Table of Contents

Working Capital Turnover Ratio

Working Capital Turnover Ratio

Working Capital Turnover Ratio-

The working capital turnover ratio establishes a relationship between Revenue from Operations or Turnover and Working Capital. The working capital turnover ratio indicates the speed at which the working capital is utilized for business operations.

Key Points of working capital turnover ratio

- This ratio measures the efficiency at which the working capital is being used by a Business Enterprise.

- A higher working capital turnover ratio shows efficient use of working capital.

- A low working capital turnover ratio indicates the underutilization of working capital.

- A very high working capital turnover ratio is also dangerous, as it is a sign of overtrading.

- A very low working capital turnover ratio may be a sign of under-trading comparison to working capital.

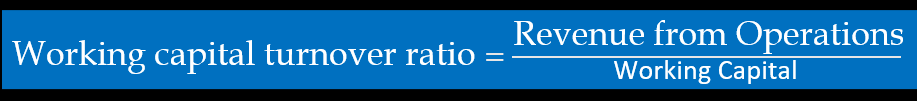

Formula For Calculating Working Capital Turnover Ratio

Working Capital = Current Assets – Current Liabilities

Current Assets = Current Investments + Inventories (Excluding Spare Parts and Loose Tools) + Trade Receivables + Cash and Cash Equivalents +Short Term Loans and Advances + Other Current Assets.

Or

Current Assets = Total Assets- Non current Assets

Current Liabilities= Short-Term Borrowings +Trade Payables +Other Current Liabilities+ Short-term Provisions.

Or

Current Liabilities= Total Liabilities-Non Current Liabilities-Shareholders fund

Golden Rules Of Accounting MCQs with solved answers

Working Capital Turnover Ratio

1. Example-

Calculate Working capital turnover ratio:

Revenue from Operations = 48,00,000

Working Capital =8,00,000

Solution:

Working capital turnover ratio=48,00,000/8,00,000

Working capital turnover ratio= 6 Times

Working Capital Turnover Ratio

2. Example-

Calculate Working capital turnover ratio:

Revenue from Operations = 48,00,000

Current Assets =18,00,000

Current Liabilities=6,00,000

Solution:

Working Capital = Current Assets – Current Liabilities

Working Capital =18,00,000-6,00,000

Working Capital =12,00,000

Working capital turnover ratio=48,00,000/12,00,000

Working capital turnover ratio= 4 Times

Working Capital Turnover Ratio

3. Example-

Calculate Working capital turnover ratio:

Sundry debtors 4,00,000

Inventories 1,60,000

Marketable securities 80,000

Cash 1,20,000

Prepaid expenses 40,000

Bills payables 80,000

Sundry creditors 2,60,000

Debentures 2,00,000

Outstanding Expenses 60,000

“Revenue from Operations” 20,00,000

Solution:

Working Capital = Current Assets – Current Liabilities

Current Assets = Sundry debtors+Inventories +Marketable securities+Cash + Prepaid expenses

Current Assets =4,00,000+1,60,000+80,000+1,20,000+40,000

Current Assets =8,00,000

Current Liabilities= Bills payables+Sundry creditors +Outstanding Expenses

Current Liabilities=80,000+2,60,000+60,000

Current Liabilities =4,00,000

Working Capital = 8,00,000 – 4,00,000

Working Capital = 4,00,000

Working capital turnover ratio=20,00,000/4,00,000

Working capital turnover ratio= 5 Times

Working Capital Turnover Ratio

4. Example-

Calculate Working capital turnover ratio:

Total Assets= 85,00,000

Non-current Assets= 40,00,000

Non-Current Liabilities=26,00,000

Shareholders fund=24,00,000

Revenue from Operations=90,00,000

Current Assets = Total Assets- Non current Assets

Current Assets = 85,00,000 – 40,00,000

Current Assets =45,00,000

Current Liabilities= Total Liabilities-Non Current Liabilities-Shareholders fund

Current Liabilities= 85,00,000-26,00,000-24,00,000

Current Liabilities= 35,00,000

Working Capital = Current Assets – Current Liabilities

Working Capital = 45,00,000 – 35,00,000

Working Capital = 10,00,000

Working capital turnover ratio=90,00,000/10,00,000

Working capital turnover ratio= 9 Times