Table of Contents

Bill of Exchange: Meaning and Types

INTRODUCTION

In the present scenario, the sale and purchase of goods are done both on a cash basis and on a credit basis. In the case of credit transactions, the buyer is under an obligation to pay the amount after a specified period, In such a case, the seller prefers to get a written undertaking from the buyer to get the payment after a fixed period. So, the traders (buyer and seller) exchange has written documents containing agreements to ensure that the payment is made on the due date.

The Two main Documents used in the credit transactions of purchase and sale of goods are

- Bill of Exchange and

- Promissory Note.

Both of these documents or instruments are legal instruments under the Negotiable Instrument Act, 1881. Let us have a detailed study of these two documents.

Also Check Out: ISC ACCOUNTS SAMPLE PAPER YEAR-2021

BILL OF EXCHANGE

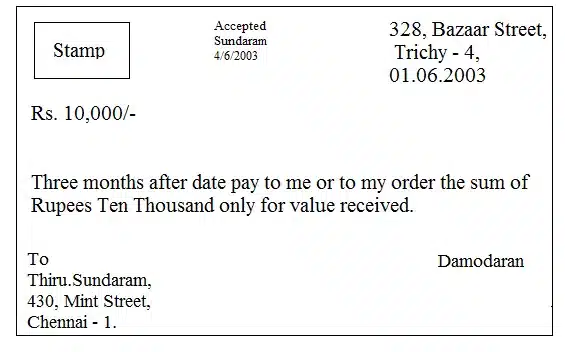

Meaning: According to Section 5 of the Negotiable Instruments Act, 1881, “A Bill of Exchange is an instrument in writing, containing an unconditional order signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of, a certain person or to the bearer of the instrument”

Parties to a Bill of Exchange

Promissory Note

According to secton 4 of the Negotiable Instruments Act, 1881, A Promissory Note is an instrument in writing (not being a bank note or a currency note) containing an unconditional undertaking signed by the maker to pay a certain sum of money only to or to the order of a certain person.

Promissory Note is an unconditional undertaking in writing by the maker to pay the specified amount to the specified person or to the bearer of the promissory note.

Features of a Promissory Note

1. It is an unconditional written undertaking to pay the specified amount.

2. It is drawn and signed by the maker/promisor.

3. It specifies the name of the payee.

4. The specific amount is payable to the specified person or to his order or to the bearer.

5. Proper stamp duty is paid on Promissory Note.

6. It is not payable to the bearer.

Parties of a Promissory Note

1. Drawer/Maker: He is the person who makes the promise to pay the amount. He is the debtor.

2. Drawee :He is the person in whose favour the promissory note is drawn. Generally he is the creditor. In a promissory note the drawee and payee are the same parties.

3. The Payee : The payee is a person to whom payment is to be made. He is the creditor.

Types of Bill of Exchange

Advantages of Bill of Exchange

Important Terms Related to Bills of exchange

- Term of Bill :

The period intervening between the date on which a bill is drawn and the date on which it becomes due for payment is called ‘Term of Bill’.

- Due Date :

Due date is the date on which the payment of the bill is due. Due date is ascertained in the following manner :

(i) In case of ‘Bill at sight’ –

Due date is the date on which a bill is presented for the payment.

(ii) In case of ‘Bill after Date’ –

Due Date = Date of Drawing + Term of Bill.

(ii) In case of ‘ Bill after sight’ –

Due date = Date of Acceptance + Term of Bill.

- Days of Grace :

Drawee is allowed three extra days after the due date of bill for making payments. Such 3 days are known as ‘Days of Grace’. It is a custom to add the days of grace.

- Date of Maturity :

The date which comes after adding three days of grace to the due date of a bill is called ‘Date of maturity’.

- Bill at sight/Bill on Demand:

When no time for payment is mentioned in the bill of exchange and the bill is payable whenever it is presented to the drawee for the payment, such bills are known as “Bill at sight” or “Bill on Demand”. 3 days of grace are not allowed when bill is payable on demand.

- Bill after Date:

Bill after date is the bill in which due date and date of maturity is ascertained from the date on which the bill is drawn.

3 days of grace are allowed for ascertaining the date of maturity in case of bill after date.

- Discounting of Bill:

When the bill is encashed from the bank before its due date, it is known as discounting of bill. Bank deducts its charges from the amount of bill and disburses the balance amount.

- Endorsement of Bill:

Endorsement of a bill means the Process of transferring the title of bill from the drawer or holder to their creditors.

The person transferring the title is called ” Endorser” and the person to whom the bill is transferred called ‘Endorsee’. The endorsee can further endorse the bill in favor of his creditors. Endorsement is executed by putting the signature at the back of the bill.

- Bill sent for Collection:

It is a process when the bill is sent to the bank with instructions to keep the bill till maturity and collect its amount from the acceptor on the date of maturity.

- Dishonour of Bill:

When the drawee (or acceptor) of the bill fails to make payment of the bill on the date of maturity, it is called ‘Dishonour of Bill.

- Noting of Bill:

To obtain the proof of dishonour of a bill, it is re-sent to the drawee through a legally authorized persons called Notary Public. Notary Public charges a small fee for Providing this service known as noting charges.

Noting charges are paid to the Notary Public first by the holder of the bill but are ultimately recovered from the drawee, because he is the person responsible for the dishonour.

- Retirement of a Bill:

When the drawee makes the payment of the bill before its due date it is called ‘Retirement of a bill’.

In such a case, holder of the bill usually allow a certain amount as Rebate to the drawee. Amount of rebate is calculated at a fixed percentage for the unexpired period only.

- Renewal of a Bill:

Sometimes, the drawee of a bill finds himself unable to meet the bill on due date. To avoid dishonouring of bill, he may request the holder of the bill to cancel the original bill and draw a new bill in place of old one. It the holder agrees, the old bill is cancelled and a new bill with new terms is drawn on the drawee and also accepted by him. This process is called ‘Renewal of a bill’. In this case, Noting of the bill is not required as cancellation of the bill is mutually agreed upon by both the parties of the bill.

Normally, the drawer charge interest for the period of new bill. The interest may be paid in cash or may be added in the amount of new bill. If any part payment is made at the time of renewal of a bill, interest is calculated only on the outstanding amount.

- Accommodation Bill:

When bills of exchange or promissory note are not drawn to settle a trade between drawer and drawee but are written for the purpose of mutual help and to raise funds temporarily then it is known as Accommodation bill.

- Insolvency of Acceptor :

When the drawee (i.e., acceptor) of a bill is unable to meet his liabilities on due date, the drawee become insolvent. In such a case, entries for the dishonour of the bill are passed in the books of drawer/holder and drawee of the bill.

Any proportionate amount received from the drawee is recorded in the books of the holder and the amount unrecoverable is debited to ‘Bad Debts A/c’.