CBSE 12 Profitability Ratio Questions for Practice

Profitability Ratios: Profitability ratio is used to evaluate the company’s ability to generate income as compared to its expenses and other cost associated with the generation of income during a particular period. These ratios are calculated to analyse the earning capacity of the business which is the outcome of utilisation of resources employed in the business. It also represents how profitable owner’s funds have been utilized in the company.

”Profitability is the ability of a company to use its resources to generate revenues in excess of its expenses. In other words, this is a company’s capability of generating profits from its operations”.

Types of Profitability Ratio

- Gross Profit Ratio

- Net Profit Ratio

- Operating Ratio

- Operating Profit Ratio

- Earning per share

- Price Earning Ratio

- Return on Investment

CBSE12 Profitability Ratio Questions for Practice

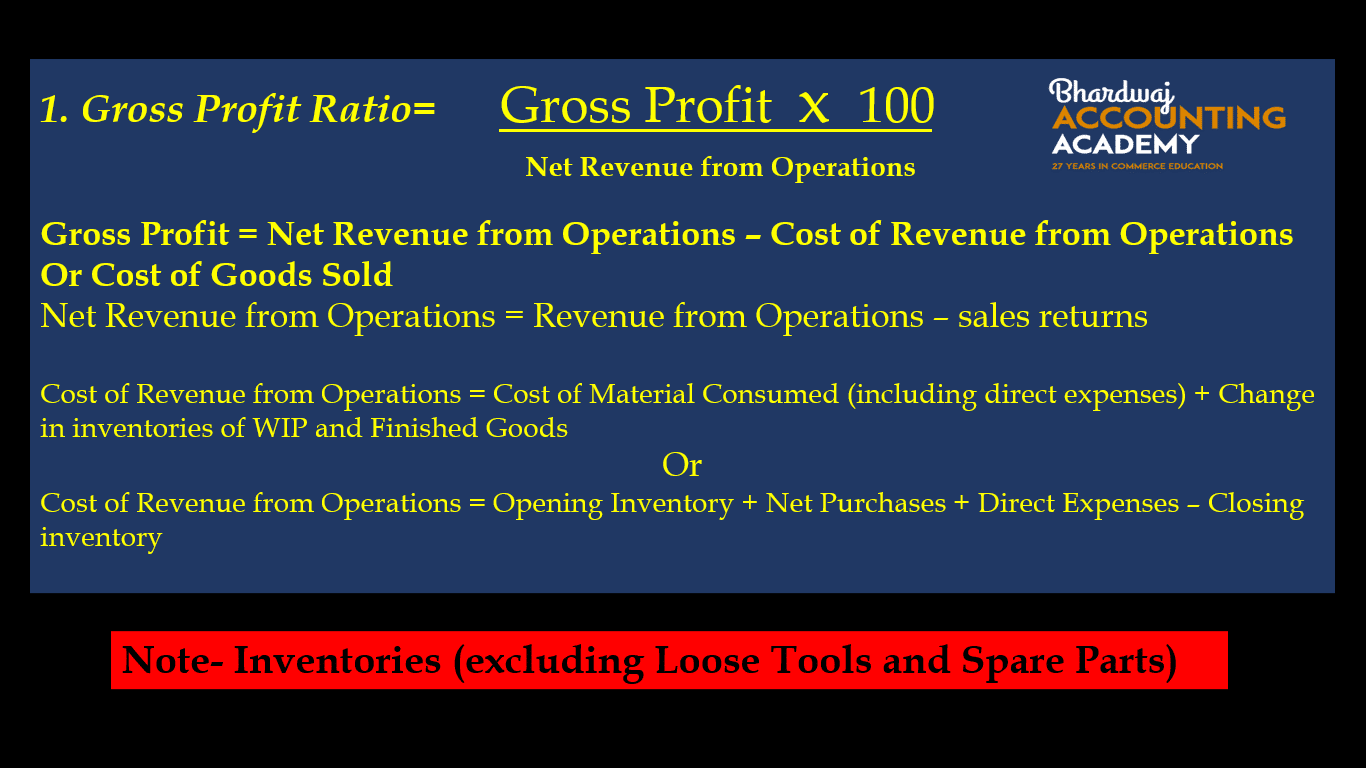

1. Gross profit ratio:

Gross profit ratio establishes the relationship between gross profit and revenue from operations (net sales). This ratio is expressed in percentages. Gross profit ratio shows the margin of profit. A high gross profit ratio is a great satisfaction to the management.

