Oversubscription of shares

What Is Oversubscription of shares?

oversubscription of shares is a financial situation where a company receives more applications for shares than the number of shares it has made available to the public.

When the company receives applications for more shares than the number of shares offered to the public for subscription it is a case of over-subscription.

Usually, the companies that are financially strong, have a good reputation in the market, or have profitable future prospects, receive over-subscription of shares. In case of over-subscription, A company cannot allot more shares than what it has offered.

Or

Shares are said to be over-subscribed when the number of shares applied for is more than the number of shares offered for issue.

Or

When the number of shares applied for, is more than the number of shares offered for subscription, the shares are said to be oversubscribed.

For example: The company issued 30,000 shares to the public, public applied for 35,000 shares, This situation is an Over-subscription.

ISC 12 oversubscription of shares

In case of oversubscription, the following three alternatives are available

(i) Rejection of applications

(ii) Partial or pro-rata allotment

(iii) Combination of pro-rata allotment and rejection

1. Reject the Excess Applications and Money Return: The journal entry made is as follows:

Share Application A/c Dr.

To Bank A/c

(Reject the Excess Applications and Money Return)

2. Prorata allotment and Excess application money adjusted with Allotment: The journal entry made is as follows:

Shares Application A/c Dr.

To Share Allotment A/c

(Excess application money adjusted with allotment)

ISC 12 Issue of Shares Questions Previous Papers

3. Prorata allotment and Excess application money adjusted with Calls: The journal entry made is as follows:

Share Application A/c Dr.

To Call-in-advance A/c

(Excess application money adjusted with Calls)

4. Share application Money Transfer to Share capital Account: The journal entry made is as follows:

Share Application A/c Dr.

To Share Capital Account A/c

(Share application Money Transfer to Share capital Account)

NOTE: Joint entry can be made in all above situations as follows:

Share Application A/c Dr.

To Share Capital Account A/c

To Share Allotment A/c

To Call-in-advance A/c

To Bank A/c

(Share application Money Transfer to Share capital Account, Excess application money adjusted with allotment and Calls and Reject the Excess Applications and Money Return)

CBSE 12 oversubscription of shares

Treatment of surplus application money in case of proportionate allotment:

(i) If the question is silent about the treatment of surplus application money or states that the surplus application money will be adjusted only on allotment, the surplus application money will be used only for allotment, and the balance, if still left, will be returned.

CBSE 12 oversubscription of shares

(ii) If the question specifically states that the surplus application amount will be adjusted against allotment and call, the surplus application amount is transferred to the allotment and advance call account. If the balance amount is still left then it will be refunded.

