Table of Contents

Depreciation journal Entry

1.Depreciation journal Entry when depreciation is charged to asset account:

(1) When depreciation is charged to asset account or credited to the assets account:

Under this method depreciation charged directly to assets account.

The value of the asset is reduced by the amount of depreciation and the balance of the asset account is termed as Book Value’ of the asset.

In the Balance Sheet, asset is shown at its book value, i.e., Cost less Depreciation provided till date.

Depreciation Account is closed by transferring its balance to the Debit side of Profit and Loss Account.

Depreciation journal Entry-

Journal entries for recording under this method are as follows-

(a) For purchase of fixed asset-

When assets is purchased For cash-

Asset A/c Dr.

To CashA/c

(Being Assets purchased for cash)

When assets is purchased By cheque-

Asset A/c Dr.

To BankA/c

(Being Assets purchased and amount paid by cheque)

When assets is purchased on credit

Asset A/c Dr.

To vendor A/c

(Being Assets purchased on credit)

(b) Following entries are recorded at the end of each year-

(i) For depreciation charged on assets-

Depreciation A/c Dr.(Annual Depreciation)

To Asset A/c

( Being Depreciation charged on assets)

(ii) For Depreciation transferred to Profit and loss A/c Or Statement of Profit and loss-

Profit and loss A/c Dr.

Or

Statement of Profit and loss Dr. (In case Of Company)

To Depreciation A/c

(Being Depreciation transferred to profit &Loss account /Statement of Profit and loss)

(c)For sale of an asset-

Cash/Bank/ vendor A/c A/c Dr.

To Asset A/c

(Being Assets sold)

(D)For loss on sale of assets transferred to Profit and loss A/c Or Statement of Profit and loss –

Profit and loss A/c Dr.

Or

Statement of Profit and loss Dr. (In case Of Company)

To Assets A/c

(Being loss on sale of assets transferred to profit &Loss account /Statement of Profit and loss))

(E)For Profit on sale of assets transferred to Profit and loss A/c Or Statement of Profit and loss –

Assets A/c Dr.

To Profit and loss A/c

Or

To Statement of Profit and loss(In case Of Company)

(Being Profit on sale of assets transferredto profit &Loss account /Statement of Profit and loss)

According to this method the following accounts are opened in the books of account-

