Table of Contents

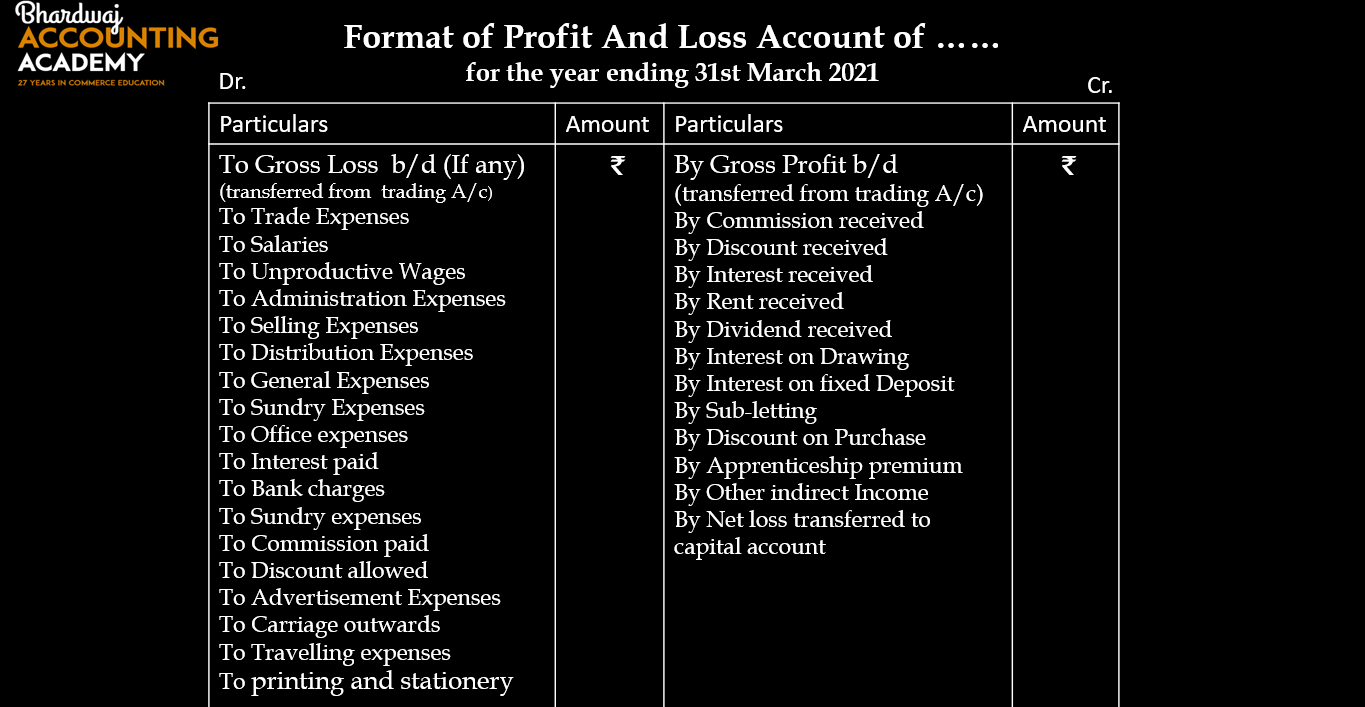

Format of Profit And Loss Account

Profit and Loss Account-

A Profit and Loss Account is a financial statement (Income Statement) specifically designed to determine the net profit or net loss of a business enterprise during a particular accounting period. It provides a detailed breakdown of the company’s revenues and expenses to calculate its overall financial performance.

The Profit and Loss Account is prepared to determine the net result of business activities

According to Prof. Carter, “A Profit & Loss Account is an account into which all gains and losses are collected, to ascertain the excess gains over the losses or vice-versa”.

NEED AND IMPORTANCE OF PROFIT & LOSS ACCOUNT

A Profit & Loss Account (P&L) is a crucial financial statement for any business, providing valuable insights into its financial health and performance:

- To ascertain the Net Profit or Net Loss: A Trading Account only discloses the Gross Profit earned as a result of trading activities, whereas the Profit & Loss Account discloses the net profit (or net loss) available to the proprietor and credited to his capital account.

