Important questions of fundamentals of partnership-2

1. Interest on Capital

2. Interest on drawing

3. Profit and Loss Appropriation Account

4. Profit and Loss Appropriation Account and Partners Capital Account

5. Past Adjustment

6.Guarantee of Profit

Important questions of fundamentals of partnership-2

INTEREST ON DRAWING

The money or goods or both withdrawn by a partner from the business firm for personal Or domestic use is known as drawings.

If the partnership deed has a provision of charging interest on drawings, the firm may charge interest on drawings from partners. It is calculated at the agreed rate.

If Partnership Deed is Silent, Interest on drawings is not charged on partners Drawing.

If Partnership Deed Provides, Interest on drawings is charged on partners Drawing.

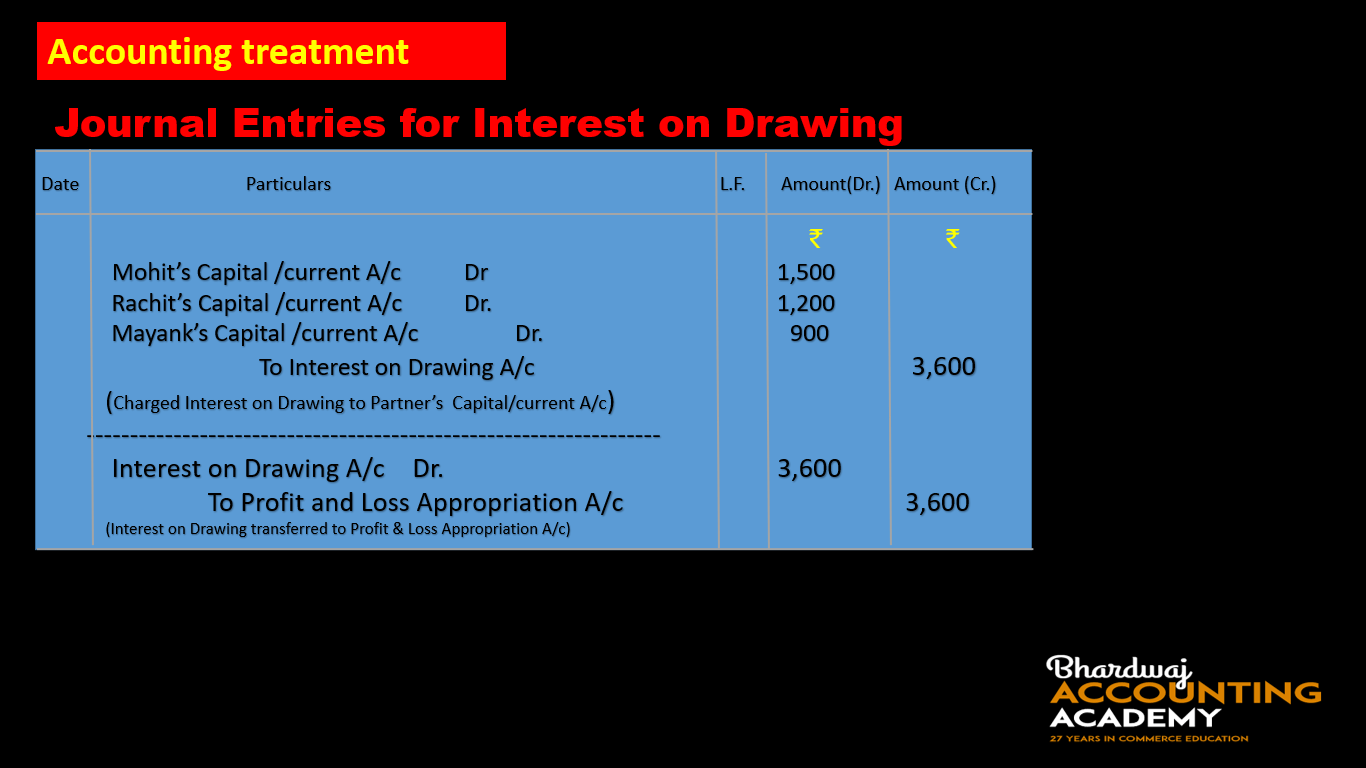

Accounting treatment of Interest on Drawing:

Interest on Drawings is income to the firm and an expense to the partner. The amount of interest on drawings will be credited to the Profit and Loss Appropriation Account and will be debited to the partner’s capital account/current account (Individually).