- Assets Account

- Depreciation Account

- Profit and Loss Account

Example-

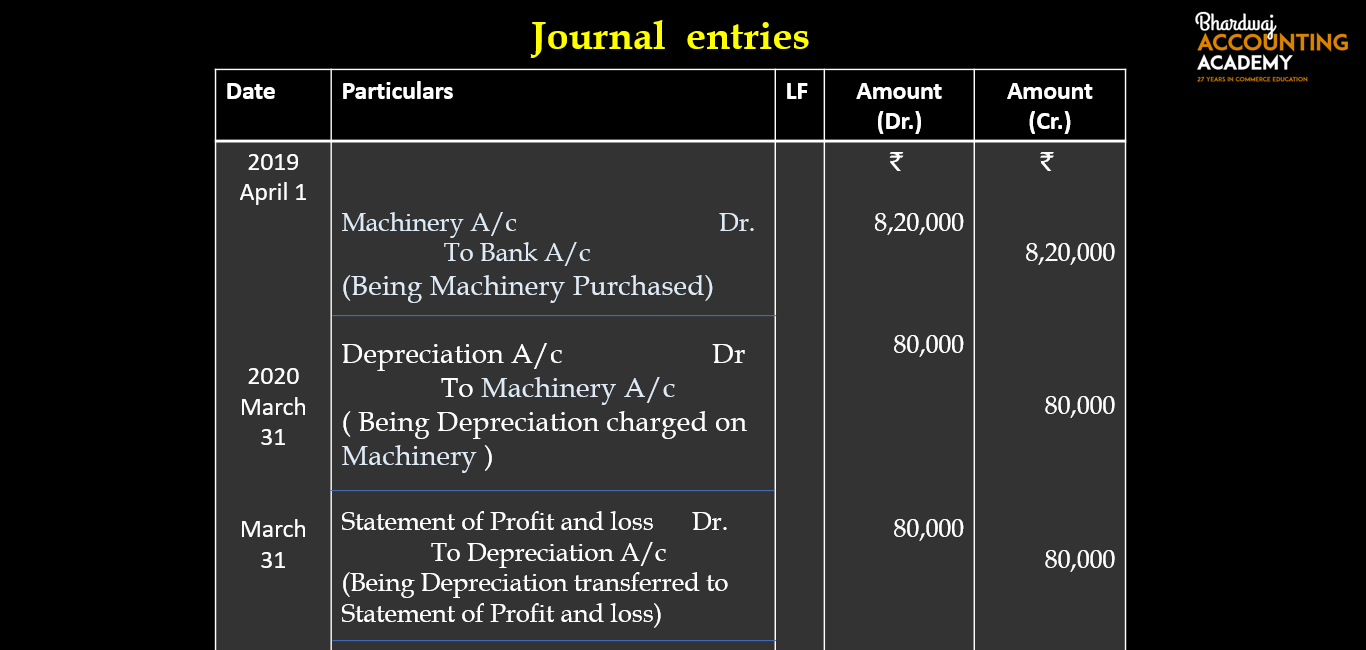

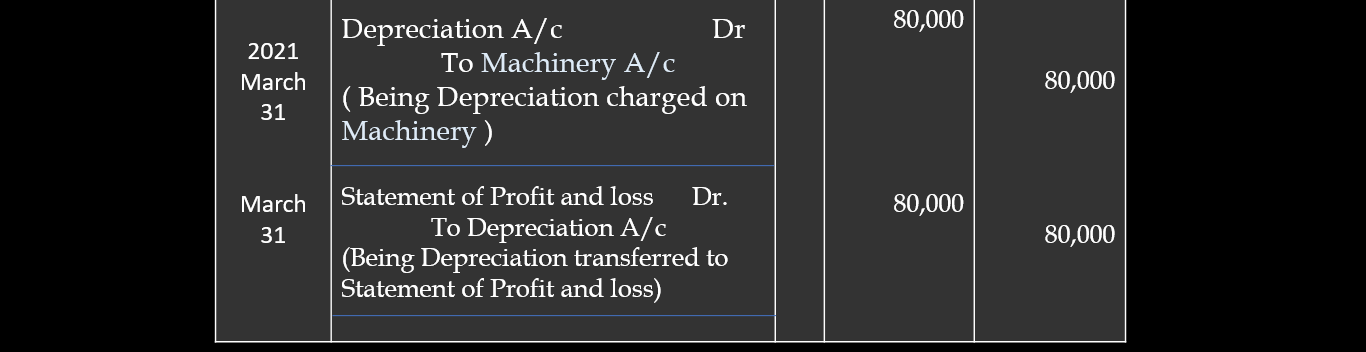

X company limited purchased a machinery on April 1, 2019 for 8,20,000 whose life was expected to be 10 years. Its estimated scrap value at the end of 10 years was 20,000. Depreciation charged by fixed instalment method.Find the amount of depreciation to be charged to statement of Profit and Loss every year. Pass journal entry in the books of X company limited for two year . When depreciation is charged to asset account

Solution:

Calculation of Annual Depreciation-

Annual Depreciation = Cost of Machinery – Estimated Scrap Value/Expected Life of the Machinery

Annual Depreciation = 8,20,000-20000/10

Annual Depreciation = 80,000

Depreciation journal Entry when depreciation is charged to asset account-

2.Depreciation journal Entry when Depreciation is credited to Provision for depreciation Account/Accumulated Depreciation Account:

(2) When depreciation is credited to Provision for depreciation Account/Accumulated Depreciation Account-

Under this method, Depreciation is credited to ‘Provision for Depreciation Account’ instead of Asset Account.

