Table of Contents

Adjustment entries

Adjustment entries- Adjustment entries are those entries that need to be passed at the end of the accounting period so, that the true profit or loss and fair financial position of the business can be shown.

Meaning of adjustment- All those items relating to income or expenses that require to be adjusted at the time of preparing final accounts is called Adjustments.

Objectives or need for adjustments-

(i) To show the true net profit/ net Loss of the business concern.

(ii) To show the assets and liabilities at their actual values.

(iii) To make a record of the transactions omitted from the books of accounts.

(iv) To record all outstanding expenses.

(v) To record all accrued incomes.

(vi) To create reserves and provisions.

(vii) To overcome the limitations of Trial Balance.

(viii) To show the true and fair financial position of the business concern.

(ix) To rectify errors.

(x) To provide for depreciation.

(xi) To adjust prepaid expenses.

(Xii) To adjust advance income.

Closing Stock

The stock of goods remaining unsold at the end of the accounting period is called Closing stock.

Or

Closing stock is refers to as the amount of unsold goods that remain with the business on a given date.

Ordinarily this does not appear in the Trial Balance.

Hence, this needs to be incorporated in financial statements.

Note- Closing stock is to be Valued at cost price or market price whichever is lower.

The adjustment entry for the closing stock will be:

Closing Stock A/c Dr

To Trading A/c

(Closing stock transferred to trading A/c)

Treatment in final Accounts-

Closing stock appears on the credit side of the Trading Account.

Closing stock appears on the Assets side of the Balance Sheet.

In case closing stock has already been accounted for it will form part of the Trial Balance and hence there is no need of making any adjustments in the Trading A/c.

Then the adjusted closing stock will be appears on the asset side of the Balance Sheet only.

