Table of Contents

Hidden Goodwill at the time of Admission of A New Partner

Hidden goodwill: Hidden goodwill refers to the difference between the capitalized value of the firm and the net worth of the firm.

The hidden goodwill is calculated by calculating the difference between the capitalized value of the new firm (on the basis of New partner capital) and the net worth of the new firm (Including the new partner).

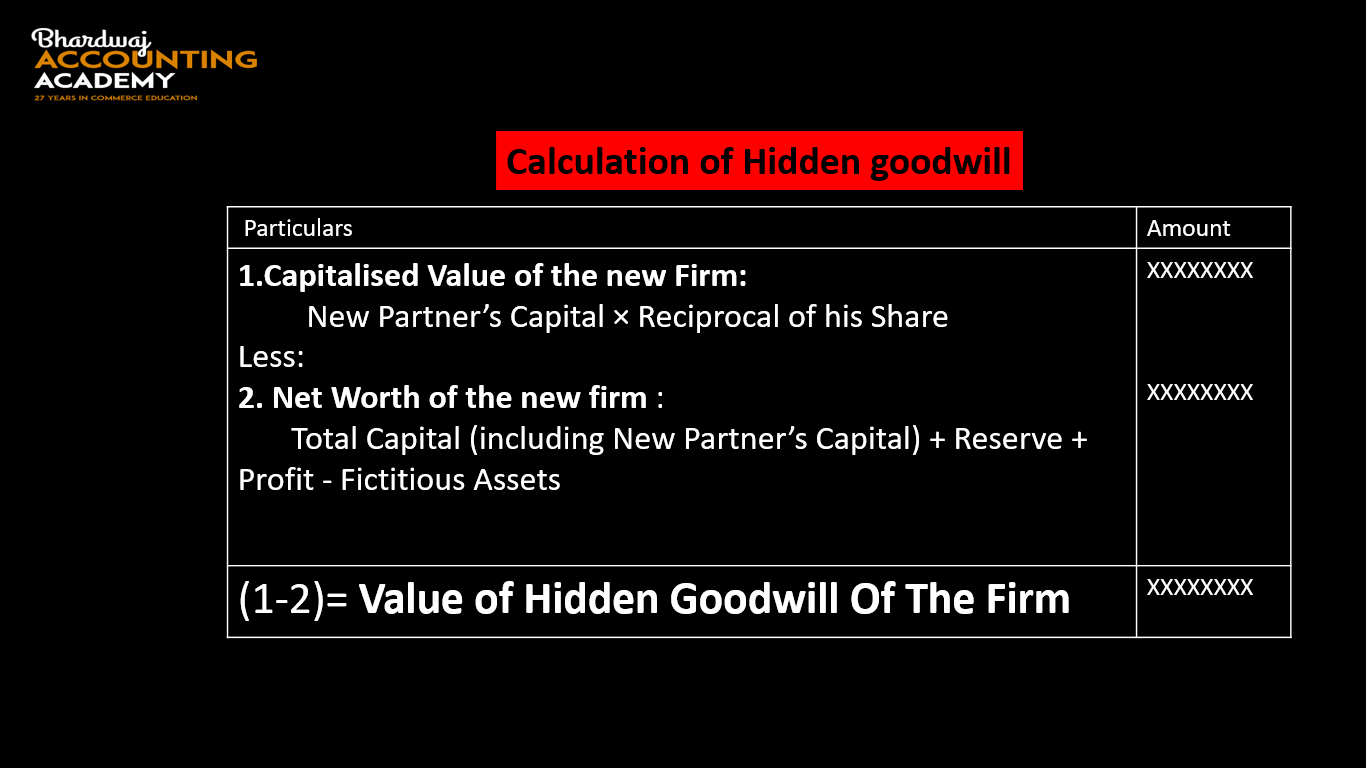

Calculation of Hidden goodwill at the time of admission of a new Partner:

Step 1. Calculate Capitalised Value of the new Firm:

