Table of Contents

Prepaid expense journal entry

Prepaid Expenses?

Sometimes a part of a certain expense paid may relate to the next accounting period. Such expenses are called prepaid expenses or expenses paid in advance.

Or

At the end of the accounting year, it is found that the benefits of some expenses have not yet been fully received; a portion of its benefit would be received in the next accounting year. This portion of expenses is carried forward to the next year and is termed prepaid expenses.

Or

In short, Prepaid expenses refer to the expenses, which have been paid in advance, i.e. they are not yet due but paid.

For example, insurance premium paid in the current year maybe for the year ending, the date of which falls in the next year. The part of the insurance premium which relates to the next accounting year is the insurance premium paid in advance or prepaid Insurance.

Prepaid expense journal entry:

1. At the time of expenses paid in advance or prepaid:

Expenses A/c Dr.

To Cash /Bank A/c

(Expenses paid)

2. At the time of Adjustment of prepaid expenses (at the end of the financial Period):

Prepaid Expenses A/c Dr.

To Expenses A/c

(Adjustment of prepaid expenses)

Note: If the financial statement is the prepared at end of every month both entries are passed.

Treatment in final Accounts-

If Prepaid Expenses are given outside the trial balance-

1. Deduct from the concerned expenses on the debit side of Trading Account Or Profit & Loss Account.

2. Shown on the assets side of the Balance Sheet under the heads of current assets.

Treatment in final Accounts-

If Prepaid Expenses have been mentioned inside the Trial balance, then it means the adjustment entry has already been passed in such a case-

1. prepaid expenses are Shown only on the assets side of the Balance Sheet under the heads of current assets.

Prepaid expense journal entry:

Examples 1:

Adjustment Entry:

Treatment in final accounts:

Prepaid expense journal entry:

Examples 2:

