Table of Contents

Double Column Cash Book (Cash and Bank)

Double Column Cash Book (Cash and Bank)

A double-Column Cash book is a type of cash book which has two columns for the amount on both sides (Receipts side Dr. and Payments side Cr.). One column is for recording cash transactions and the other column is for recording bank transactions.

In other words, the Two-column Or Double column cash book has two amount columns, one for cash and the other for the bank on each side. In such a cash book, both cash and bank transactions are recorded datewise. Since such a cash book has cash and bank columns, it serves the purpose of both Cash Account and Bank Account.

Things to keep in mind while preparing Double Column Cash Book

- Cash Account is an Assets Account as per the Modern Approach the rules of debit and credit applicable to Assets Account” Increase in assets debited and Decrease in assets credited”

- Cash Account is a Real Account as per the Traditional Approach the rules of debit and credit applicable to Real Account” Debit what comes in Credit what goes Out”

- All cash receipts are recorded on the debit side (Receipts Side) of cash book in ‘Cash Column’.

- All cash payments are recorded on the credit side(Payments Side) of cash book in ‘Cash Column’.

- Bank Account is an Assets Account as per the Modern Approach the rules of debit and credit applicable to Assets Account” Increase in assets debited and Decrease in assets credited”

- Bank Account is a Personal Account as per the Traditional Approach the rules of debit and credit applicable to Real Account” Debit what comes in Credit what goes Out”

- For cash deposited into the bank, the Bank balance increases or the bank is receiver and therefore is debited in the bank column of cash book.

- For cash withdrawal from the bank, the Bank balance decreases or the bank is giver and therefore is credited in the bank column of cash book.

- Cash column will either have debit balance or Nil balance.

- Bank Column may have debit balance or credit balance.

- Cheque received from customer or Debtor and deposit same day into the bank recorded debit side of bank column in cash book. Following Journal entry will be passed:

Bank A/c Dr

To Customer’s A/c

- Goods sold and amount deposited same day into the bank recorded debit side of bank column in cash book. Following Journal entry will be passed:

Bank A/c Dr

To Sales A/c

- Cheque received from customer or Debtor and not deposited same day into the bank. Following Journal entry will be passed:

Cash A/c Dr

To Customer’s A/c

- Cheque received from customer or Debtor and deposited on another day into the bank. Following Journal entry will be passed:

Bank A/c Dr

To Cash A/c

- Expenses paid by Cheque recorded credit side bank column of cash book in. Following Journal entry will be passed:

Expenses A/C Dr

To Bank A/C

- Amount paid by Cheque to creditors recorded credit side bank column in cash book . Following Journal entry will be passed:

Creditors A/C Dr

To Bank A/C

- Direct Deposit by a customer into the Bank recorded debit side of bank column in cash book. Following Journal entry will be passed:

Bank A/C Dr.

To Customer’s A/C

- If Opening balance of cash is given, it will be written on the debit side of the cash book in cash column as To Balance b/d

- If Opening balance of Bank Account ( Debit) is given, it will be written on the debit side of the cash book in Bank column as To Balance b/d

- If Opening balance of Bank Account (Credit Or Overdraft) is given, it will be written on the Credit side of the cash book in Bank column as By Balance b/d

Contra Entries- There are some transactions in which cash and bank are affected simultaneously, entry of such transactions is done on both the debit and credit side in the double column cash book, for this the entry passed is called contra entries.

In other words: When there is a transaction that relates to both cash and bank, this will be written on one side of Bank Column and on other side of Cash Column, Such transactions are known as ‘Contra entries’.

In case, cash is withdrawn from bank for office use, it is entered on the credit side of bank column and also in the debit side of cash column of the Double column cash Book.

Cash A/C Dr

To Bank A/C

In case, cash is deposited in the bank, the amount is recorded on the debit side of bank column and on the credit side of cash column of the Double column cash book.

