Table of Contents

ISC ACCOUNTS 12 Past Adjustment In Partnership MCQs with solved answers

ISC ACCOUNTS 12 Past Adjustment In Partnership MCQs with solved answers

Sometimes, after closing the accounts of the partnership firm at the end of the financial year, it is discovered that there had been some errors or omissions in the accounts.

In such cases, instead of altering the old accounts and the signed Balance Sheet an adjustment entry for such errors or omissions is made at the beginning of the next year.

Usually, the following types of adjustments are made:-

(i) Interest on Capital has been omitted.

(ii) Interest on Drawings has been omitted.

(iii) Interest on Capital and on Drawings have been provided at higher or lower rates than the rates agreed in the Deed.

(iv) Salary or commission to partners either not given or a higher or lower amount has been given.

(v) Profit shared in a wrong ratio.

ISC ACCOUNTS 12 Past Adjustment In Partnership MCQs with solved answers

Question 1.

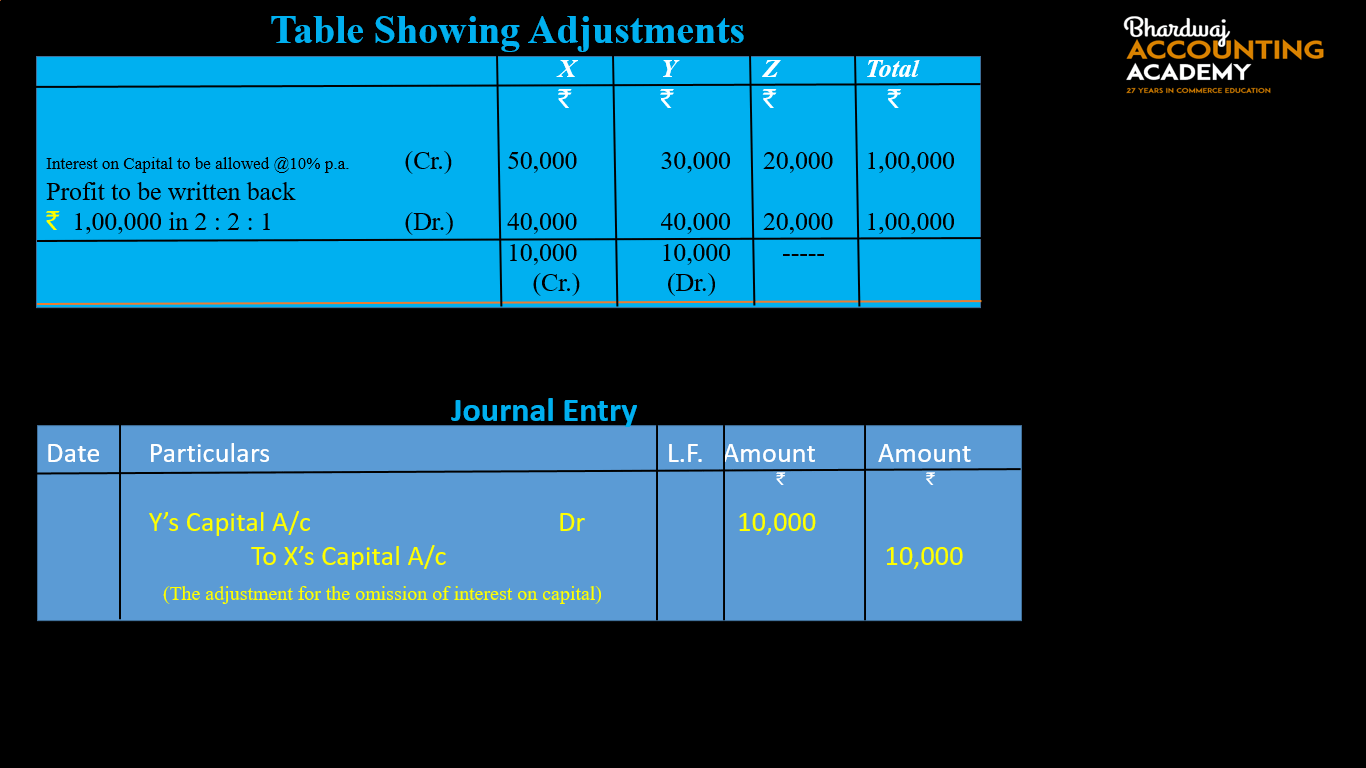

X, Y, and Z are partners sharing profits in the ratio of 2 : 2: 1. Their capitals on 1st April 2019 were ₹ 5,00,000 ₹ 3,00,000 and ₹ 2,00,000 respectively. After closing the accounts on 31st March 2021 it was found out that according to the partnership agreement interest on capital at 10% p.a. was not provided before distribution of profit.

It was agreed among the partners to make the adjustment entry at the beginning of the next year rather than to alter the Balance Sheet.

