Table of Contents

Internal users of Accounting Information

Internal users?

Internal users of Accounting Information are those individuals or groups who are within the business organisation.

Or

Internal users of Accounting Information are the persons who are directely connected with the operation and management of the business entity.

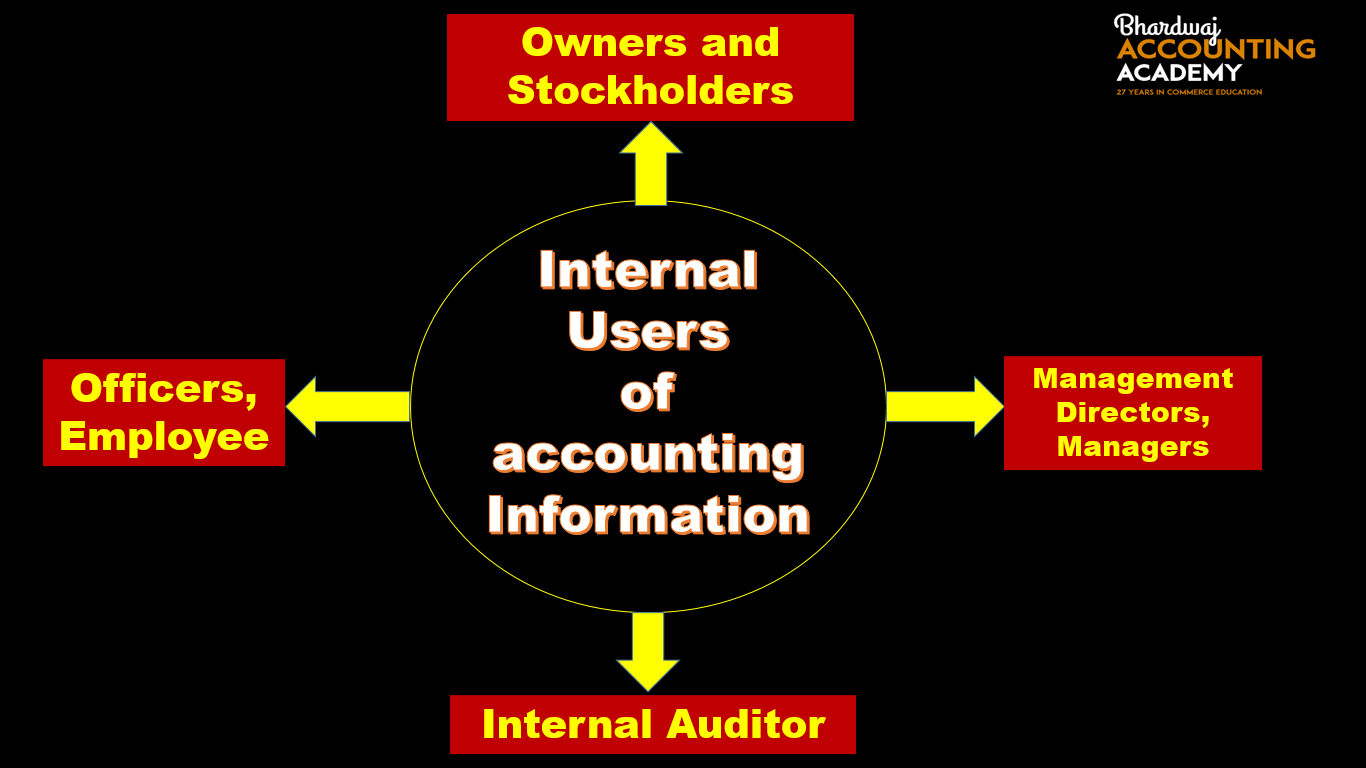

Internal users of accounting information are –

1. Owners

2. Management

3. Employees

4. Directors

5. Managers

6. Officers

7. Internal Departments

8. Internal Auditor

Internal users of accounting information-

1. Owners :

The persons who have contributed capital into business, are called owners or proprietors of business. Owners contribute capital in the business and ultimately responsible to bear all risks associated with the business. Owners want to know about profitability of the business. They are interested in financial soundness(Solvency) of the business. They want to know whether the profits are increasing or decreasing. They also want to know the reasons for the increase or decrease of profits. They are also interested to know the value of assets of the business. All such information is provided by accounting. The financial statements give the information about profit or loss and financial position of the business.

Owners want to know following from financial statements :

(a) What is the income for current year and previous years ?

(b) What are the factors responsible for change in current year’s income ?

(c) Whether the management has made good use of assets ?

(d) What are the future prospects of the enterprise ?

2.Management :

Management may consist the board of directors, managers and other executives of the business enterprise. Management is one of the most important users of accounting information. The managers of a business require financial information for judging its performances. They require accounting information on cost of sales, profitability and The solvency of the business enterprise to plan, control and make decisions. Accounting provides useful information to the management for:

(i) planning,

(ii) control(cost control),

(iii) decision-making (determination of selling price,investment into new projects),

(iv) performance measurement.

Accounting information is the “eyes and ears” of the management. Management likes to seek answers to the following :

(i) Which products are one most profitable?

(ii) Is business improving in terms of sales, cost, and profit?

(iii) Is return to shareholders adequate? How can it be improved?

(iv) How much money should be borrowed to expand the business?

(v) Whether the financial position of the firm is sound?

(vi) Which products is not profitable ? How profitable it?

(vii) How much to invest in a new project?

3. Employees and Workers :

Employees and Workers are need information about the profits or soundness of a business for the security of their job. Accounting information is also needed to assess the ability of the business to pay higher wages, salaries, bonus and other allowances. Accounting information is also needed for deciding employees’ share in profits and for settling wage disputes. If there is a continuous loss in the business, employees may decide to leave the organization.