Table of Contents

Operating Ratio

Operating Ratio

The operating ratio establishes the relationship between (Cost of Revenue from Operations+ Operating Expenses) operating cost and Net revenue from operations (net sales). This ratio is expressed in percentage.

The main objective of calculating this ratio is to the measurement of the efficiency and profitability of the business enterprise. The lower the operating ratio, the better it is for the business because it will leave higher margin of profit on revenue from operations.

Operating Expenses?

Operating expenses are day-to-day expenses incurred in the normal course of business. These expenses appear on the income statement.

Or

Operating expenses are the expenses that are incurred by the business in the normal course of its operations.

Or

Operating expenses are expenses a business incurs in order to keep it running, such as Employee Benefit Expenses, Depreciation, and Amortisation Expenses, Selling and Distribution Expenses, Office and Administrative Expenses, Rent Tax and Insurance, Discount allowed, Bad Debts, Employees Salaries etc.

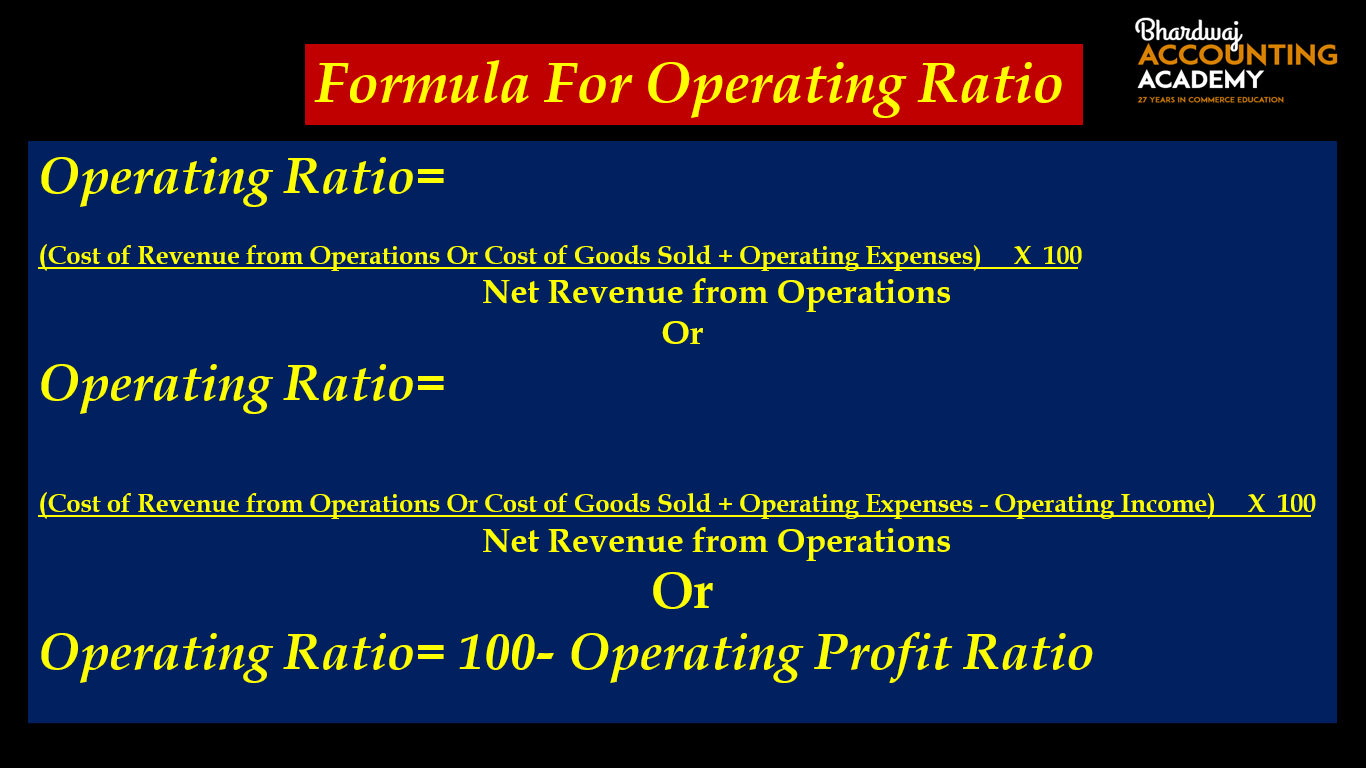

Formula For Operating Ratio

Cost of Revenue from Operations

Cost of Revenue from Operations = Cost of Material Consumed + direct expenses+ Change in inventories of WIP and Finished Goods

Or

Cost of Revenue from Operations = Opening Inventory + Net Purchases + Direct Expenses – Closing inventory

Or

Cost of Revenue from Operations = Net revenue from operations – Gross Profit

Note- Inventories (excluding Loose Tools and Spare Parts)

Note- Operating Ratio and Operating Profit Ratio are inter-related. The total Operating Ratio and Operating Profit Ratio will be 100.

