Table of Contents

Issue of Debentures under the Terms and Conditions of Redemption of Debentures

Terms of Issue of Debentures When a company issues debentures, it usually mentions the terms on which they will be redeemed on their maturity.

Redemption of debentures means the discharge of liability on account of debentures by repayment made to the debenture holders.

Debentures can be redeemed either at par or at a premium.

The following six situations are commonly found in practice depending upon the terms and conditions of the issue and redemption of debentures.

Six situations Issue of Debentures under the Terms and Conditions of Redemption of Debentures:

(i) Issued at par and redeemable at par

(ii) Issued at a discount and redeemable at par

(iii) Issued at a premium and redeemable at par

(iv) Issued at par and redeemable at a premium

(v) Issued at a discount and redeemable at a premium

(vi) Issued at a premium and redeemable at a premium

In all the above six cases, the following journal entries will be passed:

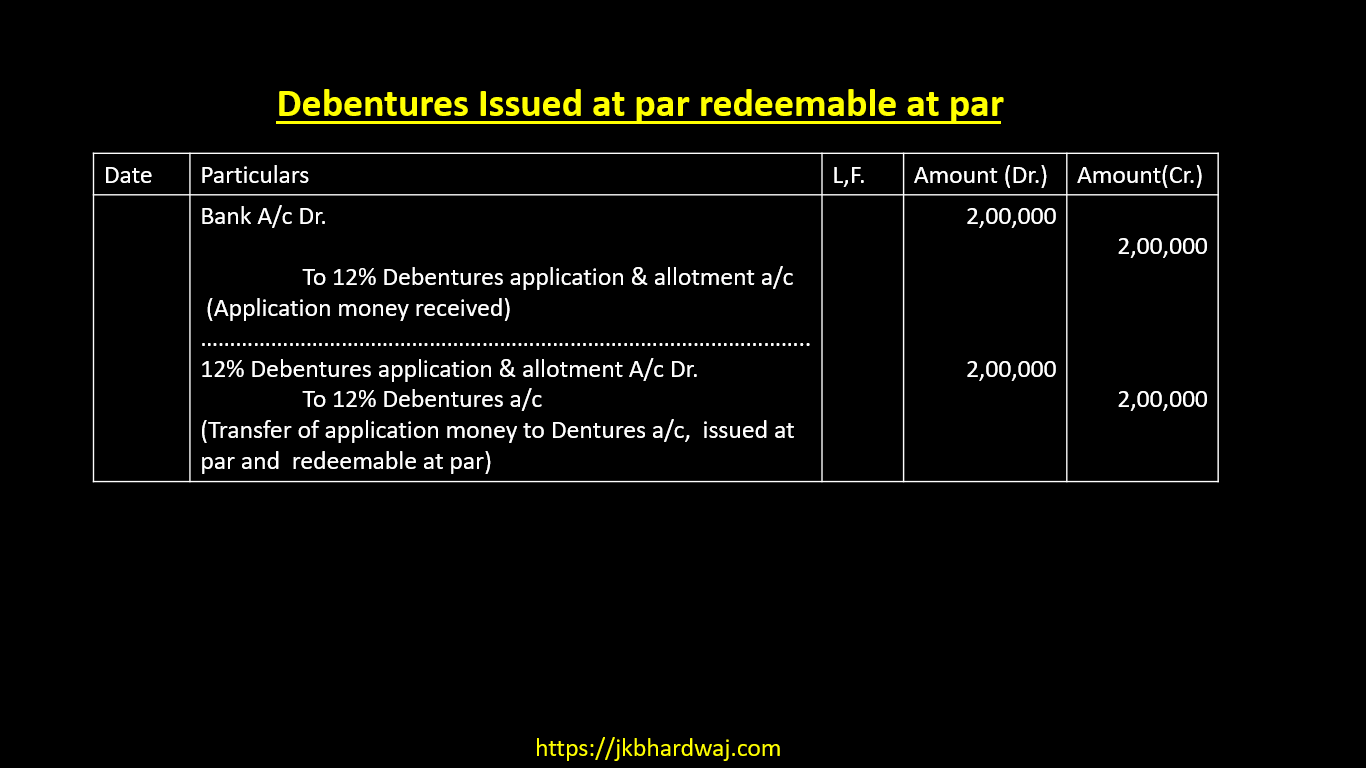

1. Issue at par and redeemable at par:

(a) Bank A/c Dr.