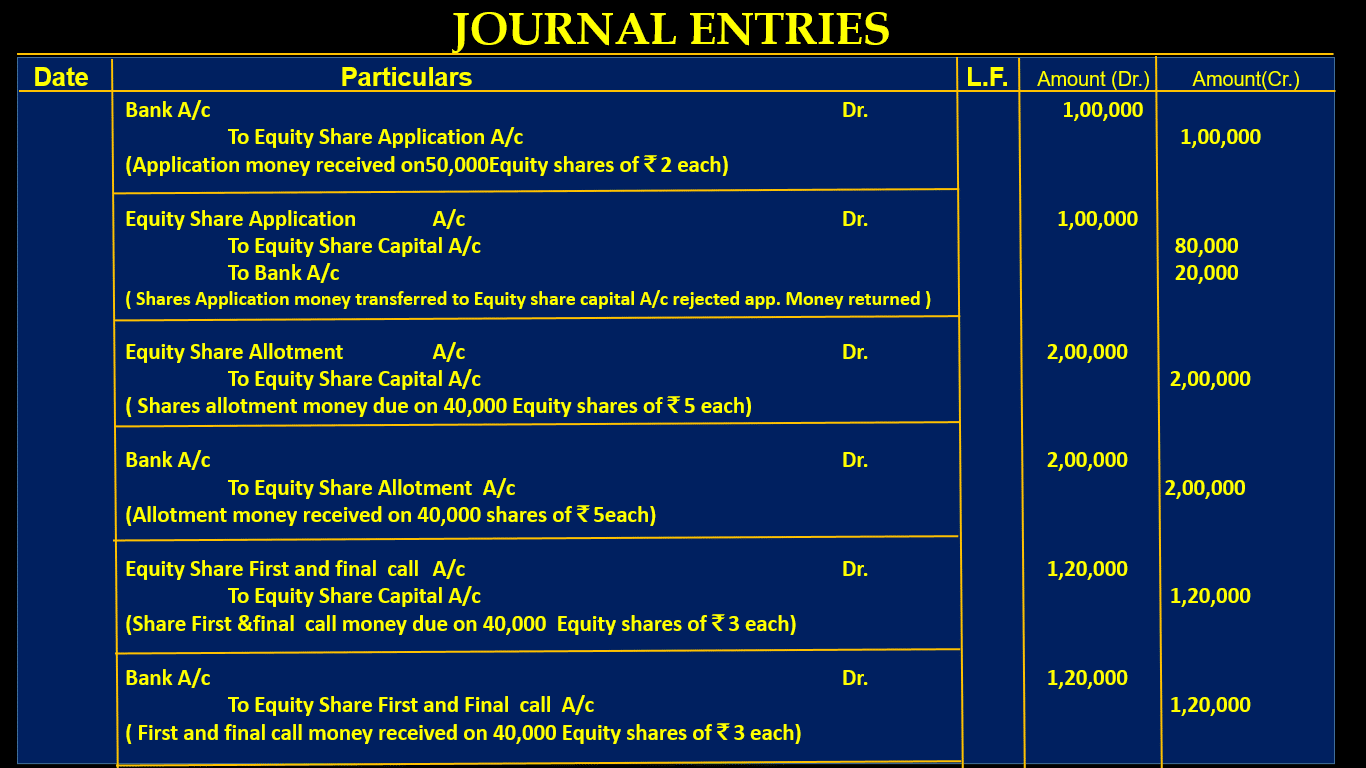

Example 1 :

BHARAT Ltd issued for public subscription 40,000 equity shares of ₹10 each. Application received for 50,000 shares . The amount payable is as under:

On application ₹2 per share,

on allotment ₹5 per share,

on first and Final call ₹3 per share.

All duly money received. Excess application rejected and money returned.

Pass journal entries in the books of the company.

Solution:

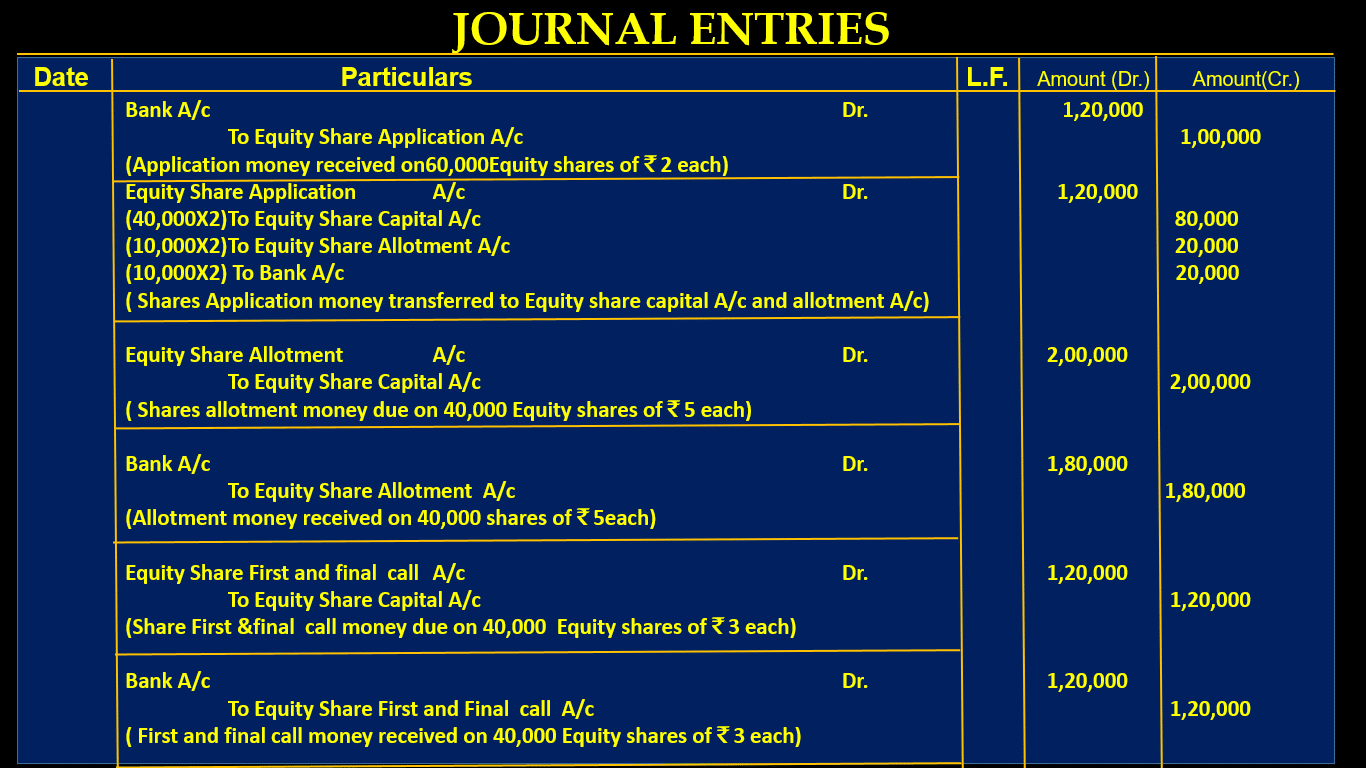

Example 2 :

BHARAT Ltd issued for public subscription 40,000 equity shares of ₹10 each. Application received for 50,000 shares. 40,000 shares allotted to 50,000 applicants on a pro-rata basis and Excess application money adjusted with allotment. The amount payable is as under:

On application ₹ 2 per share,

on allotment ₹ 5 per share,

on the first and Final call ₹ 3 per share.

All duly money received. Pass journal entries in the books of the company.

Solution:

Example 3 :

BHARAT Ltd issued for public subscription 40,000 equity shares of ₹ 10 each. Application received for 60,000 shares. Allotment of Shares on a pro-rata basis is as follows-

30,000 applicants = 30,000

20,000 applicants = 10,000

10,000 applicants = NIL

on a pro-rata basis and Excess application money adjusted with allotment and rejected application money returned. The amount payable is as under:

On application ₹2 per share,

on allotment ₹5 per share,

on first and Final calls ₹3 per share.

All duly money received.

Pass journal entries in the books of the company.

Solution:

