Table of Contents

REALISATION ACCOUNT Meaning

Realisation Account is a nominal account which is prepared at the time of dissolution of firm.

Realisation account is prepared It is prepared to realize the various assets and pay off the liabilities.

The objective of realisation account is to find out the Profit or loss on realisation of assets and payment of liabilities.

The profit or loss on realisation is distributed among all the partners in their profit sharing ratio.

- When the firm is dissolved, finally all the books of accounts are closed through Bank Account.

- Only those assets which can be converted into cash are transferred to Realisation Account (Debit side) in their book value.

- Only those liabilities which relate to third party are transferred to Realisation Account (Credit side) in their book value.

- Realisation Account also shows what amount were realised on the sale of assets and which liabilities were discharged at what amount.

- Assets are sold and the liabilities are paid off through Realisation account.

- Amount realised from assets recorded credit side of realisation account.

- Amount paid to liabilities recorded debit side of realisation account.

- Dissolution expenses recorded debit side of realisation account.

- This account is closed by transferring the balance (i.e., profit or loss on realisation) to partner’s capital accounts.

- Balance of Partner’s Loan Account is not transferred to Realisation Account. Separate accounts is opened to settle such liabilities.

- Provident Fund is a liability of the firm towards employees and hence it is transferred to Realisation Account.

REALISATION ACCOUNT

ACCOUNTING ENTRIES

Only those assets which can be converted into cash are transferred to Realisation a/c.

1.For closing of various asset accounts on the dissolution of partnership firm:

Realisation A/c Dr.

To Sundry Asset a/c (By Name)

(Except cash, bank balance and fictitious assets)

If provisions against any asset exists then asset at gross value is transferred to Realisation a/c and provision is created to Realisation a/c)

2.Provisions and reserves against assets should be closed by crediting the Realisation Account. The Journal entry is made:

Provision for Doubtful Debts A/c Dr.

Provision for Depreciation A/c Dr.

Any other Provision A/c Dr.

Investment Fluctuation Reserve A/c Dr.

To Realisation A/c

(Transfer of provision on assets)

Only those liabilities which relate to third party are transferred to Realisation a/c.

3.For closing various liabilities accounts on the dissolution of partnership firm:

Sundry Liabilities a/c Dr (By name)

To Realisation a/c

(Except partner’s loan, capital and accumulated profits)

4.For sale of asset (Whether recorded or unrecorded):

Cash or Bank a/c Dr

To Realisation a/c

(For cash realized from sale of asset)

5.For asset taken over by partner (Whether recorded or unrecorded):

Partner Capital a/c Dr

To Realisation a/c

(For cash realized from sale of asset)

6.For payment of liability (Whether recorded or unrecorded):

Realisation a/c Dr

To Cash or Bank a/c

(For liability paid)

ALSO READ : Partnership Deed

7.For assuming of liability paid by partner (Whether recorded or unrecorded):

Realisation a/c Dr

To Partner capital a/c

(For liability paid)

8.For payment of realization expenses by firm:

Realisation a/c Dr

To Cash or Bank a/c

(For realization expenses paid)

9.For payment of realization expenses by Partner:

Realisation a/c Dr

To Partner capital a/c

(For realization expenses paid)

10.For profit on Realisation:

Realisation a/c Dr

To All partners’ Capital a/c

(Being profit on Realisation distributed to all partners in their profit sharing ratio)

11.For loss on Realisation:

All partners’ Capital a/c Dr.

To Realisation a/c

(Being loss on Realisation distributed to all partners in their profit sharing ratio)

12.The undistributed profits are transferred to all partners’ capital account in their sharing ratio:

General Reserve a/c Dr

Profit &Loss a/c Dr

To All partners’ capital account (in their ratio)

(Being undistributed profits transferred to all partners’ capital accounts)

13.Then distributed losses are transferred to all partner’s capital accounts in their profit sharing ratio:

All partners’ Capital a/c Dr. (in their ratio)

To profit & loss a/c

To Advertisement suspenseA/c

To Deferred revenue Expenses a/c

(Being undistributed losses are transferred to all partners’ capital account)

FORMAT OF REALISATION ACCOUNT

ALSO READ : Deferred Revenue Expenditure Definition

REALISATION ACCOUNT Meaning

Settlement of Partners’ Capital Accounts

After all the adjustments related to partners’ capital accounts and transfer of profit or loss on realisation to the partners’ capital accounts, the capital accounts are closed in the following manner:

(a) If the Partner’s Capital Account shows a debit balance, the partner has to bring the necessary amount of cash. The following journal entry is made :

Bank/Cash A/c Dr.

To Partner’s Capital A/c

(Cash brought by the partner)

(b) If the Partner’s Capital Account shows a credit balance, he/she is to be paid off the necessary amount of cash. The following journal entry will be made:

Partner’s Capital A/c Dr.

To Bank/Cash A/c

(Cash paid to partner)

(C) For payment of partner’s loan by firm:

Partner’s Loan a/c Dr

To Cash or Bank a/c

(For partner’s loan paid)

ACCOUNTING TREATMENT OF REALISATION EXPENSES

(A) When realisation expenses are paid by the firm ( borne by the firm and paid by firm ). The following journal entry will be recorded:

Realisation A/c Dr.

