Table of Contents

Salary paid Journal Entry

Salary paid Journal Entry :

Meaning Of Salary –The amount of money paid by the employer to the employee in return for the services rendered by him is called salary. Salary is paid on monthly or yearly basis as per the service contract.

Salary is a fixed amount of money or compensation paid to an employee by an employer in return for work performed.

According to Cambridge English Dictinary- “Fixed amount of money agreed every year as pay for an employee, usually paid directly into his or her bank account every month”.

Fixed compensation paid by employer to employee regularly for their services, called salary.

The salary paid to the employees is considered as the Expenses of the business. According to the accounting rules, the increase in the Expenses will be debited. Therefore, the salary account will be debited while passing the Journal entry.

The cash is reduced when the salary is paid in cash and cash is the asset of the business. According to the rules of accounting, the decrease in assets is credited, So the cash account will be credited while passing the Journal entry.The following journal entry is made for payment of salary to the employees-

Salary paid Journal Entry-

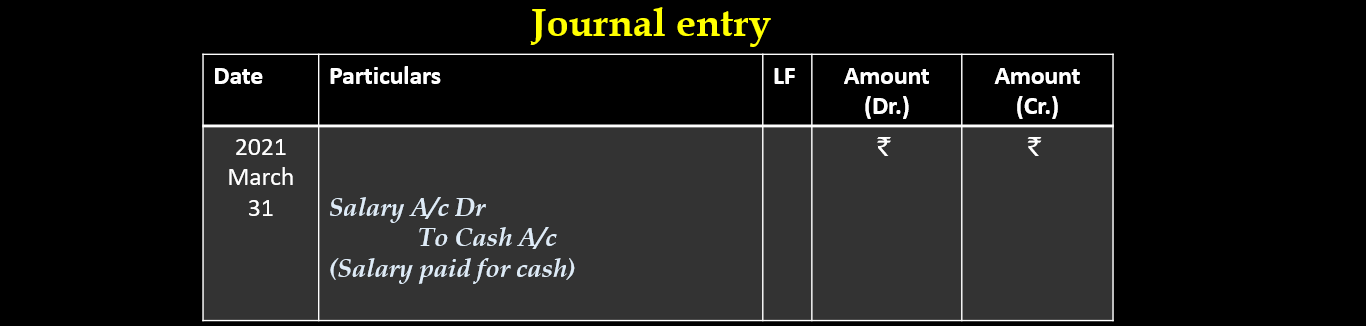

Salary paid to employee for Cash-

Example-

On 31st March, 2021 Salary paid to employee Rs. 50,000. Pass journal Entry.

Salary paid Journal Entry-

The salary paid to the employees is considered as the Expenses of the business. According to the accounting rules, the increase in the Expenses will be debited. Therefore, the salary account will be debited while passing the Journal entry.

The cash is reduced when the salary is paid in cash and cash is the asset of the business. According to the rules of accounting, the decrease in assets is credited, So the cash account will be credited while passing the Journal entry.

Also read : Golden Rules Of Accounting

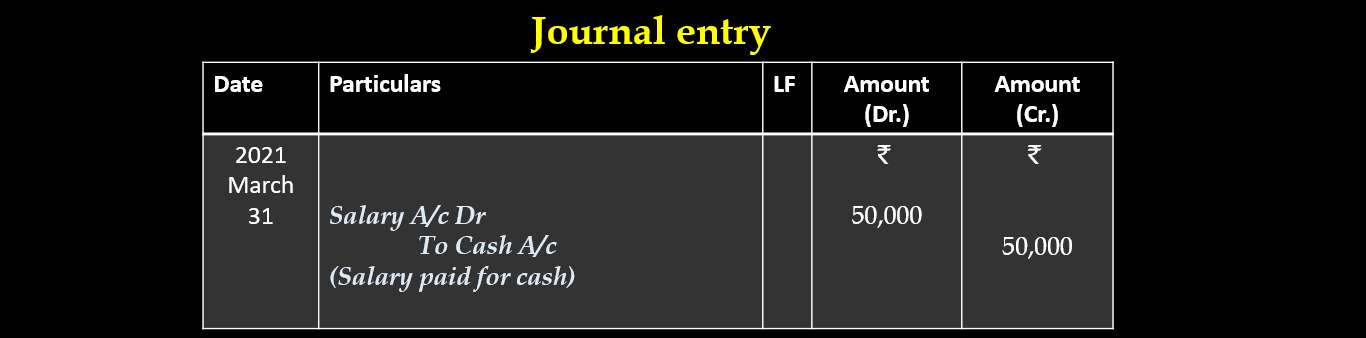

Salary paid to employee by cheque-

Example-

On 31st March, 2021 Salary paid by cheque to employee Rs. 60,000. Pass journal Entry.