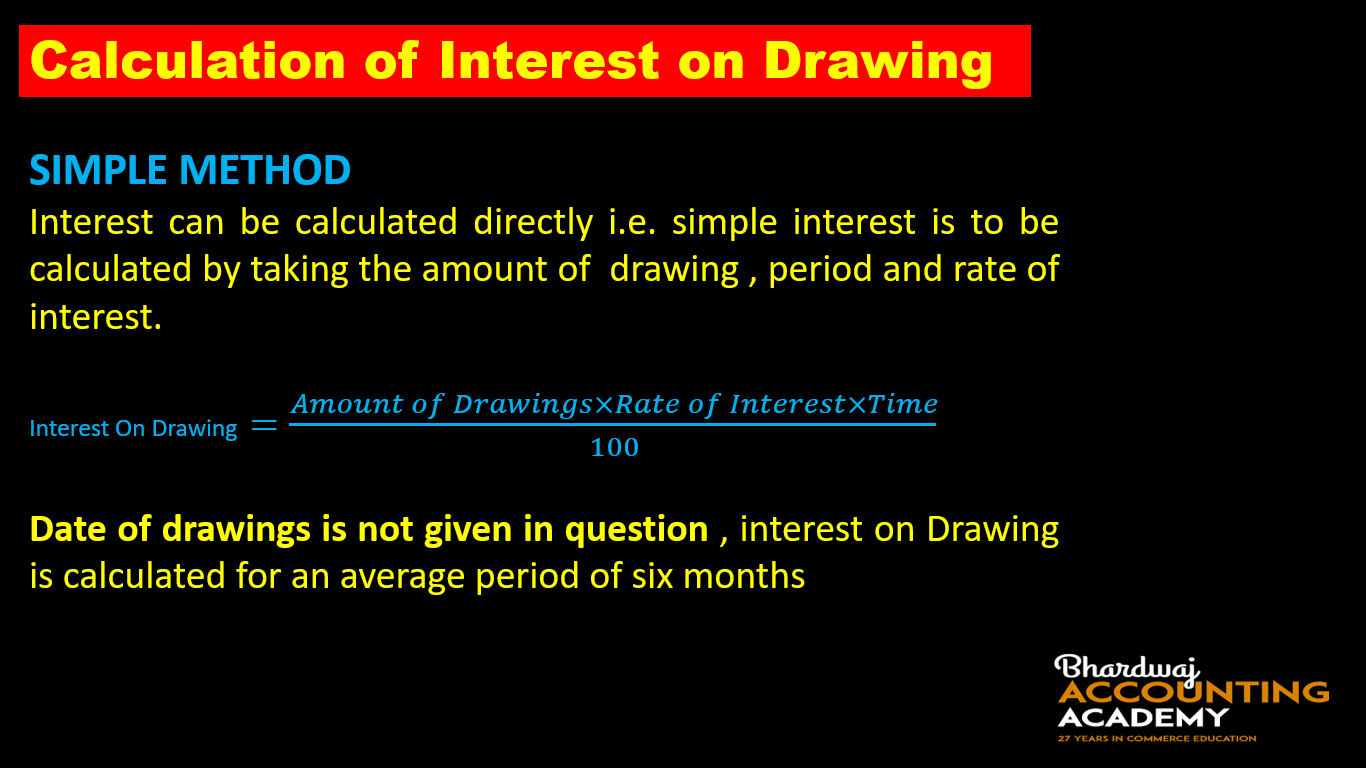

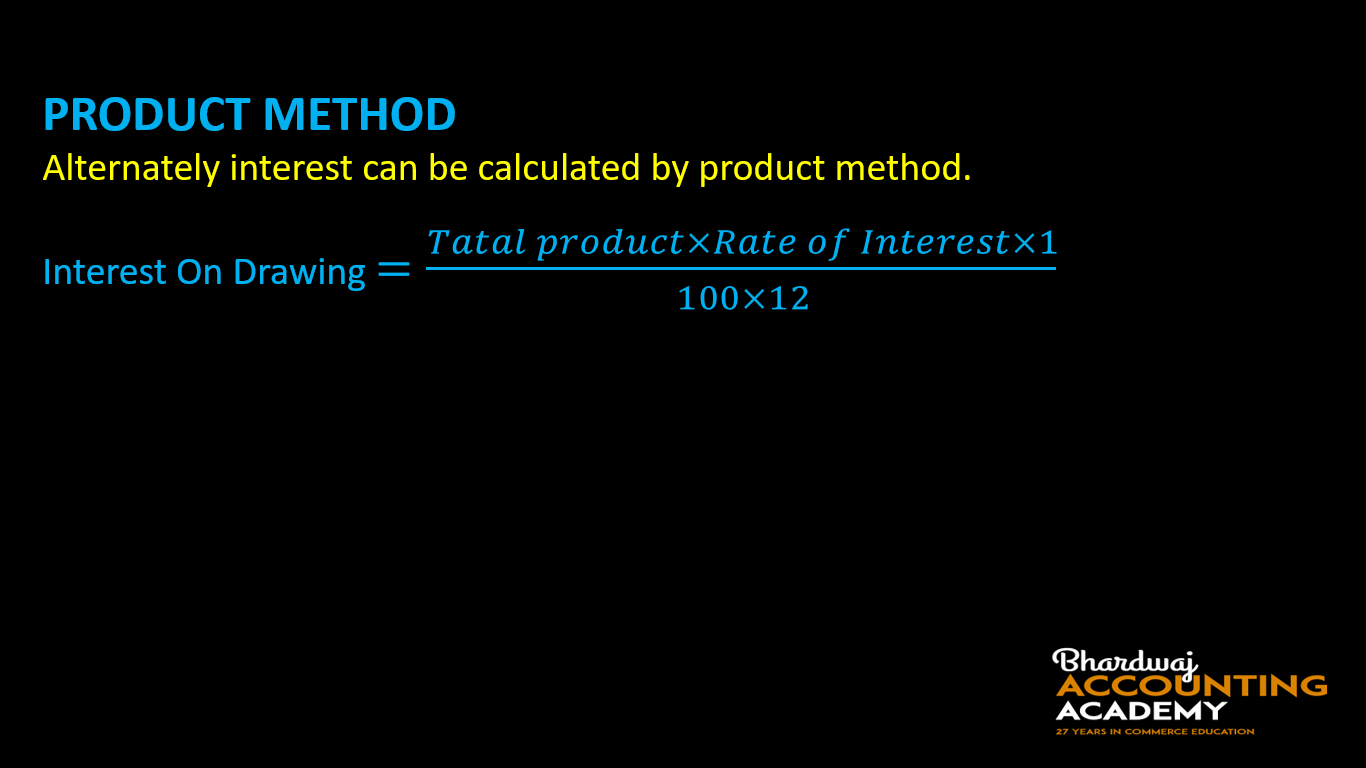

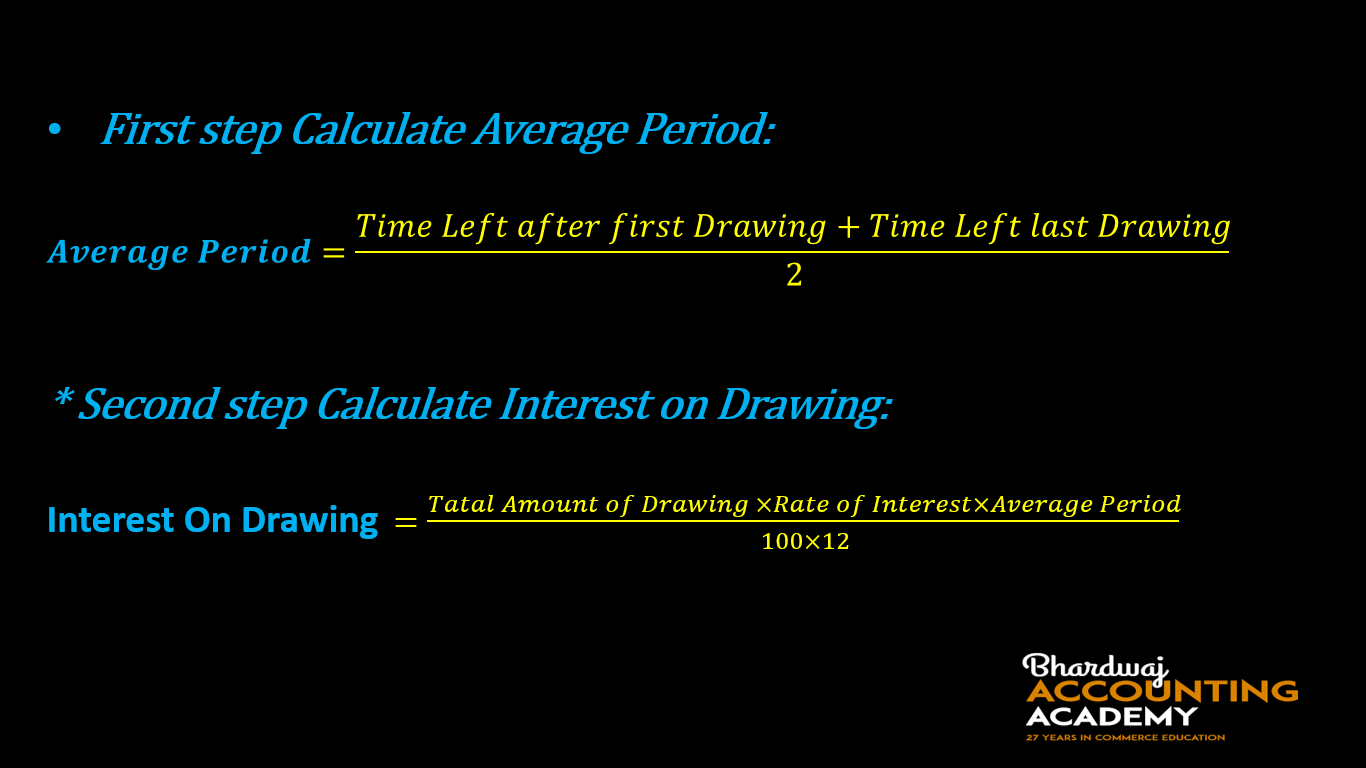

Calculation of Interest on Drawing:

