Table of Contents

Cash Flow From Operating Activities

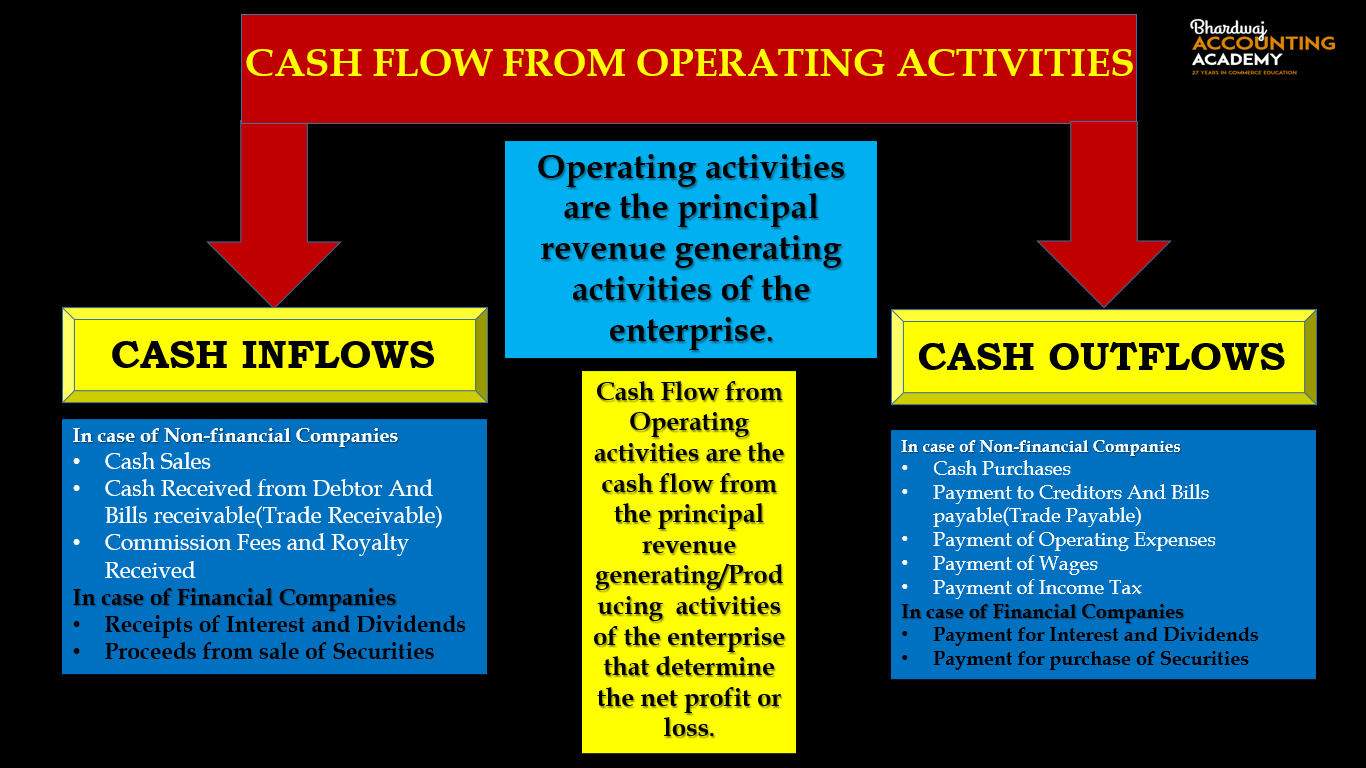

Cash Flow from Operating activities are the cash flow from the principal revenue generating/Producing activities of the enterprise that determine the net profit or loss.

Operating Activities?

“Operating activities are the principal revenue generating activities of the enterprise”.

principal revenue generating activities?

principal revenue generating activities means business activities being carried by the business enterprise to earn profit.

For Example-

1.For a trading company , purchase and sale of goods to earn profit is its principle revenue generating/Producing activity.

2.For a mobile manufacturing company , manufacturing and selling of mobile to earn profit is its principle revenue generating/Producing activity.

3.For a finance company , purchase and sale of securities and giving & taking loan to earn profit is its principle revenue generating/Producing activity.

4.For a Car manufacturing company , manufacturing and selling of Car to earn profit is its principle revenue generating/Producing activity.

Cash Flow From Operating Activities-

Cash flows?

Cash flows are inflows and outflows of cash and cash equivalents. Transactions that increase cash and cash equivalents are inflows while transactions that decrease it are outflows of cash and cash equivalents.

CASH INFLOWS FROM OPERATING ACTIVITIES-

In case of Non-financial Companies

- Cash Sales

- Cash Received from Debtor And Bills receivable(Trade Receivable)

- Commission Fees and Royalty Received

In case of Financial Companies

- Receipts of Interest and Dividends

- Proceeds from sale of Securities

CASH OUTFLOWS TO OPERATING ACTIVITIES-

In case of Non-financial Companies

- Cash Purchases

- Payment to Creditors And Bills payable(Trade Payable)

- Payment of Operating Expenses

- Payment of Wages

- Payment of Income Tax

In case of Financial Companies

- Payment for Interest and Dividends

- Payment for purchase of Securities

Examples of cash flows from operating activities –

In case of non-financial companies-

(a) Receipts from the sale of goods and/or rendering of services;

(b) Receipts from royalty, fees and commission, etc.;

(c) Receipts from trade receivables (ie, debtors and bills receivable);

(d) payment for the purchase of goods and/or services;

(e) payment of business liabilities (ie, creditors and bills payable);

(f) payment of wages, salaries and other payments to employees;

(g) Payment and return of income-tax

In case of Financial companies-

(a) payments for the purchase of securities

(b) payment of interest on the loans;

(c) receipts from the sale of securities;

(d) Dividends received on securities;

(e) payment of wages, salaries and other payments to employees;

Methods Of Calculating Cash Flow From Operating Activities-

1, Direct Method

2. Indirect Method

Cash Flow Statement?

Cash Flow Statement is a statement that shows flow of cash and cash equivalents during the period under report.

In the other words-The statement that shows net increase or decrease of cash and cash equivalents under each activity separately- operating, investing and financing as well as collectively, called Cash Flow Statement.