Table of Contents

Comprehensive project of Accountancy for CBSE class 12 (2021-2022)

- Journal Entries

- Ledger

- Trial Balance

- Trading and Profit & Loss Account

- Balance Sheet

- Ratios

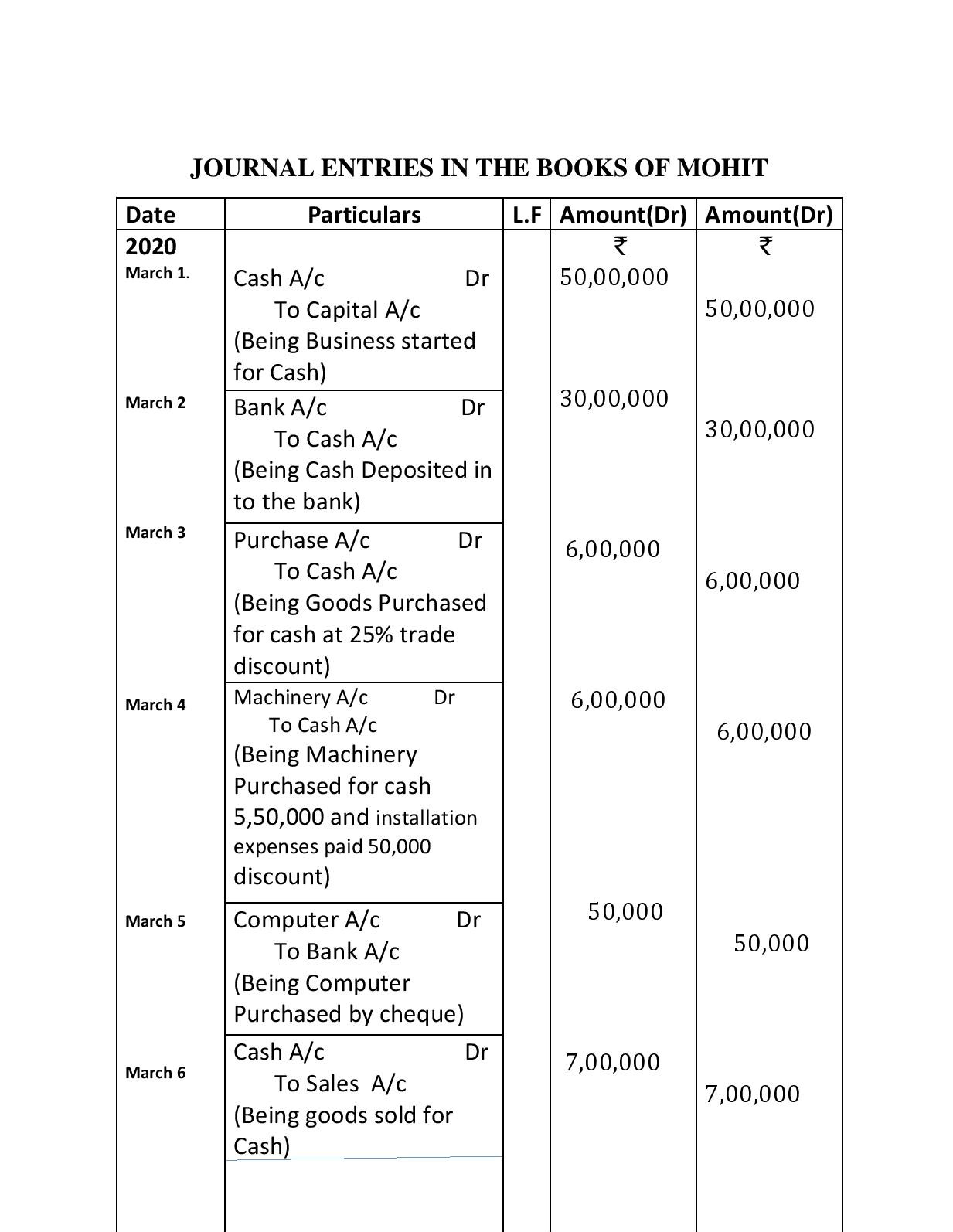

Comprehensive project of Accountancy for CBSE class 12 (2021-2022)- On 1st March, 2020 Mr. Mohit started a Furniture business in GANDHI NAGAR Mr. Mohit invested Rs 50,00,000.

March 2 Cash deposited into the bank Rs. 30,00,000.

March 3 Goods purchased (3,000 Chairs) for cash Rs 8,00,000 at 25% trade discount .

March 4 Machinery Purchased for cash Rs.5,50,000 and installation expenses paid Rs. 50,000.

