Table of Contents

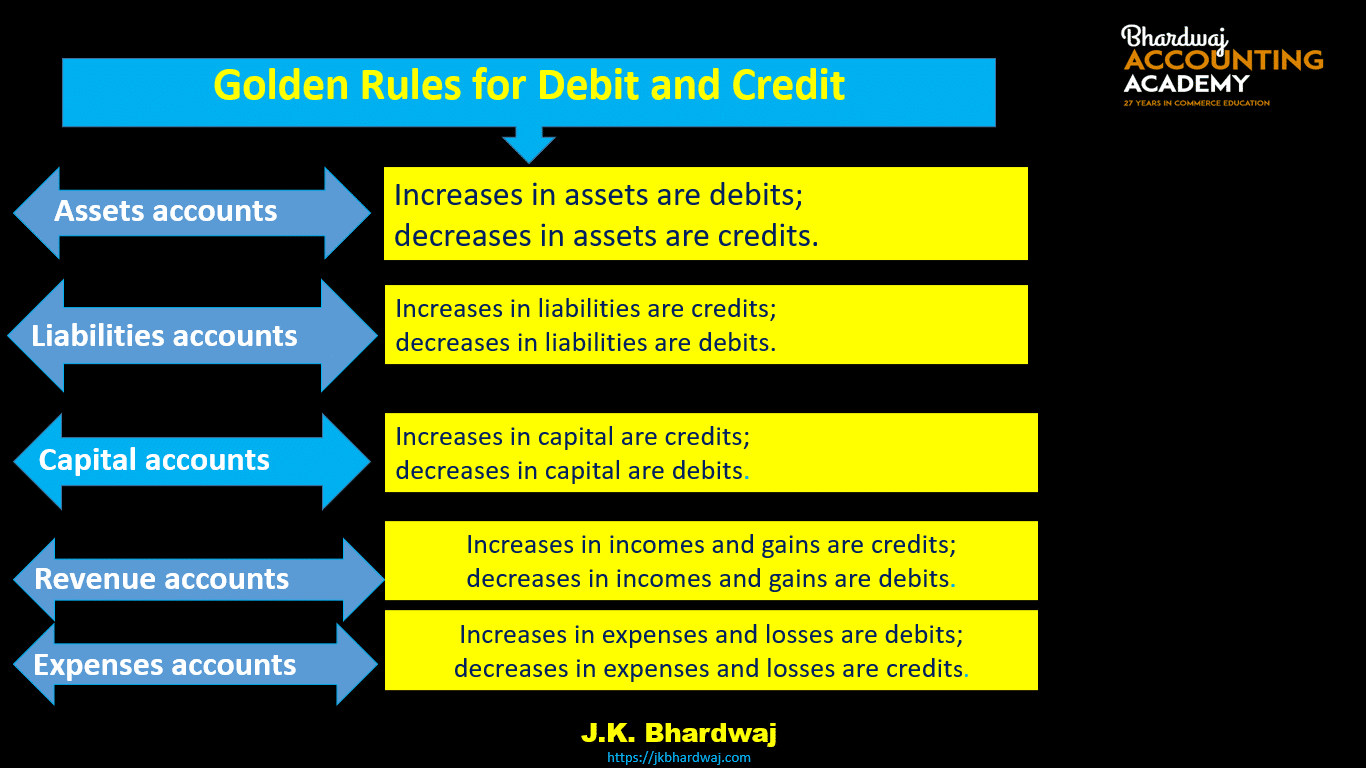

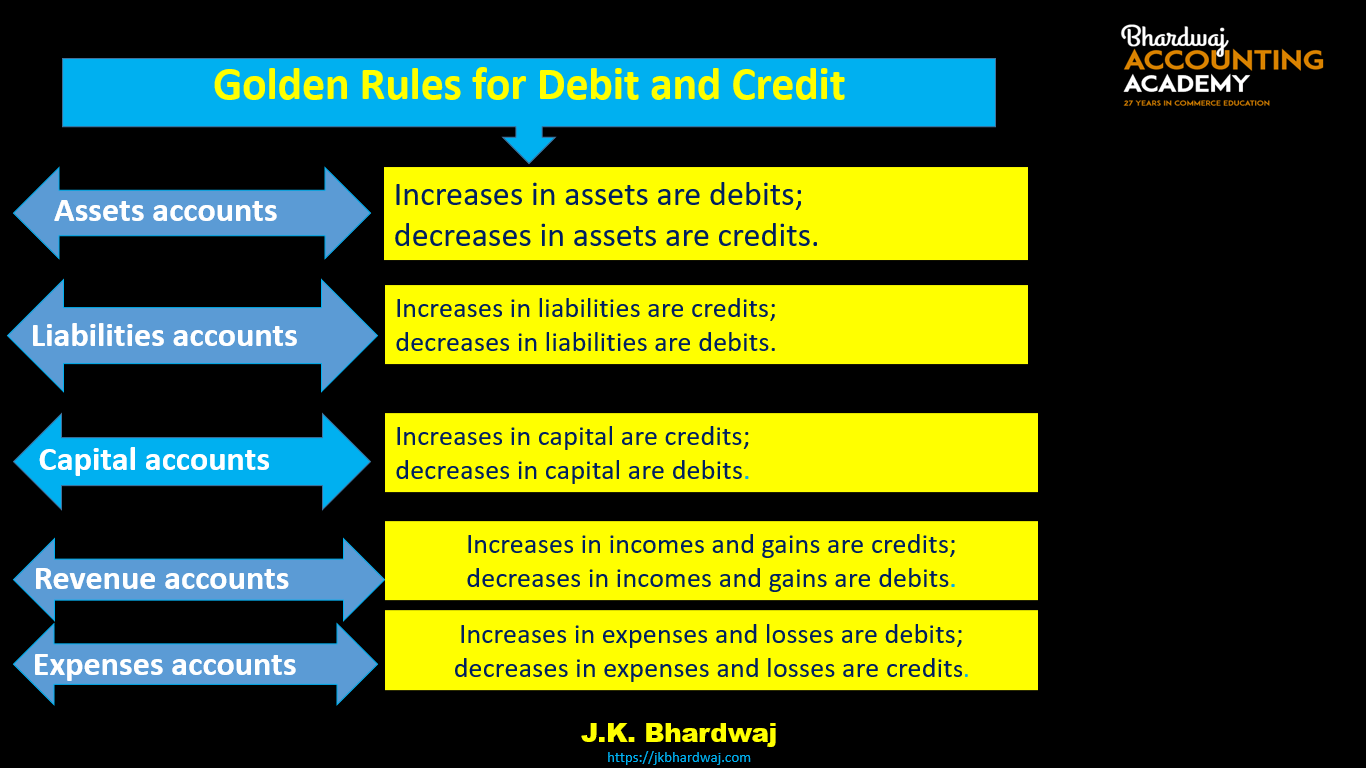

Rules Of Debit and Credit as per Modern Approach

Golden Rules Of Accounting Modern Approach

Five Golden Rules Of Accounting-

The modern Approach is also known as the American Approach. The modern Approach is also known as Accounting Equation Approach/ Balance sheet Equation Approach.

Under this approach, transactions are recorded based on the accounting equation. An Accounting equation is based on the dual aspect concept. The dual aspect is the foundation or basic principle of accounting.

It provides the basis for recording business transactions into the book of accounts(Journal). This concept states that every transaction has a dual or two-fold effect and should therefore be recorded in two places.

According to American Approach Or Modern Approach Or Accounting Equation Approach Or Balance sheet Equation Approach Accounts are divided into five categories-

1. Assets Accounts

2. Liabilities Accounts

3. Capital Accounts

4. Revenue accounts

5. Expenses accounts

1. Assets Accounts-

Those accounts related to Assets and properties of a business are called assets accounts. Such as Building account ,

Land account,

Plant& Machinery account,

Cash account,

Furniture account,

Computer account ,

Investment account,

Motor account,

Fixture and fitting account,

Plant account ,

stock account(Inventory)

Debtors account etc.

Rules for Debit and Credit – Increases in assets are debits; decreases in assets are credits.

Golden Rules Of Accounting Modern Approach

For Example-

1. Building Purchased for cash Rs. 2,00,000.

Building Account (Assets Account)

Cash Account (Assets Account)

Assets Increase in the form of Building

Assets Decrease in the form of Cash

Rules- Increases in assets are debits;

decreases in assets are credits.

Building Account Debit

Cash Account Credit

2. Old Machinery Sold Rs. 60,000 for cash.

Machinery Account (Assets Account)

Cash Account (Assets Account)

Assets Increase in the form of Cash

Assets Decrease in the form of Machinery

Rules-

Increases in assets are debits;

decreases in assets are credits.

Cash Account Debit

Machinery Account Credit

2. Liabilities Accounts-

Those accounts related to the Liabilities of a business are called Liabilities accounts.

Such as Creditors account,

Bills payable account,

Bank loan account,

Outstanding Expenses account,

Bank overdraft account etc.

Rules for Debit and Credit- Increases in liabilities are credits; decreases in liabilities are debits.

For Example-

1.Loan taken from Jay Rs. 90,000.