- Comparison with previous years’ profit: The net profit of the current year can be compared with that of the previous years. It enables the businessman to know whether the business is being conducted efficiently or no.

- Control on Expenses: Profit & Loss Account helps in comparing various expenses with the expenses of the previous year. Also the percentage of each individual expenses to net profit is calculated and compared with the similar ratio of previous years. Such comparison will be helpful in taking concrete steps for controlling the unnecessary expenses.

- Helpful in the preparation of Balance Sheet: A Balance Sheet can only be prepared after ascertaining the Net Profit through the preparation of Profit and Loss Account.

Preparation of Profit and Loss Account-

A Profit and Loss Account is started with the amount of gross profit or gross loss brought down from the Trading Account.

As such, all those expenses and losses that have not been debited to the Trading Account are now debited to the Profit & Loss Account, and all indirect income is credited to the Profit and Loss Account.

A Profit and Loss Account is a Nominal Account, and as such, all indirect expenses and losses are shown on its debit side, while all incomes and gains are shown on its credit side.

ALSO READ: format-of-trading-account

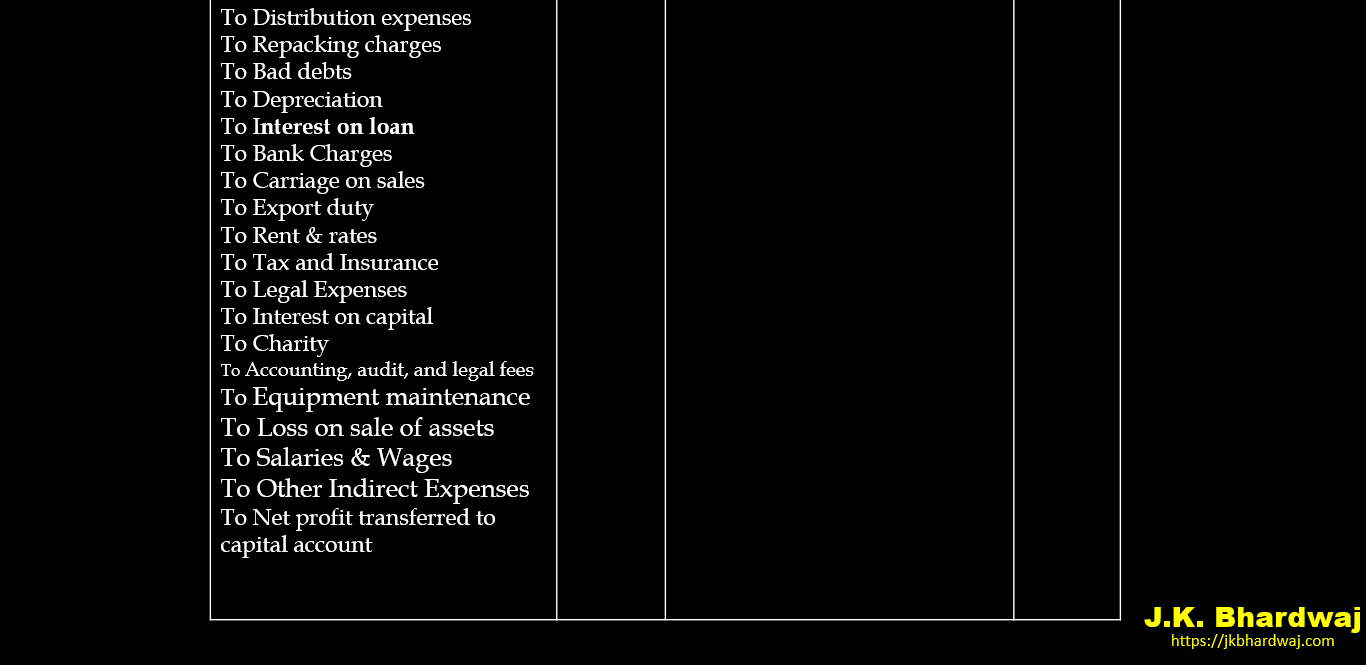

Items written on the Dr. side of Profit & Loss Account-

1.Gross Loss: If the trading account discloses Gross Loss, it is shown on the debit side first of all.