Important questions of fundamentals of partnership-2

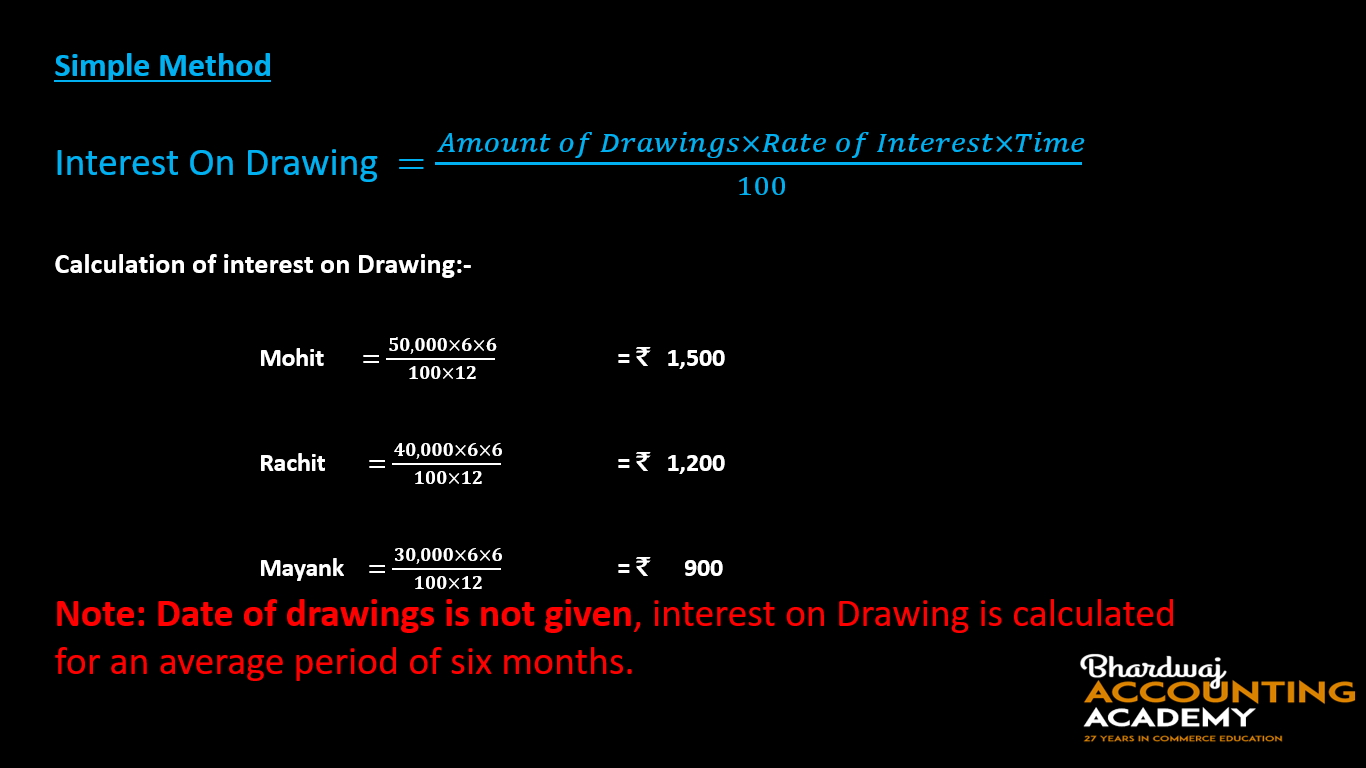

Example 1.

Mohit, Rachit, and Mayank started a partnership business on 1st April, 2019. Their capital contributions were ₹4,00,000 , ₹3,00,000 and ₹2,00,000 respectively. Their Drawings are ₹ 50,000, ₹ 40,000, and ₹30,000 respectively. Interest charged on Drawings @ 6 % p.a. Calculate interest on Drawing for the year ending 31st March 2020 and Pass Journal Entries in the Books of firms.

Calculation of Interest on Drawing:

Example 2.