Bank A/c Dr

To Cash A/c

Some Examples of Banking Transactions that are helpful to preparing a Double Column Cash Book-

1. Cash Deposited into the Bank $80,000

Bank A/C Dr. 80,000 Assets Increase

To Cash A/C 80,000 Assets Decrease

(Being Cash Deposited into the Bank)

- Cash is withdrawn from Bank $15,000

Cash A/C Dr.15,000 Assets Increase

To Bank A/c 15,000 Assets Decrease

(Being Cash withdrawn from Bank)

- Payment of expenses by cheque $5,000

Expenses A/C Dr. 5,000 Expenses Increase

To Bank A/C 5,000 Assets Decrease

(Being expenses paid by cheque)

- Payment to creditors by cheque $15,000

Creditors A/C Dr. 15,000 Liabilities decrease

To Bank A/C 15,000 Assets Decrease

(Being amount paid to Creditors by cheque)

5 When a cheque is received from customer $40,000 and not deposited into bank same day…

Cash A/C Dr. 40,000 Assets Increase

To Customer’s/Debtors A/C40,000 Assets Decrease

(Being Cheque received from Customer)

- Cheque deposited into the Bank next day…..

Bank A/C Dr. Assets Increase

To Cash A/C Assets Decrease

(Being Cheque deposited into the Bank)

- When a cheque is received from customer $30,000 and deposited into bank same day…

Bank A/C Dr.30,000 Assets Increase

To Customer’s A/C 30,000 Assets Decrease

(Being cheque is received from customer and deposited into bank same day)

- Cheque dishonoured…..

Customer’s A/C Assets Increase

To Bank A/C Assets Decrease

(Being cheque dishonoured)

- Cash is withdrawn from Bank $10,000 for personal use

Drawing A/C Dr. 10,000 Capital Decrease

To Bank A/c 10,000 Assets Decrease

(Being Cash withdrawn from Bank for personal use)

10 Bank charges charged by bank $2,000

Bank Charges A/C Dr. 2,000 Expenses Increase

To Bank A/C 2,000 Assets Decrease

(Being bank charges charged by bank)

11.Direct Deposit by a customer in to the Bank $20,000

Bank A/C Dr. 20,000 Assets Increase

To Customer’s A/C20,000 Assets Decrease

(Being Direct Deposit by a customer in to the Bank)

- Interest on Investment collected by Bank $5,000

Bank A/C Dr. 5,000 Assets Increase

To Interest on Investment A/C 5,000 Revenue Increase

(Being Interest on Investment collected by the Bank)

- Dividend collected by Bank $15,000

Bank A/C Dr. 15,000 Assets Increase

To Dividend A/C 15,000 Revenue Increase

(Being dividend collected by the Bank)