March 5 Computer Purchased paid by cheque Rs. 50,000.

March 6 Goods sold (2,000 Chairs) for Cash Rs. 7,00,000.

March 7 Carriage paid Rs. 18,000.

March 10 Goods purchased (1,000 Tables) from Dinesh & company Rs. 12,50,000 at 20% trade discount .

March 12 Goods Sold( 500 Tables to Mohit & Brother Rs.20,00,000 at 40% trade discount .

March 13 Investment purchased by cheque Rs. 2,00,000.

March 15 amount paid to Dinesh & company by cheques Rs. 4,00,000.

March 16 Furniture Purchased for office use paid by cheque Rs. 1,50,000.

March 17 Cash withdrawn for personal use Rs. 40,000.

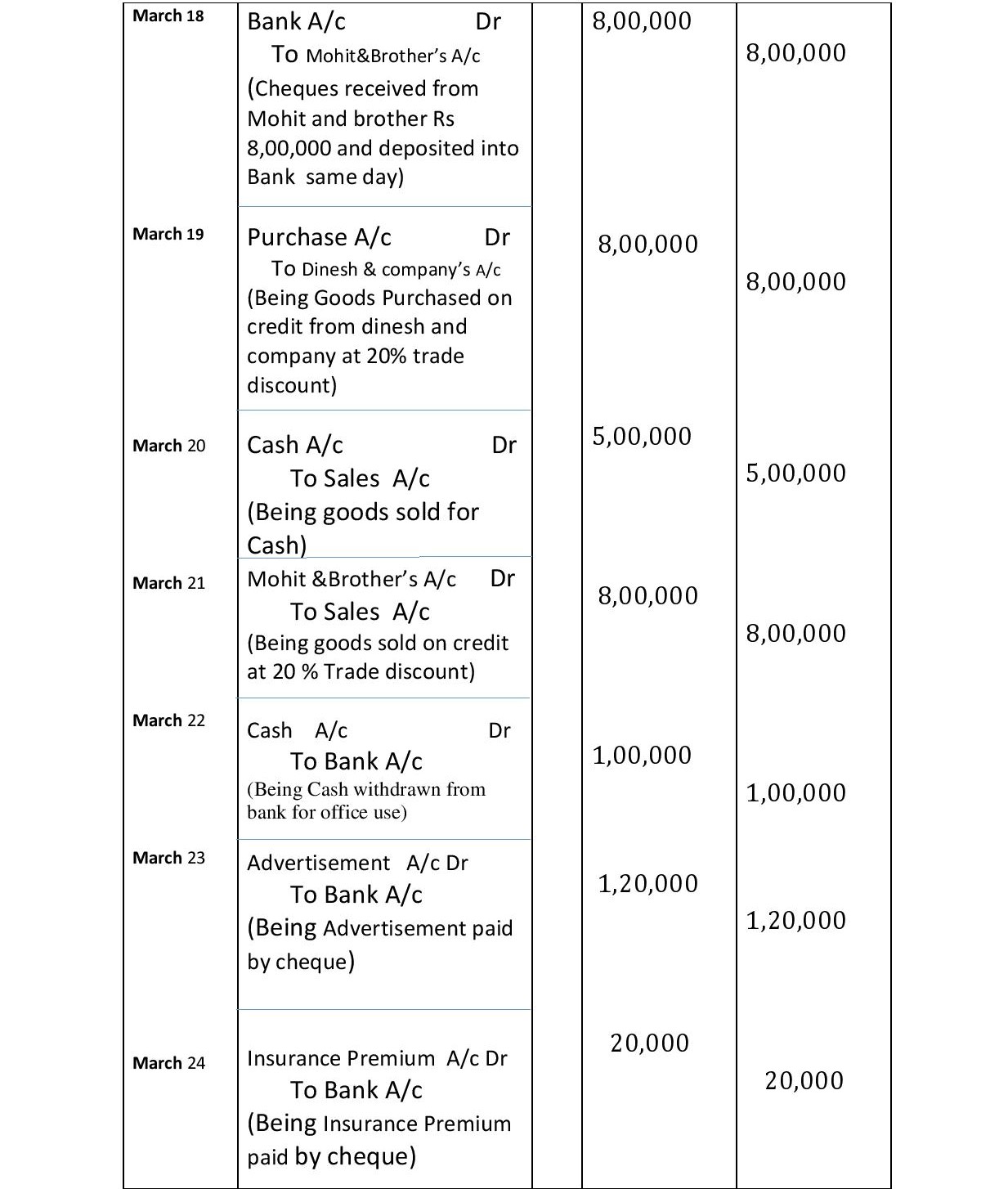

March 18 Cheques received from Mohit and brother Rs 8,00,000 and deposited into Bank same day.