Cash Account (Assets Account)

Jay’s Loan Account (Liabilities Account)

Assets Increase in form of Cash

Liabilities Increase in form of Jay’s Loan

Rules-

Increases in assets are debits;

decreases in assets are credits.

Increases in liabilities are credits;

decreases in liabilities are debits

Cash Account Debit

Jay’s Loan Account Credit

2. Amount paid to creditors Rs. 50,000.

Cash Account (Assets Account)

Creditors Account (Liabilities Account)

Assets Decrease in form of Cash

Liabilities Decrease in form of creditors

Rules-

Increases in assets are debits;

decreases in assets are credits.

Increases in liabilities are credits;

decreases in liabilities are debits

Creditors Account Debit

Cash Account Credit

3. Capital Accounts-

Capital Accounts refers to the accounts of the proprietors/ partners who have invested money in the business. (Represent Owner/Proprietors or partners).

Capital means the amount or asset which is invested in the business by a businessman or owner of the business enterprise.

Rules for Debit and Credit- Increases in capital are credits; decreases in capital are debits.

Golden Rules Of Accounting Modern Approach for Capital Accounts

For Example-

1. Mr. Mohit started the Business with cash of Rs. 59,00,000.

Cash Account (Assets Account)

Owner’ Account (Capital Account)

Assets Increase in the form of Cash

Capital Increase in form investment by the owner

Rules-

Increases in assets are debits;

decreases in assets are credits.

Increases in capital are credits;

decreases in capital are debits.

Cash Account Debit

Capital Account Credit

2. Amount withdrawn by proprietors for personal use Rs. 10,000.

Cash Account (Assets Account)

Drawing Account (Capital Account)

Assets Decrease in form of Cash

Capital Decrease in form of personal use by owner

Rules-

Increases in assets are debits;

decreases in assets are credits.

Increases in capital are credits;

decreases in capital are debits.

Capital Account Debit

Cash Account Credit

4. Revenue accounts-

Those accounts related to Income and gains of a business are called revenue accounts.

Such as Sales account,

Commission received account,

Discount received account,

Rent received account,

Interest Received Account,

Dividend received account etc.

Revenue means the amount receivable or realized from sale of goods and earnings from interest, dividends, commission, etc.

Rules for Debit and Credit-

Increases in incomes and gains are credits;

decreases in incomes and gains are debits.

Golden Rules Of Accounting Modern Approach for Revenue Accounts

For Example-

1.Goods sold for cash Rs.90,000.

Cash Account (Assets Account)

Sales Account (Revenue Account)

Assets increase in the form of Cash

Revenue increase in the form Sale of goods

Rules-

Increases in assets are debits;

decreases in assets are credits.

Increases in incomes and gains are credits;

decreases in incomes and gains are debits

Cash Account Debit

Sales Account Credit

2. Commission received Rs. 15,000.

Cash Account (Assets Account)

Commission Received Account (Revenue Account)

Assets increase in the form of Cash

Revenue increase in form commission received

Rules-

Increases in assets are debits;

decreases in assets are credits.

Increases in incomes and gains are credits;

decreases in incomes and gains are debits

Cash Account Debit

Commission Received Account Credit

5. Expenses accounts-

Those accounts related to the expenses of a business are called expense accounts.

Such as a purchase account,

commission account,

Discount account,

Rent account,

Repairs account,

General expenses account,

Office expenses account, etc.

Costs incurred by a business in the process of earning revenue are called expenses. Examples of expenses are Purchase of Goods, Office Expenses, Carriage, Commission to agent, Depreciation, Rent, Wages, Salaries, Interest, Carriage, Manufacturing expenses, Light and water and Telephone, Postage, Administration, Advertisement expenses, etc.

Rules for Debit and Credit-

Increases in expenses and losses are debits;

decreases in expenses and losses are credits.

Golden Rules Of Accounting Modern Approach for Expense Accounts

For Example-

1. Goods purchased for cash Rs. 50,000.

Cash Account (Assets Account)

Purchase Account (Expenses Account)

Assets decrease in the form of Cash

Expenses increase in the form of the purchase of goods

Rules-

Increases in assets are debits;

decreases in assets are credits.

Increases in expenses and losses are debits;

decreases in expenses and losses are credits.

Purchase Account Debit

Cash Account Credit

2.Wages paid Rs. 15,000.

Cash Account (Assets Account)

Wages Account (Expenses Account)

Assets decrease in form of Cash

Expenses increase in form Wages

Rules-

Increases in assets are debits;

decreases in assets are credits.

Increases in expenses and losses are debits;

decreases in expenses and losses are credits.

Wages Account Debit

Cash Account Credit

Golden Rules of Debit and Credit in the American Approach–

Golden Rules Of Accounting Modern Approach: Conslusion

Also read : Accounting Equation Class 11