Table of Contents

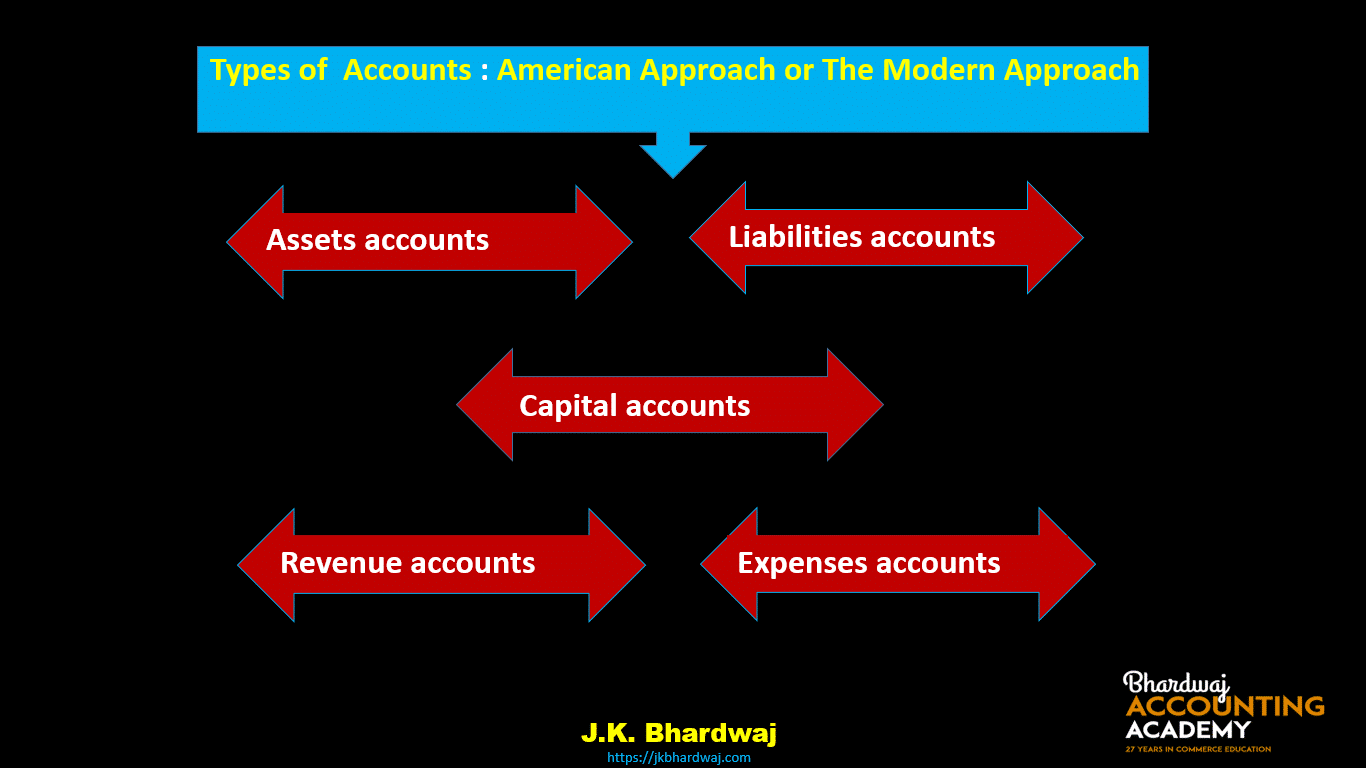

Types of Accounts American Approach or The Modern Approach

Under this approach transactions are recorded based on the accounting equation. An Accounting equation is based on the dual aspect concept. Dual aspect is the foundation or basic principle of accounting. This concept states that every transaction has a dual or two-fold effect and should therefore be recorded at two place.

“An accounting equation represents the mathematical relationship between the assets, liabilities, and owner’s equity(Capital) of a business enterprise”.

It provides the basis for recording business transactions into the book of accounts(Journal).

Modern Approach is also known as the American Approach. Modern Approach is also known as Accounting Equation Approach/ Balance sheet Equation Approach.

Types of Accounts American Approach or The Modern Approach

According to American Approach Or Modern Approach Or Accounting Equation Approach Or Balance sheet Equation Approach Accounts are divided into five categories-

1. Assets Accounts

2. Liabilities Accounts

3. Capital Accounts

4. Revenue Or Income Accounts

5. Expenses Or Losses Accounts

Accounting Principle and Accounting Assumptions

Also read:Types of Accounts American Approach or The Modern Approach

1. Assets Accounts-

Those accounts related to Assets and properties of a business are called assets accounts. Such as

Building account,

Land account,

Plant& Machinery account,

Cash account,

Furniture account,

Computer account ,

Investment account,

Motor Vehicles account,

Fixture and fitting account,

Plant account,

Stock account(Inventory)

Fixed Deposit account,

Bills Receivable account,

Accrued Income account,

Prepaid Expenses account,

Goodwill account,

Trade Mark account,

Debtors account etc.

“Assets are valuable and economic resources of an enterprise useful in its operations”.