March 19 Goods purchased ( 1000 Tables) from Dinesh & company Rs. 10,00,000 at 20% trade discount .

March 20 Goods sold for Cash Rs. 5,00,000.

March 21 Goods Sold ( 500 Chairs and 500 tables) to Mohit & Brother Rs.10,00,000 at 20% trade discount .

March 22 Cash withdrawn from bank for office use Rs. 1,00,000.

March 23 Advertisement Expenses paid by cheque Rs. 1,20,000.

March 24 Insurance premium paid Rs. 20,000 by cheque.

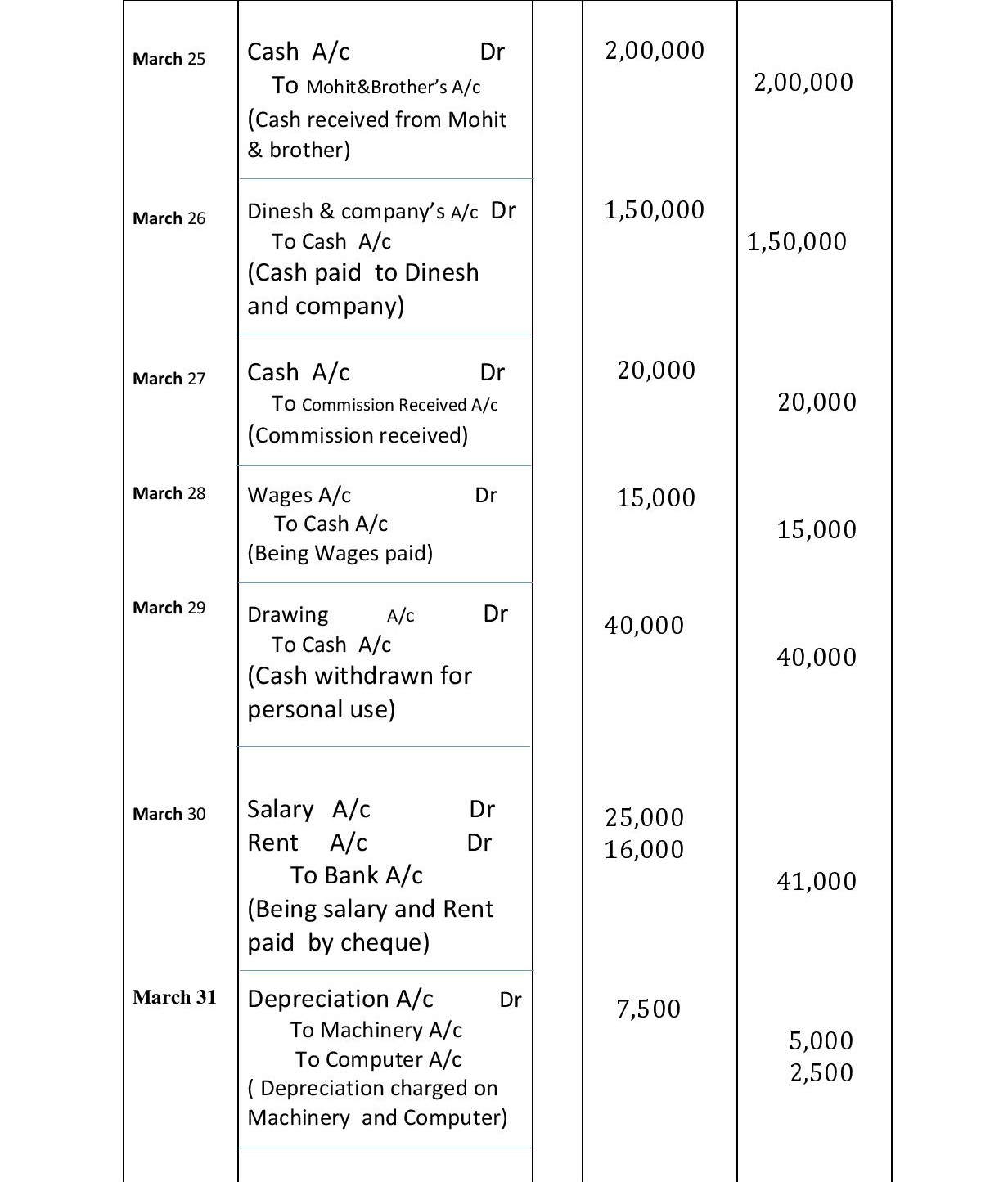

March 25 Cash received from Mohit & brother Rs 2,00,000.