Adjustment entries

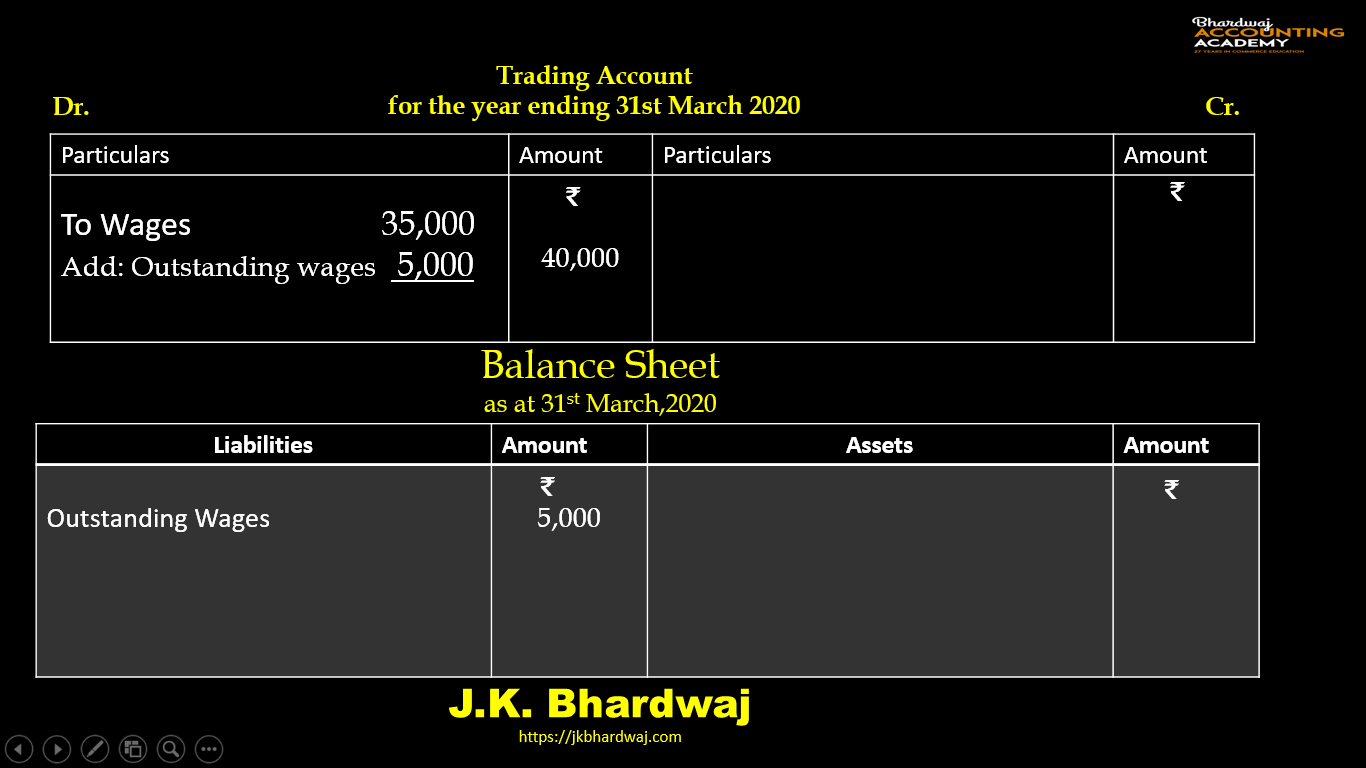

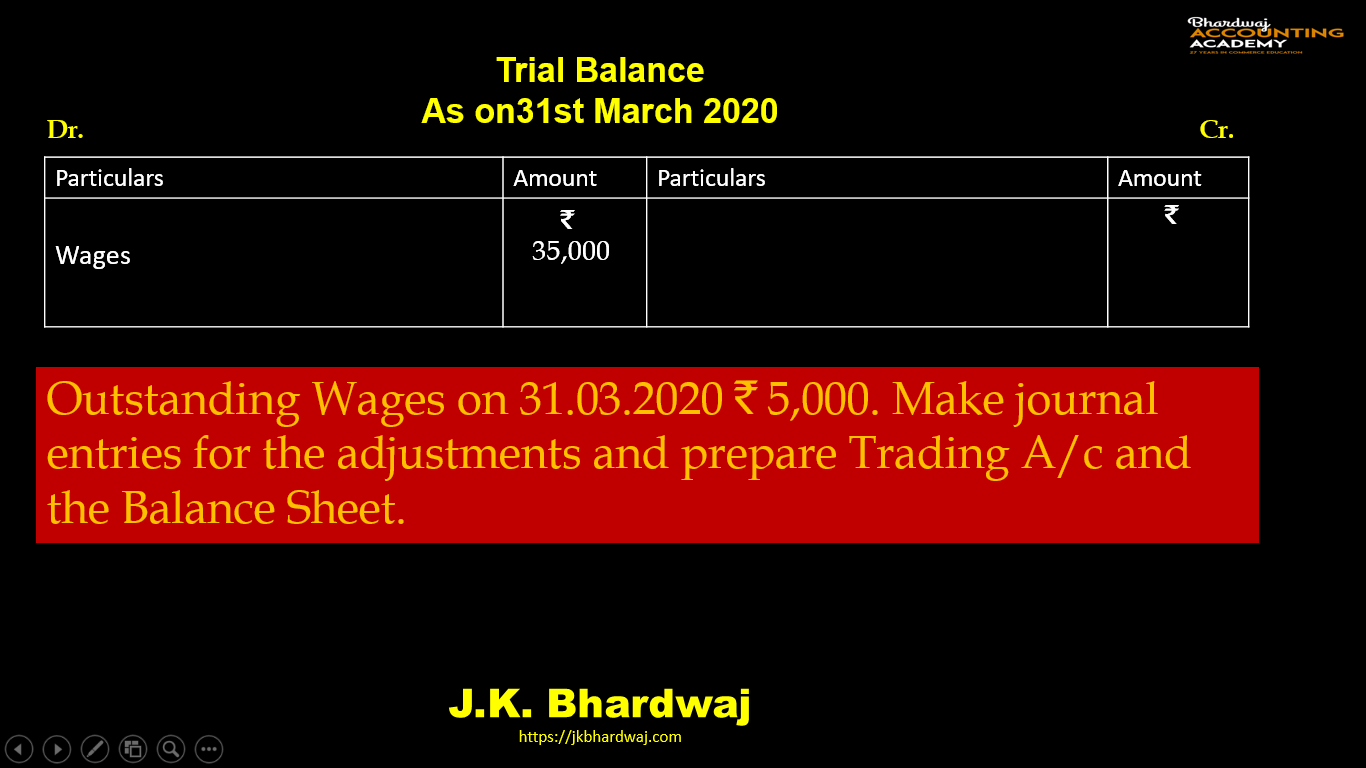

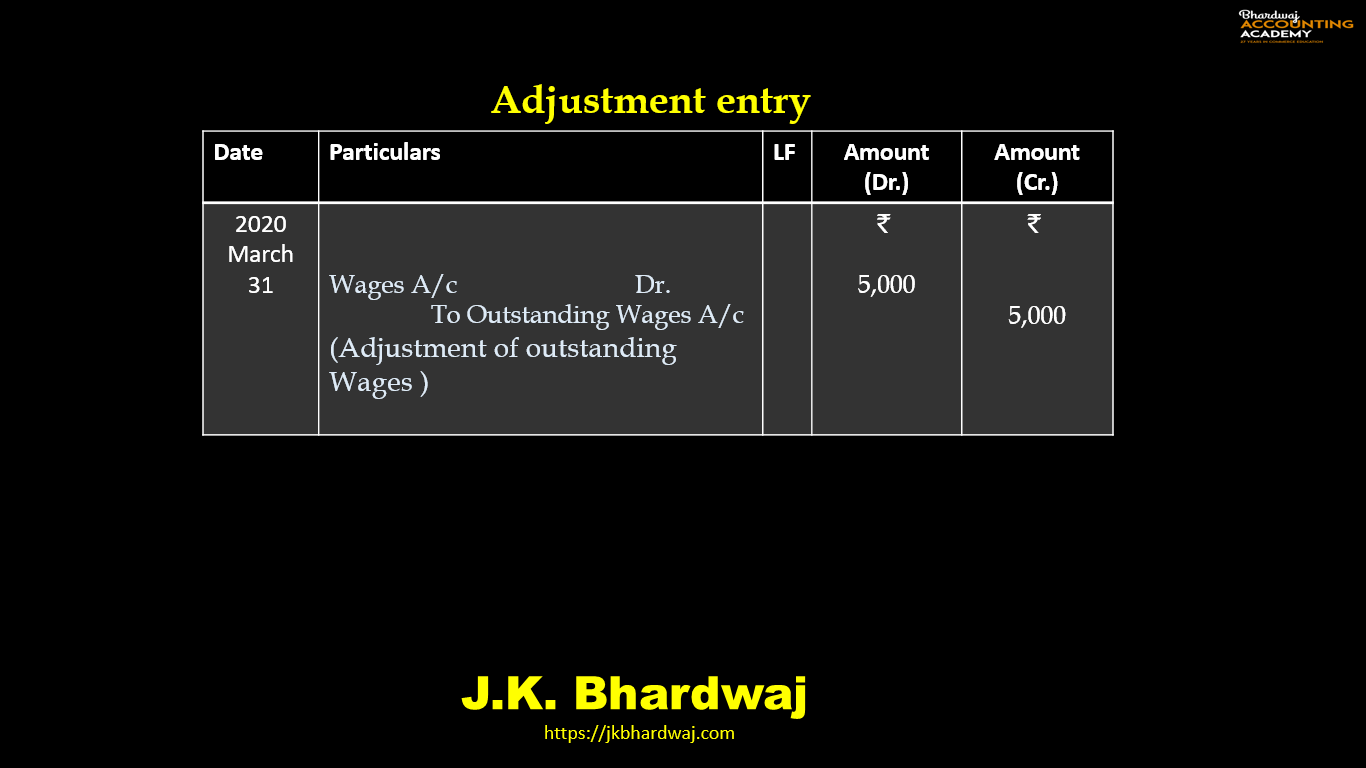

Outstanding Expenses

Expense which is related to the current accounting period but not yet paid is known as Outstanding Expense.

Suppose the accounts are closed on 31st March every year.

Salary for the month of March is due but not paid. It is an example of salary outstanding.

In case of Salaries Outstanding following adjustment entry will be made :

Salary A/c Dr.

To Outstanding Salary A/c

(Salary outstanding for the month of March)

Treatment in final Accounts-

Outstanding Expenses given outside the trial balance-

Add to the concerned item on the Debit side of Trading/Profit & Loss Account.

Shown on the liabilities side of Balance Sheet.

Treatment in final Accounts-

If Outstanding Expenses given in trial balance-

Shown on the liabilities side of Balance Sheet.