The salary paid to the employees is considered as the Expenses of the business. According to the accounting rules, the increase in the Expenses will be debited. Therefore, the salary account will be debited while passing the Journal entry.

The Bank balance is reduced when the salary is paid by cheque and Bank balance(Dr.) is the asset of the business. According to the rules of accounting, the decrease in assets is credited, So the Bank account will be credited while passing the Journal entry.

Also read : Fictitious Assets

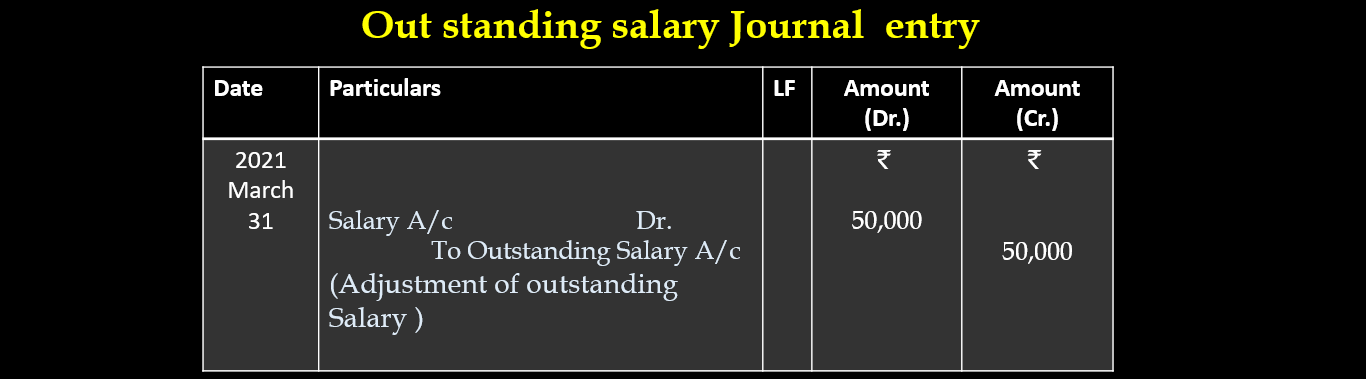

Outstanding Salary Journal Entry-

Salary for the month of March is due but not paid. It is an example of salary outstanding.

Example-

Outstanding Salary on 31.03.2021 Rs. 50,000. Make journal entry for outstanding Salary.

Outstanding Salary Journal Entry-

The salary Due or Outstanding to the employees is considered as the Expenses of the business. According to the accounting rules, the increase in the Expenses will be debited. Therefore, the salary account will be debited while passing the Journal entry.

The salary Due or Outstanding is the liabilities of the business. According to the rules of accounting, the increase in liability is credited, Therefore, the Outstanding salary account will be credited while passing the Journal entry.

Treatment in final Accounts-

Outstanding salary given outside the trial balance/adjustment-

* Add to the salary on the Debit side of Profit & Loss Account.

* Shown on the liabilities side of BALANCE SHEET.

Treatment in final Accounts-

If Outstanding Salary given in trial balance-

* Shown on the liabilities side of BALANCE SHEET.

Salary allowed to Partner’s –

Example-

Salary allowed to Partner’s Rs. 20,000 –

Journal Entry for Salary allowed to partner’s-

Partner’s Salary A/c Dr. 20,000

To Partner’s Capital A/c 20,000

(salary allowed to partner’s)

Also read: Book-keeping meaning definitions and objectives for class 11

Also read : Format of Trading Account

Also read : Format of Profit and loss Appropriation Account