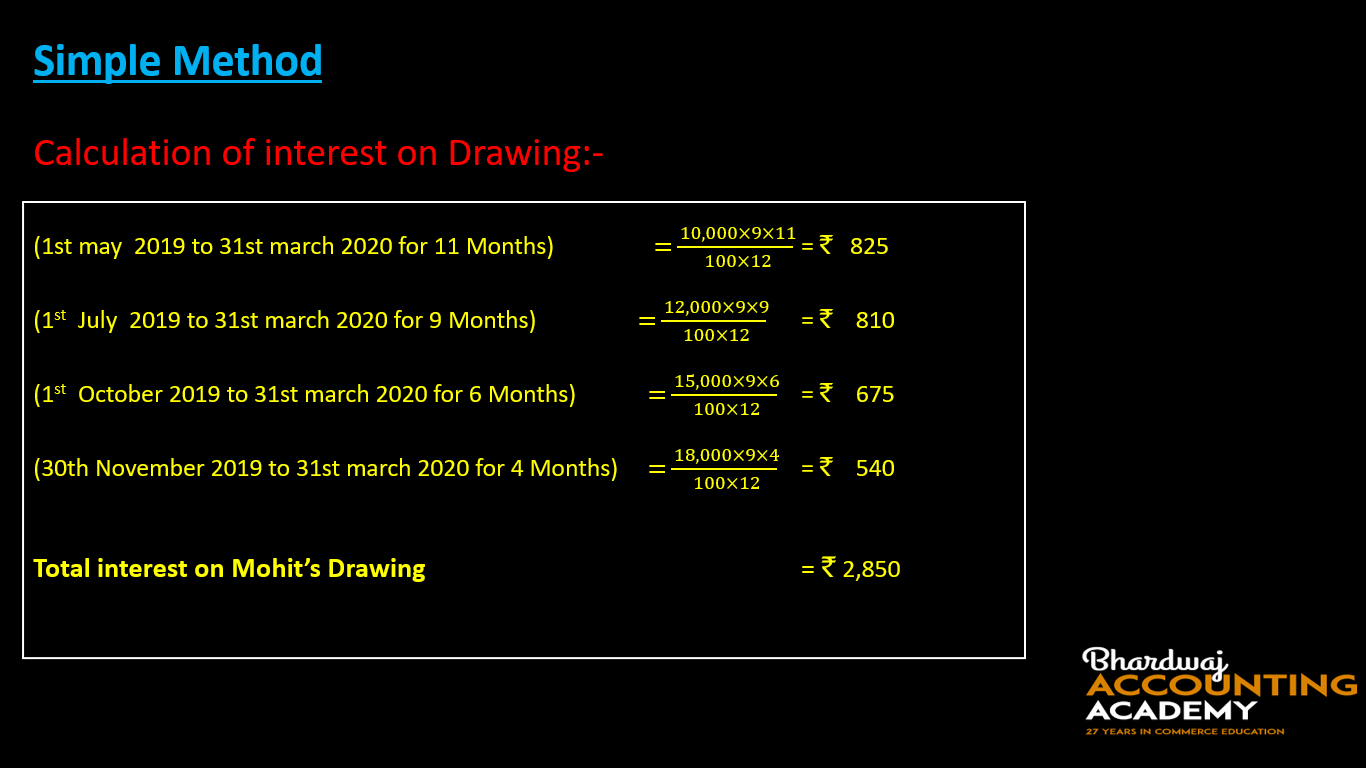

Mohit is a partner in a firm, his withdrawals are as follows:-

May 1st 2019 ₹10,000

July 1st 2019 ₹ 12,000

October 1st 2019 ₹ 15,000

November 30th 2019 ₹ 18,000

Interest charged on Drawings @ 9 % p.a. Calculate interest on Drawing for the year ending 31st March 2020. By Simple Method.

Example 3.

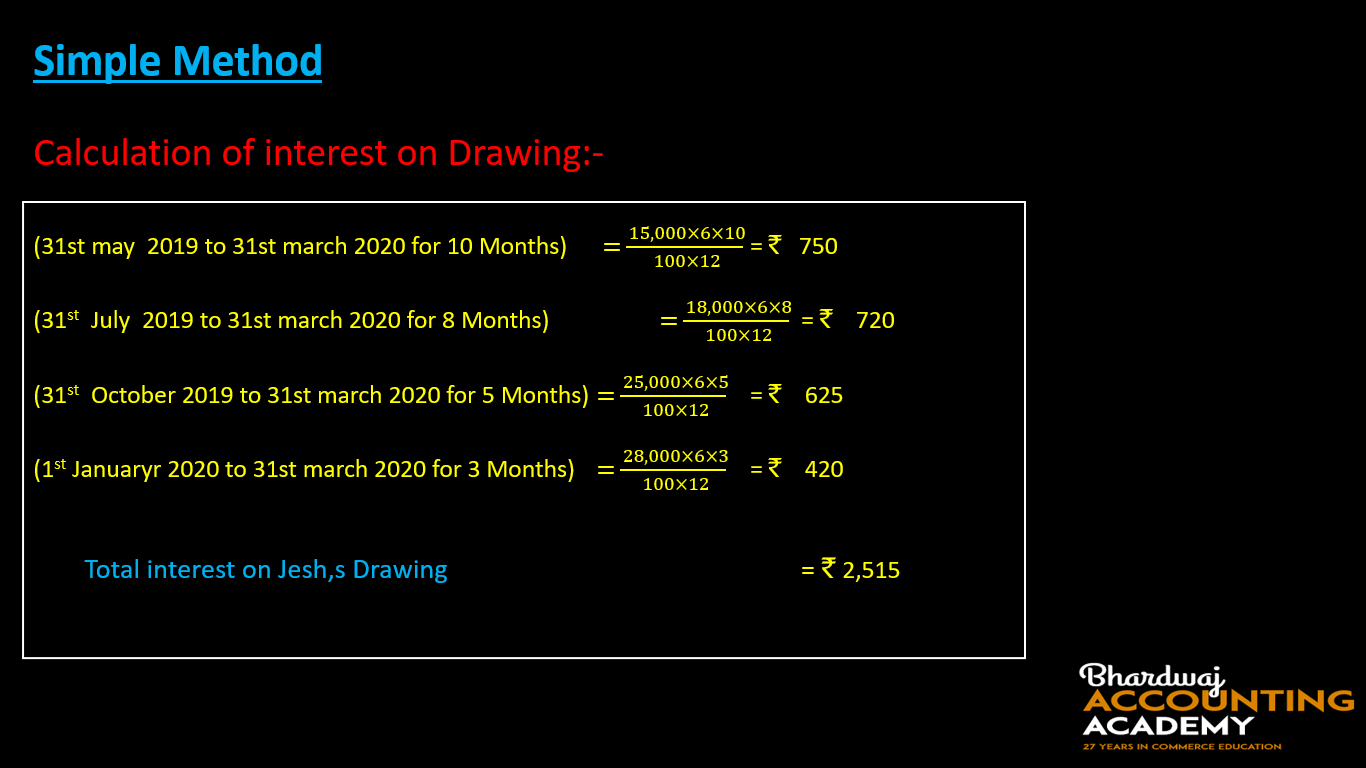

Jesh is a partner in a firm, his withdrawals are as follows:-

May 31st, 2019 ₹15,000

July 31st, 2019 ₹ 18,000

October 31st, 2019 ₹ 25,000

January 1st, 2020 ₹ 28,000

Interest charged on Drawings @ 6 % p.a. Calculate interest on Drawing for the year ending 31st March 2020. by Simple Method.