Adjustment entries

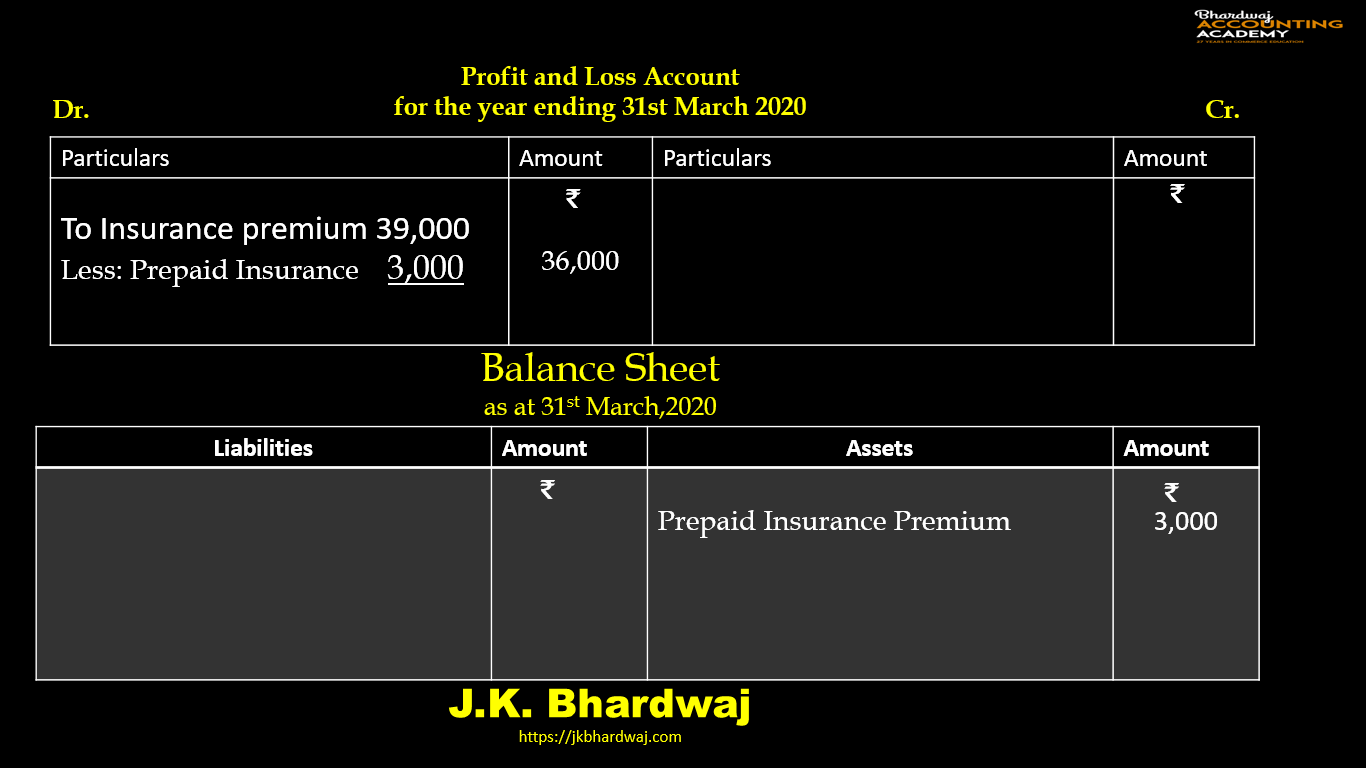

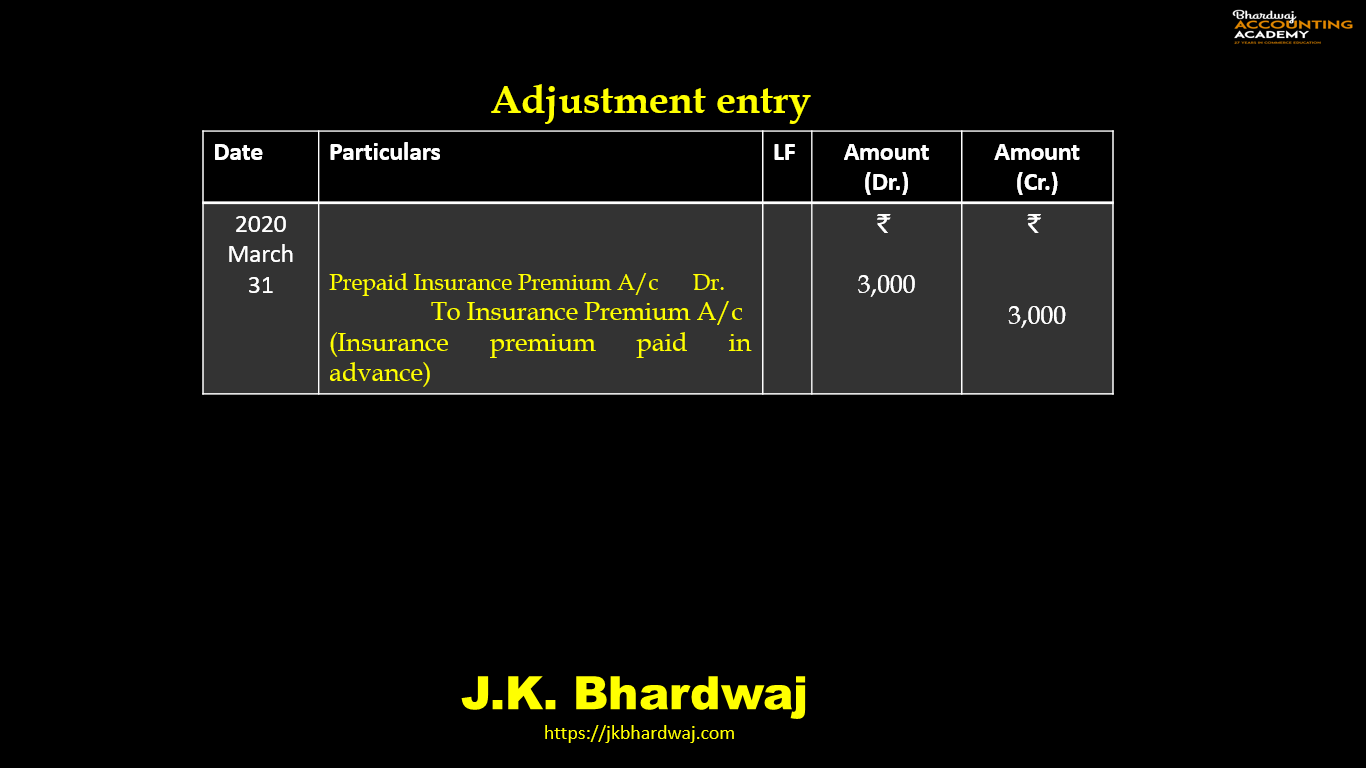

Prepaid Expenses

Sometimes a part of a certain expense paid may relate to the next accounting period. Such expenses is called prepaid expense or expenses paid in advance.

Or

At the end of the accounting year, it is found that the benefits of some expenses have not yet been fully received; a portion of its benefit would be received in the next accounting year. This portion of expenses is carried forward to the next year and is termed as prepaid expenses.

For example, insurance premium paid in the current year maybe for the year ending, the date of which falls in the next year. The part of the insurance premium which relates to the next accounting year is the insurance premium paid in advance or prepaid Insurance.

Adjustment entry for prepaid Insurance Premium-

Prepaid Insurance Premium A/c Dr.

To Insurance Premium A/c

(Adjustment of Insurance premium paid in advance)

Treatment in final Accounts-

Deduct from the concerned expenses on the debit side of Profit & Loss A/c

Show on the assets side of Balance Sheet

Treatment in final Accounts-

If Prepaid Expenses given in trial balance-

Shown on the Assets side of the Balance Sheet.

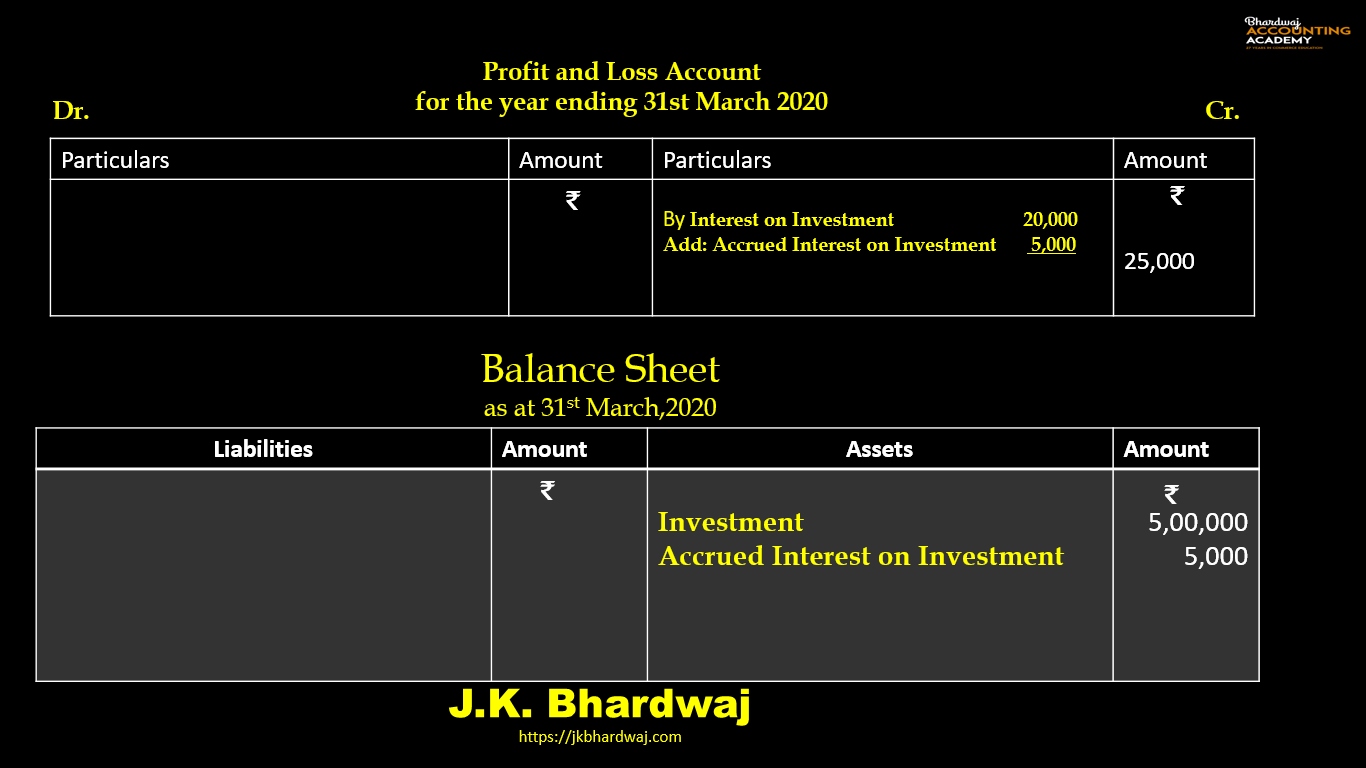

(Due but not received)

Accrued income means income earned but not received till the end of the accounting year. For example, interest on securities or dividends on shares, which has become due but may be received on a date falling in the next year.

