Table of Contents

Partners Capital Account Format

Before knowing the Partners Capital Account format, we need to know about Partners Capital Account…….

partners capital account-

In partnership firm, Partners contribute their share of capital in business are recorded in their respective capital accounts. Normally, each partners capital account is prepared separately.

A partners capital account is an account in which all the transactions between the partners and the firm are to be recorded.

Suppose there are two partners Mohit and Rachit, there will be Mohit’s capital account and Rachit’s capital account.

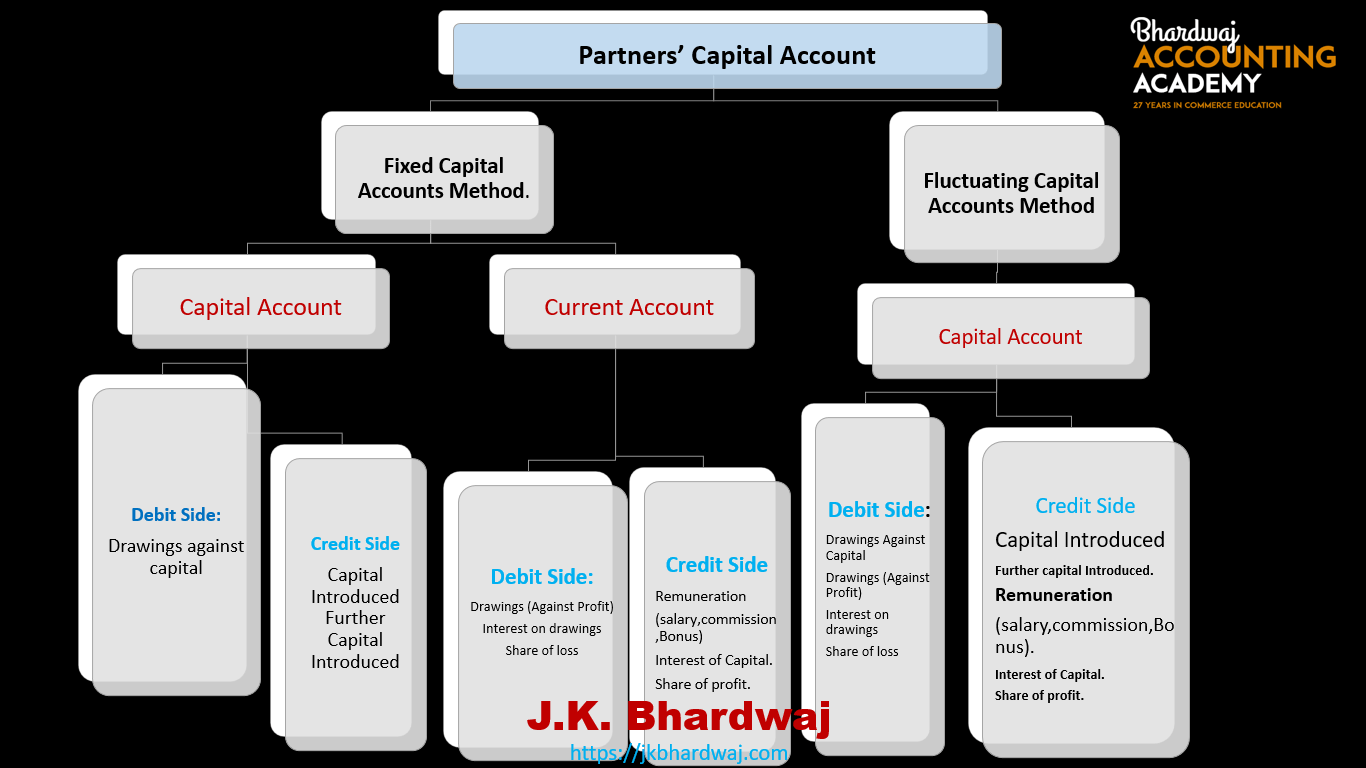

There are two methods by which the capital accounts of partners can be maintained. These are-

1.Fixed Capital Account method

2.Fluctuating Capital Account method

1.Fixed Capital Account method-

Under fixed capital account method two accounts are prepared for each Partner –

1.Partner’s Capital Account

2.Partner’s Current Account

1.Partner’s Capital Account – In fixed capital account method, in the partner’s capital accounts only these are recorded ,Capital invested by each partner’s and additional capital introduced by any partner’s , capital permanently withdrawn by any partner’s . This makes the balance in the capital account is fixed year after year. That’s the reason why this method is called fixed capital account method.

Partner’s capital Account is credited with

- Capital Introduced by partners 2. additional Capital Introduced by partners

Partner’s capital Account is debited with

- Drawings against capital (capital permanently withdrawn by any partner’s )

2. Partner’s Current Account – All items like share of profit or share of loss, interest on capital, Partner’s Salary, Partner’s commission, Partner’s Bonus, Partner’s drawings (against profit), interest on drawings, etc. are recorded in a separate account, is called Partner’s Current Account. Transactions relating to capital are not recorded in this account.(Capital Introduced by partners, additional Capital Introduced by partners, Drawings against capital)

Partner’s Current Account is credited with

- Interest on capital

- Partner’s Salary

- Partner’s commission

- Partner’s Bonus

- share of general reserve

- Share of profit

Partner’s Current Account is debited with

- Drawings (Against Profit)

- Interest on drawings

- Share of loss

- In fixed Capital method the partners’ capital accounts will always show a credit balance.