(i) What necessary journal entries will be passed in the books of the firm at the beginning of the next year? Assuming that capitals are not fixed-

(a) Y’s Capital A/c Dr ₹10,000

To X’s Capital A/c ₹10,000

(The adjustment for the omission of interest on capital)

(b) Y’s Current A/c Dr ₹10,000

To X’s Current A/c ₹10,000

(The adjustment for the omission of interest on capital)

(c) Y’s Capital A/c Dr ₹10,000

To X’s Current A/c 10,000

(The adjustment for the omission of interest on capital)

(d) Z’s Capital A/c Dr ₹10,000

To X’s Capital A/c ₹10,000

(The adjustment for the omission of interest on capital)

(ii) What necessary journal entries will be passed in the books of the firm at the beginning of the next year? Assuming that capitals are fixed-

(a) Y’s Capital A/c Dr ₹10,000

To X’s Capital A/c ₹10,000

(The adjustment for the omission of interest on capital)

(b) Y’s Current A/c Dr ₹10,000

To X’s Current A/c ₹10,000

(The adjustment for the omission of interest on capital)

(c) Y’s Capital A/c Dr ₹10,000

To X’s Current A/c 10,000

(The adjustment for the omission of interest on capital)

(d) Z’s Capital A/c Dr ₹10,000

To X’s Capital A/c ₹10,000

(The adjustment for the omission of interest on capital)

Answer 1.

(i) Answer-

(a) Y’s Capital A/c Dr ₹10,000

To X’s Capital A/c ₹10,000

(The adjustment for the omission of interest on capital)

(ii) Answer-

(b) Y’s Current A/c Dr ₹10,000

To X’s Current A/c ₹10,000

(The adjustment for the omission of interest on capital)

Note:

Due to omission of Interest on capital an excess amount, ₹1,00,000 as profit has been credited (distributed) to the partners capital/ current account in their profit sharing ratio , which should have been distributed in the capital ratio ( in the form of interest on capital) ₹1,00,000 should be written back by debiting the partners capital/current account in their profit sharing ratio.

ISC ACCOUNTS 12 Past Adjustment In Partnership MCQs with solved answers

Question 2.

X, Y, and Z are partners sharing profits in the ratio of 5 : 3 : 2 . Their capitals on 1st April 2019 were ₹ 4,00,000 ₹ 2,80,000, and ₹ 2,20,000 respectively. After closing the accounts on 31st March 2020 it was found out that according to the partnership agreement interest on capital at 5% p.a. was not provided before the distribution of profit.

It was agreed among the partners to make the adjustment entry at the beginning of the next year rather than to alter the Balance Sheet.

(i) What necessary journal entries will be passed in the books of the firm at the beginning of the next year? Assuming that capitals are not fixed-

(a) X’s Capital A/c Dr 3,000

To Y’s Capital A/c 2,500

To Z,s Capital A/c 500

(The adjustment for the omission of interest on capital)

(b) X’s Capital A/c Dr 2,500

To Y’s Capital A/c 500

To Z,s Capital A/c 2,000

(The adjustment for the omission of interest on capital)

(c) Y’s Capital A/c Dr ₹2,500

To X’s Current A/c 2,500

(The adjustment for the omission of interest on capital)

(d) Z’s Capital A/c Dr ₹3,000

To X’s Capital A/c ₹3,000

(The adjustment for the omission of interest on capital)

(ii) What necessary journal entries will be passed in the books of the firm at the beginning of the next year? Assuming that capitals are fixed-

(a) X’s Current A/c Dr 2,500

To Y’s Current A/c 500

To Z,s Current A/c 2,000

(The adjustment for the omission of interest on capital)

(b) X’s Capital A/c Dr 2,500

To Y’s Capital A/c 500

To Z,s Capital A/c 2,000

(The adjustment for the omission of interest on capital)

(c) Y’s Current A/c Dr ₹2,500

To X’s Current A/c 2,500

(The adjustment for the omission of interest on capital)

(d) Z’s Capital A/c Dr ₹3,000

To X’s Current A/c ₹3,000

(The adjustment for the omission of interest on capital)

Answer 2.

(i) Answer-

(b) X’s Capital A/c Dr 2,500

To Y’s Capital A/c 500

To Z,s Capital A/c 2,000

(The adjustment for the omission of interest on capital)

(ii) Answer-

(a) X’s Current A/c Dr 2,500

To Y’s Current A/c 500

To Z,s Current A/c 2,000

(The adjustment for the omission of interest on capital)

Note:

Due to the omission of Interest on capital an excess amount, ₹45,000 as profit has been credited (distributed) to the partners capital/ current account in their profit sharing ratio, which should have been distributed in the capital ratio( in the form of interest on capital) ₹45,000 should be written back by debiting the partners capital/current account in their profit sharing ratio.