Provision for Depreciation Account is also known as ‘Accumulated Depreciation Account’ or ‘Depreciation Fund Account’.

The balance on the credit side of Provision for Depreciation Account shows the total amount of depreciation accumulated to date.

Under this method, In the Balance Sheet, the asset will continue to appear at the original cost, with Provision for Depreciation as a deduction in the inner column and final amount in the outer column.

Or

Under this method, In the Balance Sheet, the asset may be shown the original cost on the Assets Side and Provision for Depreciation may be shown on the liabilities side of the balance sheet.

Depreciation journal Entry-

Journal entries for recording under this method are as follows-

(a) For purchase of fixed asset-

When assets is purchased For cash-

Asset A/c Dr.

To CashA/c

(Being Assets purchased for cash)

When assets is purchased By cheque-

Asset A/c Dr.

To BankA/c

(Being Assets purchased and amount paid by cheque)

When assets is purchased on credit

Asset A/c Dr.

To vendor A/c

(Being Assets purchased on credit)

(b) Following entries are recorded at the end of each year-

(i) For Charging depreciation –

Depreciation A/c Dr.(Annual Depreciation)

To Provision for Depreciation A/c

( Being Depreciation charged on assets)

(ii) For Depreciation transferred to Profit and loss A/c Or Statement of Profit and loss-

Profit and loss A/c Dr.

Or

Statement of Profit and loss Dr. (In case Of Company)

To Depreciation A/c

(BeingDepreciation transferred to profit &Loss account /Statement of Profit and loss)

(c)For sale of an asset-

Cash/Bank/ vendor A/c A/c Dr.

To Asset A/c

(Being Assets sold)

(d)When assets is sold than the total Accumulated Depreciation for that assets transferred to the credit side of the Assets account-

Provision for Depreciation A/c Dr.

To Asset A/c

(Being Accumulated Depreciation for that assets transferred to the credit side of the Assets account)

(D)For loss on sale of assets transferred to Profit and loss A/c Or Statement of Profit and loss –

Profit and loss A/c Dr.

Or

Statement of Profit and loss Dr. (In case Of Company)

To Assets A/c

(Being loss on sale of assets transferred to profit &Loss account /Statement of Profit and loss))

(E)For Profit on sale of assets transferred to Profit and loss A/c Or Statement of Profit and loss –

Assets A/c Dr.

To Profit and loss A/c

Or

To Statement of Profit and loss (In case Of Company)

(Being Profit on sale of assets transferredto profit &Loss account /Statement of Profit and loss)

According to this method the following accounts are opened in the books of account-

