Table of Contents

Cash Withdrawal from Bank Journal Entry

At present time, a business enterprise does most of its business transactions (receipts, payments, deposits, withdrawal) through a bank. Banks play an important role in the conduct of business. We can withdraw money from the bank only when we have deposited it in the bank.

The journal entry is passed in the books of account for Cash Withdrawal from Bank in the following manner-

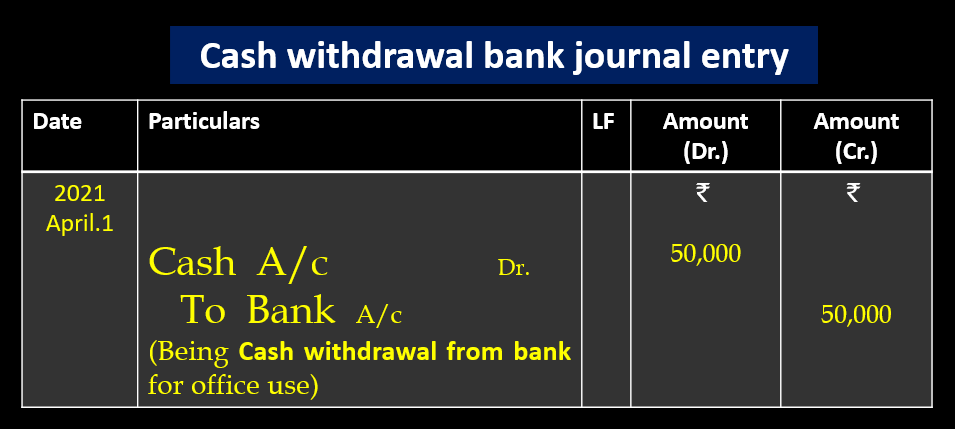

Cash withdrawal from bank journal entry (According to Traditional Approach)

Example- On 1st April 2021 Cash withdrawal from Bank ₹50,000.

Explanation: According to the traditional approach in this transaction, two accounts are affected-

1. Cash account (Real Account)

Rules of Real Account– Debit what comes in, Credit what goes out. Here cash is coming into the business, so according to the rules, Cash account will be debited while passing the journal entry.

2. Bank account (Personal Account)

Rules of personal Account– Debit the Receiver, Credit the giver. Here the bank is the giver, according to the rules, bank account will be credited while passing the journal entry.

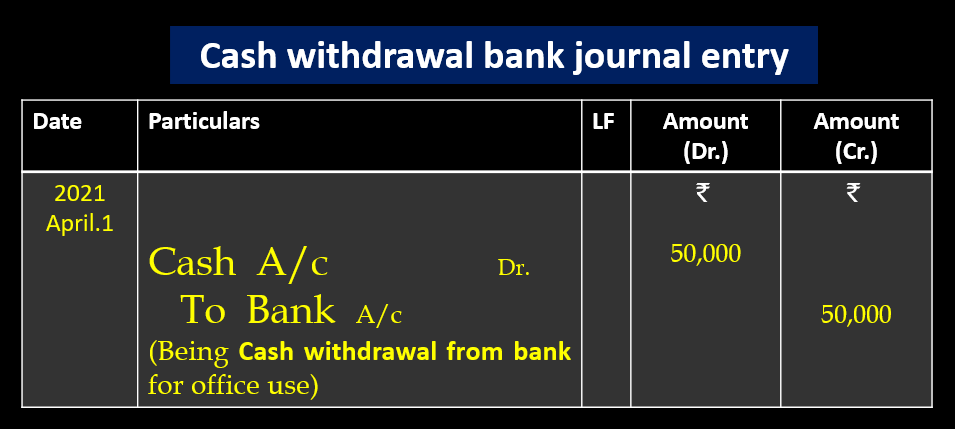

Cash withdrawal from bank journal entry (According to Modern Approach)

Example- On 1st April 2021 Cash withdrawal from Bank ₹50,000.

Explanation: According to the modern approach in this transaction, two accounts are affected-

1.Cash account (Assets Account)

Rules of Assets Account– Increases in assets are debits; decreases in assets are credits.

Here the assets increase in the form of cash, according to the rules, cash account will be Debited while passing the journal entry.

2. Bank account (Assets Account)

Rules of Assets Account– Increases in assets are debits; decreases in assets are credits.

Here the assets decrease in the form of bank deposits, according to the rules, bank account will be credited while passing the journal entry.

Cash deposit into bank journal entry

Double Column Cash Book (Cash and Bank)