- Office and Administrative Expenses: Such as salary of office employees, office rent, lighting, postage, printing, legal charges, audit fee, etc.

- Selling and Distribution Expenses: Such as advertisement charges, commission, carriage outwards, bad debts, packing charges etc.

- Miscellaneous Expenses: Such as interest on loan, interest on capital, repair charges, depreciation, charity etc.

Items written on the Cr. side of Profit & Loss Account-

- Gross Profit: the starting point of the Cr. side of the Profit and Loss Account is the gross profit brought down from the Trading Account.

- Other Incomes and Gains: All items of income and gains are shown on the credit side of the Profit & Loss Account, such as income from investments, rent received, discount received, commission earned, interest received, dividend received, etc.

If the credit side of the profit and loss account exceeds the debit side, the difference is termed net profit. On the other hand, the excess of the debit side over the credit side is termed net loss. Net profit is added to the capital, whereas net loss is deducted from the capital.

Closing Entries relating to Profit and Loss Account-

The preparation of the profit and loss account requires that the balances of (Indirect Expenses and Indirect Income, Gain and Loss) all concerned items are transferred to profit and loss account it, by passing the following closing entries:

Balance of all Indirect income and indirect expenses transferred transfer to profit and loss account.

Balance of all indirect income transferred to the credit side of the profit and loss account.

Balance of all indirect expenses transferred to the debit side of the profit and loss account.

Balance of losses is transferred to the debit side of the profit and loss account.

Balance of gains transferred to the credit side of the profit and loss account.

- Accounts of various items of expenses (Indirect expenses) and losses are transferred to the debit side of the Profit and Loss Account by means of the following entry:

Profit and Loss A/c Dr.

To Salaries A/c

To Rent, Rates and Taxes A/c

To Printing and Stationery A/c

To Postage and Telegrams A/c

To General Expenses A/c

To Advertisement Expenses A/c

To Administration Expenses A/c

To Office Expenses A/c

To Bad Debts A/c

To Depreciation A/c

To Bank Charges A/c

To Carriage on sales A/c

To Export Duty A/c

To Commission on Sales A/c

To Discount Allowed A/c

To Salaries and wages A/c

To Carriage Outward A/c

To Legal Expenses A/c

To Financial Expenses A/c

To Sundry Expenses A/c

To Interest on Bank Overdraft A/c

To Other indirect expenses A/c

(Transfer of nominal accounts showing Dr. balances(Indirect expenses and Losses) to the Debit of P & L A/c)

- Balances of all the accounts of Indirect incomes and gains will be transferred to the credit side of the Profit and Loss Account by means of the following entry:

Interest Received A/c Dr.

Commission Received A/c Dr.

Rent Received A/c Dr.

Dividend Received A/c Dr.

Discount Received A/c Dr.

To Profit and Loss A/c

(Transfer of nominal accounts showing Cr. balances to the Credit of P & L A/c)

- Balances of gains will be transferred to the credit side of the Profit and Loss Account by means of the following entry:

Profit on sale of Assets A/c Dr.

Bad debts Recovered A/c Dr.

To Profit and Loss A/c

(Transfer of gains accounts showing Cr. balances to the Credit of P & L A/c)

- For the transfer of the credit balance of Profit & Loss A/c, known as net profit, to the capital Account:

Profit and Loss A/c Dr.

To Capital A/c

(Transfer of net profit to Capital A/c)

- For the transfer of debit balance of Profit & Loss A/c, known as net loss to capital Account:

Capital A/c Dr.

To Profit and Loss A/c

(Transfer of net loss to Capital A/c)