CBSE 12 Profitability Ratio Questions for Practice

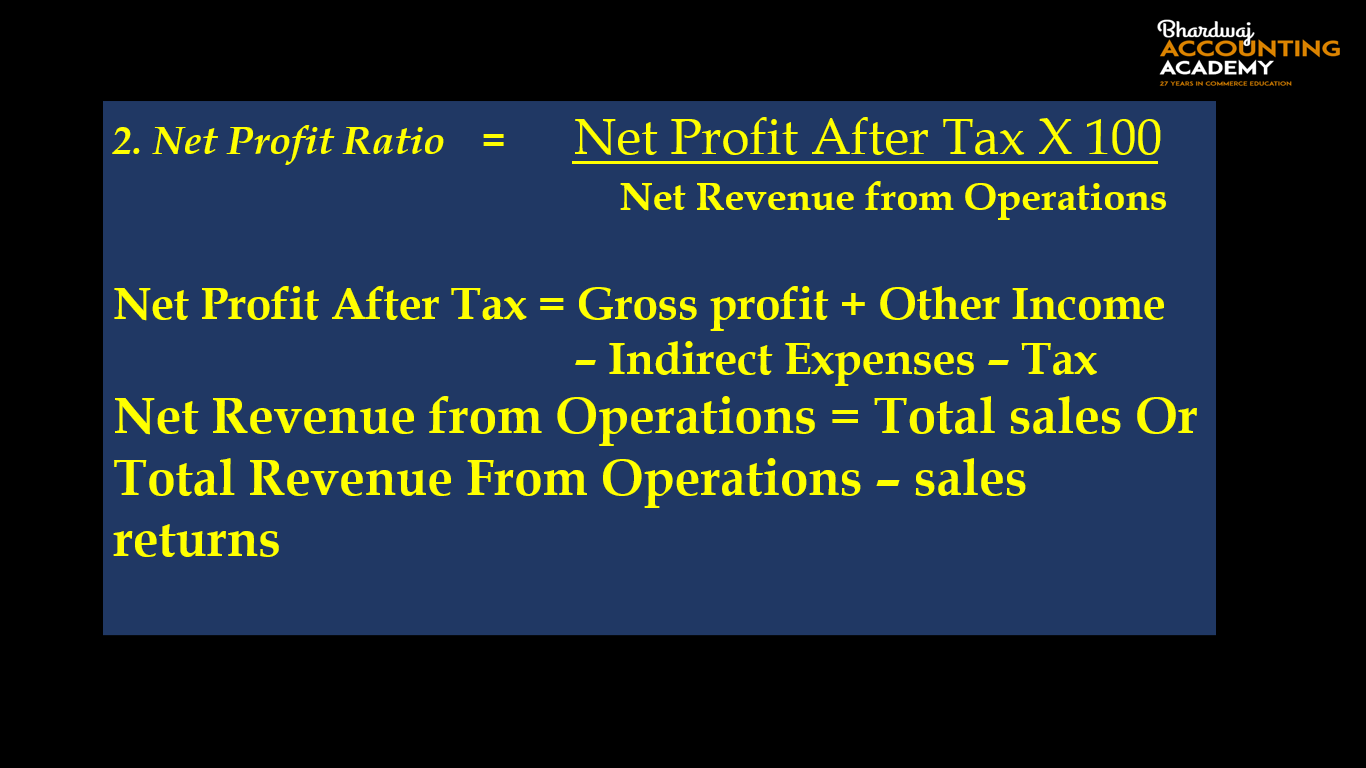

2.Net Profit Ratio-

Net profit ratio establishes the relationship between Net profit and revenue from operations (net sales).This ratio is expressed in percentage. The main objective of calculating this ratio is to determine the overall profitability. Higher the net profit Ratio, better it is for the business.

3. Operating Ratio-

Operating ratio establishes the relationship between (Cost of Revenue from Operations+ Operating Expenses) operating cost and revenue from operations (net sales).

This ratio is expressed in percentages. The main objective of calculating this ratio is to the measurement of the efficiency and profitability of the business enterprise. lower the Operating ratio, better it is for the business because it will leave higher margin of profit on revenue from operations.