To Debenture Application & Allotment A/c

(Receipt of application money)

(b) Debenture Application & Allotment A/c Dr.

To Debentures A/c

(Allotment of debentures)

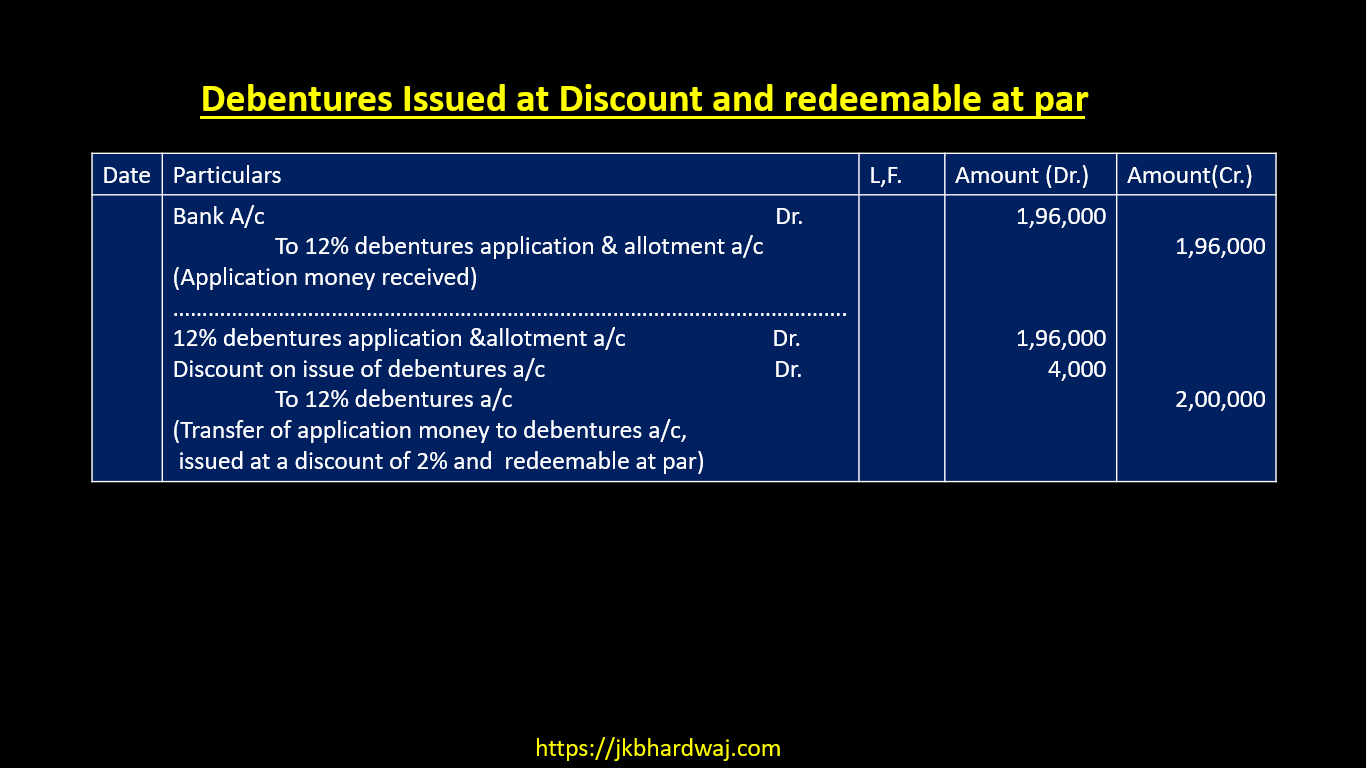

2. Issue at a discount and redeemable at par:

(a) Bank A/c Dr.