Such income does not appear in the trial balance but should be duly accounted for in the year, because such income has accrued.

Or

It may sometime happen that certain items of income such as a interest on fixed deposit, Dividend on shares, etc. are earned during the current accounting year but have not been actually received by the end of the same year. Such incomes are known as accrued income.

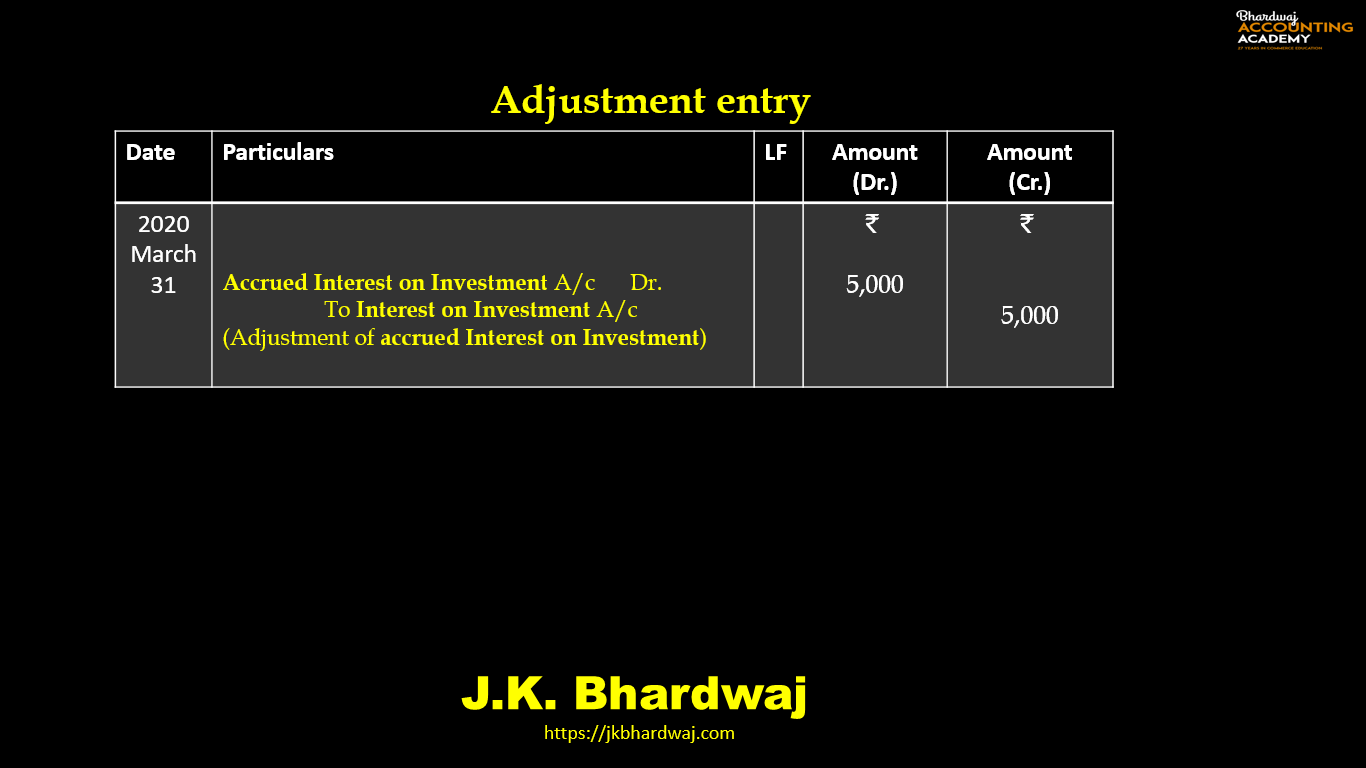

Adjustment entry for accrued Interest on Investment-

Accrued Interest on Investment A/c Dr.

To Interest on Investment A/c

(Adjustment of Accrued Interest on Investment )

Treatment in final Accounts-

Add to the concerned income on Credit side of Profit and Loss A/c

Show on the assets side of Balance Sheet.

Treatment in final Accounts-

If Accrued Income given in trial balance-

Shown on the Assets side of the Balance Sheet.