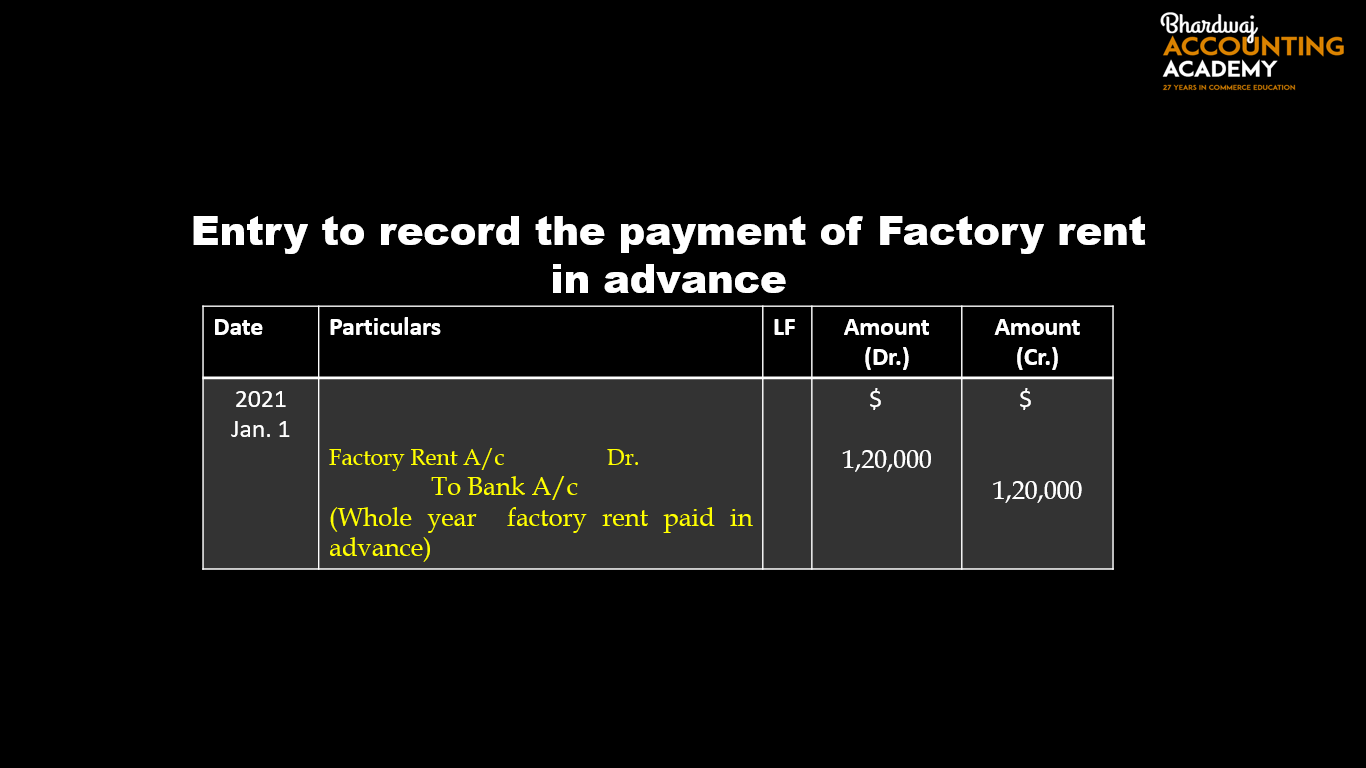

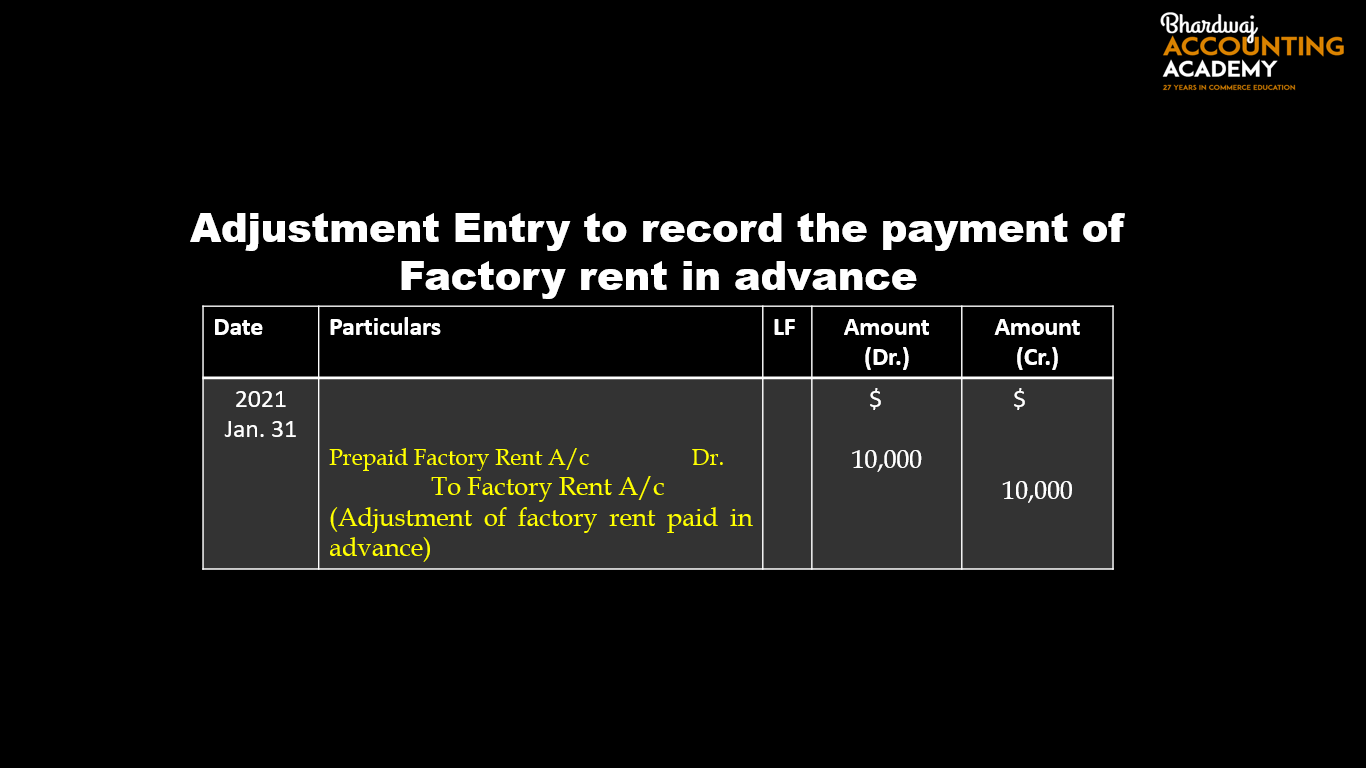

X Company Ltd. started a business, and for that, it requires the Factory Building on rent. It signed an agreement with Mr. Prakash to take the Factory Building on rent for one year. As per the agreement, X Company Ltd has to pay rent of full 12 months in advance (at the beginning of the year on 01.01.2021) itself to the landlord amounting to $ 1,20,000 for a whole year.

Analyze the treatment of the amount paid as rent for the Factory Building by the company and pass the necessary journal entries recording the payment and the adjusting entries for January 2021.

List of current assets and current liabilities

Diminishing Balance Method Or Reducing Balance Method Or Written Down Value Method