To Debenture Application & Allotment A/c

(Receipt of application money)

(b) Debenture Application & Allotment A/c Dr.

Discount on Issue of Debentures A/c Dr.

To Debentures A/c

(Allotment of debentures at a discount)

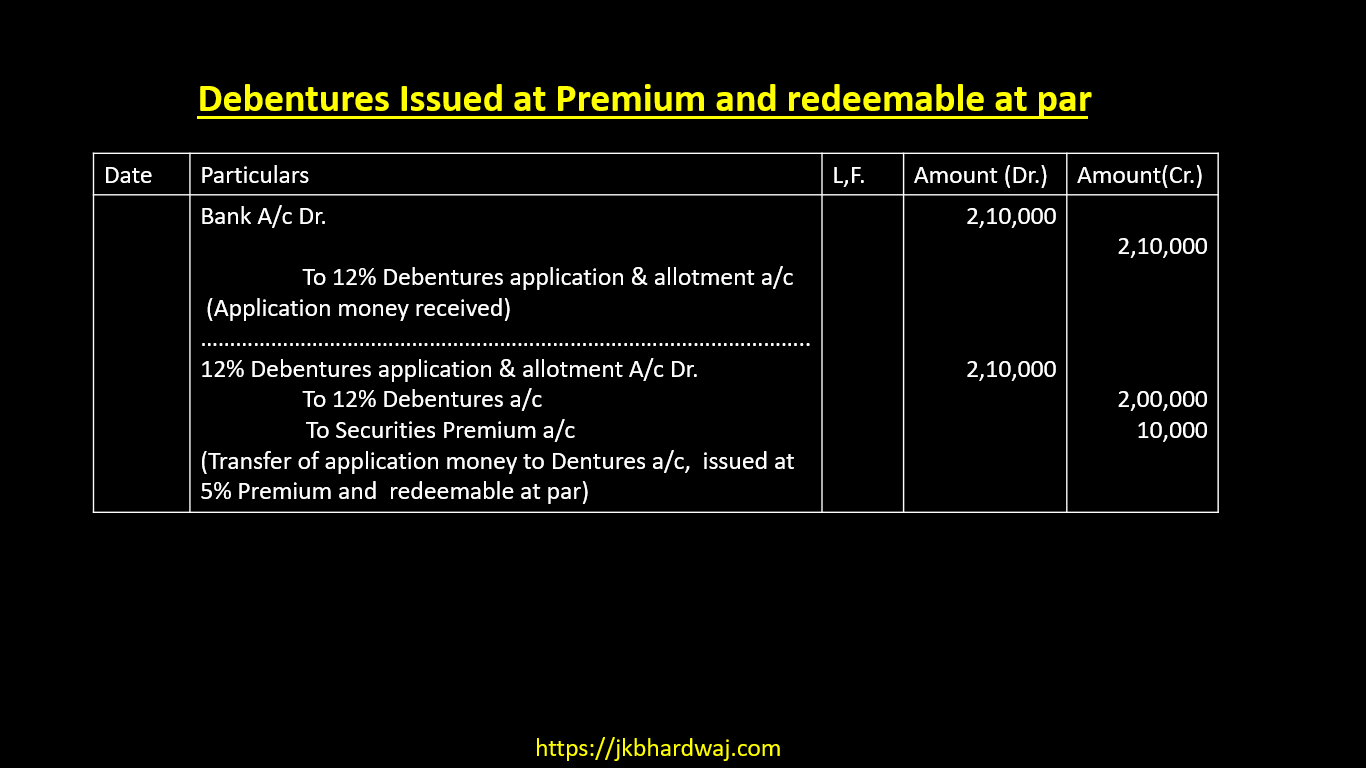

3. Issue at a premium and redeemable at par:

(a) Bank A/c Dr.

