Table of Contents

Cost Sheet Format

Before discussing the cost sheet format, we need to know about the meaning of cost sheet and the features of cost sheet, its uses and elements of cost and classification of cost-

What is Cost Sheet?

A cost sheet is a statement in which the expenses incurred in the production of a product is shown in such a systematic manner that the total cost of the product and the cost per unit can be ascertained very easily.

In the other words- A cost sheet is a statement that shows the various components of total cost for a product manufactured during a particular period of time. The cost sheet is prepared for a particular period of time monthly, quarterly, yearly etc.

Difinitions of Cost Sheet-

According to CIMA London, “Cost Sheet is ‘A statement which provides for the assembly of the detailed cost of a centre or a cost unit”.

According to Walter W. Bigg, “The expenditure, which has been incurred upon production for a period, is extracted from the financial books and the store records, and out in a memorandum statement. If this statement is confined to the discloser of the cost of the units produced during the period, it is termed cost sheet”.

“Cost sheet is a statement/document which provides for the assembly of the detailed cost of a cost centre or cost unit. Itis a periodical statement of cost designed to show in detail the various components of cost of goods produced like prime cost, factory cost, cost of production, total cost and cost per unit”

Features or Characteristics of Cost Sheet-

1.Cost Sheet is a statement designed to show the output of a particular accounting period along with the breakup of costs (Prime Cost, Manufacturing Cost,Cost of Production, Total Cost, Cost of goods sold, Estimated profit, EstimatedSelling Price).

2.Cost Sheet provides information relating to cost per unit at different stages of the total cost of production.

3.The cost sheet is prepared for a particular period of time monthly, quarterly, yearly etc.

4.The cost sheet shows the various components of total cost for a product.

5. The cost sheet shows the sub-division of cost arrenged in a logical order under different heads.

6. The components of cost can be summarized in the form of a statement, usually referred to as Cost Sheet.

Uses of Cost Sheet-

1. Cost sheet gives total cost and cost per unit for a particular period of time.

2. It gives information to management for cost control.

3. It provides comparative study of actual current costs with the cost of corresponding periods, thus causes of inefficiencies and wastage can be known and suitably corrected by management.

4. Cost sheet acts as a guide to manufacture in formulation of suitable and definite policies and in fixing up the selling price more accurately.

Elements of cost-

For the production of any commodity, we need material, labour and other expenses, these are called elements of cost. There are mainly three elements of cost:-

1.Material

2.Labour

3. Expenditure

1.Material- No product can be made without material. Therefore, material has been considered very important in cost accounts. There are two types of material.

a. Direct Material – Direct material means such material which is used directly for the production of the product and is the main part of the manufactured Product. For example, wood to make a table, jute for making cloth, iron for making machine, Sugarcane etc. are direct ingredients for making sugar.

b.Indirect Material – Indirect material means such material which does not actually become a major part of the manufactured item, but without this material construction work cannot be carried out smoothly. For example, in a factory, the cloth and oil to clean the machines, the thread for sewing the cloth, nails used in shoes,The thread used in binding of books are indirect materials.

2-Labour – The work that is done for the manufacture of goods is called labour, it is of two types.

a.Direct Labour – The labor which is used to change the form or shape or type of material is called direct labour. Its place in the manufactured object is in the same way as that of the direct material. For example, the carpenter’s labor in making the table,the labour of the sugar worker,tailor’s labour, etc.

b.Indirect Labour – The labour of which no part is directly used in the manufacture of the goods. It is called indirect labour.

For example, the labour of the watchman of the factory,inspector’s labor,Supervisor’s labour etc.

3 Expenses- Expenses are divided into two parts like material and labour-

a.Direct Expenses – Under direct expenses, all those expenses which are done in relation to direct material and direct labour, these expenses are directly related to the manufactured goods, such expenses which are related to production. are called direct expenses.

For example, the cost of bringing the material from the place of purchase to the factory,rights fee, Expenditure on research etc.

b.Indirect Expenses – Indirect Expenses are those expenses which are not directly related to the manufactured item but are so necessary but so necessary that without as much as the manufacture of the object is not possible. like-

(i) Factory Expenses/Overheads- All those expenses which are incurred in connection with the manufacture of the article in the factory are called factory expenses.

For example, Factory rent, factory fuel and power, factory lighting, factory insurance, plant and machine depreciation, factory building repair, factory building wear, factory stationery, factory manager’s salary, unproductive wages , factory related fees of haulage (pulling) operators etc.

(ii) Office Expenses / Overheads – Such expenses which are incurred in making the item salable and in the management of the factory are called office overheads.

For example, salaries of office workers, operators’ fees, office rent, office insurance, office stationery, and printing, depreciation on office building, telephone expenses, bank expenses, legal expenses, miscellaneous expenses, keeping the office cool in summer. Expenditure of office, keeping the office warm in winter, repair of office building, other office related expenses.