If Operating Ratio 75 %. It means that the operating profit ratio is 25%.

If Operating Profit Ratio 20 %. It means that the operating ratio is 80%.

Working Capital Turnover Ratio

1. Example

Calculate the Operating ratio from the following data :

Sales ₹ 3,25,000 sales return ₹ 25,000 and cost of revenue from operations₹ 2,40,000, Operating Expenses ₹ 30,000.

Solution:

Operating ratio=(2,40,000+30,000)×100/3,00,000

Operating ratio=(2,70,000)×100/3,00,000

Operating ratio=90%

2. Example

Calculate the Operating ratio from the following data :

Revenue from Operations ₹ 3,25,000

sales return ₹ 25,000,

Opening Inventory ₹ 20,000

Closing Inventory ₹ 10,000

Purchase ₹ 2,05,000

Purchase return ₹ 5,000

Direct Expenses ₹ 5,000

Operating Expenses ₹ 25,000

N0n-Operating Expenses ₹ 12,000.

Solution:

Cost of Revenue from Operations = Opening Inventory + Net Purchases + Direct Expenses – Closing inventory

Net Purchase= Purchase-Purchase return

Net Purchase=2,05,000-5,000

Net Purchase=2,00,000

Cost of Revenue from Operations =20,000+2,00,000+5,000-10,000

Cost of Revenue from Operations =2,15,000

Operating ratio=(2,15,000+25,000)×100/3,00,000

Operating ratio=(2,40,000)×100/3,00,000

Operating ratio=80%

3. Example

Calculate the Operating ratio from the following data :

Revenue from Operations ₹ 4,15,000

sales return ₹ 15,000,

Gross Profit Ratio 25%

Direct Expenses ₹ 8,000

Selling and Distribution Expenses ₹ 5,000,

Office and Administrative Expenses₹ 12,000,

Rent Tax and Insurance₹ 3,000,

N0n-Operating Expenses ₹ 10,000.

Solution:

Cost of Revenue from Operations = Net revenue from operations – Gross Profit

Cost of Revenue from Operations = 4,00,000 – (4,00,000X25%)

Cost of Revenue from Operations = 4,00,000 – 1,00,000

Cost of Revenue from Operations = 3,00,000

Operating Expenses=Selling and Distribution Expenses ++Office and Administrative Expenses +Rent Tax and Insurance

Operating Expenses=₹ 5,000+₹ 12,000+₹ 3,000

Operating Expenses=20,000

Operating ratio=(3,00,000+20,000)×100/4,00,000

Operating ratio=(3,00,000)×100/4,00,000

Operating ratio=80%

Question For Practice

Question 1

Calculate the Operating ratio from the following data :

Revenue from Operations ₹ 5,25,000 sales return ₹ 25,000 and cost of revenue from operations₹ 3,40,000, Operating Expenses ₹ 60,000.

Question 2

Calculate the Operating ratio from the following data :

Revenue from Operations ₹ 4,25,000

sales return ₹ 25,000,

Opening Inventory ₹ 50,000

Closing Inventory ₹ 30,000

Purchase ₹ 3,05,000

Purchase return ₹ 5,000

Direct Expenses ₹ 15,000

Operating Expenses ₹ 35,000

N0n-Operating Expenses ₹ 15,000.

N0n-Operating Income ₹ 10,000.

Question 3

Calculate the Operating ratio from the following data :

Revenue from Operations ₹ 5,15,000

sales return ₹ 15,000,

Gross Profit Ratio 25%

Direct Expenses ₹ 18,000

Selling and Distribution Expenses ₹ 15,000,

Office and Administrative Expenses₹ 22,000,

Rent Tax and Insurance₹ 13,000,

N0n-Operating Expenses ₹ 30,000.

N0n-Operating Income ₹ 20,000.

Question 4

Calculate the Operating ratio from the following data :

Revenue from Operations ₹ 8,35,000

sales return ₹ 35,000,

Gross Profit Ratio 35%

Discount Allowed ₹10,000

Selling and Distribution Expenses ₹ 15,000,

Office Expenses ₹20,000

Administrative Expenses₹ 22,000,

Rent Tax and Insurance₹ 13,000,

N0n-Operating Expenses ₹ 30,000.

N0n-Operating Income ₹ 20,000.