ISC ACCOUNTS 12 Past Adjustment In Partnership MCQs with solved answers

Question 3.

X, Y, and Z are partners sharing profits in the ratio of 5 : 3 : 2 Their capitals on 1st April 2019 were ₹ 4,00,000 ₹ 3,00,000, and ₹ 2,00,000 respectively.

During the year their drawings were ₹20,000, ₹ 15,000, and ₹ 10,000 respectively.

After closing the accounts on 31st March 2020 it was found out that according to the partnership agreement interest on drawing ₹ 1,000, ₹ 750 and ₹ 250 respectively was not charged, before distribution of profit.

It was agreed among the partners to make the adjustment entry at the beginning of the next year rather than to alter the Balance Sheet. What necessary journal entries will be passed in the books of the firm at the beginning of the next year? Assuming that capitals are not fixed-

(a) Y’s Capital A/c Dr 150

To Z’s Capital A/c 150

(The adjustment of interest on Drawing omitted in previous year’s Account)

(b) Y’s Current A/c Dr 150

To Z’s Current A/c 150

(The adjustment of interest on Drawing omitted in previous year’s Account)

(c) Y’s Current A/c Dr 150

To X’s Current A/c 150

(The adjustment for the omission of interest on capital)

(d) None of these

Answer 3.

(a) Y’s Capital A/c Dr 150

To Z’s Capital A/c 150

(The adjustment of interest on Drawing omitted in previous year’s Account)

ISC ACCOUNTS 12 Past Adjustment In Partnership MCQs with solved answers

Question 4.

A, B and C are partners in a firm sharing profits and losses in the ratio of 2: 2: 1. Their capitals were ₹ 30,00,000; ₹ 20,00,000 and ₹ 10,00,000 respectively.

Interest on capital for the year ended 2020 was credited to them @ 5% p.a. instead of 10% p.a. What journal entries will be passed in the books of the firm at the beginning of the next year? Assuming that capitals are fluctuating-

(a) B’s Capital A/c Dr 20,000

C’s Capital A/c Dr 10,000

To A’s Capital A/c 30,000

(The adjustment of interest on capital credited to them @ 5% p.a. instead of 10% p.a.)

(b) B’s Current A/c Dr 20,000

C’s Current A/c Dr 10,000

To A’s Current A/c 30,000

(The adjustment of interest on capital credited to them @ 5% p.a. instead of 10% p.a.)

(c) B’s Capital A/c Dr 30,000

To A’s Capital A/c 30,000

(The adjustment of interest on capital credited to them @ 5% p.a. instead of 10% p.a.)

(d) C’s Capital A/c Dr 30,000

To A’s Capital A/c 30,000

(The adjustment of interest on capital credited to them @ 5% p.a. instead of 10% p.a.)

Answer 4.

(a) B’s Capital A/c Dr 20,000

C’s Capital A/c Dr 10,000

To A’s Capital A/c 30,000

(The adjustment of interest on capital credited to them @ 5% p.a. instead of 10% p.a.)

ISC ACCOUNTS 12 Past Adjustment In Partnership MCQs with solved answers

Question 5.

A, B and C are partners in a firm sharing profits and losses in the ratio of 2 : 2 : 1. Their capitals were ₹30,00,000; ₹ 20,00,000 and ₹ 10,00,000 respectively.

Interest on capital for the year ended 2020 was credited to them @ 6% p.a. instead of 10% p.a. The profit for the year before charging interest was ₹ 20,00,000. What journal entries will be passed in the books of the firm at the beginning of the next year? Assuming that capitals are fixed-

(a) B’s Capital A/c Dr 16,000

C’s Capital A/c Dr 8,000

To A’s Capital A/c 24,000

(The adjustment of interest on capital credited to them @ 6% p.a. instead of 10% p.a.)

(b) B’s Current A/c Dr 16,000

C’s Current A/c Dr 8,000

To A’s Current A/c 24,000

(The adjustment of interest on capital credited to them @ 6% p.a. instead of 10% p.a.)

(c) B’s Capital A/c Dr 24,000

To A’s Capital A/c 24,000

(The adjustment of interest on capital credited to them @ 6% p.a. instead of 10% p.a.)

(d) C’s Capital A/c Dr 24,000

To A’s Capital A/c 24,000

(The adjustment of interest on capital credited to them @ 6% p.a. instead of 10% p.a.)

Answer 5.

(b) B’s Current A/c Dr 16,000

C’s Current A/c Dr 8,000

To A’s Current A/c 24,000

(The adjustment of interest on capital credited to them @ 6% p.a. instead of 10% p.a.)

ISC ACCOUNTS 12 Past Adjustment In Partnership MCQs with solved answers

Question 6.