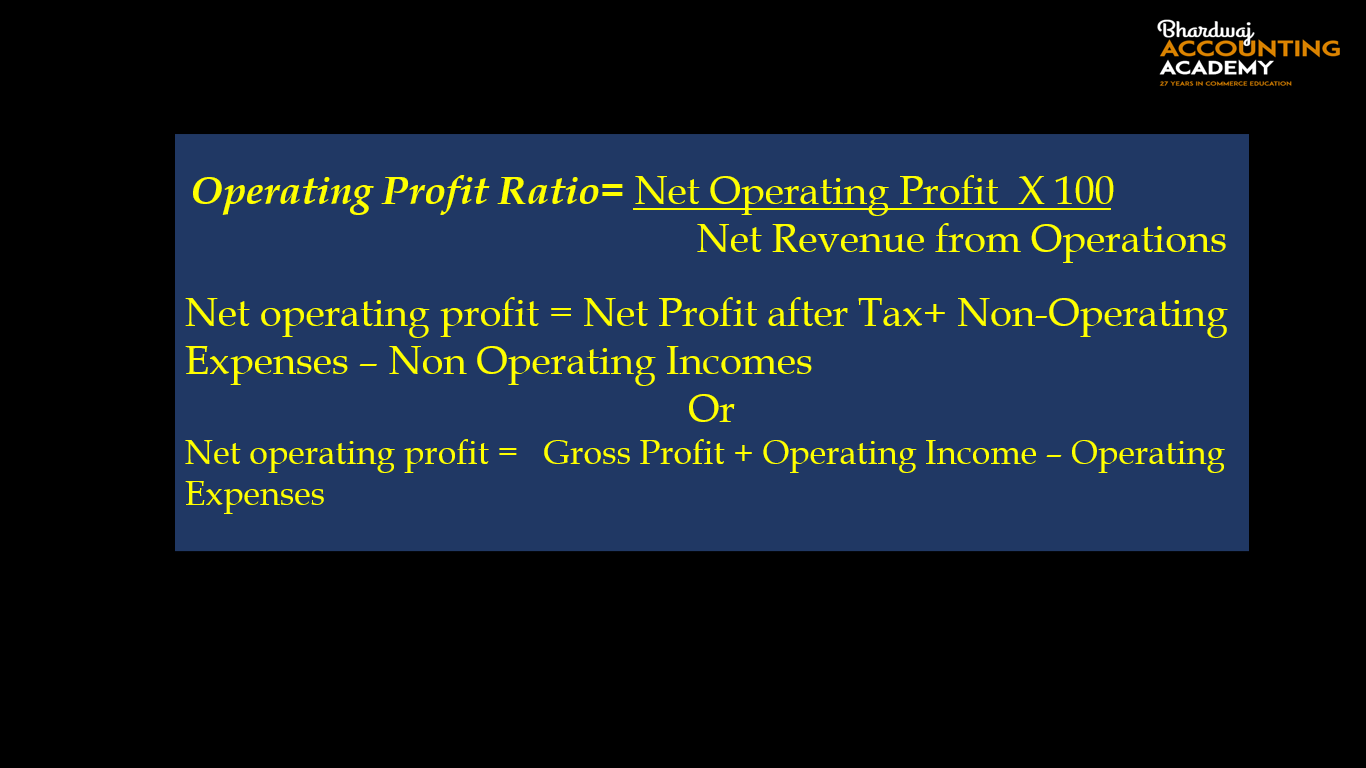

4. Operating Profit Ratio-

Operating Profit Ratio establishes the relationship between Operating Profit and revenue from operations (net sales).

This ratio is expressed in percentages. It helps in examining the overall efficiency of the business. It measures profitability and soundness of the business. The higher the ratio, the better is the profitability of the business.

Non-Operating Expenses = Interest on Debentures / Long Term Loans + Loss on sale of Non-Current Assets.

Non-Operating Incomes = Interest and Dividend Received on Investment + Profit on sale of Non-Current Assets.

Operating Expenses = Employee Benefit Expenses + Depreciation and Amortisation Expenses + Selling and Distribution Expenses+ Office and Administrative Expenses.

Operating Income = Commission received, cash discount received.