Capitalised Value of the Firm = New Partner’s Capital × Reciprocal of his Share

Step 2. Calculate net worth or Combined Capital of all Partners :

Net Worth or Combined Capital of all Partners = Total Capital (including New Partner’s Capital) + Reserve+Profit-Fictitious Assets

Step 3. Hidden Goodwill:

Hidden Goodwill = Capitalised Value of the new Firm (step 1) – Net Worth or Combined Capital of all Partners (step 2)

Hidden Goodwill at the time of Admission of A New Partner

Example 1:

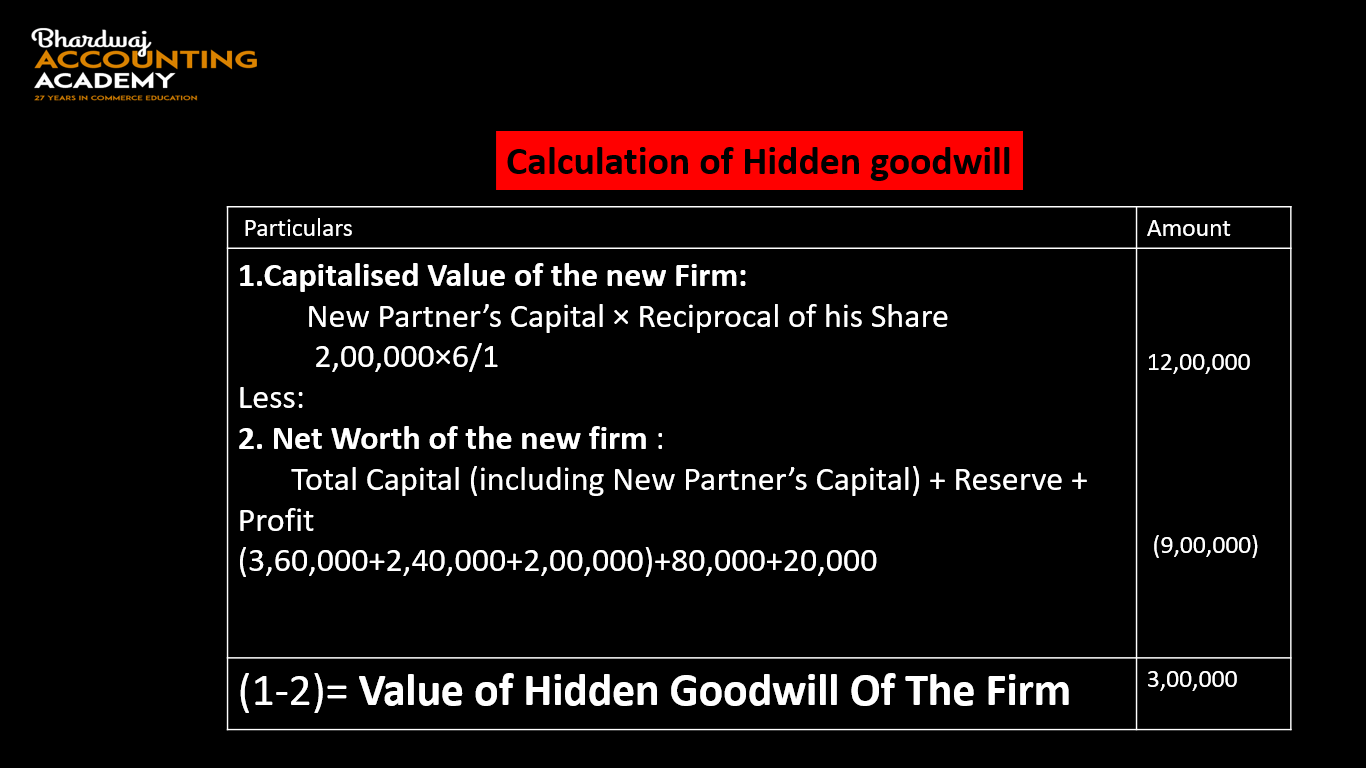

Calculation of Hidden goodwill Of The Firm:

Capitalised Value of the Firm = New Partner’s Capital × Reciprocal of his Share

Capitalised Value of the Firm = 2,00,000×6

Capitalised Value of the Firm = 12,00,000

Net Worth or Combined Capital of all Partners = Total Capital (including New Partner’s Capital) + Reserve+Profit

Net Worth or Combined Capital of all Partners =(3,60,000+2,40,000+2,00,000)+80,000+20,000

Net Worth or Combined Capital of all Partners =9,00,000

Hidden Goodwill = Capitalised Value of the new Firm (step 1) – Net Worth or Combined Capital of all Partners (step 2)

Hidden Goodwill = 12,00,000 – 9,00,000

Hidden Goodwill = 3,00,000

C’s Share of Goodwill= 3,00,000×1/6

C’s Share of Goodwill= 50,000

A solution in table form:

Example 2:

A and B are partners in a firm with the capital balances of ₹ 4,50,000 and ₹ 2,50,000 respectively, Sharing profits and losses in the ratio of 4:1. They admitted C into the firm for the 1/6th share of profits. He brings ₹ 2,50,000 as capital. The firm had a general reserve of ₹ 1,80,000, Undistributed Profit ₹ 40,000, and Advertisement Suspense Account₹ 30,000 at the time of admission of C. Calculate the firm’s goodwill and C’s share of goodwill.

Calculation of Hidden goodwill Of The Firm:

Capitalised Value of the Firm = New Partner’s Capital × Reciprocal of his Share

Capitalised Value of the Firm = 2,50,000×6

Capitalised Value of the Firm = 15,00,000

Net Worth or Combined Capital of all Partners = Total Capital (including New Partner’s Capital) + Reserve+Profit-Fictitious Assets

Net Worth or Combined Capital of all Partners =(4,50,000+2,50,000+2,50,000)+1,80,000+40,000-30,000(Advertisement Suspense Account)

Net Worth or Combined Capital of all Partners =11,40,000

Hidden Goodwill = Capitalised Value of the new Firm (step 1) – Net Worth or Combined Capital of all Partners (step 2)

Hidden Goodwill = 15,00,000 – 11,40,000

Hidden Goodwill = 3,60,000

C’s Share of Goodwill= 3,60,000×1/6

C’s Share of Goodwill= 60,000

Hidden Goodwill at the time of Admission of A New Partner

Example 3:

A and B are partners in a firm sharing profits and losses in the ratio of 3:2. They admitted C into the firm for the 1/5th share of profits. He brings ₹ 3,00,000 as capital. Total Assets of the firm ₹ 10,50,000 and Liabilities ₹ 1,50,000. Calculate the firm’s goodwill and C’s share of goodwill.

Calculation of Hidden goodwill Of The Firm:

Capitalised Value of the Firm = New Partner’s Capital × Reciprocal of his Share

Capitalised Value of the Firm = 3,00,000×5

Capitalised Value of the Firm = 15,00,000

Net Worth or Combined Capital of all Partners = Total Capital (including New Partner’s Capital)

Total Capital Of A and B= Total assets – Liabilities

Total Capital Of A and B= 10,50,000-1,50,000

Total Capital Of A and B=9,00,000

Net Worth or Combined Capital of all Partners =(9,00,000+3,00,000)

Net Worth or Combined Capital of all Partners =12,00,000

Hidden Goodwill = Capitalised Value of the new Firm (step 1) – Net Worth or Combined Capital of all Partners (step 2)