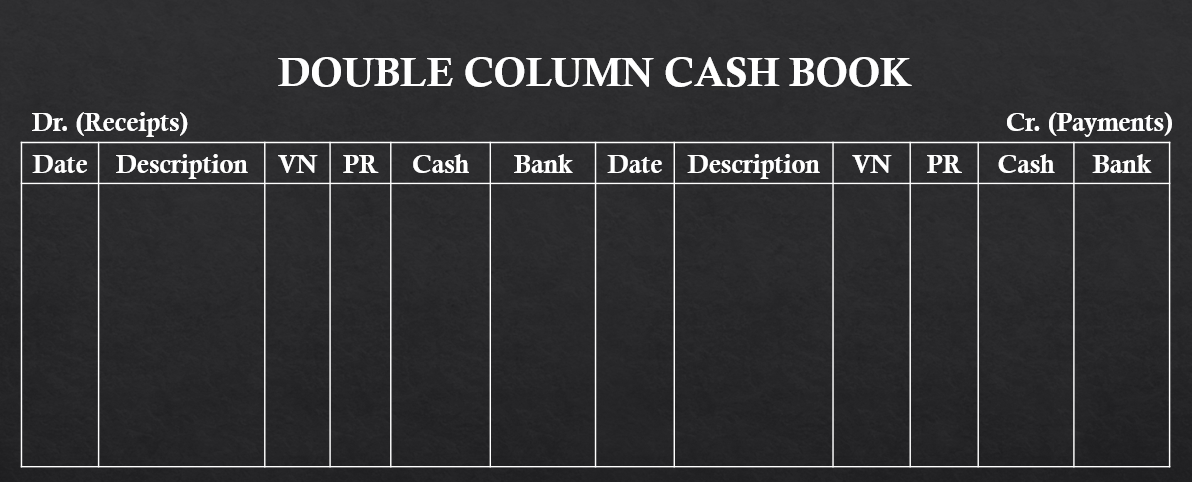

Format Of Double Column Cash Book-

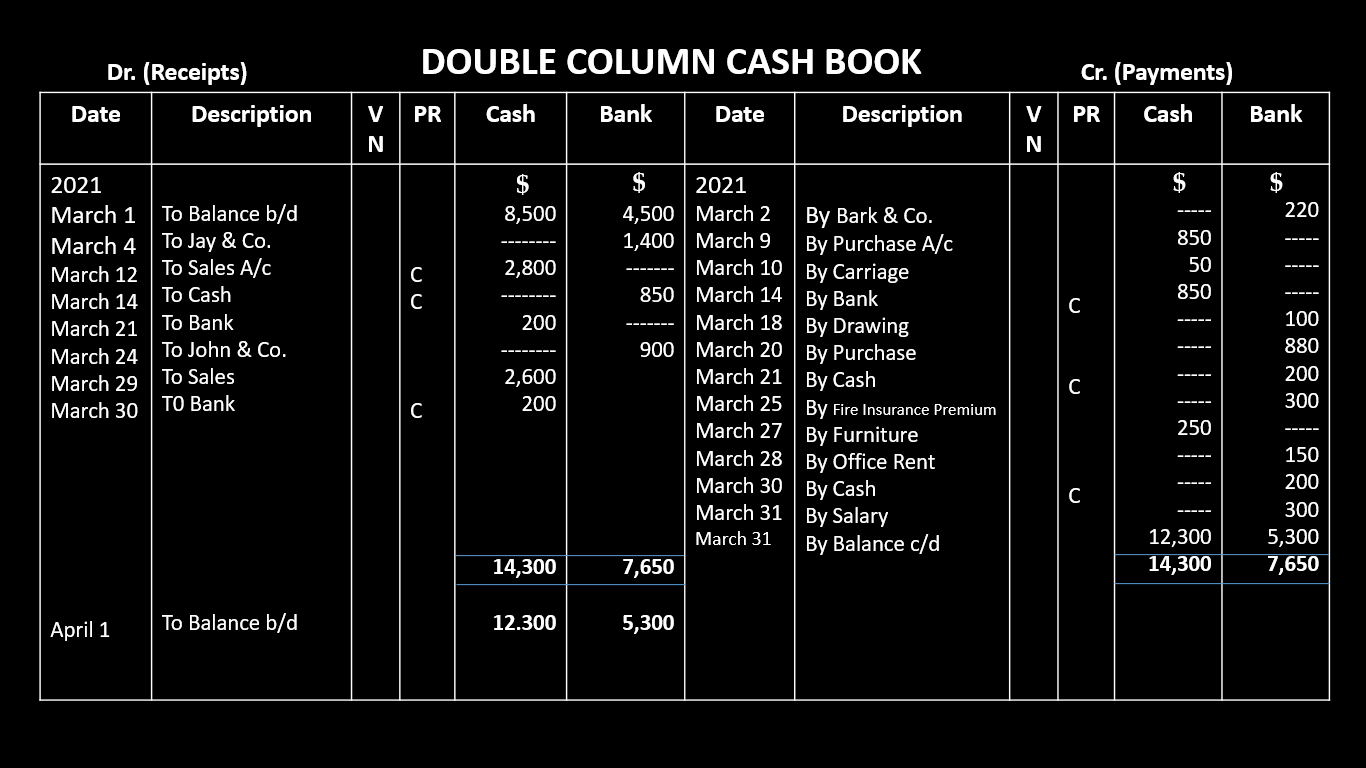

Example-

Record the following transactions in a double-column cash book of X- Company. It engaged in the following transactions during the month of March 2021:

March 01: Cash balance $8,500 (Dr.), bank balance $4,500 (Dr.).