To Bank/ Cash A/c

(Payment of realisation expenses)

(B) When Realisation expenses are paid by the partner on behalf of the firm (realisation expenses paid by the partner but borne by the firm). The following journal entry is made:

Realisation A/c Dr.

To Partners’ Capital A/c

(Payment of realisation expenses by partner on behalf of firm)

(C) When Realisation expenses are borne by partner and paid by the partner:

No journal entry is made In the books of firms

(D) Realisation expenses were agreed to be borne by the partner but paid by the firm.The following journal entry is made:

Partner’s Capital A/c Dr.

To Cash/Bank A/c

(Realisation expenses paid by firm and borne by partner)

(E) When the firm has agreed to pay fixed amount to the partner towards Realisation expenses and the partner has to bear the expenses.The following journal entry is made:

Realisation A/c Dr.

To Partners’ Capital A/c

(Remuneration allowed to the partner)

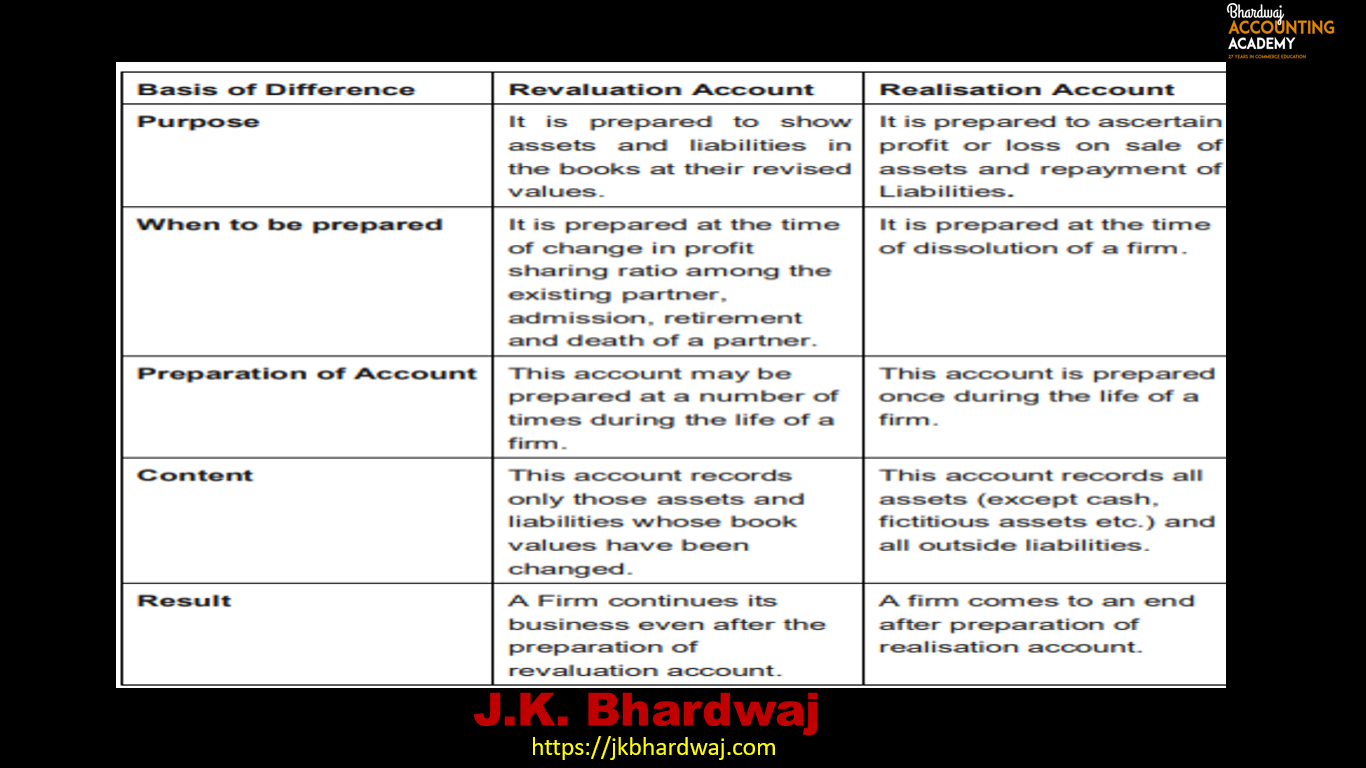

DIFFERENCE BETWEEN REVALUATION ACCOUNT AND REALISATION ACCOUNT

DISSOLUTION OF PARTNERSHIP FIRM

Dissolution of partnership firm means that the firm closes down its business and comes to an end. The dissolution of the firm implies a complete breakdown of the partnership relation among all the partners. On the dissolution of partnership firm, assets of the firm are sold and liabilities are paid off and out of remaining amount the accounts of partners are settled.

Dissolution of a firm: As per Indian Partnership Act, 1932: “Dissolution of firm means termination of partnership among all the partners of the firm”

ALSO READ : Concept of Goodwill