Important questions of fundamentals of partnership-2

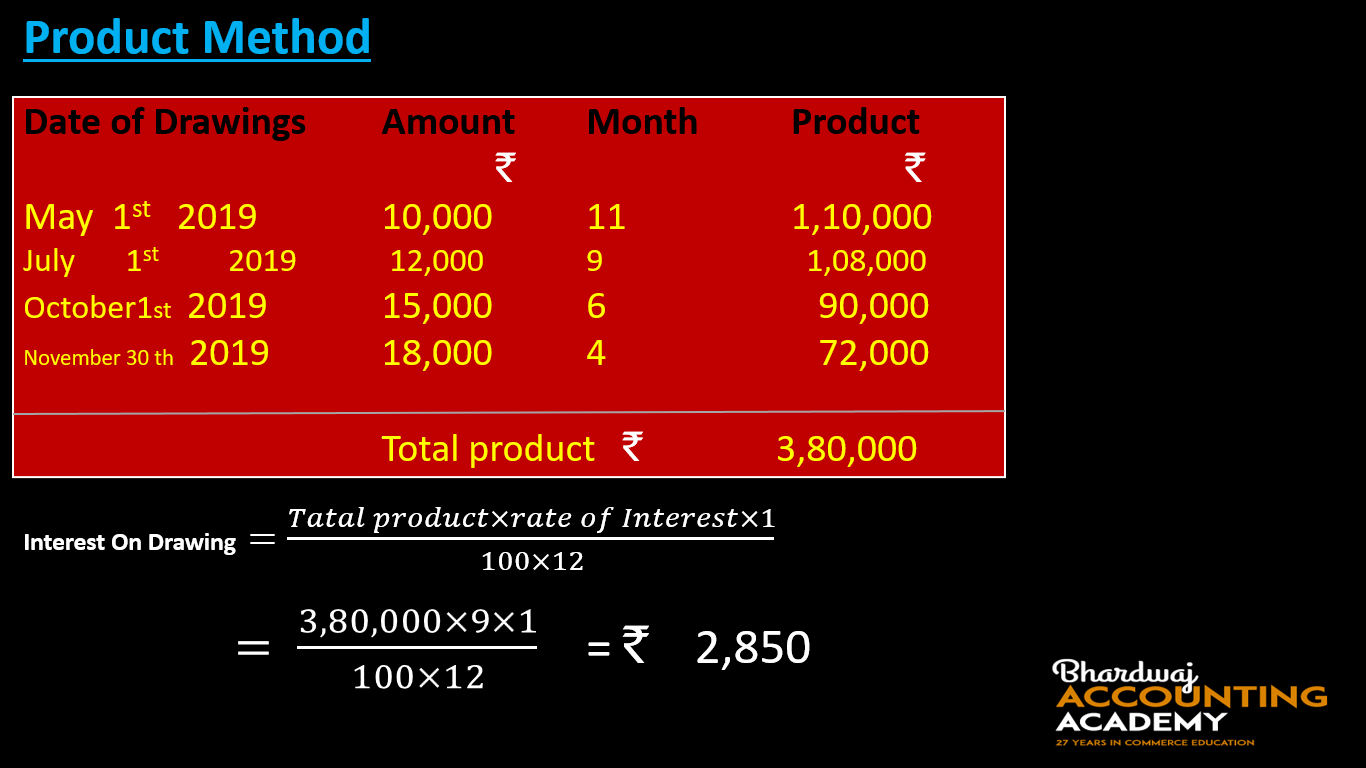

Example 4.

Mohit is a partner in a firm, his withdrawals are as follows:-

May 1st, 2019 ₹10,000

July 1st, 2019 ₹ 12,000

October 1st, 2019 ₹ 15,000

November 30th, 2019 ₹ 18,000

Interest charged on Drawings @ 9 % p.a. Calculate interest on Drawing for the year ending 31st March 2020. By Product Method.

When Fixed Amounts are Withdrawn at Equal Time Intervals

A fixed amount is withdrawn by the partners, at equal time intervals, say each month or each quarter or Middle of each year.

The calculation of the total time period, in such situations, will depend upon whether the money was withdrawn at the beginning of the month, middle of the month, or at the end of the month.