Hidden Goodwill = 15,00,000 – 12,00,000

Hidden Goodwill = 3,00,000

C’s Share of Goodwill= 3,00,000×1/5

C’s Share of Goodwill= 60,000

Hidden Goodwill at the time of Admission of A New Partner

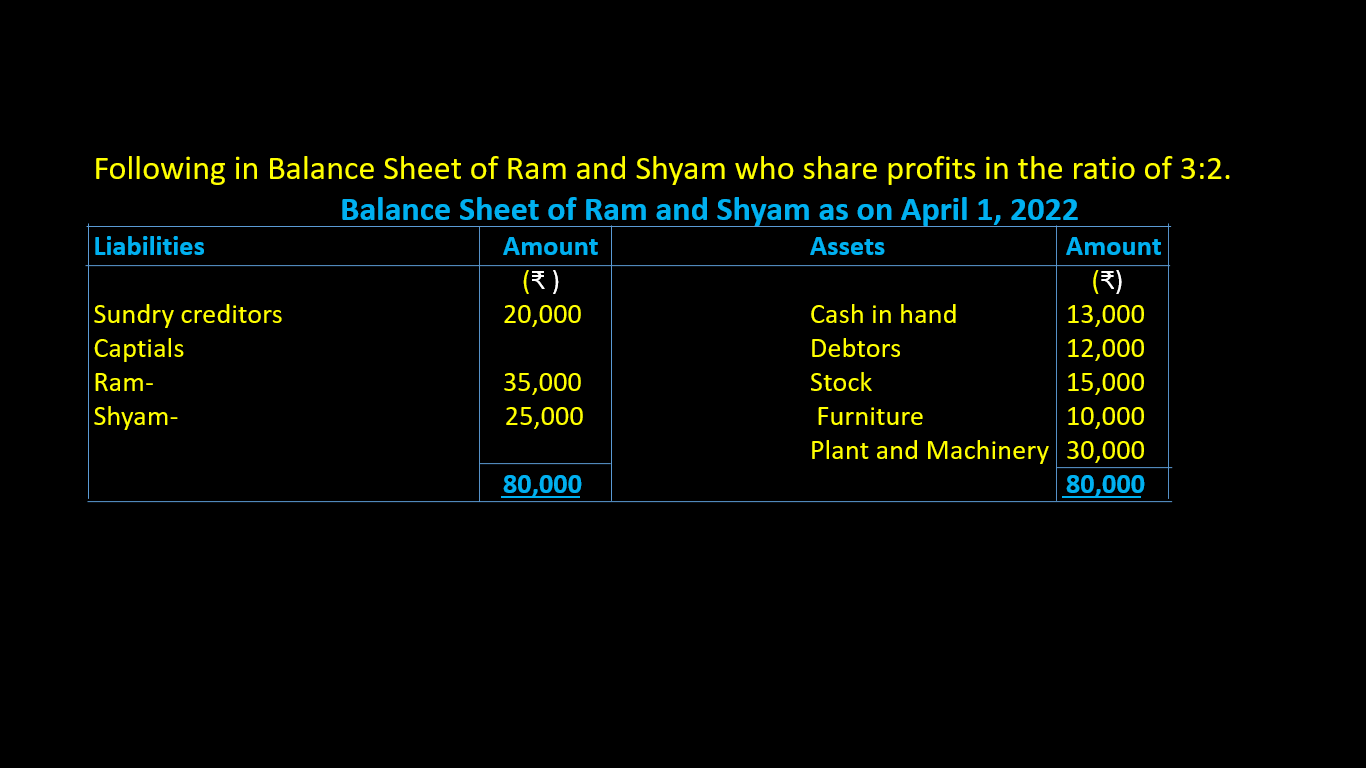

Example 4:

On that date, Sohan is admitted into the partnership for 1/5 share of profit. Sohan is to bring in ₹ 40,000 as capital. Calculate the firm’s goodwill and Sohan’s share of goodwill.