A, B, and C are partners in a firm sharing profits and losses in the ratio of 5:3:2. Their capital were ₹ 50,00,000; ₹ 10,00,000 and ₹ 20,00,000 respectively. For the year ended 31st March 2020 interest on capital was credited to them @15% instead of 10%. What journal entries will be passed in the books of the firm at the beginning of the next year? Assuming that capitals are not fixed-

(a) A’s Capital A/c Dr 50,000

C’s Capital A/c Dr 20,000

To A’s Capital A/c 70,000

(The adjustment of interest on capital credited to them @ 15% p.a. instead of 10% p.a.)

(b) A’s Capital A/c Dr 40,000

C’s Capital A/c Dr 30,000

To A’s Capital A/c 70,000

(The adjustment of interest on capital credited to them @ 15% p.a. instead of 10% p.a.)

(c) A’s CurrentA/c Dr 50,000

C’s Current A/c Dr 20,000

To A’s Capital A/c 70,000

(The adjustment of interest on capital credited to them @ 15% p.a. instead of 10% p.a.)

(d) None of these

Answer 6.

(a) A’s Capital A/c Dr 50,000

C’s Capital A/c Dr 20,000

To A’s Capital A/c 70,000

(The adjustment of interest on capital credited to them @ 15% p.a. instead of 10% p.a.)

ISC ACCOUNTS 12 Past Adjustment In Partnership MCQs with solved answers

Question 7.

A, B and C are partners in a firm sharing profits and losses in the ratio of 5:3:2. Their capital were ₹ 10,00,000; ₹ 5,00,000 and ₹ 5,00,000 respectively. For the year ended 31st March, 2020 interest on capital was credited to them @12% instead of 10%. What journal entries will be passed in the books of the firm at the beginning of the next year? Assuming that capitals are not fixed-

(a) A’s Capital A/c Dr 1,500

C’s Capital A/c Dr 500

To A’s Capital A/c 2,000

(The adjustment of interest on capital credited to them @ 12% p.a. instead of 10% p.a.)

(b) C’s Capital A/c Dr 2,000

To B’s Capital A/c 2,000

(The adjustment of interest on capital credited to them @ 12% p.a. instead of 10% p.a.)

(c) C’s Current A/c Dr 2,000

To B’s Current A/c 2,000

(The adjustment of interest on capital credited to them @ 12% p.a. instead of 10% p.a.)

(d) None of these

ISC ACCOUNTS 12 Past Adjustment In Partnership MCQs with solved answers

Answer 7.

(b) C’s Capital A/c Dr 2,000

To B’s Capital A/c 2,000

(The adjustment of interest on capital credited to them @ 12% p.a. instead of 10% p.a.)

ISC ACCOUNTS 12 Past Adjustment In Partnership MCQs with solved answers

Question 8.

A ,B and C are partners in a firm .capital accounts on 1 april 2019 stood at ₹ 2,00,000 , ₹ 1,00,000 and ₹1,00,000.

Each partner withdrew 10,000 during the FY 2019-2020.

As per the provisions of the Partnership deed-

- B was entitled to a salary of ₹ 2,000 p.m.

- Int. on capital was to be allowed @ 10 % p.a.

- Int. on drawings was to be charged @ 4% p.a.

- Profits and losses were to be shared in the ratio of their capitals.

- C was entitled to a Commission ₹ 10,000

The net profit of ₹90,000 for the year ended 31st march 2020 was divided equally amongst the partners without providing for the terms of the Partnership deed. What journal entries will be passed in the books of the firm at the beginning of the next year? Assuming that capitals are not fixed-

(a) A’s Capital A/c Dr 6,000

C’s Capital A/c Dr 1,950

To B’s Capital A/c 7950

(The adjustment entry made)

(b) A’s Capital A/c Dr 1,900

C’s Capital A/c Dr 6,050

To B’s Capital A/c 7950

(The adjustment entry made)

(c) C’s Current A/c Dr 7,950

To B’s Current A/c 7,950

(The adjustment of interest on capital credited to them @ 12% p.a. instead of 10% p.a.)

(d) None of these

ISC ACCOUNTS 12 Past Adjustment In Partnership MCQs with solved answers

Answer 8.

(b) A’s Capital A/c Dr 1,900

C’s Capital A/c Dr 6,050

To B’s Capital A/c 7950

(The adjustment entry made)

ISC ACCOUNTS 12 Past Adjustment In Partnership MCQs with solved answers

ISC ACCOUNTS 12 Guarantee of Profit to a partner MCQs with solved answers

ISC ACCOUNTS 12 Interest On Drawing MCQs with solved answers

ISC ACCOUNTS 12 Interest On Capital MCQs with solved answers

ISC ECONOMICS 12 Price Elasticity Of Supply MCQs with solved Answers

Fundamentals of partnership MCQs and Answer

ISC ACCOUNTS 12 Fundamental of Partnership MCQs With solved Answers