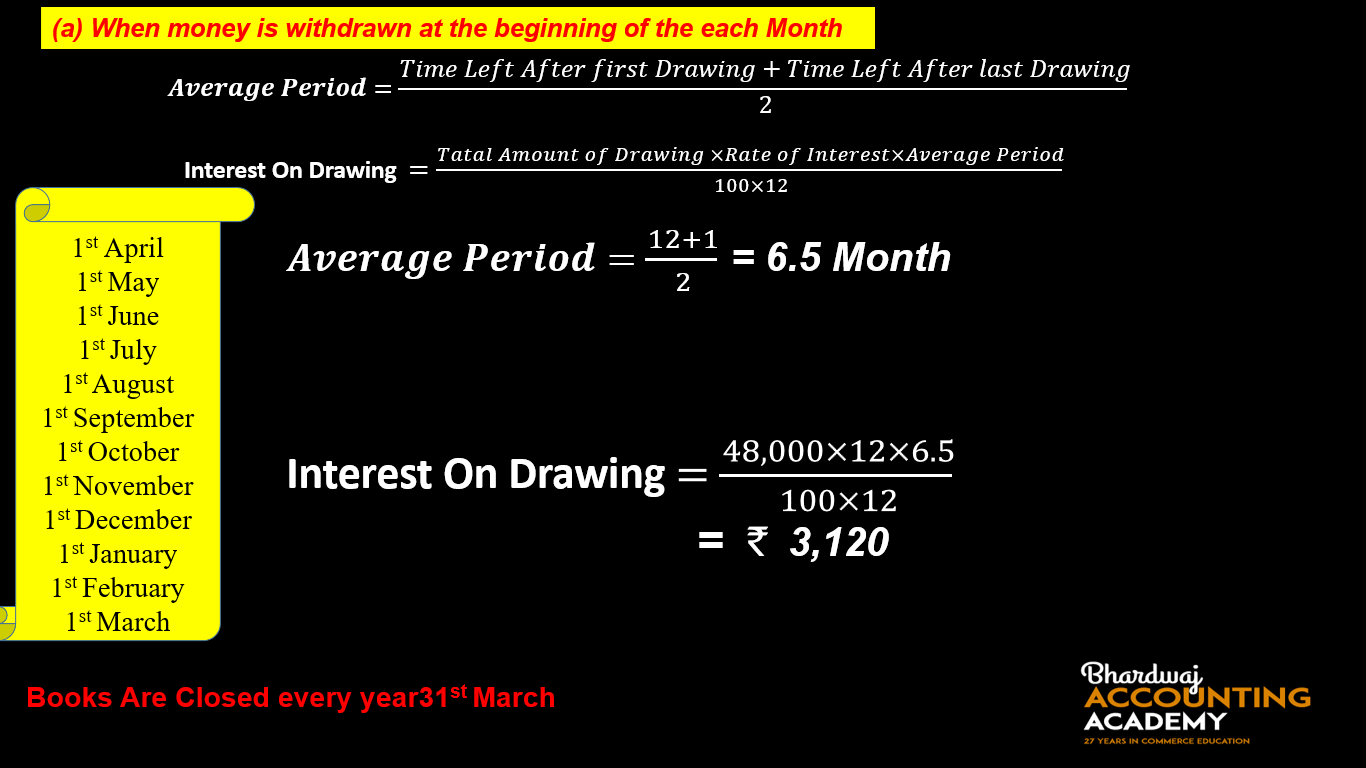

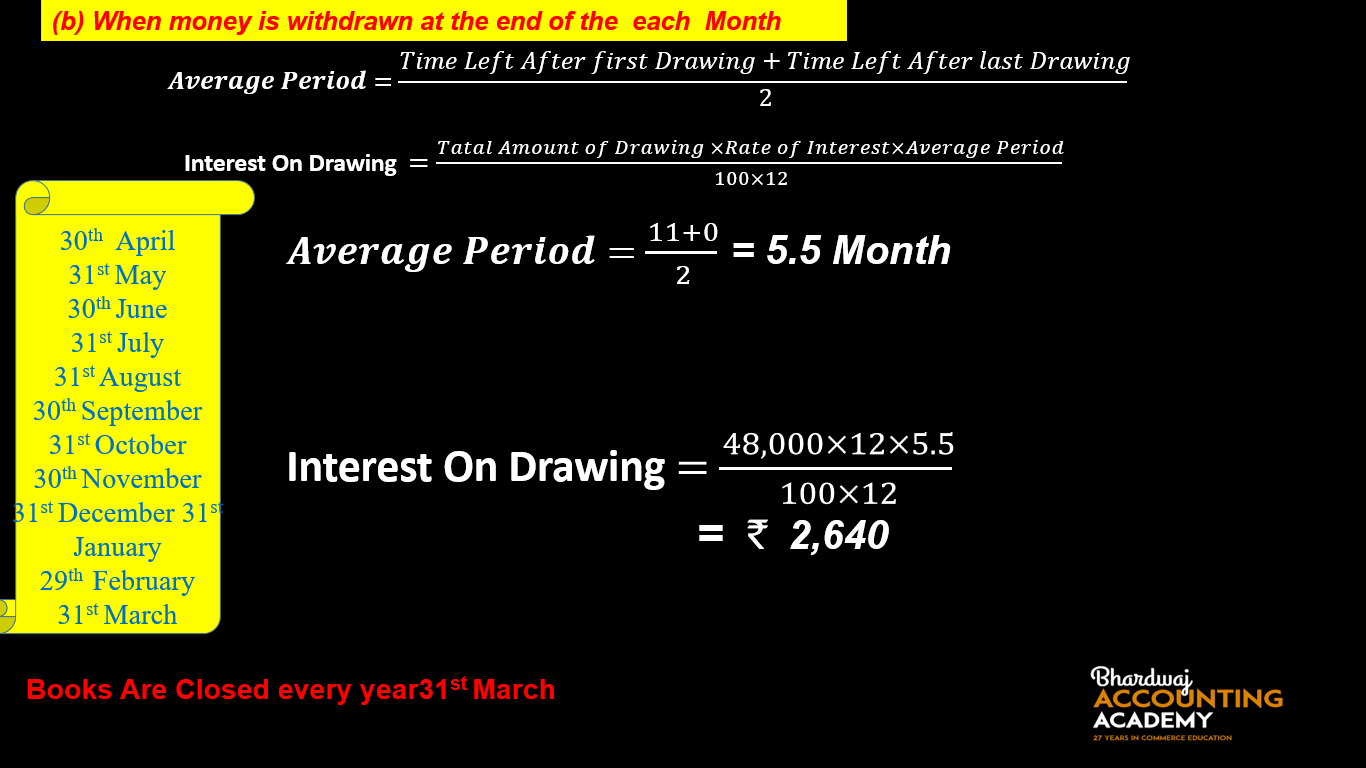

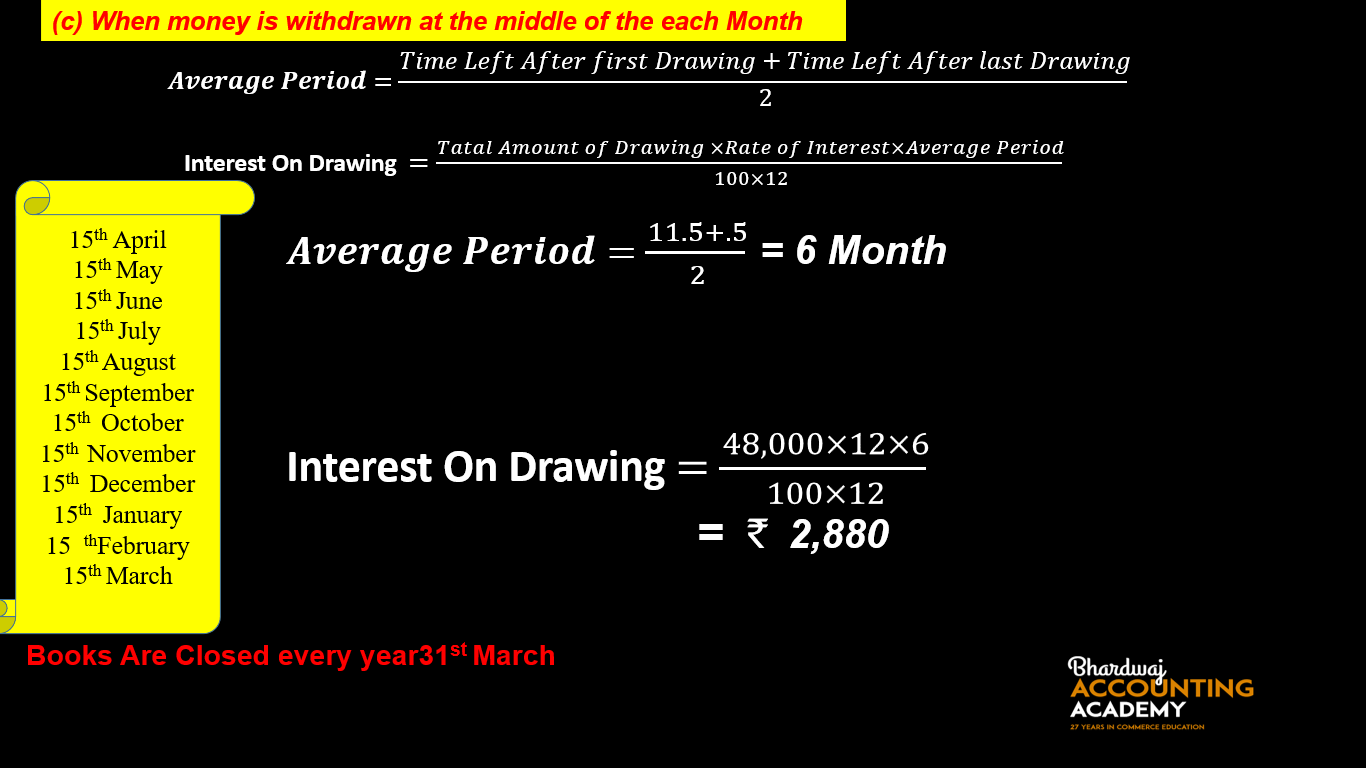

Example 5.

Mohit withdrew ₹ 4,000 per month from the firm for his personal use during the year ending March 31st, 2020. interest is charged at the rate of 12% per annum. Calculate the average period and the interest on drawings in different situations would be as follows:

(a)When money is withdrawn at the beginning of the each Month

(b) When money is withdrawn at the end of the each Month

(c) When money is withdrawn in the middle of the each month

(a)When money is withdrawn at the beginning of the each Month:

(b) When money is withdrawn at the end of the each Month:

(c) When money is withdrawn in the middle of the each month:

Example 6.