To Debenture Application & Allotment A/c

(Receipt of application money)

(b) Debenture Application & Allotment A/c Dr.

To Debentures A/c

To Securities Premium A/c

(Allotment of debentures at a premium)

4. Issue at par and redeemable at a premium:

(a) Bank A/c Dr.

To Debenture Application & Allotment A/c

(Receipt of application money)

(b) Debenture Application & Allotment A/c Dr.

Loss on Issue of Debentures A/c Dr. (with a premium on redemption)

To Debentures A/c (with nominal value of debenture)

To Premium on Redemption of Debenture A/c (with premium on redemption )

(Allotment of debentures at par and redeemable at a premium)

5. Issue at a discount and redeemable at a premium:

Bank A/c Dr.

To Debenture Application & Allotment A/c

(Receipt of application money)

Debenture Application & Allotment A/c Dr.

Loss on Issue of Debentures A/c Dr. (with discount on issue plus premium on redemption)

To Debentures A/c (with nominal value of debenture)

To Premium on Redemption of Debentures A/c (with premium on redemption)

(Allotment of debentures at a discount and redeemable at a premium)

6. Issued at a premium and redeemable at a premium:

Bank A/c Dr.

To Debenture Application & Allotment A/c

(Receipt of application money)

Debenture Application & Allotment A/c Dr.

Loss on Issue of Debentures A/c Dr. (with the premium on redemption)

To Debentures A/c (with nominal value of debenture)

To Securities Premium A/c (with a premium on the issue)

To Premium on Redemption of Debentures A/c (with premium on redemption)

Notes:

1. When debentures are redeemable at a premium, the premium payable on redemption is debited to ‘Loss on Issue of Debentures A/c’. It may be noted that when debentures are issued at a discount and are redeemable at a premium, the amount of discount on issue is also debited to ‘Loss on Issue of Debentures’. It may be noted that when the debentures are issued at a discount and are redeemable at par, the amount debited to ‘Discount on Issue of Debentures A/c’ as usual.

2. Premium on redemption is a liability of a company payable in future. It is a provision and is shown under the head Non-current liabilities under the subhead ‘Long-term Borrowings’ until debentures are redeemed.

Case 1. Issue at par and redeemable at par:

X Company Ltd Issued 2,000, 12% debentures of Rs. 100 each at par, redeemable at par. Pass Journal Entry.

Case 2. Issue at a premium and redeemable at par:

X Company Ltd Issued 2,000, 12% debentures of Rs 100 each at a premium of 5%, redeemable at par. Pass Journal Entry.

Case 3. Issue at a discount and redeemable at par:

X Company Ltd Issued 2,000, 12% debentures of Rs. 100 each at a discount of 2%, redeemable at par. Pass Journal Entry.

Note: At the end of the year Discount on Issue of Debenture is written off.

Statement of Profit and Loss Dr. 4,000

To Discount on Issue of Debenture A/c 4,000

(Discount on issue of debentures written-off)

