Table of Contents

Rent paid journal entry

Rent paid journal entry

The amount of money paid to the owner of a property in return for the use of his property is called rent.

When a person, firm, or company gives the right to use its property to another person, firm, or company in exchange for a certain consideration (based on a fixed period), the consideration paid is called rent paid.

In other words When any amount is paid by the business firm in exchange for the use of the assets (Building, Machinery, Furniture) of the business firm by another person then it will be called rent paid.

Rent paid journal entry

Rent paid to LandLord for Cash-

Example-

On 31st March 2023 Rent paid to LandLord ₹15,000 for Cash. Pass Journal Entry.

Explanation:

The Rent paid to the Landlord is considered as the Expense of the business. According to the accounting rules, the increase in Expenses will be debited. Therefore, the Rent account will be debited while passing the Journal entry.

The cash is reduced when the Rent is paid in cash and cash is the asset of the business. According to the rules of accounting, the decrease in assets is credited, So the cash account will be credited while passing the Journal entry.

Also read : Golden Rules Of Accounting

Rent paid journal entry

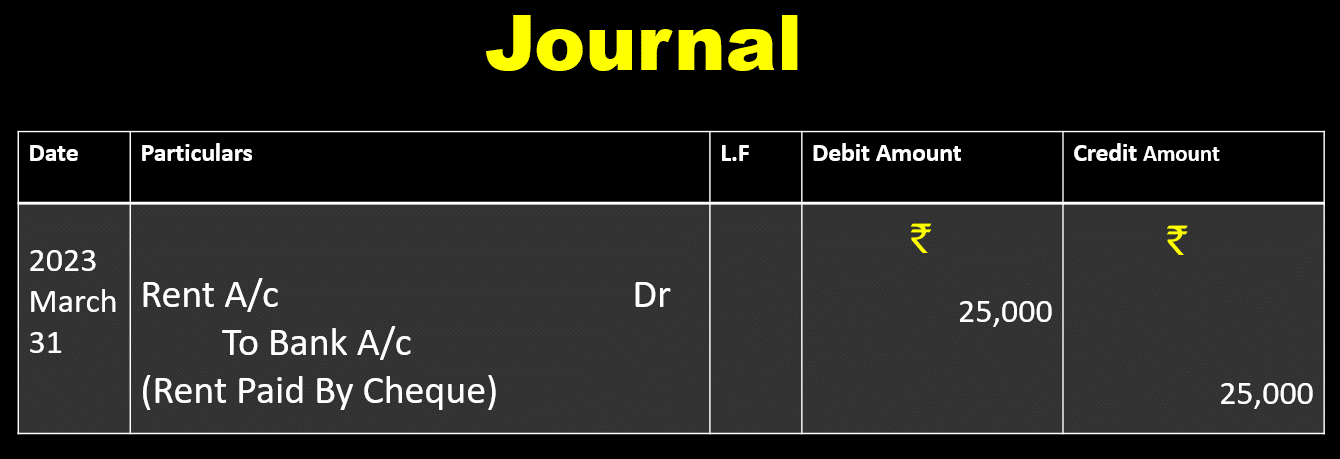

Rent paid to LandLord by Cheque-

Example-

On 31st March 2023 Rent paid to LandLord ₹25,000 by Cheque. Pass Journal Entry.

Explanation:

The Rent paid to the Landlord is considered as the Expense of the business. According to the accounting rules, the increase in Expenses will be debited. Therefore, the Rent account will be debited while passing the Journal entry.

The Bank balance is reduced when the Rent is paid by cheque and the Bank balance is the asset of the business. According to the rules of accounting, the decrease in assets is credited, So the Bank account will be credited while passing the Journal entry.