- Assets Account

- Depreciation Account

- Provision for Depreciation Account

- Profit and Loss Account

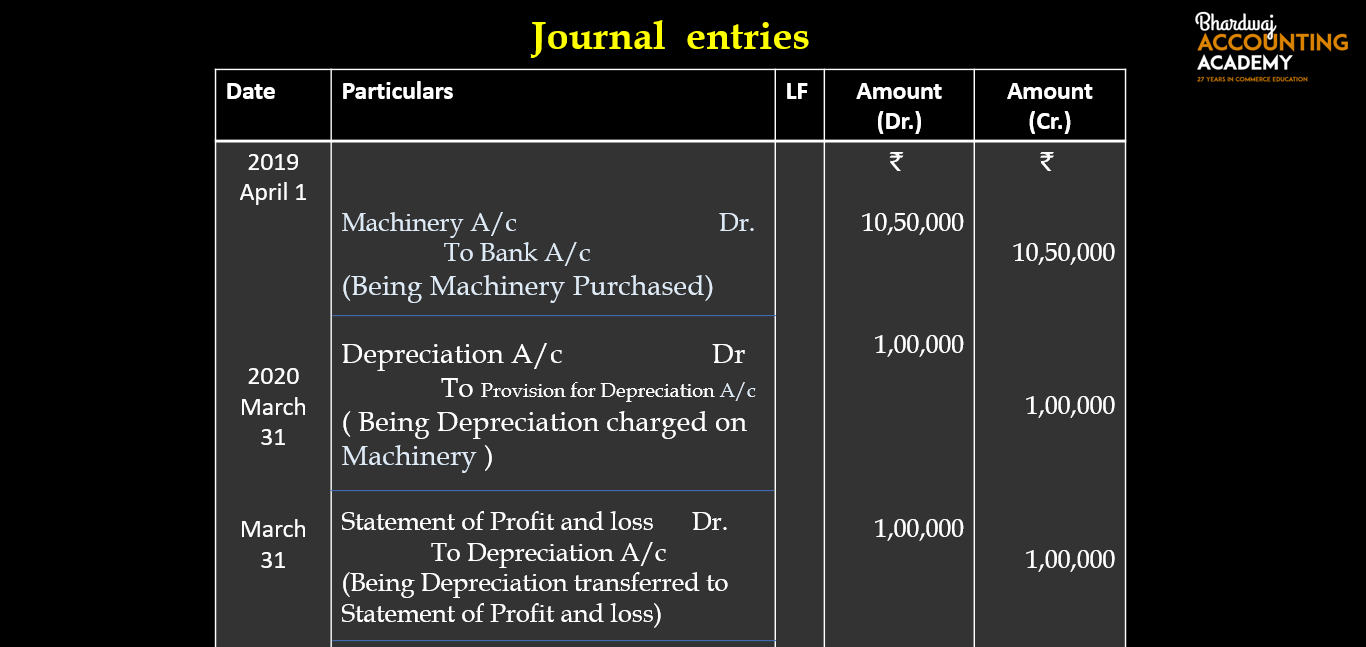

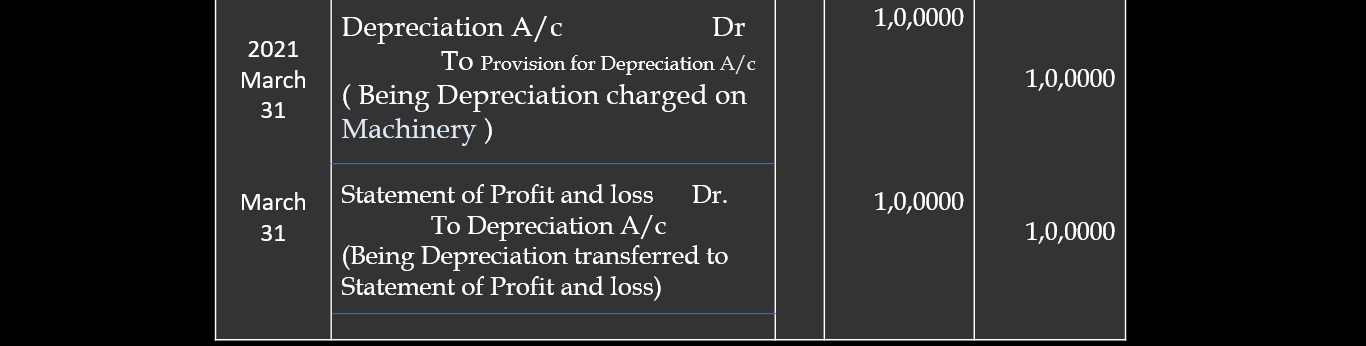

Example-

X company limited purchased a machinery on April 1, 2019 for 10,50,000 whose life was expected to be 10 years. Its estimated scrap value at the end of 10 years was 50,000. Depreciation charged by fixed instalment method.Find the amount of depreciation to be charged to statement of Profit and Loss every year. Pass journal entry in the books of X company limited for two year . When Depreciation is credited to Provision for depreciation Account.

Solution:

Calculation of Annual Depreciation-

Annual Depreciation = Cost of Machinery – Estimated Scrap Value/Expected Life of the Machinery

Annual Depreciation = 10,50,000-50000/10

Annual Depreciation = 1,00,000