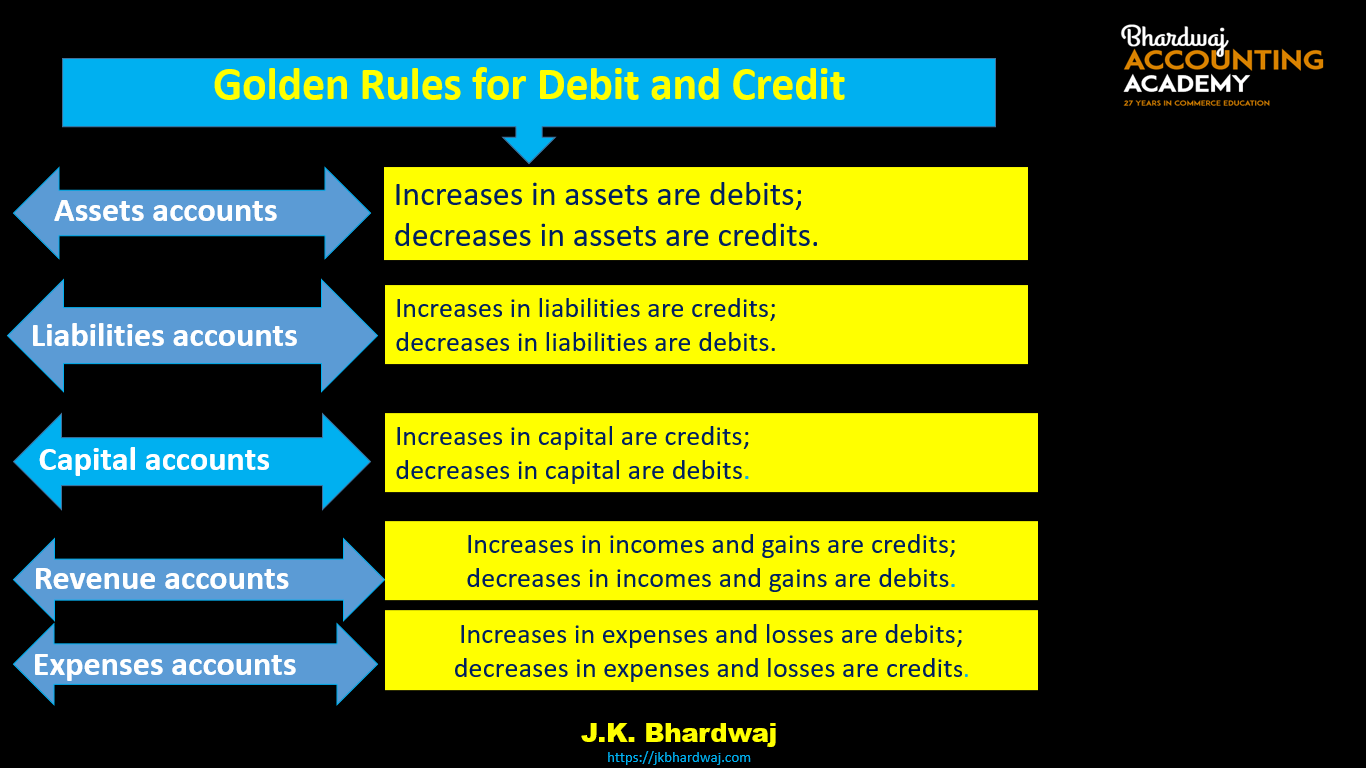

Rules for Debit and Credit – Increases in assets are debits; decreases in assets are credits.

Types of Accounts American Approach or The Modern Approach

2. Liabilities Accounts-

Those accounts related to Liabilities of a business are called Liabilities accounts. Such as Creditor’s account,

Bills payable account,

Bank loan account,

Outstanding Expenses account,

Advance Income account,

Bank overdraft account etc.

“Liabilities are obligations or debts that an enterprise has to pay after some time in the future”.

Rules for Debit and Credit- Increases in liabilities are credits; decreases in liabilities are debits.

Types of Accounts American Approach or The Modern Approach

3. Capital Accounts-

Capital Accounts refers to the accounts of the proprietors/ partners who have invested money in the business. (Represent Owner/Proprietors or partners).

For example, Capital account, Drawings account.

Capital means the amount or asset which is invested in the business by a businessman or owner of the business enterprise.

Rules for Debit and Credit- Increases in capital are credits; decreases in capital are debits.

4. Revenue accounts-

In this type of category, accounts are related to selling goods and rendering services.

Or

Those accounts related to Income, Profit, or gains of a business are called revenue accounts. Such as

Sales account,

Commission received account,

Discount received account,

Rent received account,

Interest received account,

Dividend received account etc.

Revenue means the amount receivable or realised from sale of goods and earnings from interest, dividend, commission, rent, etc.

Rules for Debit and Credit-

Increases in incomes and gains are credits;

decreases in incomes and gains are debits.

5. Expenses accounts-

Those accounts related to expenses and losses of a business are called expenses accounts. Such as purchase account,

commission account,

Discount account,

Rent account,

Repairs account,

General expenses account,

Office expenses account etc.

Costs incurred by a business in the process of earning revenue are called expenses. Examples of expenses are Purchase of Goods, Office Expenses, Carriage, Commission to agent, Depreciation, Rent, Wages, Salaries, Interest, Carriage, Manufacturing expenses, Light and water and Telephone, Postage, Administration, Advertisement expenses etc.

Rules for Debit and Credit-

Increases in expenses and losses are debits;

decreases in expenses and losses are credits.

Also read: basic-accounting-terms-class-11

Golden Rules of Debit and Credit in American Approach-

Golden Rules Of Accounting-

What are the types of accounts in accounting? Traditional Approach

Also read 30 transactions with their Journal Entries, Ledger, Trial balance and Final Accounts- Project

financestrategists.com/accounting/transaction-analysis/classification-of-accounts/