Table of Contents

Accounting Meaning Definitions and Objectives

Accounting Meaning Definitions and Objectives-

Accounting Meaning-

Accounting is the systematic process of identifying, recording, classifying, summarizing, interpreting and communicating financial information to the users for judgment and decision-making.

Book-keeping does not present a clear financial picture of the state of affairs of a business. Book keeping is the recording phase while accounting is concerned with the summarizing phase of an accounting system.

“Accounting is also called the language of business”

Accounting Meaning Definitions and Objectives-

Accounting Definitions-

In the words of American Accounting Association (AAA) “Accounting is the process of identifying, measuring and communicating economic information to permit informed judgments and decisions by users of information’.

The American Institute of Certified Public Accountants (AICPA) defined accounting as “The art of recording, classifying, summarising, analysing and interpreting the business transactions systematically and communicating business results to interested users in accounting”

According to Smith and Ashburne, “Accounting is the science of recording and classifying business transactions and events, primarily of a financial character, and the art of making significant summaries, analysis and interpretations of those transactions and events and communicating the results to persons who must make decisions or form judgment.”

on the above definitions we can say that “Accounting is a systematic process of identifying, measuring,recording, classifying, summarizing, analysing ,interpreting and communicating financial information to the users for judgment and decision-making”.

Accounting Meaning Definitions and Objectives-

Features of Accounting –

1. Identifying: Identifying the business transactions from the source documents.

2.Recording: The next function of accounting is to keep a systematic record of all business transactions, which are identified in an orderly manner, soon after their occurrence in the journal or subsidiary books.

3. Classifying: This is concerned with the classification of the recorded business transactions so as to group the transactions of similar type at one place. i.e., in ledger accounts. In order to verify the arithmetical accuracy of the accounts, trial balance is prepared.

4. Summarising : The classified information available from the trial balance are used to prepare profit and loss account and balance sheet in a manner useful to the users of accounting information.

5. Analysing: It establishes the relationship between the items of the profit and loss account and the balance sheet. The purpose of analysing is to identify the financial strength and weakness of the business. It provides the basis for interpretation.

6. Interpreting: It is concerned with explaining the meaning and significance of the relationship so established by the analysis. Interpretation should be useful to the users, so as to enable them to take correct decisions.

7.Communicating: The results obtained from the summarised, analysed and interpreted information are communicated to the nterested parties.

Also read :Book-keeping meaning definitions and objectives for class 11

Accounting Meaning Definitions and Objectives-

Accounting Objectives-

The main objectives of accounting are

1.To maintain a systematic and complete record of business transactions in the proper books of accounts (Journal or subsidiary books) according to specified principles and rules to avoid the possibility of omission and fraud.

2.To calculate the result (Profit or Loss) of operations during a particular accounting period which further help in knowing the financial performance of a business.

3.To ascertain the financial position of a business. Means of financial statement i.e. balance sheet which shows assets on one side and Capital & Liabilities on the other side

4.To communicate the information to various users like owners, investors, creditors, banks, employees and government authorities etc who analyse them as per their requirements

5.To provide financial information to the management which help in decision making, budgeting and forecasting.

Accounting Meaning Definitions and Objectives-

Advantages of Accounting-

1. It provides information which is useful to management for making economic decisions.

2. It help owners to compare one year’s results with those of other years to know the factors which leads to changes.

3. It provide information about the financial position of the business by means of balance sheet which shows assets on one side and Capital &Liabilities on the other side.

4. It help in keeping systematic and complete record of business transactions in the books of accounts according to specified principles and rules, which is accepted by the Courts as evidence.

5. It help a firm in the assessment of its correct tax Liabilities such as income tax, GST, excise duty etc.

6. Properly maintained accounts help a business entity in determining its proper purchase price.

Limitations of Accounting-

1. It is historical in nature, it does not reflect the current worth of a business. Moreover, the figures given in financial statements ignore the effects of changes in price level.

2. It contain only those information’s which can be expressed in terms of money. It ignore qualitative elements such as efficiency of management, quality of staff, customers satisfactions etc.

3. It may be affected by window dressing i.e. manipulation in accounts to present a more favourable position of a business firm than its actual position.

4. It is not free from personal bias and personal judgement of the people dealing with it. For example different people have different opinions regarding life of asset for calculating depreciation, provision for doubtful

debts etc.