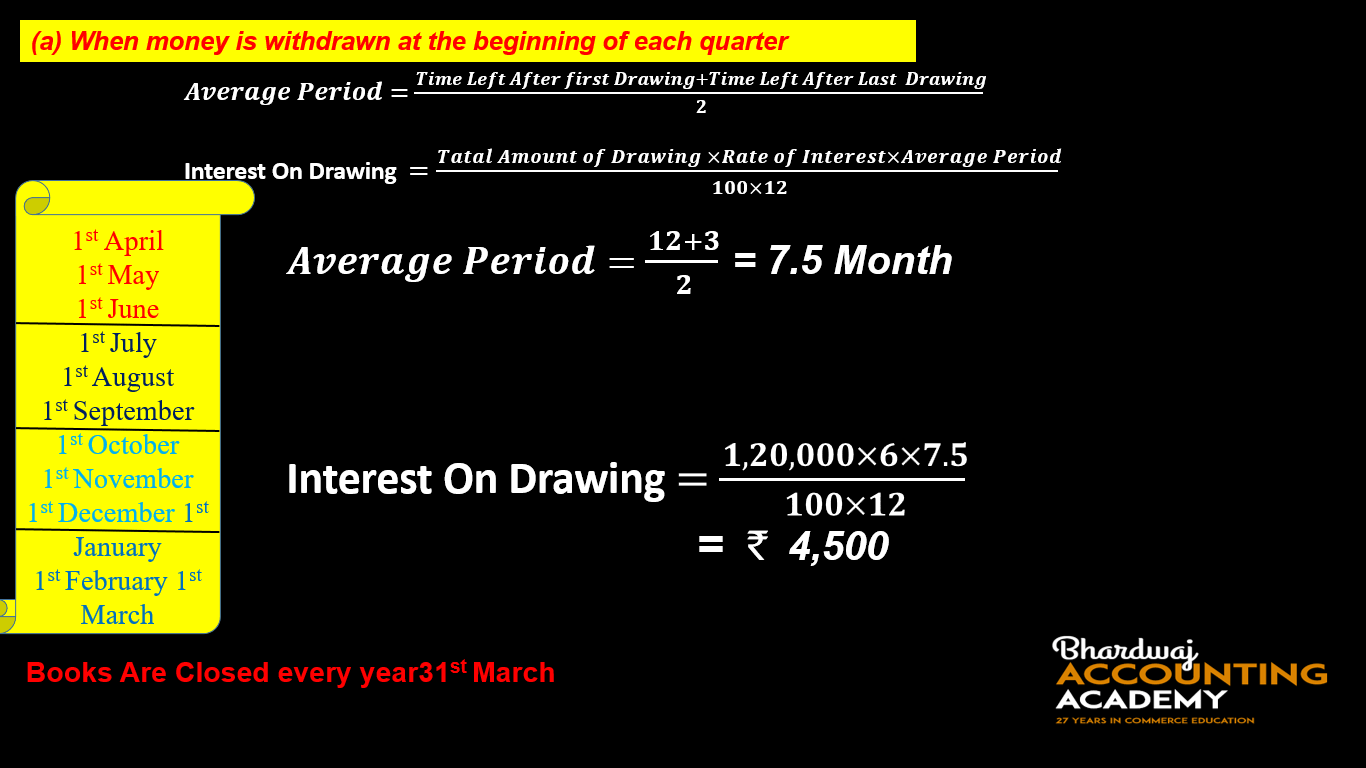

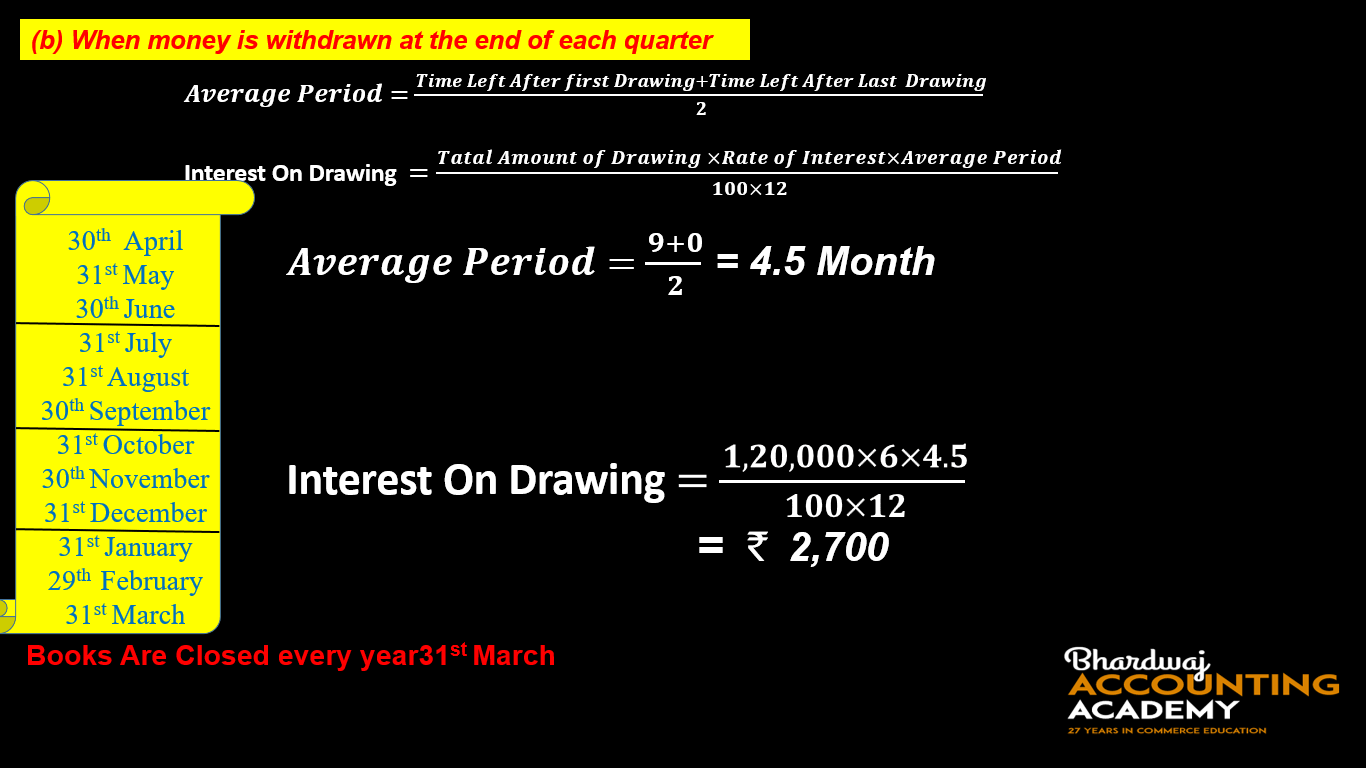

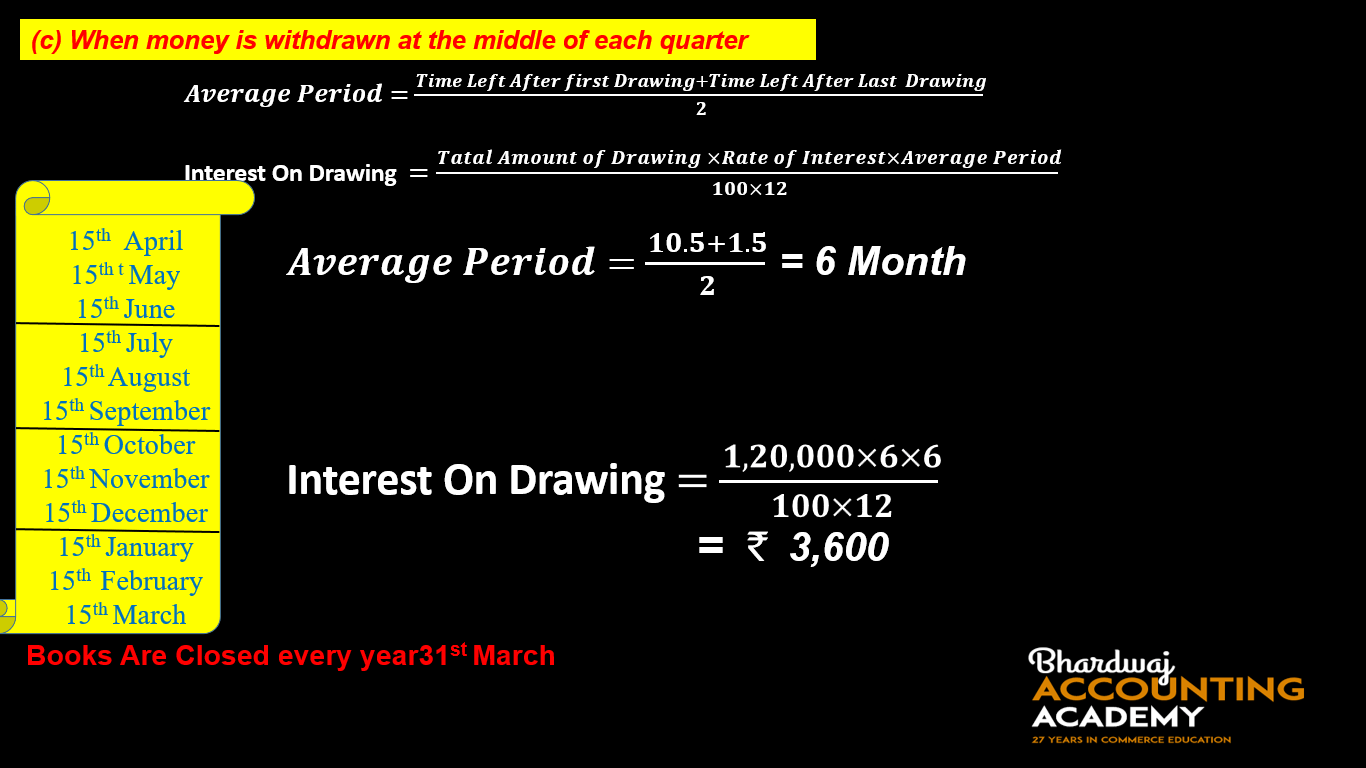

Krishana is a partner in a firm. during the year ending March 31, 2020, Krishana withdrew ₹ 30,000 quarterly.If interest is to be charged on drawings @ 6% per annum, calculate the amount of interest to be charged at the end of the year in different situations would be as follows:

(a) When money is withdrawn at the at Beginning of each quarter

(b) When money is withdrawn at the end of each quarter

(c) When money is withdrawn at the middle of each quarter

(a) When money is withdrawn at the at Beginning of each quarter:

(b) When money is withdrawn at the end of each quarter:

(c) When money is withdrawn at the middle of each quarter:

Important questions of fundamentals of partnership-2