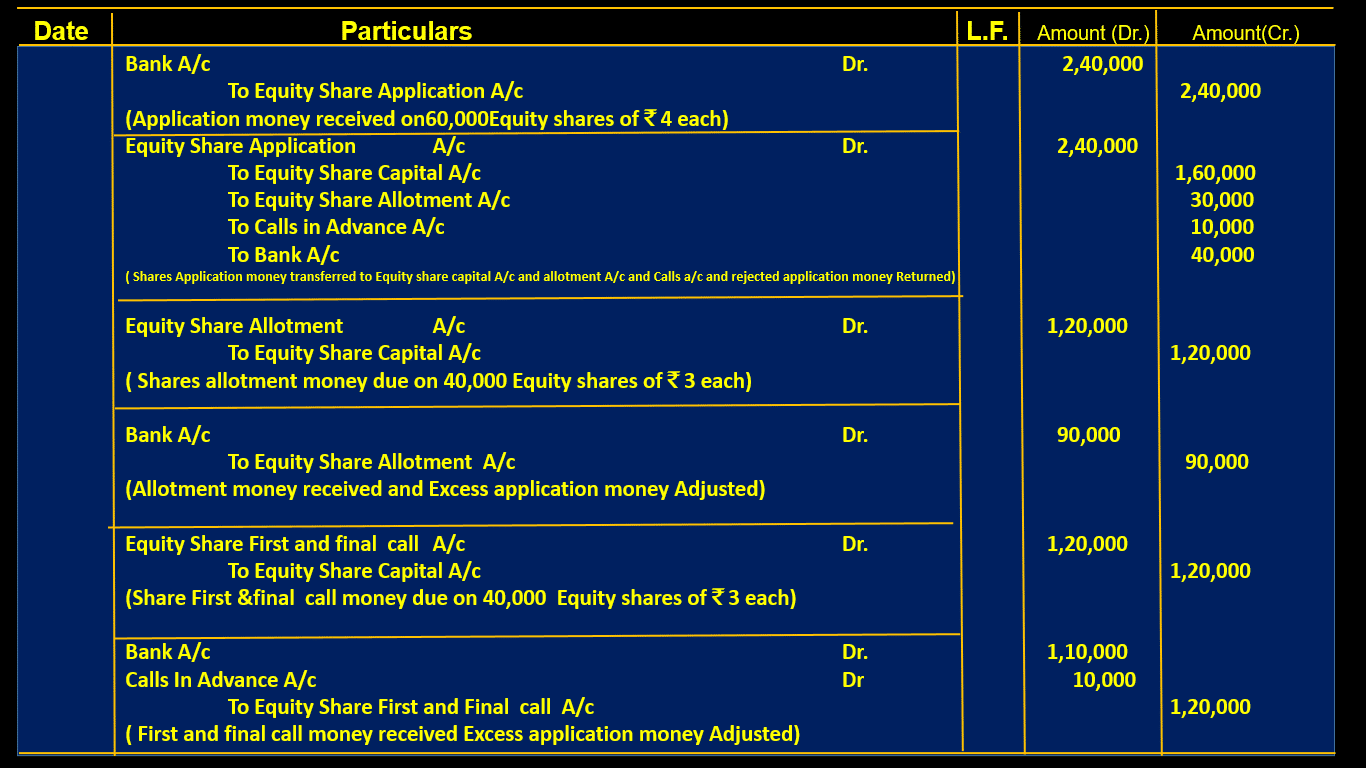

Example 4 :

BHARAT Ltd issued for public subscription 40,000 equity shares of ₹ 10 each. Application received for 60,000 shares. 40,000. Allotment of Shares on a pro-rata basis is as follows-

30,000 applicants = 30,000

20,000 applicants = 10,000

10,000 applicants = NIL

on a pro-rata basis and Excess application money adjusted with allotment and Calls and rejected application money returned. The amount payable is as under:

On application ₹4 per share,

on allotment ₹3per share,

on first and Final calls ₹3 per share.

All duly money received.

Pass journal entries in the books of the company.

CLASS 12 oversubscription of shares

Solution:

JOURNAL ENTRIES

Questions For Practice:

1. DEV Ltd issued for public subscription 40,000 equity shares of ₹ 10 each. Application received for 55,000 shares. The amount payable as under:

On application ₹2 per share,

on allotment ₹ 5 per share,

on first and Final call ₹3 per share.

All duly money received. Excess application rejected and money returned. Pass journal entries in the books of company.

2. DESHNA Ltd issued for public subscription 40,000 equity shares of Rs. 10 each. Application received for 48,000 shares. 40,000 shares allotted to 48,000 applicants on pro-rata basis and Excess application money adjusted with allotment. The amount payable as under:

On application ₹ 3 per share,

on allotment ₹ 5 per share,

on first and Final call ₹2 per share. All duly money received. Pass journal entries in the books of company.

3. SURBHI Ltd. issued a prospectus for inviting applications from the public for 20,000 equity shares of ₹10 each. The amounts were payable as follows:

₹ 3 on Application,

₹ 4 on Allotment and

the balance on First and final call.

Applications were received for 25,000 shares & the allotment was made as follows:

Full Allotment on applications for 15,000 shares;

5,000 shares on applications for 8,000 shares.

No allotment was made on applications for 2,000 shares. Rejected application money returned and Excess application money was adjusted with allotment. Pass Journal entries in the books of the company.

4. ARADHYA Ltd. issued a prospectus for inviting applications from the public for 30,000 equity shares of ₹10 each at 20% Premium. The amounts were payable as follows:

₹ 3 on Application,

₹ 6 on Allotment(With Premium) and

the balance on the First and final call.

