Table of Contents

15 Transactions With Their Journal Entries, Ledger And Trial Balance To Prepare Project

PASS THE JOURNAL ENTRIES POST THEM INTO THE LEDGER, CLOSING THE BOOKS OF ACCOUNTS, PREPARE A TRIAL BALANCE AND FINAL ACCOUNTS ( TRADING AND PROFIT&LOSS ACCOUNT, BALANCE SHEET) –

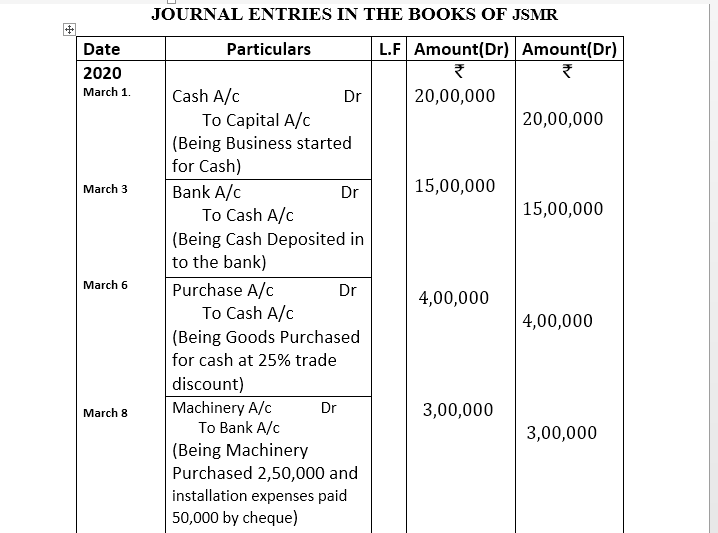

On 1st March 2020 JSMR started a business with cash Rs 20,00,000.

March 3 Cash deposited into the bank Rs. 15,00,000.

March 6 Goods purchased for cash Rs 5,00,000 at 20% trade discount .

March 8 Machinery Purchased Rs.2,50,000 and installation expenses paid Rs. 50,000. Amount paid by cheque.

March 12 Computer Purchased paid by cheque Rs. 30,000.

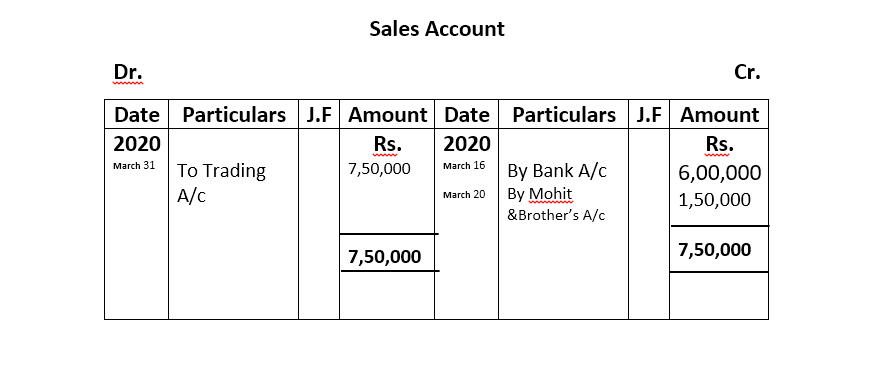

March 16 Goods sold for Cash Rs. 6,00,000 and deposited in to the bank same day.

March 18 Carriage paid Rs. 10,000.

March 20 Goods Sold on credit to Mohit & Brother Rs.2,00,000 at 25% trade discount .

March 25 Furniture Purchased for office use paid by cheque Rs. 50,000.

March 26 Cheques received from Mohit and brother Rs 1,00,000 and deposited into Bank same day.

March 27 Cash withdrawn from bank for office use Rs.40,000.

March 28 Advertisement Expenses paid by cheque Rs. 20,000.

March 29Commission Received Rs. 10,000.

March 31 Bank charges charged by bank Rs. 5,000.

Also Read: 30 transactions with their Journal Entries, Ledger, Trial balance and Final Accounts- Project

JOURNAL / BOOKS OF ORIGINAL ENTRY

The books in which a transaction is recorded for the first time from a source document are called Books of Original Entry or Prime Entry. Journal

Journal is one of the books of original entry in which transactions are originally recorded in a chronological (day-to-day) order according to the principles of the Double Entry System. Transactions when recorded in a Journal are known as entries. It is the book in which transactions are recorded for the first time. Journal is also known as ‘Book of Original Record’ or ‘Book of Primary Entry’.

