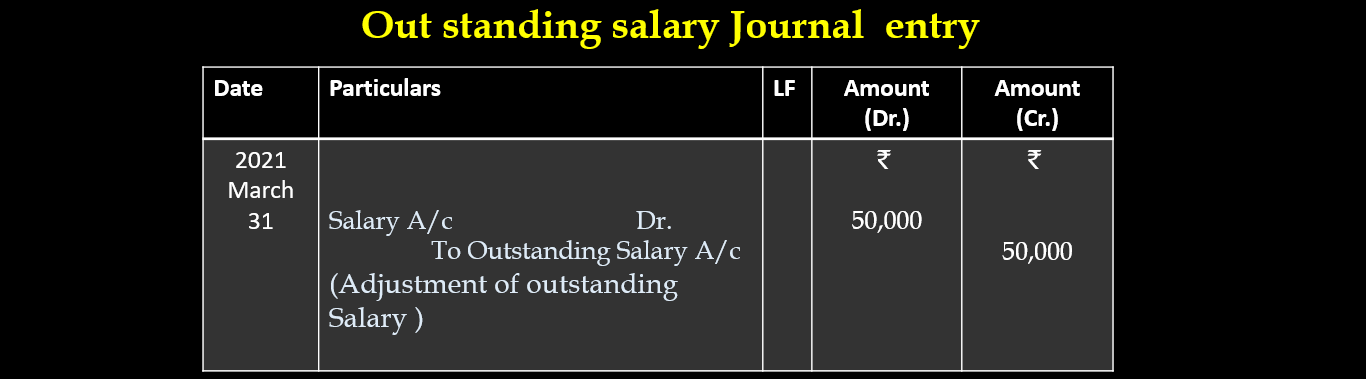

Outstanding Salary Journal Entry

Outstanding Salary-

Salary for the month of March is due but not paid called outstanding salary. It is an example of salary outstanding. Outstanding Salary on 31.03.2021 ₹ 50,000. Pass journal entry for outstanding Salary.

Outstanding Salary Journal Entry-

Explanation:

The salary Due or Outstanding to the employees is considered as the Expenses of the business. According to the accounting rules, the increase in the Expenses will be debited. Therefore, the salary account will be debited while passing the Journal entry.

The salary Due or Outstanding is the liabilities of the business. According to the rules of accounting, the increase in liability is credited, Therefore, the Outstanding salary account will be credited while passing the Journal entry.

Treatment in final Accounts-

Outstanding salary is given outside the trial balance or given in adjustment-

* Add to the salary on the Debit side of the Profit & Loss Account.

* Shown on the liabilities side of BALANCE SHEET.

Treatment in final Accounts-

If Outstanding Salary is given in trial balance-

* Shown on the liabilities side of BALANCE SHEET.