Applications were received for 40,000 shares & the allotment was made as follows:

Full Allotment on applications for 20,000 shares;

10,000 shares on applications for 15,000 shares.

No allotment was made on applications for 5,000 shares. Rejected application money was returned and Excess application money was adjusted with allotment. Pass Journal entries in the books of the company.

5. ARPIT Ltd. issued a prospectus for inviting applications from the public for 50,000 equity shares of ₹10 each at par. The amounts were payable as follows:

₹ 3 on Application,

₹ 5 on Allotment(With Premium) and

the balance on the First and final call.

Applications were received for 1,00,000 shares & the allotment was made as follows:

Full Allotment on applications for 30,000 shares;

20,000 shares on applications for 60,000 shares.

No allotment was made on applications for 10,000 shares. Rejected application money returned and Excess application money was adjusted with allotment subsequent calls. Pass Journal entries in the books of the company.

6. MAHIMA Ltd issued for public subscription 40,000 equity shares of Rs. 10 each. Application received for 48,000 shares. 40,000 shares allotted to 48,000 applicants on a pro-rata basis and Excess application money adjusted with allotment. The amount payable is as under:

On application ₹ 3 per share,

on allotment ₹ 5 per share,

on the first and Final call ₹2 per share. All duly money received. A shareholder who had been allotted 800 shares failed to pay the allotment and Calls money. Calculate the amount received on the allotment.

7. KAPIL Ltd issued for public subscription 40,000 equity shares of Rs. 10 each. Application received for 50,000 shares. 40,000 shares allotted to 50,000 applicants on a pro-rata basis and Excess application money adjusted with allotment. The amount payable is as under:

On application ₹ 3 per share,

on allotment ₹ 5 per share,

on the first and Final call ₹2 per share. All duly money received. A shareholder who had been Applied for 800 shares failed to pay the allotment and Calls money. Calculate the amount received on the allotment.

Hidden Goodwill at the time of Admission of A New Partner

8. ARYAN Ltd issued for public subscription 50,000 equity shares of Rs. 10 each. Application received for 60,000 shares. 50,000 shares allotted to 60,000 applicants on a pro-rata basis and Excess application money adjusted with allotment. The amount payable is as under:

On application ₹ 3 per share,

on allotment ₹ 5 per share,

on the first and Final call ₹2 per share. All duly money received. A shareholder who had been Applied for 1200 shares failed to pay the allotment and Calls money his share were forfeited and Re-Issued at 10% Discount. Pass Journal entries in the books of the company.

9. KAMNA Ltd. issued Equity shares of ₹10 each at a premium of ₹3 per share payable as

₹4 per share on application, ₹5 per share on allotment (including premium), ₹2 per share

on first call and ₹2 per share on final call.

Amit, who had applied for 2,000 shares, was allotted 1,200 shares. He failed to pay the

allotment money and on his failure to pay the first call his shares were forfeited.

Out of the forfeited shares, 1,000 were reissued at ₹7 per share.

You are required to pass journal entries for forfeiture and reissue.

Important questions of fundamentals of partnership-5

10. Sudesh Ltd. was registered with an authorised capital of ₹ 40,00,000 divided into

4,00,000 Equity Shares of ₹ 10 each.

The company offered 50,000 shares to the public at a premium of ₹ 2 per share,

payable as follows:

₹ 3 on application

₹ 6 on allotment (including premium)

₹ 3 on first and final call (due two months after allotment)

Applications were received for 60,000 shares and pro-rata allotment was made as

follows:

Category A: The applicants of 40,000 shares were allotted 30,000 shares.

Category B: The applicants of 20,000 shares were allotted in full.

Excess money paid on application was utilized towards allotment.

Nobby, a shareholder from Category A, who had applied for 1,200 shares failed to pay

the allotment and call money.

Vineet, a shareholder from Category B, who had been allotted 1,000 shares, paid the

call money due, along with allotment.

The company forfeited Nobby’s shares after the first and final call and paid interest on

Calls-in-advance to Vineet @ 12% per annum on the day of the final call.

You are required to:

(i) Pass journal entries to record the above transactions in the books of the

company (including entries for interest on Calls-in-advance).

(ii) Prepare Calls-in-arrears Account.