March 26 Cash paid to Dinesh & company Rs. 1,50,000.

March 27 Commission Received Rs. 20,000.

March 28 wages paid Rs.15,000.

March 29 Cash withdrawn for personal use Rs. 40,000.

March 30 Salary Rs 25,000, Rent Rs. 16,000 paid by cheque.

March 31 Depreciation charge on machinery Rs. 5,000.

March 31 Depreciation charge on Computer Rs. 2,500.

March 31 Bank charges charged by bank Rs. 5,000.

March 31. Interest received on investment Rs. 4,000.

ALSO READ : ACCOUNTING TREATMENT OF GOODWILL AT THE TIME OF ADMISSION OF A NEW PARTNER

1. Journal Entries

2. Ledger

3. Trial Balance

4. Trading and Profit & Loss Account

5. Balance Sheet

5. Ratios

Comprehensive project of Accountancy for CBSE class 12 (2021-2022)

1. Journal Entries

Comprehensive project of Accountancy for CBSE class 12 (2021-2022)

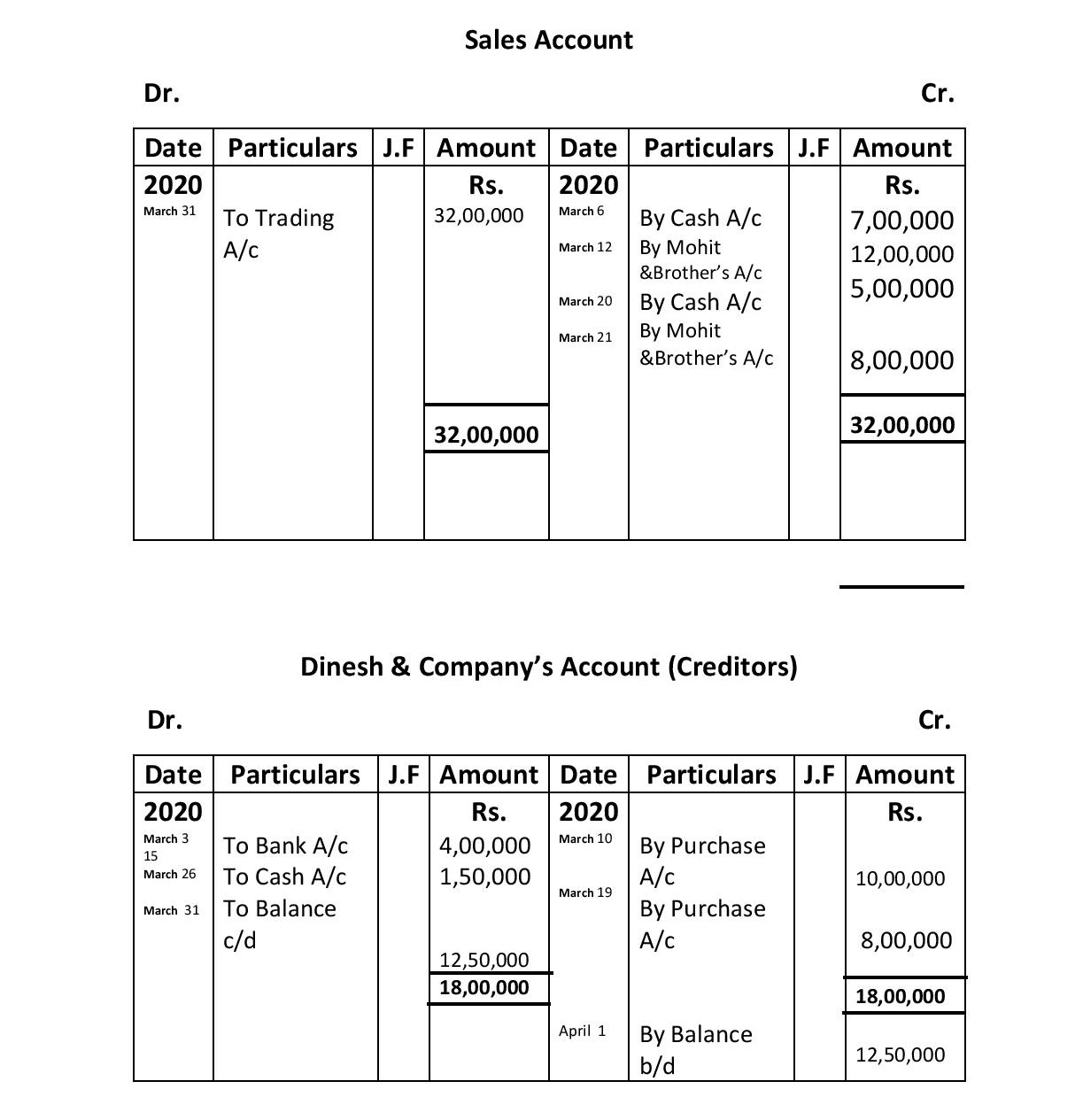

2. Ledger Example

Ledger Example

Ledger Example

Ledger Example

Ledger Example

Ledger Example

Ledger Example

Comprehensive project of Accountancy for CBSE class 12 (2021-2022)