Also Read: Closing Entries – Meaning, types and examples

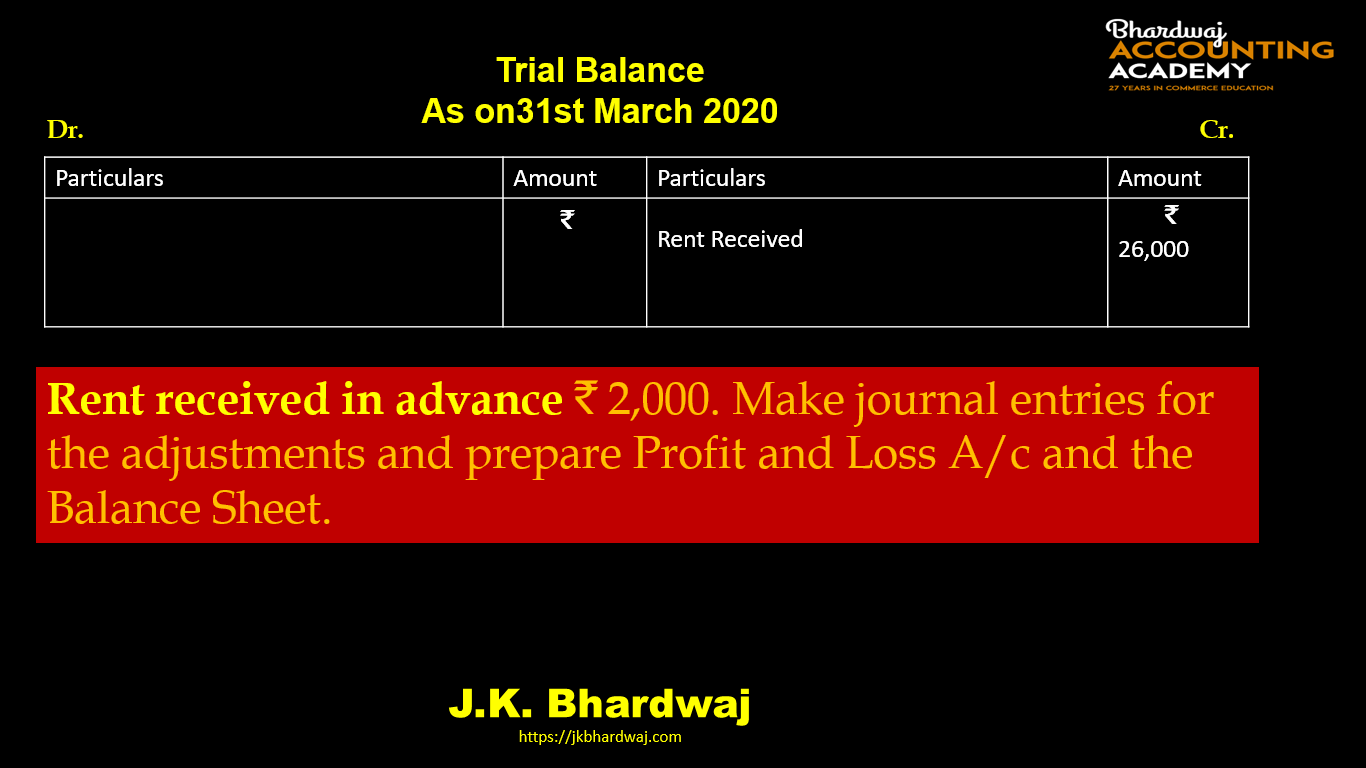

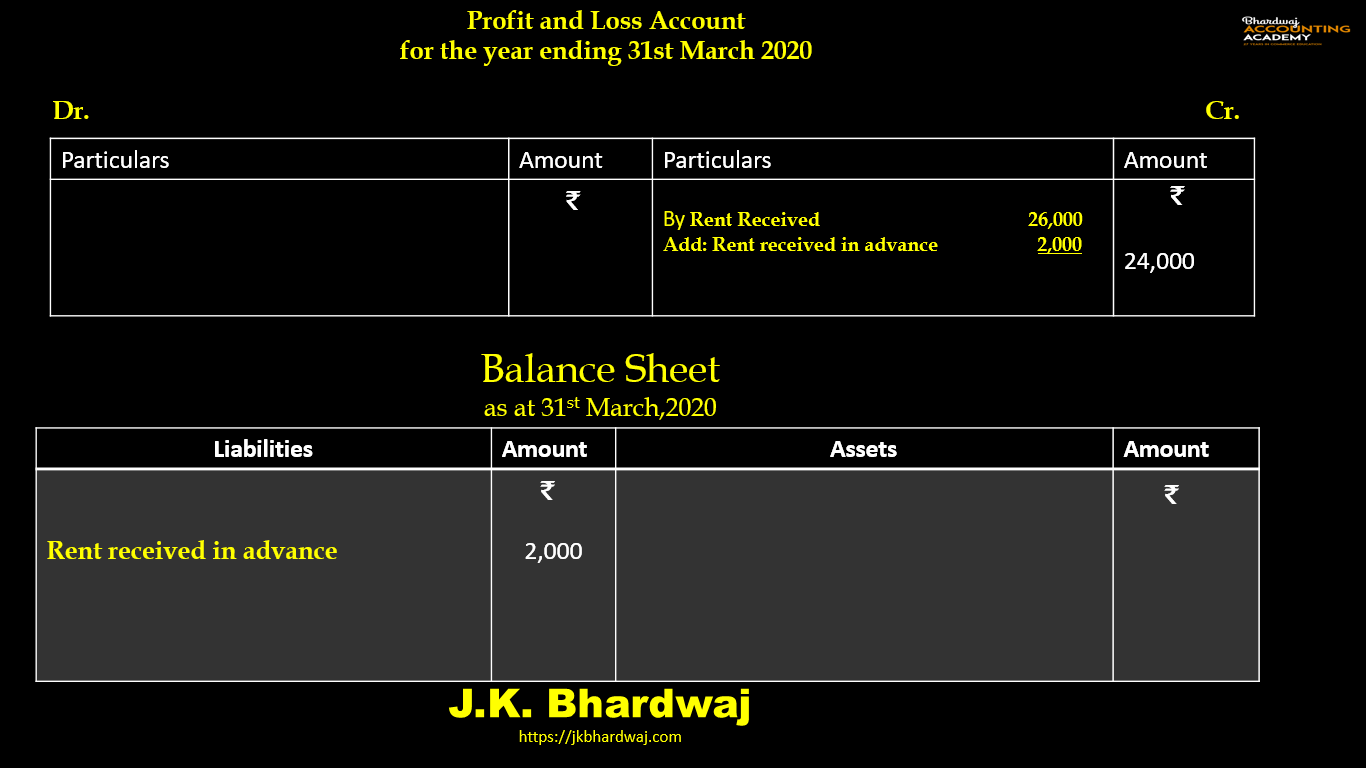

Unearned income/income Received in Advance

Sometimes income is received before it becomes actually due. Such income is called “unearned income” or “income received in advance”. Since this income does not relate to the accounting year, it should be deducted from the relevant head of income in the Profit & Loss A/c. It is a liability and hence is shown in the liability side of the Balance Sheet. Example of such income is rent that has been received for the months of April of the coming accounting year.

Adjustment entry for income Received in Advance

Rent Received A/c Dr

To Rent Received in Advance A/c

(Rent received in advance)

Treatment in final Accounts-

Deduct from the concerned income on the credit side of Profit & Loss A/c.

Show on the liabilities side of Balance Sheet.

Treatment in final Accounts-

If Advance Income given in trial balance-

Shown on the Liabilities side of the Balance Sheet.