5. It is based on various concepts and conventions which may hamper the disclosure of realistic financial position of a business firm. For example assets in balance sheet are shown at their cost and not at their market value which could be realised on their sale

Also read : Golden Rules Of Accounting

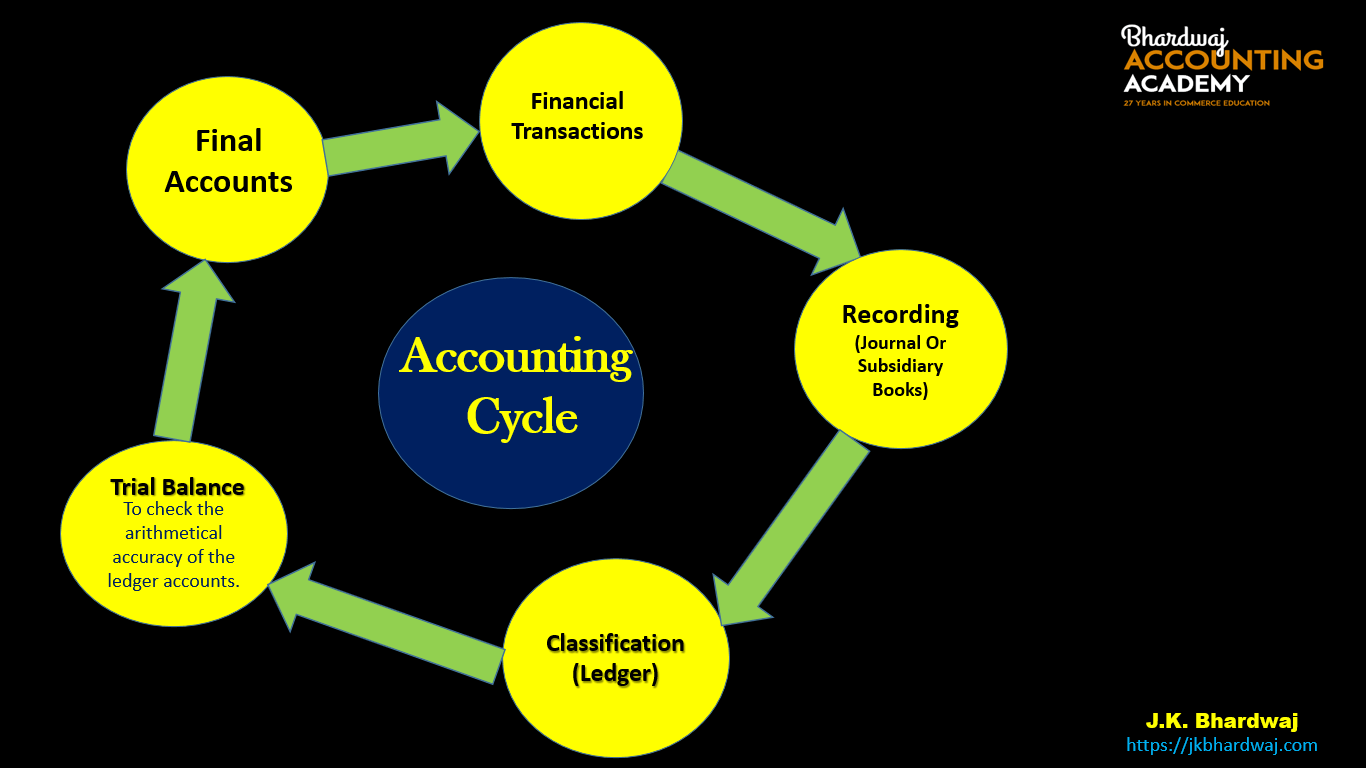

Accounting Cycle Or Accounting Process-

“An accounting cycle is a complete sequence of accounting process, that begins with the recording of business transactions and ends with the preparation of final accounts. Accounting cycle is also known as the accounting process”.

When a businessman starts his business activities, he records the day-to-day transactions in the Journal.

From the journal the transactions move further to the ledger where accounts are written up. Here, the combined effect of debit and credit pertaining to each account is arrived at in the form of balances.

To prove the accuracy of the work done, these balances are transferred to a statement called trial balance.

Preparation of trading and profit and loss account is the next step.

The balancing of profit and loss account gives the net result of the business transactions.

To know the financial position of the business concern balance sheet is prepared at the end. These transactions which have completed the current accounting year, once again come to the starting point – the journal – and they move with new transactions of the next year.

Thus, this cyclic movement of the transactions through the books of accounts is called accounting cycle. Accounting cycle is a continuous process.

Also read : Comprehensive project of Accountancy for CBSE class 12 (2021-2022)