3. Trial Balance

Comprehensive project of Accountancy for CBSE class 12 (2021-2022)

4. Trading and Profit & Loss Account

Comprehensive project of Accountancy for CBSE class 12 (2021-2022)

5. Balance Sheet

Comprehensive project of Accountancy for CBSE class 12 (2021-2022)

5. Ratios

Profitability Ratios-

1.Gross Profit Ratio= Gross Profit × 100/Net Revenue from Operations Or Net Sales

Gross Profit Ratio= 16,67,000 × 100/32,00,000

Gross Profit Ratio= 52.09%

2.Net Profit Ratio = Net Profit After Tax × 100/Net Revenue from Operations

Net Profit Ratio = 14,97,500 × 100/32,00,000

Net Profit Ratio =46.79%

3.Operating Ratio=

(Cost of Revenue from Operations Or Cost of Goods Sold + Operating Expenses) × 100/Net Revenue from Operations

Or

(Cost of Revenue from Operations Or Cost of Goods Sold + Operating Expenses – Operating Income) × 100 / Net Revenue from Operations

Cost of Revenue from Operations= Net Revenue from Operations-Gross Profit

Cost of Revenue from Operations= 32,00,000 – 16,67,000

Cost of Revenue from Operations= 15,33,000

Operating Expenses= 20,000+25,000+16,000+1,20,000+7,500+5,000

Operating Income= 20,000 (Commission Received)

Operating Ratio= (15,33,000+1,93,500-20,000)×100/32,00,000

Operating Ratio= 53.33%

4. Operating Profit Ratio= Net Operating Profit × 100/Net Revenue from Operations

Net operating profit = Net Profit after Tax+ Non-Operating Expenses – Non Operating Incomes

Or

Net operating profit = Gross Profit + Operating Income – Operating Expenses

Net operating profit = 16,67,000 + 20,000 – 1,93,500

Net operating profit =14,93,500

Operating Profit Ratio= 14,93,500 × 100/32,00,000

Operating Profit Ratio= 46.67%

Liquidity Ratios Or Short term solvency ratios

1. Current Ratio =Current Assets/Current Liabilities

Current Assets= Debtors+ Cash in hand +Cash at Bank + Stock

Current Assets= 10,00,000+ 20,61,000 +27,14,000 + 9,00,000

Current Assets= 66,75,000

Current Liabilities= Creditors

Current Liabilities= 12,50,000

Current Ratio =66,75,000/12,50,000

Current Ratio =5.43:1

Significance-

It indicates the amount of current assets available for repayment of current liabilities. Higher the ratio, the greater is the short term solvency of a firm and vice – versa. However, a very high ratio or very low ratio is a matter of concern.

If the ratio is very high it means the current assets are lying idle. Very low ratio means the short term solvency of the firm is not good. Thus, the ideal current ratio of a company is 2 : 1 i.e. to repay current liabilities, there should be twice current assets.

2.Liquid Ratio =Liquid Assets/Current Liabilities

Liquid Assets= Total Current Assets – Stock and Prepaid Expenses

Liquid Assets= 66,75,000 – 9,00,000

Liquid Assets= 57,75,000

Current Liabilities= 12,50,000

Liquid Ratio =57,75,000/12,50,000

Liquid Ratio = 4.62:1

Significance

Quick ratio is a measure of the instant debt paying capacity of the business enterprise. It is a measure of the extent to which liquid resources are immediately available to meet current obligations. A quick ratio of 1 : 1 is considered good/favourable for a company

Admission of a partner-Important Questions-2

Important questions of fundamentals of partnership-3

Profit and loss Appropriation Account

Format of Profit and loss Appropriation Account

Hidden Goodwill at the time of Admission of A New Partner

Important questions of fundamentals of partnership

Important questions of fundamentals of partnership-2

Goodwill questions for practice Class 12 ISC & CBSE

Important questions of fundamentals of partnership-5

ACCOUNTING TREATMENT OF GOODWILL AT THE TIME OF ADMISSION OF A NEW PARTNER

https://jkbhardwaj.com/quizzes/financial-accounting-quiz-questions-and-answers/

Awesome