Table of Contents

Rent received journal entry

Rent received journal entry

When a person, firm, or company gives the right to use its property to another person in exchange for a certain consideration (based on the fixed period), the amount received is called rent received. Generally, rent is received by renting out land, buildings, machines, furniture factories, etc.

In the other words When any amount is received by the business firm in exchange for the use of the assets (Building, Machinery, Furniture) of the business firm by another person then it will be called rent received.

In short, Rent received refers to rental income received from commercial property.

Rent received journal entry (According to Traditional Approach)

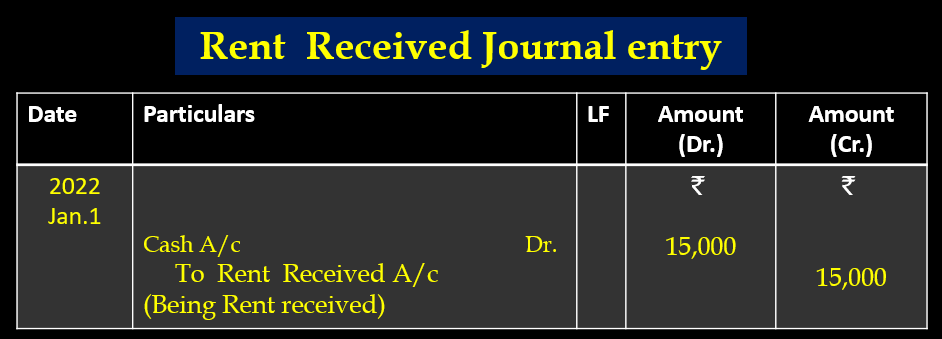

Example 1. Rent received for cash-

1. January 1, 2022, Rent received for cash ₹15,000.

Explanation:

In this transaction, two accounts are affected first cash account and the second Rent received account.

1. Cash Account ( Real Account)

Rules of real Account: Debit what comes in credit what goes out.

The cash account will be debited as per the rules (Debit what comes in) at the time of passing the journal entry.

2. Rent received Account. ( Nominal Account)

Rules of Nominal Account: Debit all losses and expenses, and credit all Income and gain.

Rent received Account will be credited as per the rules(credit all Income and gain) at the time of passing the journal entry.

Rent received journal entry( Traditional Approach)

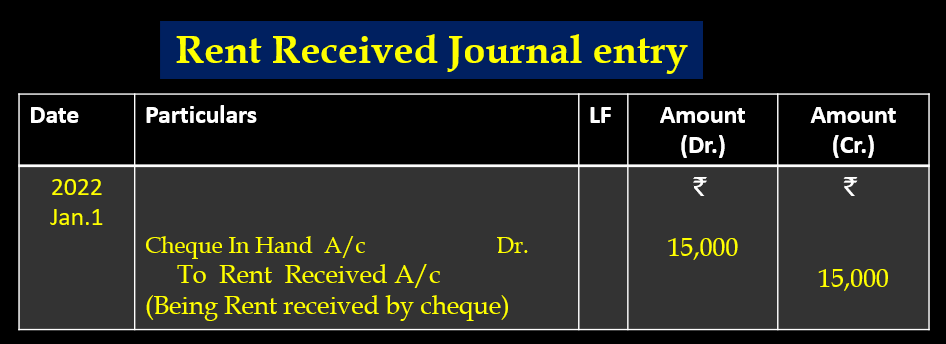

Example 2. Rent received by cheque-

1. January 1, 2022 Rent received by cheque ₹15,000. The Cheque has not yet been deposited in the bank.

Explanation:

In this transaction, two accounts are affected the first Cheque in hand account and the second Rent received account.

1. Cheque in hand account ( Real Account)

Rules of real Account: Debit what comes in credit what goes out.

Chaque in hand account will be debited as per rules(Debit what comes in) at the time of passing the journal entry.

2. Rent received Account. ( Nominal Account)

Rules of Nominal Account: Debit all losses and expenses, and credit all Income and gain.

Rent received Account will be credited as per rules( credit all Income and gain) at the time of passing the journal entry.