NOTE: Operating Ratio and Operating Profit Ratio are interrelated.

The Total Operating Ratio and Operating Profit Ratio will be 100.

If the Operating Ratio is 75 %. It means that the operating profit Ratio is 25%.

If Operating Profit Ratio 20 %. It means that the operating Ratio is 80%.

CBSE 12 Profitability Ratio Questions for Practice

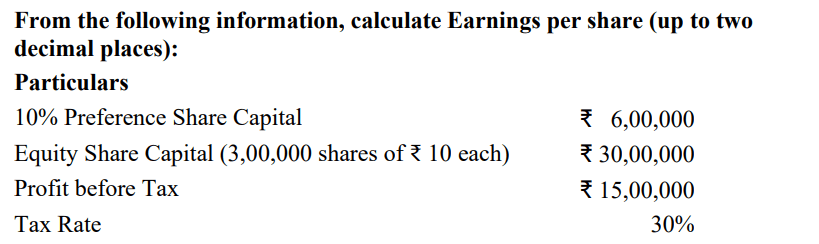

5. Earning per share-

6. Price Earning Ratio-

7. Return on Investment-

Capital employed = Shareholders’ Funds + Non-current Liabilities – Non-trade Investments

OR

Capital employed =Non-current Assets (excluding Non-trade Investments) + Working Capital

OR

Capital employed =Property, Plant & Equipment & Intangible Assets + Trade Investments + Working Capital

Note: Investments to be taken as non-trade investments unless specified as trade investments.

Note: In Return on Investments Ratio- Net Profit before interest and tax will not include interest on non-trade investments.

CBSE 12 Profitability Ratio Questions for Practice

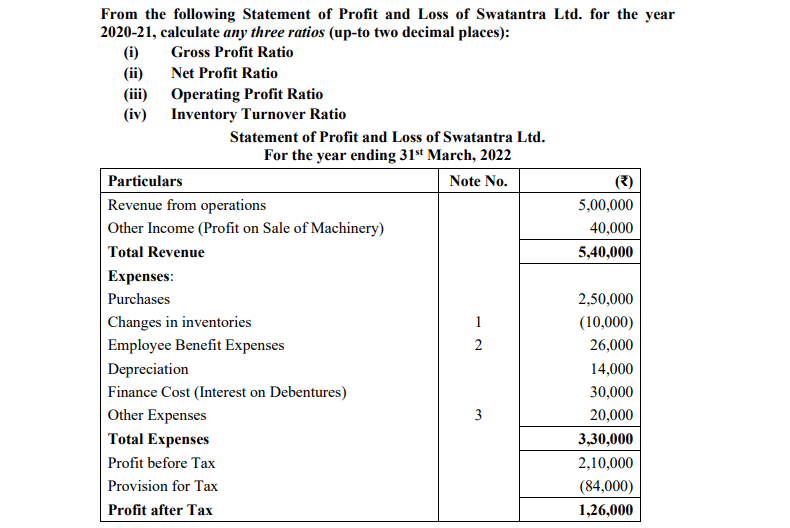

Question No.1

ISC SPECIMEN QUESTION PAPER 2023

CBSE12 Profitability Ratio Questions for Practice

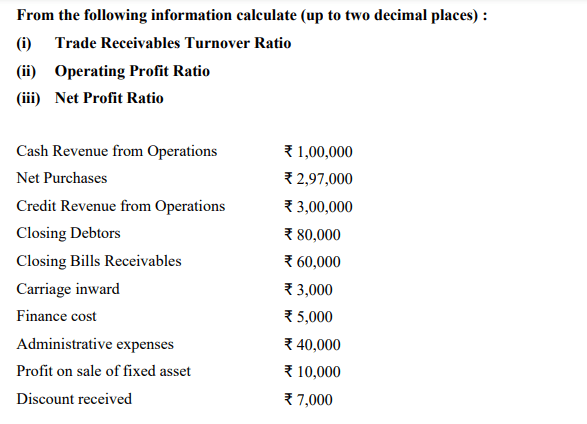

Question No.2

ISC SPECIMEN QUESTION PAPER 2018

Question No.3

CBSE 12 Profitability Ratio Questions for Practice

Question No.4

Calculate the (a) Operating ratio (b) Operating Profit Ratio from the following data :

Revenue from Operations ₹ 4,25,000

sales return ₹ 25,000,

Opening Inventory ₹ 50,000

Closing Inventory ₹ 30,000

Purchase ₹ 3,05,000

Purchase return ₹ 5,000

Direct Expenses ₹ 15,000

Operating Expenses ₹ 35,000

N0n-Operating Expenses ₹ 15,000.