- The partners’ current account may show a debit or a credit balance

- partners’ capital accounts shall always appear on the liabilities side in the balance sheet.

- The partners’ current account’s balance shall be shown on the liabilities side, if they have credit balance and on the assets side, if they have debit balance.

Partners Capital Account Format

(Under Fixed Capital Account Method)

The format of partners capital accounts and partners current account prepared under the fixed capital method is given below:

2.Fluctuating Capital Account method-

Under the fluctuating capital method, only one account, i.e. capital account is maintained for each partner.

All the adjustments such as share of profit and loss, interest on capital, drawings, interest on drawings, salary or commission to partners, etc. are recorded directly in the capital accounts of the partners. This makes the balance in the capital account to fluctuate from time to time. That’s the reason why this method is called fluctuating capital method.

Partner’s Capital Account is credited with

- Capital Introduced by partners

- Additional Capital Introduced by partners

- Interest on capital

- Partner’s Salary

- Partner’s commission

- Partner’s Bonus

- Share of general reserve

- Share of profit

Partner’s Capital Account is debited with

- Drawings (Against Capital)

- Drawings (Against Profit)

- Interest on drawings

- Share of loss

Note: In the absence of any instruction, the capital account should be prepared by this method.

Partners Capital Account Format

(Under Fluctuating Capital Account Method)

The proforma of partners’ capital accounts prepared under the fluctuating capital method is given below:

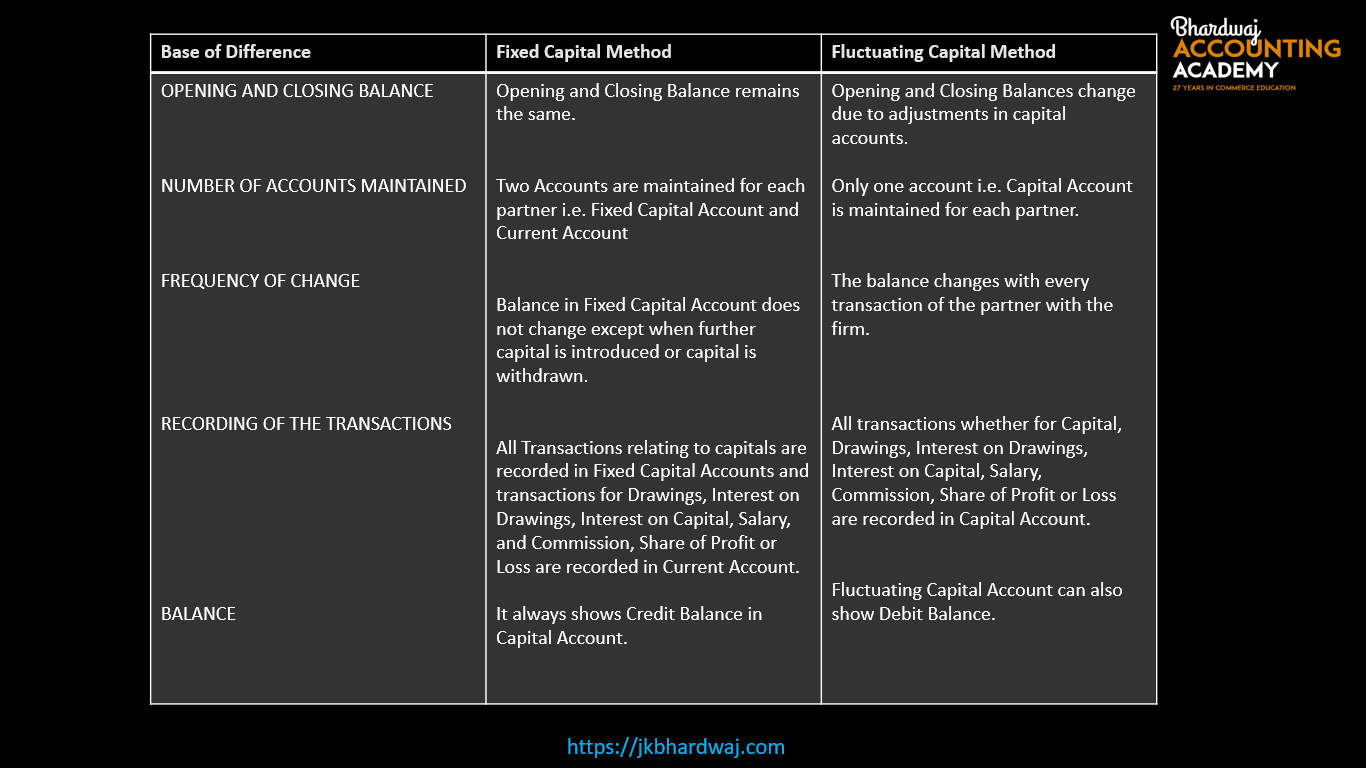

Partners Capital Account Format

Fixed Capital Method Vs Fluctuating Capital Method Or

Distinction/Difference between Fixed Capital Method and Fluctuating Capital Method –

Very good 😊

Notes for partners capital a/c👌👍

This is really interesting, You’re a very skilled blogger.

I have joined your feed and look forward to seeking more of

your wonderful post. Also, I’ve shared your site in my social networks!

Thanks you sir

Thanks Sir…

Thank’s Sir..