Table of Contents

Income and Expenditure Account

What is Income and Expenditure Account?

Income and Expenditure Account is a nominal account which is prepared by a Not-for-profit organization. Income and Expenditure Account serves the same purpose for a Not-for-profit organization as the Profit and Loss Account for a business enterprise.

In this account revenue expenditure and revenue income of the year for which Income and Expenditure A/c is prepared are taken. Revenue income recorded credit side and revenue expenditure recorded debit side of this account. If the income side of this account exceeds the expenditure side, the difference is ‘surplus’. In case the expenditure side exceeds the income side, the difference is ‘deficit’.

It is also based on the accrual concept of accounting according which every transaction belonging to the current year should be recorded in the books in the current financial year whether payment made or not and Income received or not.

Definition of Income and Expenditure Account

According to J.R.Batliboi, “This is a revenue account prepared by non-trading concerns, such as educational institutions, hospitals, etc., and includes all income earned during a given period”.

Features of Income and Expenditure Account

1. It is a nominal account.

2. Income and Expenditure Account is a Revenue Account and also Expense Account

3. It includes only revenue items. It does not include capital expenditure and capital receipts.

4. It records incomes, expenses, and losses according to the accrual basis of accounting.

5. The Credit balance of this account is called “Excess of Income over Expenditure’(surplus).

6. The Debit balance of this is called “ Excess of Expenditure over Income”.(Deficit).

7. Its debit side includes all the expenses pertaining to the particular period and the credit side includes all the income pertaining to the same period.

8. Do not take the opening balance and closing balance of Cash in hand and at Bank.

9. This account is prepared in the same manner in which a profit and loss A/C is prepared. So, All Adjustments relating to the current year such as depreciation, provision for doubtful debts, outstanding expenses, prepaid expenses, accrued income, and advance income are adjusted while preparing Income and Expenditure Account.

10. Surplus is added to the Capital Fund, whereas, Deficit is deducted from the Capital Fund.

11. Income and Expenditure Account is prepared on the basis of Receipts and Payments Account and other information.

12. Balance of this account represents surplus or Deficit.

13. This account is a part of the Double-entry system.

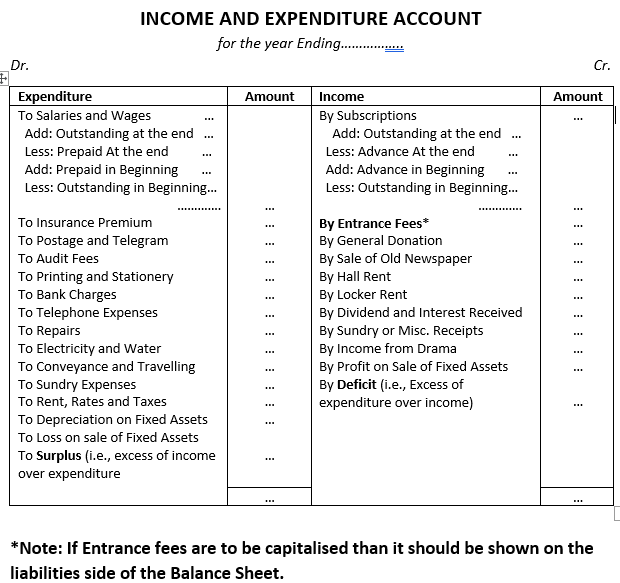

Format of Income and Expenditure Account

Or

Specimen of Income and Expenditure Account

The following points should be kept in mind while preparing Income and Expenditure Account:-

1. First of all, the name of the organization, the name of the account(Income and Expenditure Account), and the accounting year should be mentioned in the form of the title.

2. The opening and closing balance of cash and bank is not recorded in this account.

3. All revenue expenses related to the current accounting period whether paid or not paid recorded on the debit side of this account.

4. All revenue Income related to the current accounting period whether received or not received recorded on the credit side of this account.

5. Capital expenditure and capital receipts are not recorded in this account.

6. All Adjustments relating to the current year such as depreciation, provision for doubtful debts, outstanding expenses, prepaid expenses, accrued income, and advance income are adjusted while preparing Income and Expenditure Account.

7. Assets and Liabilities are not recorded in this account.

8. The Credit balance of this account is called “Excess of Income over Expenditure’(surplus).

9. The Debit balance of this is called “ Excess of Expenditure over Income”.(Deficit).

Trial balance practice questions

10 Balance Sheet Questions for Practice

Thanks Sir 🙏

Thank you so much sir for providing this material🙂…

Thank you sir❤