N0n-Operating Income ₹ 10,000.

Question No.5

Calculate Net Profit Ratio from the following data :

Revenue from Operations ₹ 8,00,000

Gross profit Ratio 25%

Operating Ratio 90%

N0n-Operating Expenses ₹ 4,000.

N0n-Operating Income ₹ 44,000.

Important questions of fundamentals of partnership

Question No.6

The following figures have been obtained from the statement of Profit and Loss of Rachit Ltd. for the year 31st March, 2022.

Opening Inventory ₹1,20,000

Revenue from operations ₹8,00,000

Purchases ₹5,50,000

Closing Inventory ₹80,000

Wages ₹10,000

Administrative expenses ₹20,000

Salary and administrative ₹80,000

Interest on investment ₹10,000

Non-operating expenses ₹30,000

Profit on sale of investment ₹20,000

You are required to calculate

(a) Gross profit ratio

(b) Net profit ratio

(c) Operating profit ratio.

CBSE 12 Profitability Ratio Questions for Practice

Question No.7

Net profit after Interest but before tax ₹ 1,40,000

15% Long term debt: ₹ 4,00,000

Shareholders fund: ₹ 2,40,000

Tax rate: 50%, Calculate Return on capital employed.

Question No.8

From the following information, calculate the Gross profit ratio

Information:

Revenue from operations (Net sales) ₹ 4,00,000, opening inventory ₹ 10,000, closing inventory ₹ 3,000 less than the opening inventory, net purchase 80% of revenue from operations, direct expenses ₹ 20,000.

Question No.9

The operating ratio of a company is 80%. State whether the following transactions will increase, decrease or not change the ratio

(i) Purchased goods on credit ₹ 20,000

(ii) Paid wages ₹ 5,000

(iii) Redeemed ₹ 8,000, 9% debentures

(iv) Sold goods ₹ 50,000 for cash.

Question No.10

X Ltd’s profits after interest and tax was ₹ 1,00,000. Its current assets were ₹ 4,00,000 current liabilities ₹ 2,00,000; fixed assets ₹ 6,00,000 and 10% long-term debt ₹ 4,00,000. The rate of tax was 20%. Calculate ‘Return on Investment of X Ltd.

Question No.11

From the following information, calculate operating profit ratio.

Opening stock ₹ 10,000, purchases ₹ 1,20,000, revenue from operations ₹ 4,00,000, purchase returns ₹ 5,000, returns from revenue from operations ₹ 15,000, selling expenses ₹ 70,000, administrative expenses ₹ 40,000, closing stock ₹ 60,000.

Question No.12

From the following information related to Jay Ltd, calculate Return on investment :

Information:

Fixed assets ₹ 75,00,000; current assets ₹ 40,00,000; current liabilities ₹ 27,00,000; 12% debentures ₹ 80,00,000 and net profit before interest, tax and dividend ₹ 14,50,000.

Question No.13

From the following calculate Operating profit ratio:

| Information | Amt (₹) |

| Revenue from Operations | 2,00,000 |

| Gross Profit | 75,000 |

| Office Expenses | 15,000 |

| Selling Expenses | 26,000 |

| Interest on Debentures | 5,000 |

| Accidental Losses | 12,000 |

| Income from Rent | 2,500 |

| Commission Received | 2,000 |

| Current Assets | 60,000 |

| Current Liabilities | 10,000 |

Question No.14

From the following information, calculate operating profit ratio:

Opening stock ₹ 20,000; purchases ₹ 2,20,000; revenue from operations ₹ 5,00,000; purchase returns ₹ 5,000; returns from revenue from operations ₹ 15,000; selling expenses ₹ 60,000; administrative expenses ₹ 50,000; closing stock ₹ 70,000.

Important questions of fundamentals of partnership-2

Important questions of fundamentals of partnership-5

ACCOUNTING TREATMENT OF GOODWILL AT THE TIME OF ADMISSION OF A NEW PARTNER