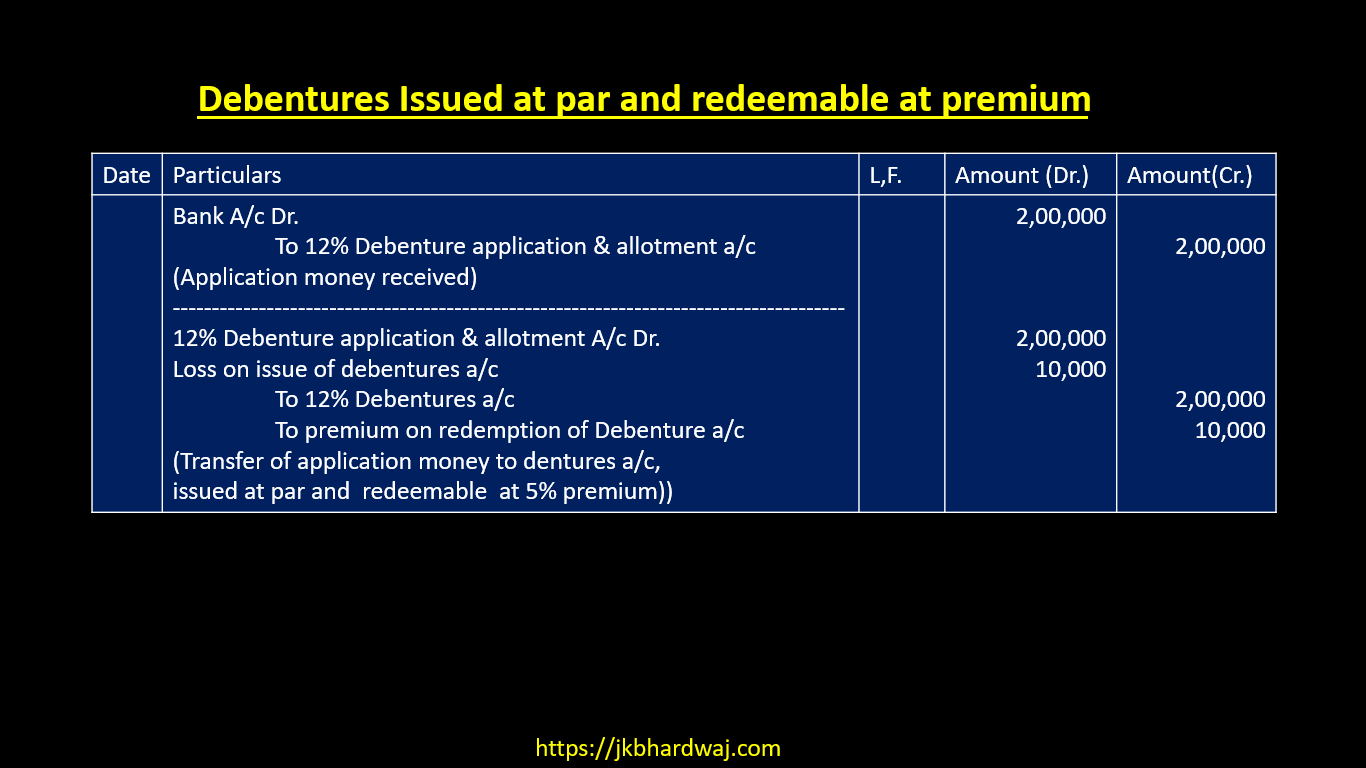

Case 4. Issue at par and redeemable at a premium:

X Company Ltd Issued 2,000, 12% debentures of Rs. 100 each at par, redeemable at 5% Premium. Pass Journal Entry.

Note: At the end of the year Loss on Issue of Debenture is written off.

Statement of Profit and Loss Dr. 10,000

To Loss on Issue of Debenture A/c 10,000

(Loss on issue of debentures written-off)