March 02: Paid Bark & Co. by cheque $220.

March 03: Received from Jay & Co. a check amounting to $1,400.

March 04: Deposited into bank the check received from Jay & Co. on March 03.

March 9: Purchased merchandise/Goods for cash, $850.

March 10: Carriage paid cash, $50.

March 12: Sold merchandise/Goods for cash, $2,800.

March 14: Cash deposited into bank, $850.

March 18: Withdrew from bank for personal expenses, $100.

March 20: Issued a cheque for merchandise purchased, $880.

March 21: Drew from bank for office use, $200.

March 24: Received a cheque from Peter & Co. and deposited the same into bank immediately, $900.

March 25: Paid Insurance premium by cheque $300.

March 27: Bought furniture for cash for office use, $250.

March 28: Paid office rent by cheque, $150.

March 29: Cash sales, $2,600.

March 30: Withdrew from bank for office use, $200.

March 31: Paid salary to employees by cheque, $300.

Required: Record the above transactions in a double column cash book.

Solution

Question for Practice-

1. Record the following transactions in a double-column cash book of Y- Company.It engaged in the following transactions during the month of March 2021:

March 01: Cash balance $7,500 (Dr.), bank balance $5,500 (Dr.).

March 02: Paid Vijaya & Co. by check $300.

March 04: Received from Laurance & Co. a Cheque amounting to $2,400.

March 05: Deposited into bank the check received from Laurance & Co. on March 04.

March 08: Purchased stationery for cash, $150.

March 12: Purchased merchandise/Goods for cash, $900.

March 13: Sold merchandise/Goods for cash, $3,800.

March 15: Cash deposited into bank, $1,850.

March 17: Withdrew from bank for personal expenses, $200.

March 19: Issued a cheque for merchandise/Goods purchased, $680.

March 20: Drew from bank for office use, $300.

March 22: Received a cheque from Mariya & Co. and deposited the same into bank immediately, $900.

March 26: Bought computer for cash for office use, $300.

March 28: Paid office rent by cheque, $1250.

March 29: Cash sales, $3,600.

March 30: Withdrew from the bank for office use, $400.

March 31: Paid wages by cheque, $300.

2. Record the following transactions in a double-column cash book of W- Company.It engaged in the following transactions during the month of March 2021:

March 01: Cash balance $17,500 (Dr.), bank balance $15,500 (Dr.).

March 02: Paid Vijaya & Co. by check $1,300.

March 04: Received from Laurance & Co. a Cheque amounting to $3,400.

March 05: Deposited into bank the check received from Laurance & Co. on March 04.

March 07: Purchased stationery for cash, $450.

March 11: Purchased merchandise/Goods for cash, $1,900.

March 14: Sold merchandise/Goods for cash, $13,800.

March 16: Cash deposited into bank, $2,850.

March 18: Withdrew from bank for personal expenses, $1,200.

March 19: Issued a cheque for merchandise/Goods purchased, $1,680.

March 20: Drew from bank for office use, $1,300.

March 21: Received a cheque from Mariya & Co. and deposited the same into bank immediately, $3,900.

March 24: Bought computer for cash for office use, $1,300.

March 25: Paid office rent by cheque, $2,250.

March 29: Cash sales, $6,600.

March 30: Withdrew from the bank for office use, $1,400.

March 31: Paid wages by cheque, $1,300.

Contents found very effective.

Thak you very much for nice presentation.!

with best regards.