This process of recording transactions in the journal is’ known as ‘Journalising’. Journal is also known as ‘Book of Original Record’ or ‘Book of Primary Entry’.

15 Transactions

15 Transactions

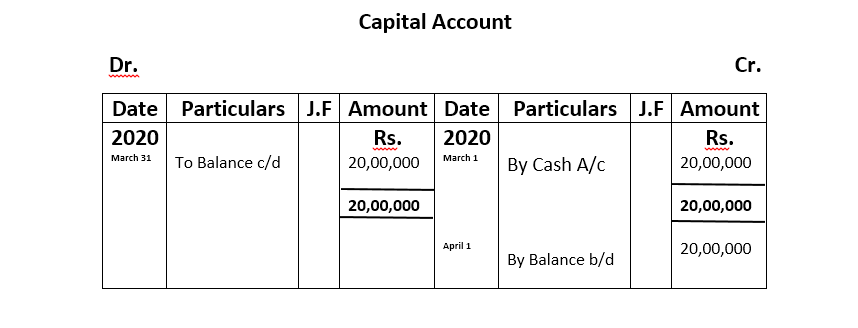

LEDGER

Ledger is also called the Principal Book of Accounts.

After recording the business transactions in the Journal or special purpose Subsidiary Books, the next step is to transfer the entries to the respective accounts in the Ledger.

Ledger is a book where all the transactions related to a particular account are collected at one place.

A Ledger is a book which contains all the accounts whether personal, real or nominal, which are first entered in journal or special purpose subsidiary books.

According to L.C. Cropper,” The book which contains a classified and permanent record of all the transactions of a business is called the ledger.”

POSTING

RULES OF POSTING

*If an account is debited in the journal entry, the posting in the ledger should be made on the debit side of that particular account. In the particular column the name of the other account (which has been credited in the Journal entry) should be written for reference.

* For the A/c credited in the Journal entry, the posting in the ledger should be made on the credit side of that particular account . In the particular column the name of the other account (which has been debited in the Journal entry) should be written for reference.

Points to be Remember

‘To’ is written before the A/c s which appear on the debit side of ledger.

“By” is written before the A/c s appearing on the credit side.

Use of these words ‘To’ and ‘By’ is optional.

READ: 20 transactions with their Journal Entries, Ledger and Trial balance to prepare project

15 Transactions

15 Transactions

15 Transactions

TRIAL BALANCE

First step recording of transactions in journal. The next step post them into ledger and the next step in the accounting process is to prepare a statement to check the arithmetical accuracy of the transactions recorded so for. This statement is called ‘Trial Balance’.

Trial Balance

As on 31st March, 2020

| Name of Accounts | L.F |

Debit Balance (Amount) |

Credit Balance (Amount) |

|

Cash Account Capital Account Bank Account Purchase Account Machinery Account Computer Account Sales Account Mohit &Company(Debtors) Furniture Account Commission Received Account Carriage Account Advertisement Account Bank Charges TOTAL |

Rs. 1,40,000 ————- 17,55,000 4,00,000 3,00,000 30,000 ———— 50,000 50,000 ———– 10,000 20,000 5,000 27,60,000 |

Rs.

————— 20,00,000 ————- ————- ————- ————- 7,50,000 ————- ————- 10,000 ———– ———– ————- 27,60,000 |

- Value of Closing Stock Rs. 20,000.

FINAL ACCOUNTS

The accounts which are prepared at the final stage (at the end of the financial year) of the accounting cycle to know the profit or loss and financial position of a business concern are called Final Accounts.

Final accounts gives an idea about the Profitabilitty and Financial position of a business to its management, owners, and other interested parties.

It is a combination of the following statement: –

1.Trading Account

2.Profit and loss account

3.Balance Sheet

FORMAT OF TRADING ACCOUNT

15 Transactions

FORMAT OF PROFIT AND LOSS ACCOUNT

15 Transactions

https://jkbhardwaj.com/quizzes/financial-accounting-quiz-questions-and-answers/

This website certainly has all of the info I wanted about this subject

and didn’t know who to ask.

Very good information

I relish, cause I discovered just what I used to be looking for.

You’ve ended my 4 day long hunt! God Bless you man. Have a nice day.

Bye

Thank u

Sir please guide us for making the project of 15 transaction of not for profit organisation….. 🙏

Thank you sir , this project is too helpful