Example 7.

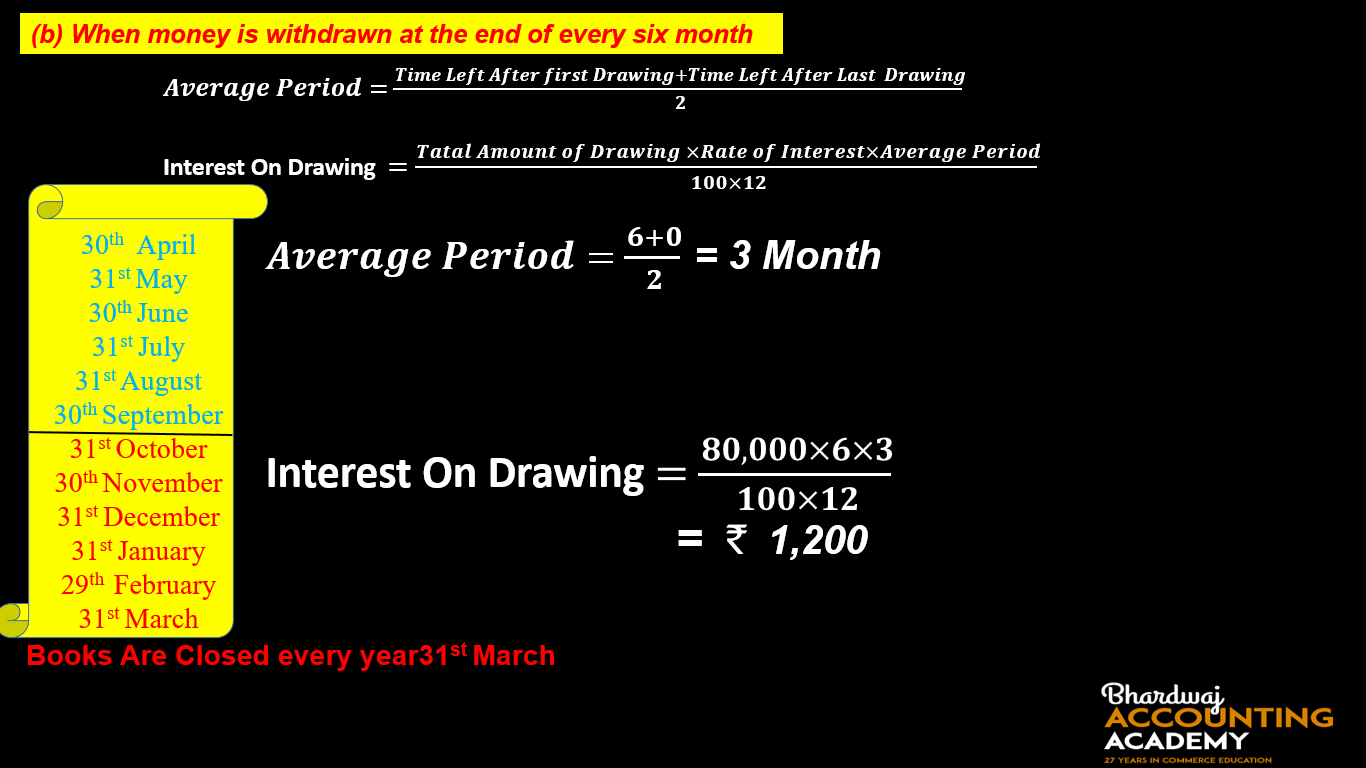

Mukul is a partner in a firm. during the year ending March 31, 2020, Mukul withdrew ₹40,000 half-yearly . If interest is to be charged on drawings @ 6% per annum, calculate the amount of interest on drawing to be charged at the end of the year.

(a) When money is withdrawn at the at Beginning of every six month

(b) When money is withdrawn at the end of every six month

(a) When money is withdrawn at the at Beginning of every six month:

(b) When money is withdrawn at the end of every six month:

Important questions of fundamentals of partnership

Profit and loss Appropriation Account

Format of Profit and loss Appropriation Account

Hidden Goodwill at the time of Admission of A New Partner

Important questions of fundamentals of partnership-2