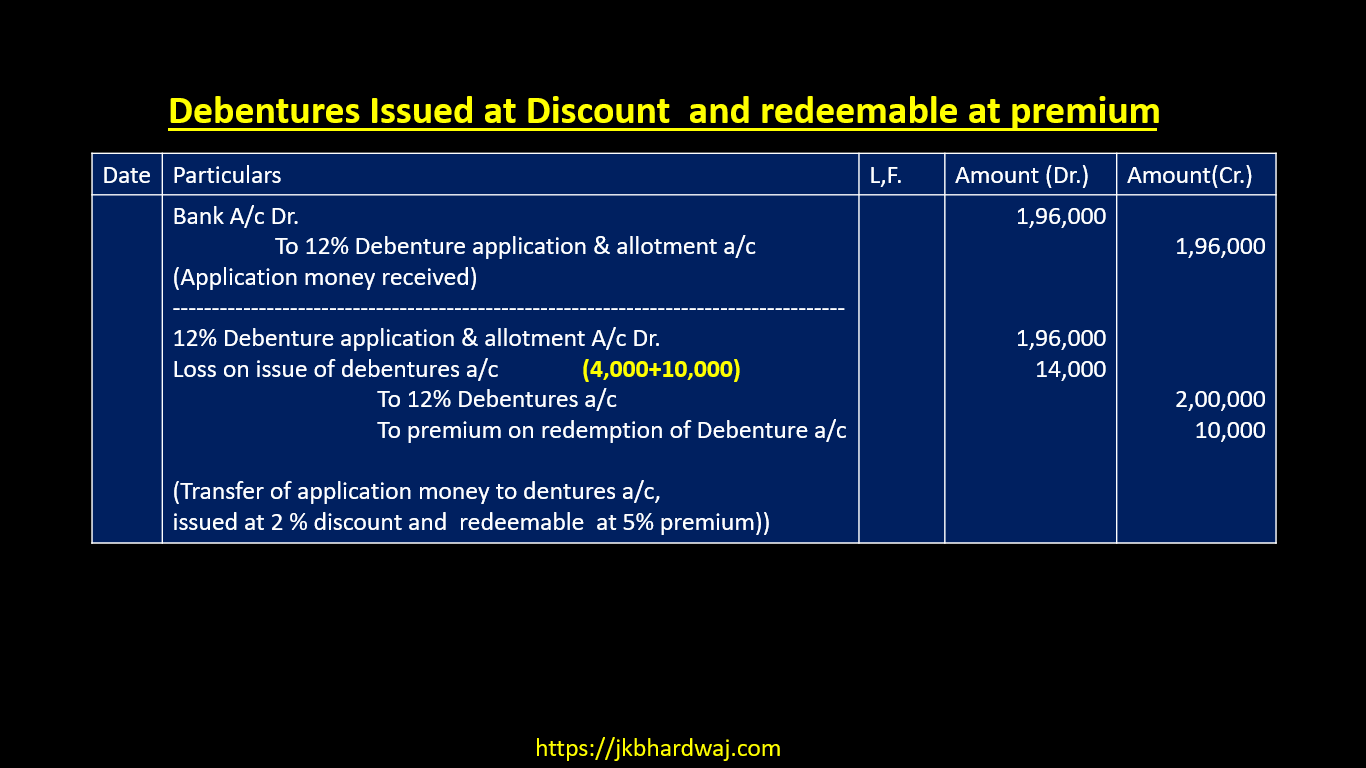

Case 5. Issue at a discount and redeemable at a premium:

X Company Ltd Issued 2,000, 12% debentures of Rs. 100 each at 2% discount, redeemable at 5% Premium. Pass Journal Entry.

Note: At the end of the year Loss on Issue of Debenture is written off.

Statement of Profit and Loss Dr. 14,000

To Loss on Issue of Debenture A/c 14,000

(Loss on issue of debentures written-off)