(iii) Selling Expenses / Overheads – Those expenses which are incurred in selling the article are called selling expenses. For example, commission of sales agent, advertising expenses, bad debts, expenses incurred on samples, discounts allowed to customers, depreciation on furniture installed in the shop, other sales expenses.

(iv).Distribution Expenses/overheads- The expenses incurred to deliver the goods to the customers for sale are called distribution expenses.Such as train freight for delivering goods to the customers, remuneration of the driver of the vehicles to reach the customers, repair expenses of the vehicles, petrol charges for the vehicles etc.

Classification of cost-

Prime cost – The sum of direct materials, direct labor and direct expenses is called prime cost. Therefore, we can say that the direct material and direct labor used in the manufacture of an product, if direct expenses are added to it, then the cost thus incurred will be called the original cost, it is called Direct Cost / Flat Cost. Also called / First Cost/Prime Cost.

Prime cost= Direct Material+Direct Labour+Direct Expenses

Factory cost – The cost incurred by adding factory expenses to the original cost is called factory cost, it is also called work cost / manufacturing cost.

Factory cost= prime cost+Factory overheads

Office cost –summates office and administration overheads and factory cost. This is also termed as administration cost or the total cost of production After adding the office expenses to the factory cost.

Office cost= Factory cost+office and administration overheads

Total Cost- Total Cost or cost of sales is the sum total of selling and distribution overheads and the total cost of production.

Total cost= Office cost+Selling and distribution overheads

Treatment of stock-

Stock requires special treatment while preparing a cost sheet. Stock may be of raw materials, work-inprogress and finished goods…..

Stock of Raw Materials-

If opening stock of raw material, purchase of raw materials and closing stock of raw materials are given,

then, raw material consumed can be calculated as follows:

Calculation of raw material consumed-

Opening stock of raw materials ………….

Add: Purchase of raw materials …………

Less: Closing stock of raw materials ……..

Value of raw materials consumed ………..

Stock of Work-in-Progress-

Work-in-progress is valued at prime cost or works cost basis, but latter is preferred. If it is valued at works or

factory cost then opening and closing stock will be adjusted as follows :

Prime cost ……………..

Add: Factory overheads …………..

Stock of Work-in-progress (beginning) …………..

Less: Stock ofWork-in-progress (Closing) ………….

Works cost ………….

Stock of Finished Goods-

If opening and closing stock of finished goods are given, then these must be adjusted before calculating cost

of goods sold:

Cost of production ………….

Add: Opening stock of finished goods ………….

Less: Closing stock of finished goods ………….

Cost of goods sold ……………….

The following items are of financial nature and thus not included while preparing a cost sheet-

(i) Cash discount

(ii) Interest paid

(iii) Preliminary expenses written off

(iv) Goodwill written off

(v) Provision for taxation

(vi) Provision for bad debts

(vii) Transfer to reserves

(viii) Donations

(ix) Income tax paid

(x) Dividend paid

(xi) Profit/loss on sale of assets

(xii) Damages payable at law etc.