Adjustment entries

Adjustment entries

Also Read: Bill of Exchange: Meaning and Types

Adjustment entries

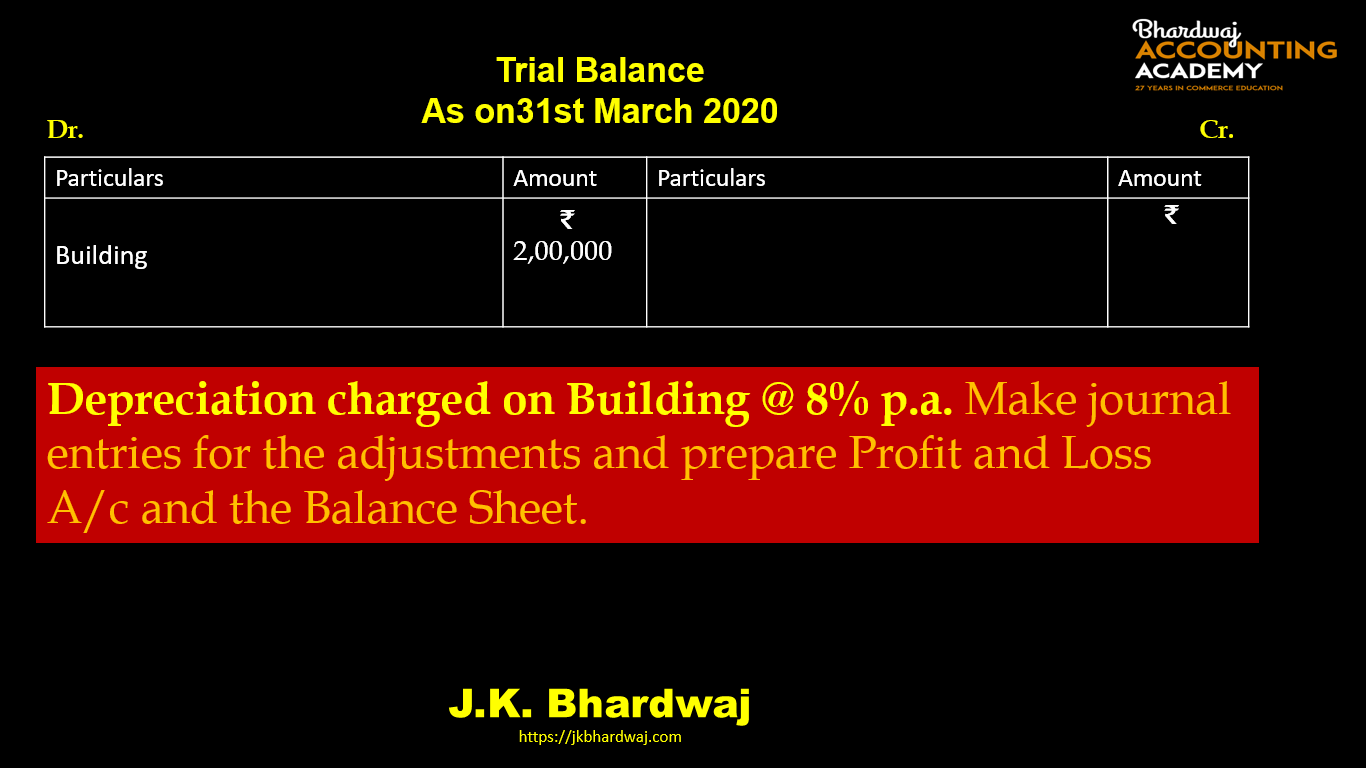

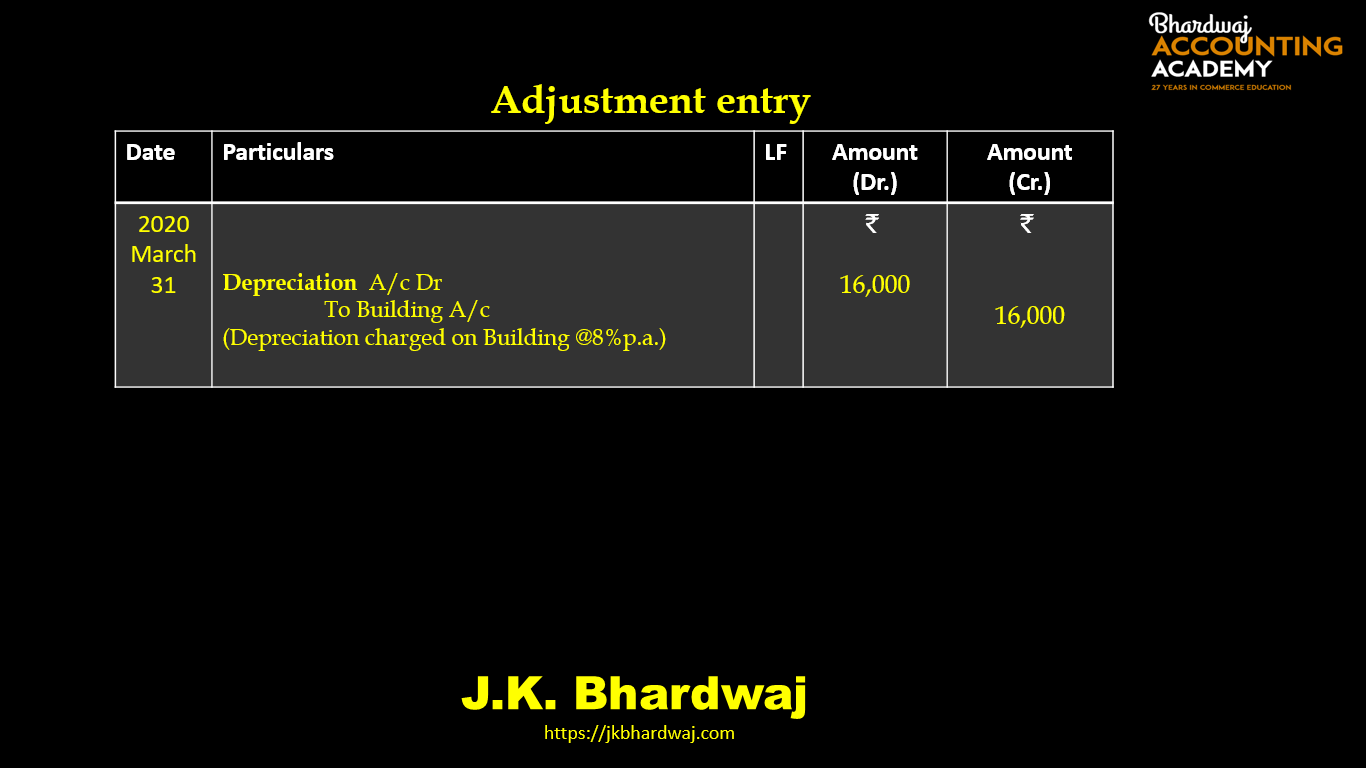

Depreciation

The gradual and permanent decrease in the value of fixed assets due to normal wear and tear; passes of time and expected obsolescence in technology, known as depreciation.

In other words, the process of allocation of the cost of a fixed asset over its useful life is known as depreciation.

Adjustment entry for Depreciation charged on fixed assets

Depreciation A/c Dr

To Assets A/c

(Depreciation charged on assets)

For closing Depreciation account

Profit and Loss A/c Dr

To Depreciation A/c

( Balance of Depreciation transferred to profit and loss A/c)

Treatment in final Accounts

(i)Recorded debit side of Profit & Loss A/c.

(ii)Deduct from the concerned assets on the assets side of Balance Sheet.

If Depreciation given in trial balance-

* Recorded on the debit side of the profit and Loss A/c.

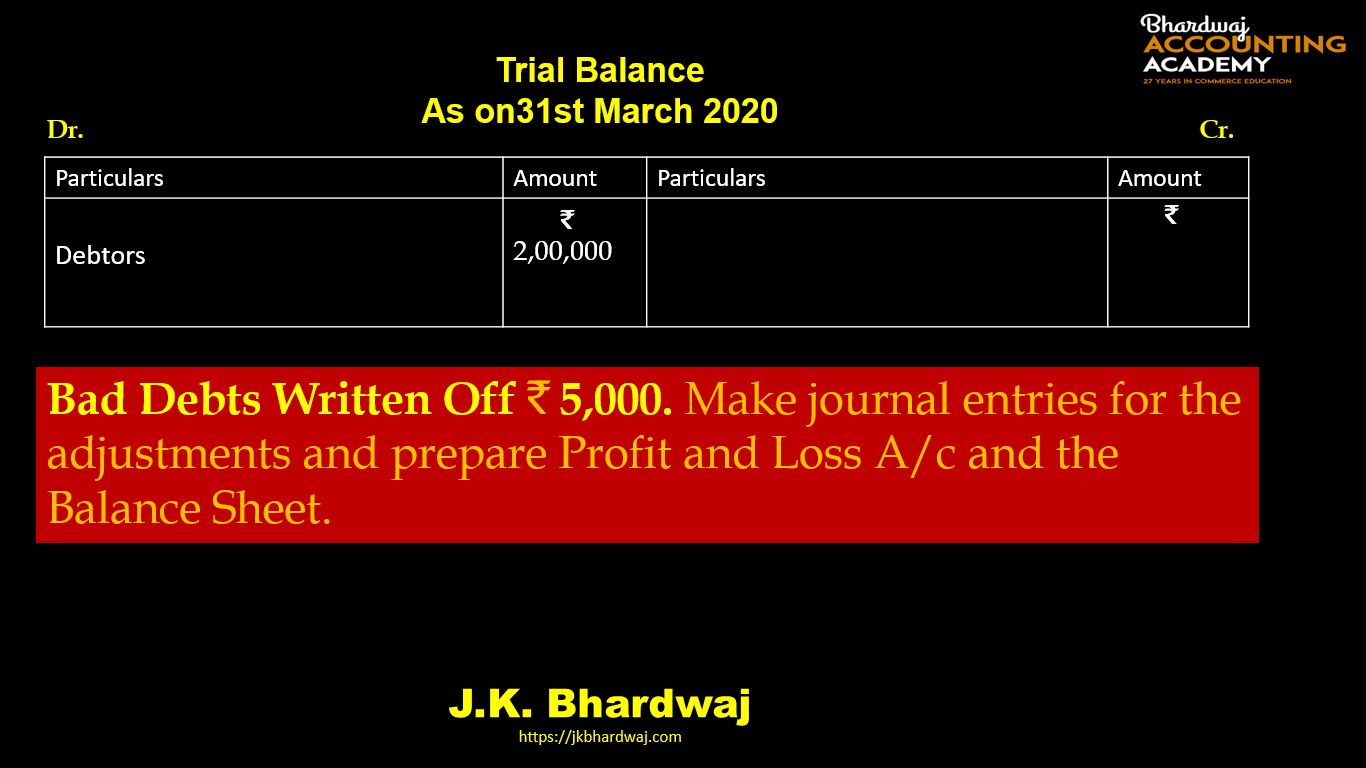

Bad Debts

Bad Debts When the goods are sold on credit basis some of the debtors partly pay the due amount or do not pay at all. If this amount cannot be recovered at the end of the financial year, it is called bad debts.

