sort of pleasurable surprise to acquire that waiting for me once i awakened today. These are constantly to the issue and easy to know. Thanks a large amount for your valuable ideas you’ve got shared here.