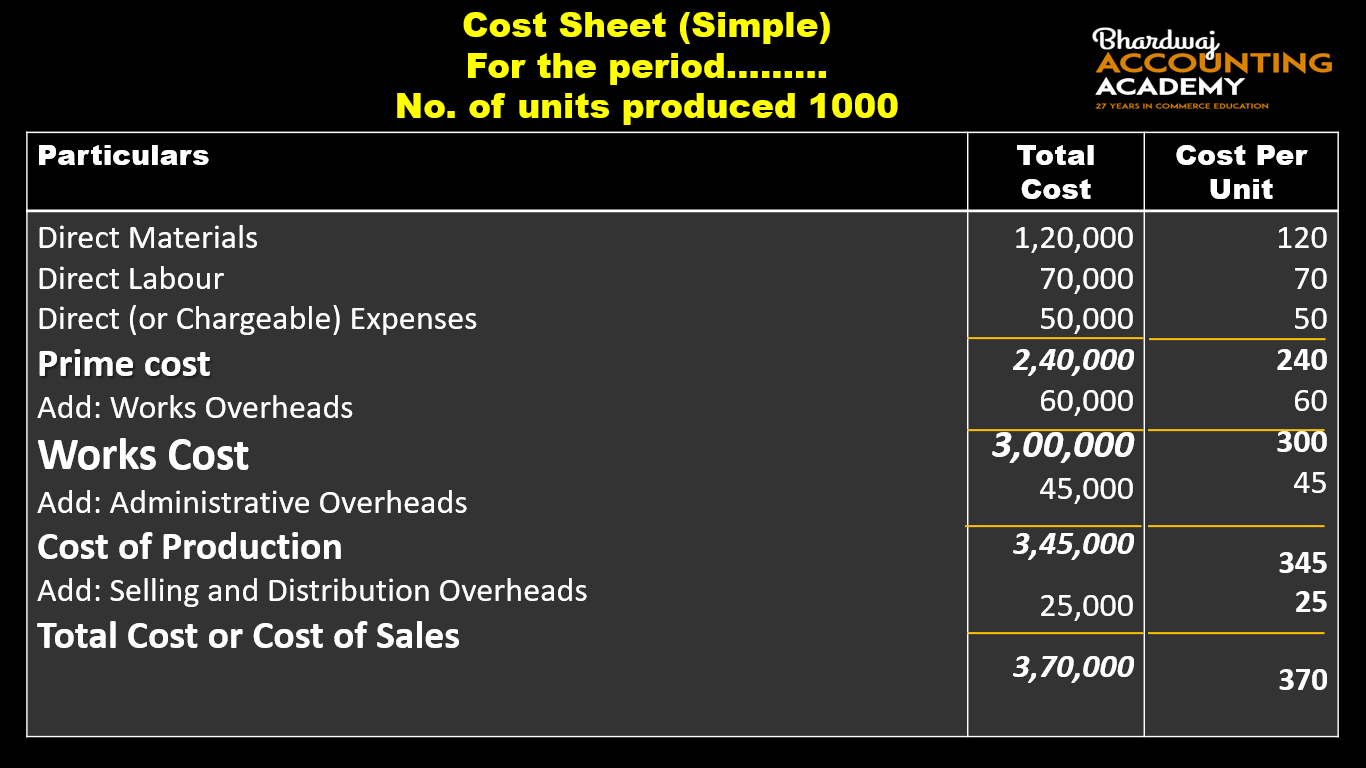

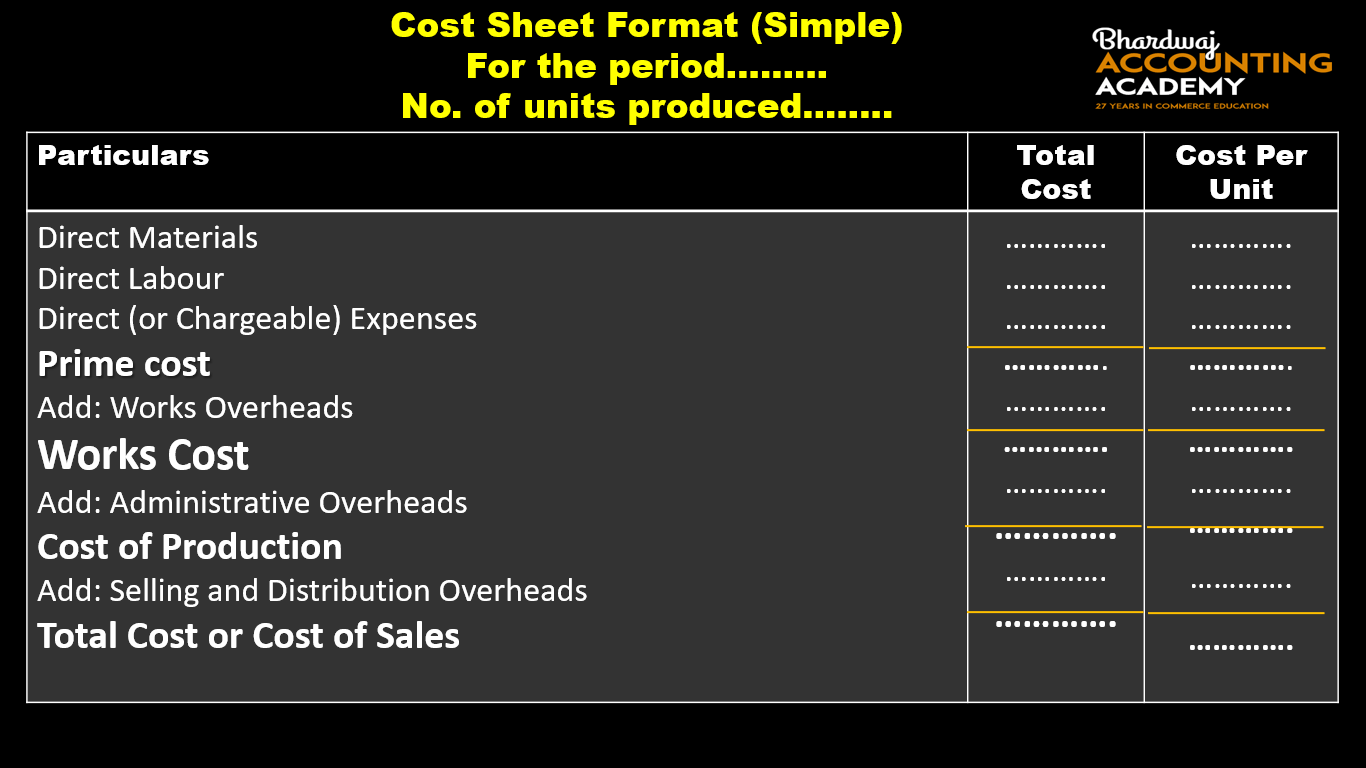

Cost Sheet Format (Simple)-

Cost Sheet Format (Simple)-

Example-

Prepare cost sheet from the following particulars:

Unit Produced = 1000

Direct Material = Rs. 1,20,000

Wages paid to laborers = Rs. 70,000

Directly chargeable expenses = Rs. 50,000

Factory on cost = Rs. 60,000

General and administrative expenses = Rs.45,000

Selling and distribution expenses = Rs. 25,000

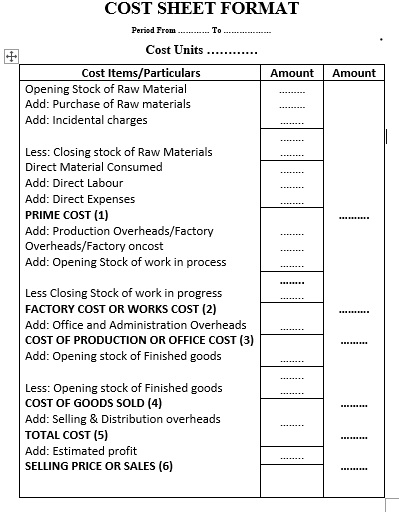

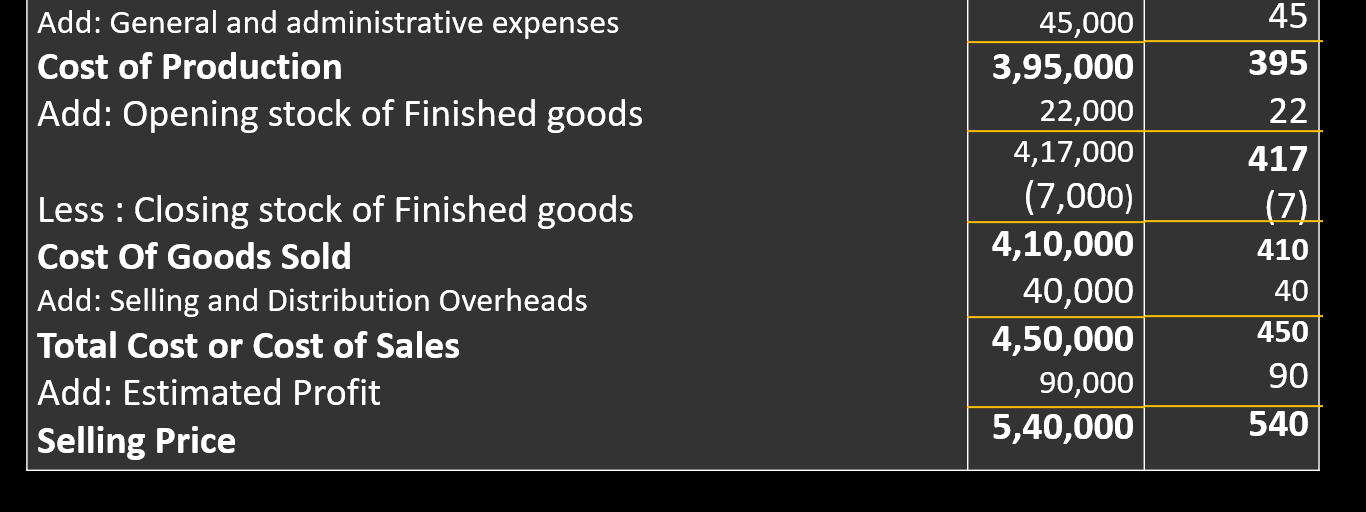

Cost Sheet Format(With Treatment of stock)-

Cost Sheet Format(With Treatment of stock)-

Example-

Unit Produced = 1000

Raw Material Purchased = Rs. 1,20,000

Opening stock of raw material =Rs. 50,000

Closing stock of raw material = Rs. 20,000

Opening stock of Work-In-Progress =Rs. 35,000

Closing stock of Work-In-Progress = Rs. 15,000

Opening stock of Finished goods =Rs. 22,000

Closing stock of Finished goods = Rs. 7,000

Direct Labour= Rs. 70,000

Directly chargeable expenses = Rs. 50,000

Works Overheads = Rs. 60,000

General and administrative expenses = Rs. 45,000

Selling and distribution expenses = Rs. 40,000

Estimated profit 20% on cost.

Also read : लागत के तत्व- Elements of Cost-लागत का वर्गीकरण -Classification of cost