Table of Contents

Interest on Capital journal entry

Interest on Capital journal entry-

Amount/Funds invested by the proprietors in the business constitute Capital. As business is considered to be a separate and distinct entity from its owners, it is usual for the business to pay interest on the capital invested by the owner. Thus, interest on capital is an expense for the firm and gain for the proprietors.

It means:

- Interest on Capital being an Expense for the business . Expenses Account will be debited as the rule Increase in expenses is debited’ is applied.

- Interest on Capital gain for the prpprietor Capital Account will be credited as the rules increase in capital is credited’ is applied.

Interest on Capital journal entry-

Interest on Capital A/c Dr.

To Capital A/c

(Being interest on capital allowed)

Note- Interest on Capital being an Expense for the business, is transferred to Profit and loss account at the end of financial year.

Profit and loss account A/c Dr.

To Interest on Capital A/c Dr.

(Being interest on capital transferred to profit and loss account)

Example for Interest on Capital journal entry-

Mr. Dabour proprietors of a Business Enterprise . Capital invested in Business 50,00,000. Interest allowed on capital @ 6 % p.a. pass journal entry for Interest on capital.

Working Note :

Calculation of Interest on capital-

Interest on capital=Amount of capital × Rate of interest on capital/100

Interest on capital=50,00,000 × 6/100

Interest on capital=3,00,000

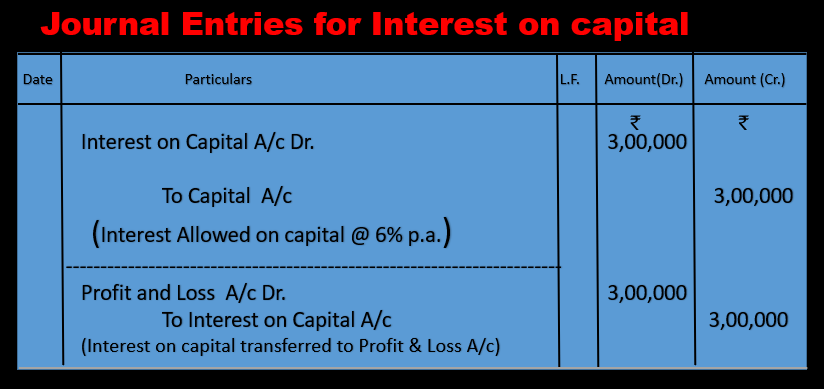

Interest on Capital journal entry-

- Interest on Capital being an Expense for the business . Expenses Account will be debited as the rule Increase in expenses is debited’ is applied.

- Interest on Capital gain for the prpprietor Capital Account will be credited as the rules increase in capital is credited’ is applied.

Also read : Golden Rules Of Accounting

Interest on partner’s capital-

Interest on partner’s capital is an expense to the firm and hence debited to profit and loss appropriation A/c. On the other hand it is an income for partners and hence credited to partner’s capital account/current account (Individually).

Accounting Entries

For Interest allowed on Capital:

Interest on Capital A/c Dr.

To Partner’s Capital /current A/c (Individually)

(Crediting ‘Interest on Capital’ to Partner’s Capital/current A/c)

For transferring on Interest on Capital to Profit and Loss Appropriation A/c :

Profit and Loss Appropriation A/c Dr.

To Interest on Capital A/c

(Interest on capital transferred to Profit & Loss Appropriation A/c