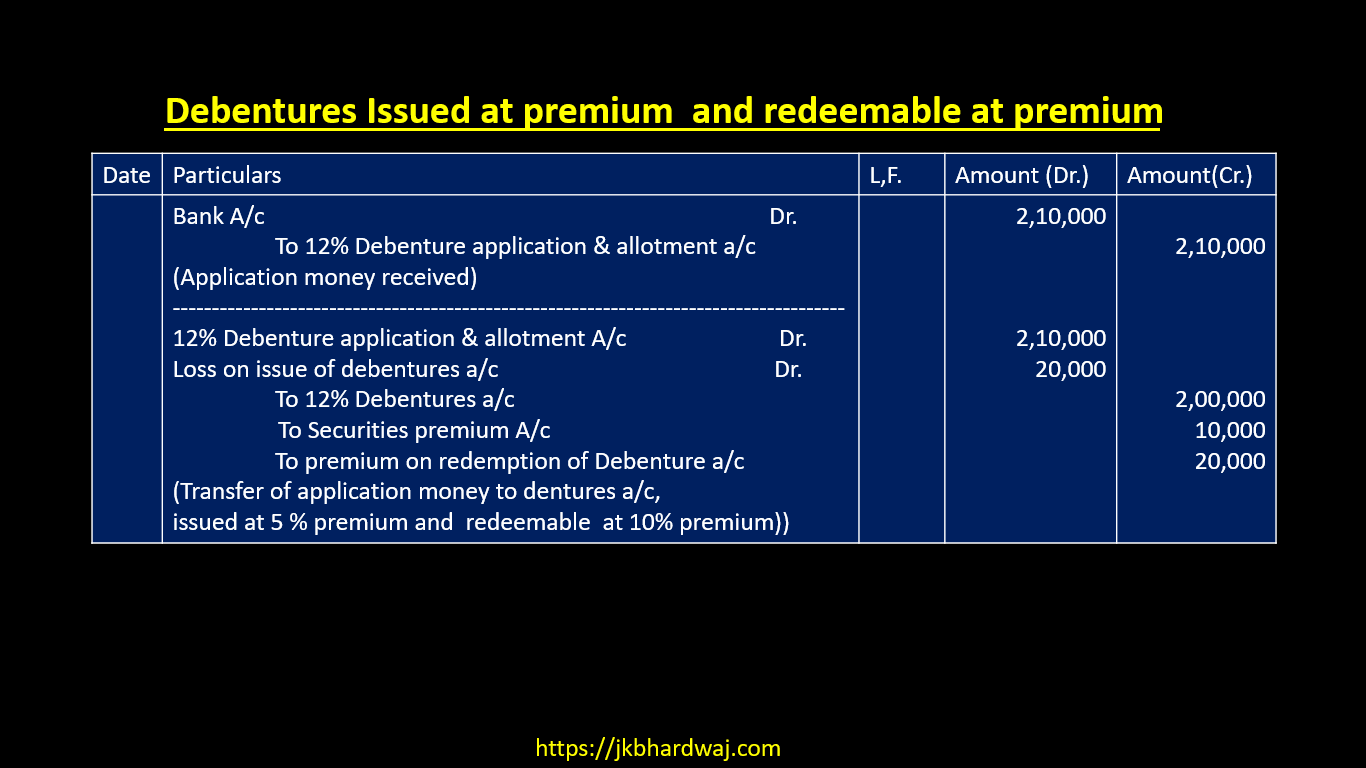

Case 6. Issued at a premium and redeemable at a premium:

X Company Ltd. Issued 2,000, 12% debentures of Rs 100 each at a premium of 5%, redeemable at 10% Premium. Pass Journal entry.

Note: At the end of the year Loss on Issue of Debenture is written off.

Securities Premium A/c Dr. 10,000

Statement of Profit and Loss Dr. 10,000

To Loss on Issue of Debenture A/c 20,000

(Loss on issue of debentures written-off)

Issue of Debentures for Consideration other than Cash

ISC 12 Admission of partner questions (previous papers)

Hidden Goodwill at the time of Retirement of A Partner

ALSO READ : ACCOUNTING TREATMENT OF GOODWILL AT THE TIME OF ADMISSION OF A NEW PARTNER

Questions For Practice:

Issue of Debentures under the Terms and Conditions of Redemption of Debentures

1. You are required to pass journal entries to record the following issues of debentures and to write off any capital losses

(a) Zoom Ltd. issues 6,000, 12% Debentures of ₹ 100 each at par redeemable after 5 years also at par.

(b) Zola Ltd. issues 5,000, 13% Debentures of ₹ 100 each at a discount of 10% to be redeemed at par after 7 years.