Rent received journal entry ( Traditional Approach)

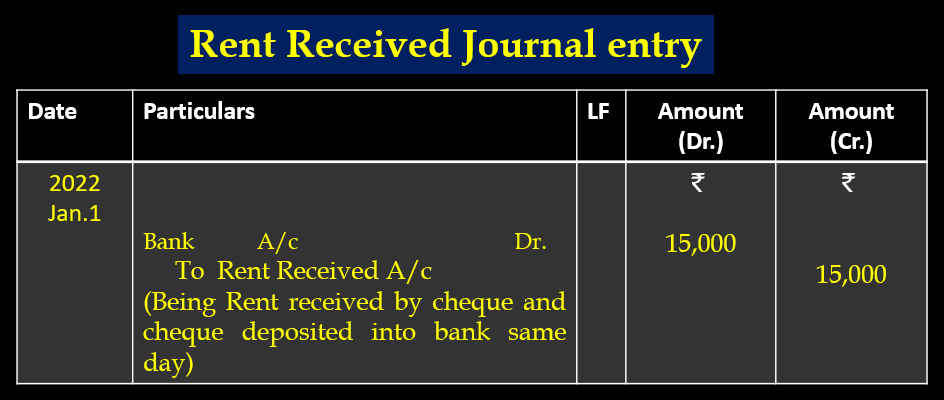

Example 3. Rent received by cheque and cheque deposited into the bank same day-

1. January 1, 2022 Rent received by cheque 15,000 and cheque deposited into the bank same day.

Explanation:

In this transaction, two accounts are affected first Bank account and the second commission received account.

1. Bank Account ( Personal Account)

Rules of personal Account: Debit the receiver credit the giver

Bank account will be debited as per rules(Debit the receiver) at the time of passing the journal entry.

2. Rent received Account. ( Nominal Account)

Rules of Nominal Account: Debit all losses and expenses, and credit all Income and gain.

Rent received Account will be credited as per rules(credit all Income and gain) at the time of passing the journal entry.

Rent received journal entry( Traditional Approach)

Rent received journal entry (According to Modern Approach)

Example 1. Rent received for cash-

1. January 1, 2022, Rent received for cash ₹15,000.

Explanation:

In this transaction, two accounts are affected first cash account and the second Rent received account.

1. Cash Account (Assets Account) –

Rules of Assets Account: Increases in assets are debits; decreases in assets are credits.)

Here the assets in the form of cash are increasing so according to the rules(Increases in assets are debits) the cash account will be debited while passing the journal entry.

2.Rent Received Account (Revenue Account)

Rules Revenue Account: Increases in incomes and gains are credits; decreases in incomes and gains are debits.

The revenue is increasing in the form of Rent received here, so the Rent received account will be credited as per rules(Increases in incomes and gains are credits) while passing the journal entry.

Rent received journal entry (Modern Approach)

Example 2. Rent received by cheque-

1. January 1, 2022, Rent received by cheque ₹15,000. The Cheque has not yet been deposited in the bank.

Explanation:

In this transaction, two accounts are affected the first Cheque In Hand account and the second Rent received account.

1. Cheque In Hand Account (Assets Account) –

Rules of Assets Account: Increases in assets are debits; decreases in assets are credits.)

Here the assets are increasing in the form of cheque in hand, so the Cheque In Hand Account will be debited as per rules(Increases in assets are debits) while passing the journal entry.

2. RentReceived Account (Revenue Account)

Rules Revenue Account: Increases in incomes and gains are credits; decreases in incomes and gains are debits.

The revenue is increasing in the form of Rent received here, so the Rent received account will be credited as per rules(Increases in incomes and gains are credits) while passing the journal entry.

Rent received journal entry (Modern Approach)

Example 3. Rent received by cheque and cheque deposited into the bank same day

1. January 1, 2022, Rent received by cheque ₹15,000 and cheque deposited into the bank same day.

Explanation:

In this transaction, two accounts are affected first Bank account and the second Rent received account.

1. Bank Account (Assets Account) –

Rules of Assets Account: Increases in assets are debits; decreases in assets are credits.)

Here the assets are increasing in the form of Bank deposits, so the Bank Account will be debited as per rules(Increases in assets are debits) while passing the journal entry.

2. Rent Received Account (Revenue Account)

Rules Revenue Account: Increases in incomes and gains are credits; decreases in incomes and gains are debits.

The revenue is increasing in the form of Rent received here, so the Rent received account will be credited as per rules(Increases in incomes and gains are credits) while passing the journal entry.

Rent received journal entry (Modern Approach)

Commission received journal entry