Calculation of Hidden goodwill Of The Firm:

Capitalised Value of the Firm = New Partner’s Capital × Reciprocal of his Share

Capitalised Value of the Firm = 40,000×5

Capitalised Value of the Firm = 2,00,000

Net Worth or Combined Capital of all Partners = Total Capital (including New Partner’s Capital)

Net Worth or Combined Capital of all Partners =(35,000+25,000+40,000)

Net Worth or Combined Capital of all Partners =1,00,000

Hidden Goodwill = Capitalised Value of the new Firm (step 1) – Net Worth or Combined Capital of all Partners (step 2)

Hidden Goodwill = 2,00,000 – 1,00,000

Hidden Goodwill = 1,00,000

C’s Share of Goodwill= 1,00,000×1/5

C’s Share of Goodwill= 20,000

Hidden Goodwill at the time of Admission of A New Partner

Question For Practice:

Question 1.

A and B are partners in a firm with the capital balances of ₹ 4,65,000 and ₹ 2,45,000 respectively, Sharing profits and losses in the ratio of 4:1. They admitted C into the firm for the 1/5th share of profits. He brings ₹ 2,20,000 as capital. Calculate the firm’s goodwill and C’s share of goodwill.

Answer: Hidden goodwill ₹ 1,70,000 and C’s share of goodwill ₹ 34,000.

Question 2.

A and B are partners in a firm with the capital balances of ₹ 4,55,000 and ₹ 2,45,000 respectively, Sharing profits and losses in the ratio of 3:1. They admitted C into a partnership for the 1/6th share of profits. He brings ₹ 2,50,000 as capital. The firm had a general reserve of ₹ 1,85,000, Undistributed Profit of ₹ 45,000, an Advertisement Suspense Account of ₹ 30,000, Contingency Reserve of ₹ 50,000 at the time of admission of C. Calculate the firm’s goodwill and C’s share of goodwill.

Answer: Hidden goodwill ₹ 3,00,000 and C’s share of goodwill ₹ 50,000.

Question 3.

X and Y are partners in a firm with the capital balances of ₹ 3,55,000 and ₹ 2,45,000 respectively, Sharing profits and losses in the ratio of 5:3. They admitted Z into the firm for the 1/4th share of profits. He brings ₹ 3,00,000 as capital. The firm had a general reserve of ₹ 80,000, Profit and Loss Account(debit Balance) of ₹ 15,000, an Advertisement Suspense Account of ₹ 25,000, Contingency Reserve of ₹ 60,000 at the time of admission of Z. Calculate the firm’s goodwill and Z’s share of goodwill.

Answer: Hidden goodwill ₹ 2,00,000 and Z’s share of goodwill ₹ 50,000.

Question 4.

A and B are partners in a firm sharing profits and losses in the ratio of 3:2. They admitted C into the firm for the 1/5th share of profits. He brings ₹ 4,00,000 as capital. Total Assets of the firm ₹ 12,50,000 and outside Liabilities ₹ 1,50,000. Calculate the firm’s goodwill and C’s share of goodwill.

Answer: Hidden goodwill ₹ 5,00,000 and Z’s share of goodwill ₹ 1,00,000.

Question 5.

X Y and Z are partners in a firm with the capital balances of ₹ 1,50,000,₹ 1,30,000, and ₹ 1,20,000 respectively, Sharing profits and losses in the ratio of 5:3:2. They admitted W as a new partner for the 1/8th share of profits. He brings ₹ 80,000 as capital. The firm had a general reserve of ₹ 30,000, Profit and Loss Account(debit Balance) of ₹ 5,000, an Advertisement Suspense Account of ₹ 15,000, Contingency Reserve of ₹ 20,000, Investment Fluctuation Reserve of ₹ 10,000 at the time of admission of W. Calculate the firm’s goodwill and W’s share of goodwill.

Answer: Hidden goodwill ₹ 1,20,000 and W’s share of goodwill ₹ 15,000.

Hidden Goodwill at the time of Admission of A New Partner

Accounting treatment of goodwill;

Goodwill Questions for Practice

Accounting treatment of Workmen Compensation Reserves

Accounting treatment of Investment fluctuation Reserves

REVALUATION ACCOUNT/ PROFIT & LOSS ADJUSTMENT ACCOUNT

Hidden Goodwill at the time of Admission of A New Partner

Thank you sir

Thanks Sir 🙏🙏