(c) Zubic Ltd issues 11% Debentures of the total face value of ₹ 12,00,000 at a premium of 5% to be redeemed at par after 6 years.

(d) Ruby Ltd. issues ₹ 5,00,000, 12% Debentures at a premium of 5% to be redeemed at 10% premium after 10 years.

(e) Sagar Ltd. issues 3,000, 9% Debentures of ₹ 100 each at a discount of 7%, to be redeemed at a premium of 10% after 4 years.

2. You are required to pass journal entries to record the following issues of debentures and to write off any capital losses

(a) RAJI Ltd. issues 5,000, 12% Debentures of ₹ 100 each at par redeemable after 5 years also at par.

(b) EVA Ltd. issues 6,000, 13% Debentures of ₹ 100 each at a discount of 10% to be redeemed at par after 7 years.

(c) VARUN Ltd issues 11% Debentures of the total face value of ₹ 10,00,000 at a premium of 5% to be redeemed at par after 6 years.

(d) ARUN Ltd. issues ₹ 8,00,000, 12% Debentures at a premium of 5% to be redeemed at a 10% premium after 10 years.

(e) RISHI Ltd. issues 6,000, 9% Debentures of ₹ 100 each at a discount of 6%, to be redeemed at a premium of 10% after 4 years.

(f) KETAN Ltd. issues 9,000, 9% Debentures of ₹ 100 each at par to be redeemed at a premium of 10% after 4 years.

3. You are required to pass journal entries to record the following issues of

debentures and to write off any capital losses:

- Issue of ₹ 1,00,000, 9% debentures of ₹ 100 each at par and redeemable at par.

- Issue ₹Rs 1,00,000, 9% debentures of ₹ 100 each at a premium of 5% but redeemable at par.

3. Issue of ₹ 1,00,000, 9% debentures of ₹ 100 each at a discount of 5% repayable at par.

4. Issue of ₹ 1,00,000, 9% debentures of ₹ 100 each at par but repayable at a premium of 5%.

5. Issue of ₹ 1,00,000, 9% debentures of ₹ 100 each at a discount of 5% but redeemable at a premium of 5%.

6. Issue of Rs 1,00,000, 9% debentures of Rs 100 each at a premium of 5% and redeemable at a premium of 5%.

4. Pass the necessary journal entries for the issue of debentures in the following cases:

(i) Rs 40,000,15% debentures of Rs 100 each issued at par redeemable at 10% premium.

(ii) Rs 90,000, 15% debentures of Rs 100 each issued at a discount of 5% redeemable at a premium of 10%.

5. Pass the necessary journal entries for the issue of debentures in the following cases

(i)Rs 40,000,15% debentures of Rs 100 each issued at a discount of 10% redeemable at par.

(ii)Rs 80,000,15% debentures of Rs 100 each issued at a premium of 10% redeemable at a premium of 10%.

6. Give journal entries in each of the following cases, if the face value of a debenture is Rs 100.

(i) A debenture issued at Rs 110 repayable at Rs 100.

(ii) A debenture issued at Rs 100 repayable at Rs 105.

(iii)A debenture issued at Rs 105 repayable at Rs 110.

(iv) A debenture issued at Rs 90 repayable at Rs 100.

(v) A debenture issued at Rs 90 repayable at Rs 110.

(vi) A debenture issued at Rs 100 repayable at Rs 100

7.Pass journal entries for the following at the time of issue of debentures:

(a) B Ltd. issues 30,000, 12% Debentures of Rs. 100 each at a discount of 5 % to be repaid at par at the end of 5 years.

(b) E Ltd. issues Rs. 60,000, 12% Debentures of Rs. 100 each at a discount of 5 % repayable at a premium of 10% at the end of 5 years.

(c) F Ltd. issues Rs. 80,000, 12% Debentures of Rs. 100 each at a premium of 5 % redeemable at 110%.