Bad Debts is a loss to the business enterprise.

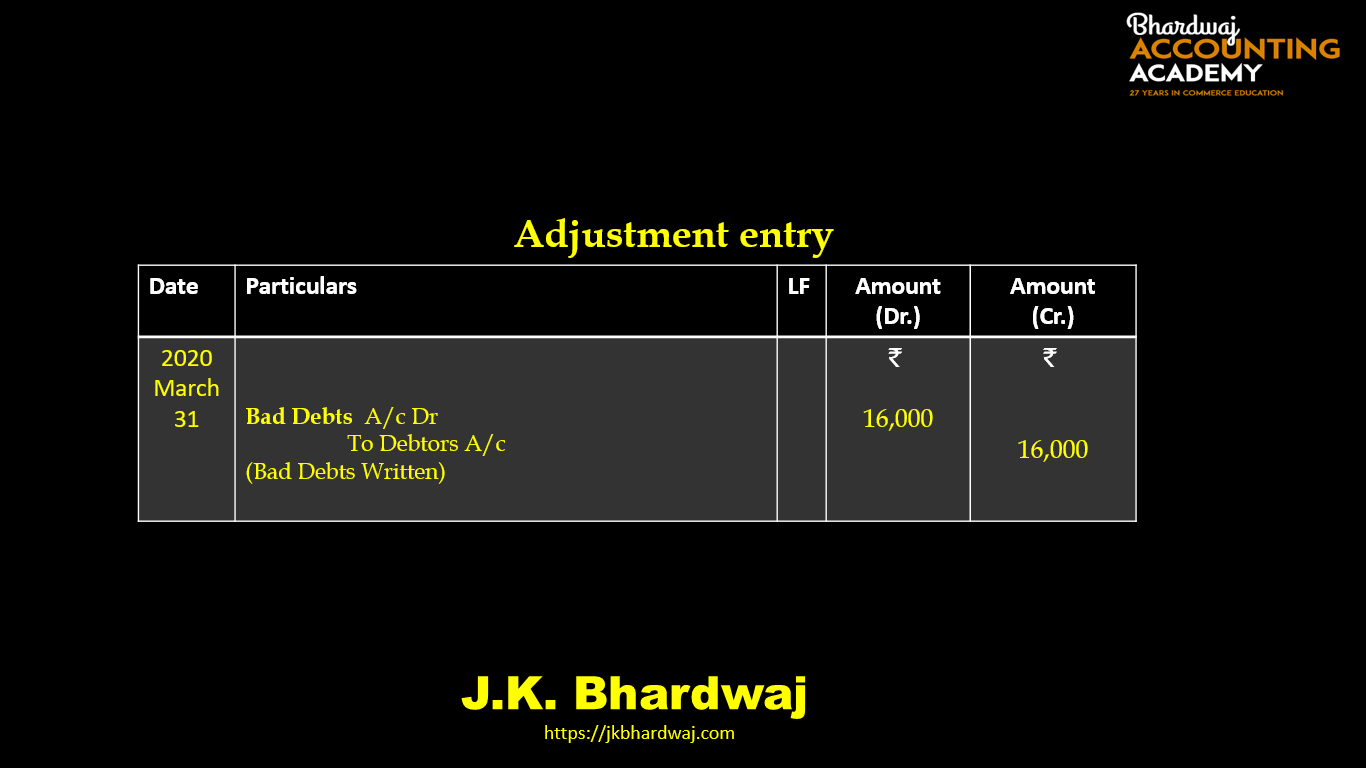

Following adjustment entry is made for Bad Debts Written off :

Bad Debts A/c Dr.

To Debtors A/c

(Bad debts Written off)

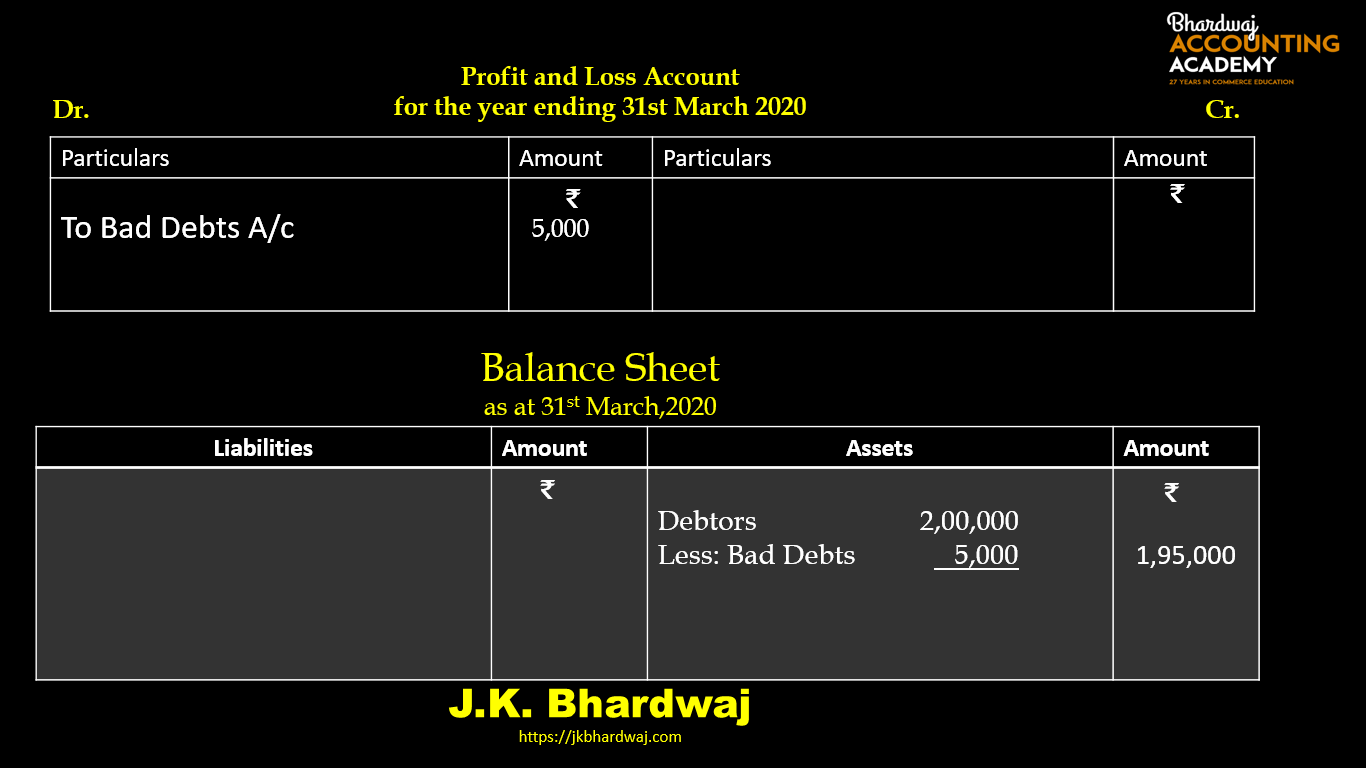

Treatment in final Accounts-

(i)Recorded debit side of Profit & Loss A/c.

(ii)Deduct from the Debtors on the assets side of Balance Sheet.

If Bad debts given in trial balance-

* Recorded on the debit side of the profit and Loss A/c.

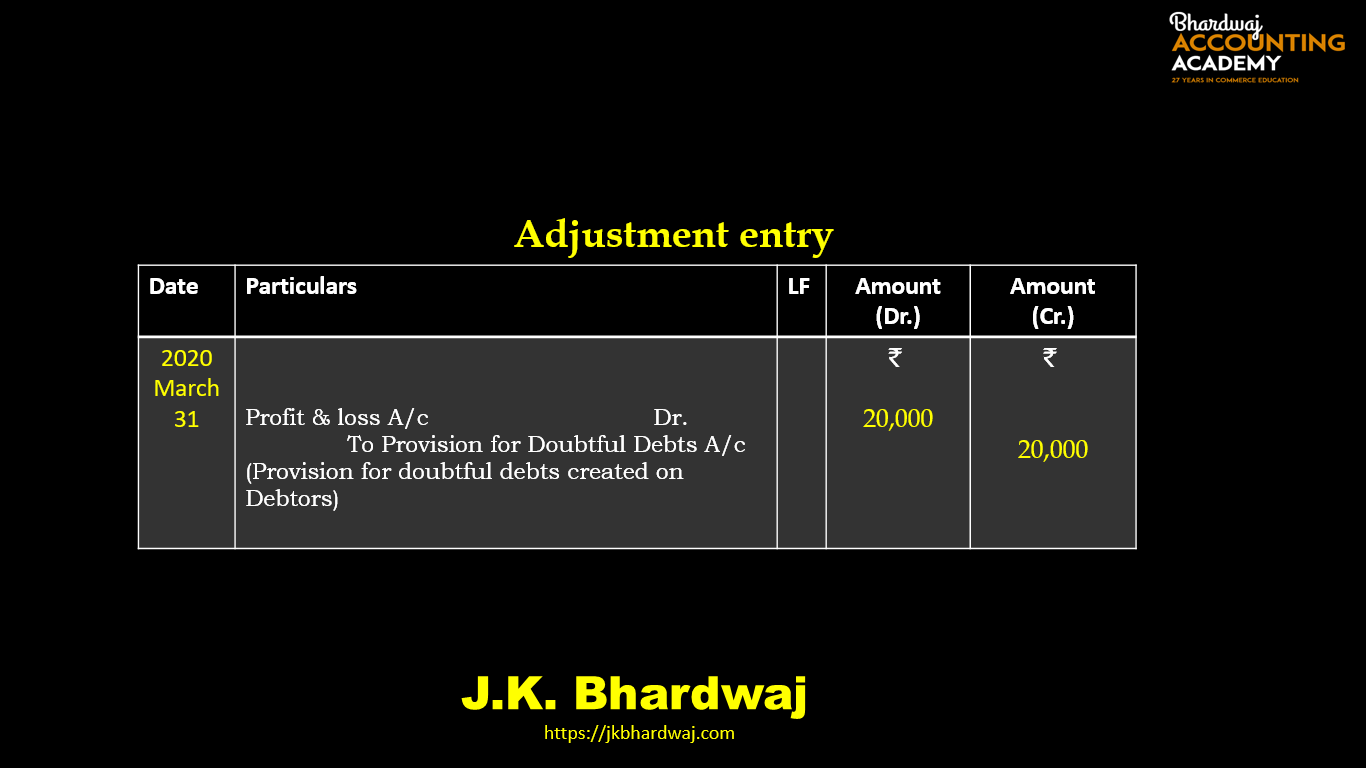

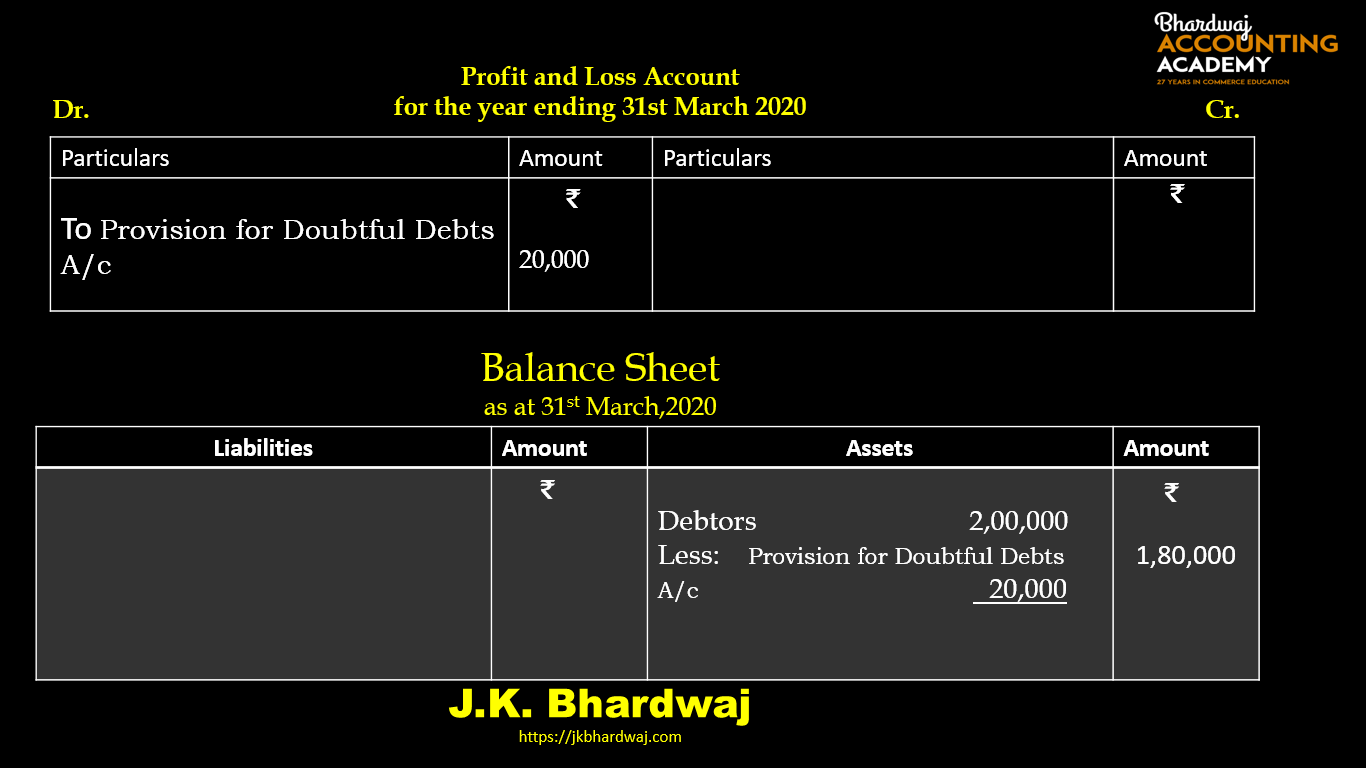

Provision for Doubtful Debts

Provision for bad debts is the estimated percentage of total doubtful debt that needs to be written off during the next year.

Following adjustment entry is made for the Provision for Doubtful Debts :

Profit & loss A/c Dr.

To Provision for Doubtful Debts A/c

(Provision for doubtful debts created on Debtors)

Treatment in final Accounts-

(i)Recorded debit side of Profit & Loss A/c.

(ii)Deduct from the Debtors on the assets side of Balance Sheet.