Table of Contents

Concept of Goodwill

Meaning of Goodwill

Goodwill is the monetary value of a business reputation. Over a period of time, a business firm develops a good name and reputation among the customers. This help the business earn some extra profits as compared to a newly set up business, The capacity of any business to earn extra profit than normal profit is called Goodwill.

In other words, goodwill is the value of the reputation of a firm in respect of the profit earned in the future over and above the normal profit.

Also Read: Adjustment entries: Adjustment entry

Definition Of Goodwill

According to Lord Macraughton- “Goodwill is a thing very easy to describe, very difficult to define. It is the benefit and advantage of good name, reputation and connection of a business. It is the attractive force which brings in customers. It is one thing which distinguishes an old established business from a new business at its start.”

According to Lord Eldon-“Goodwill is nothing more than the profitability that the old customers will resort to the old place.”

According to Morrissey-“Goodwill is the present value of firm’s anticipated ‘excess’ earnings.”

Features of Goodwill

- Goodwill is an intangible Asset.

- Goodwill does not have an existence separate from that of a business enterprise. It cannot be separated from the business and therefore cannot be sold like other identifiable and separable assets, without disposing off the business as a whole.

- Goodwill is the attractive force that brings customers to the place of business.

- Goodwill is dependent on various factors like Location, Quality of its products, Nature of Business, etc.

- Goodwill reflects the profit-earning capacity of the enterprise.

- The value of goodwill is not fixed it may change over time.

- Goodwill shows the overall reputation and position of the business enterprise in monetary terms.

- Goodwill is the monetary value of a business reputation.

- Goodwill is a realizable asset.

- Goodwill is a valuable asset.

Types of Goodwill

Goodwill may be of two types:

- Purchased goodwill- This specific term refers to the situation when one company acquires another company. The purchase price might be higher than the value of all the acquired company’s identifiable assets (like machinery or buildings). This difference represents the intangible value, or purchased goodwill, that the acquiring company is paying for.

- Non-purchased goodwill Or Self Generated goodwill– Self-generated goodwill, also known as inherent goodwill, refers to the intangible value a business builds over time through its own efforts, separate from any acquisitions. It’s essentially the positive reputation and brand recognition a company earns on its own merit.

Factors affecting the Goodwill

- Location : If the firm is located at a central place, resulting in good sale, the goodwill tends to be high.

- Quality : If a firm is known for the quality of its products the value of goodwill will be high.

- Market Situation : The monopoly condition leads to earn high profits which leads to the higher value of goodwill.

- Special Advantages: The firms which have special advantages like importing licenses, long-term contracts for the supply of material, patents, trademarks, etc. enjoy higher value of goodwill.

- Nature of Business—A business having stable continuous demand for its products such as consumer goods is able to earn more profits and hence has more goodwill.

- Good relations with customers, suppliers, labour and government.

- Efficiency of Management—A firm having efficient management enjoys advantages of high productivity and cost of efficiency. This leads to higher profits which in turn increases the value of goodwill.

- Monopolistic Business.

- Money Market condition.

- Government Policy.

Need for Valuation of Goodwill

- When there is a change in the profit-sharing ratio

- When the admission of a new partner

- When the retirement of a partner

- When the death of a partner

- When partnership firms are sold

- When the amalgamation of two or more firms

Methods of Valuation of Goodwill

The methods of valuation of goodwill are generally decided by the partners among themselves while preparing the partnership deed.

The following are the important methods of valuing the goodwill of a firm :

(i) Average Profit Method

(ii) Super Profit Method

(iii) Capitalisation Method

- Capitalisation of Average Profit Method

- Capitalisation of Super Profit Method

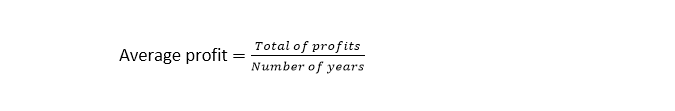

(i) Average Profit Method

This is a very simple method of valuation of goodwill . Under this method the value of Goodwill is calculated by multiplying the Average Future profit by a certain number of year’s purchase. Average Future profit calculated on the basis of number of past year profits.

Simple Average Profit Method

Goodwill = Average Profit x No. of years’ Purchase

Number of years’ purchase means for how many years the firms will earn the same amount of profit because of the past efforts.

Or

The number of year’s purchase means the time required by the new business to come at a level equal to the old settled business.

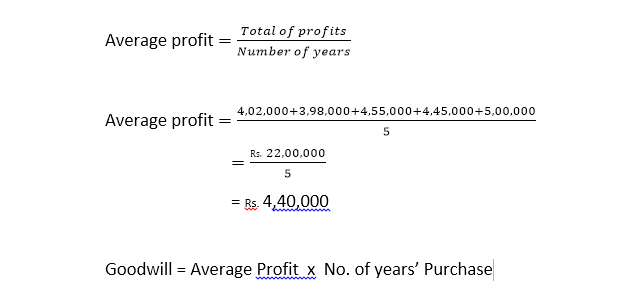

Example-The profit for the last five years of a firm were as follows –

year 2012 Rs. 4,02,000;

year 2013 Rs. 3,98,000;

year 2014 Rs. 4,55,000;

year 2015 Rs. 4,45,000;

year 2016 Rs. 5,00,000. Calculate goodwill of the firm on the basis of 3 years purchase of 5 years average profits.

= Rs. 4,40,000 x 3

= Rs. 13,20,000

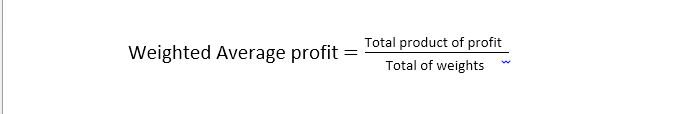

Weighted average method

This method is a modified version of the average profit method. This is a better method than the simple average method.

It takes into account the importance of each year.

Under this method, earlier years are less important than the recent years.

Thus, each year’s profit is multiplied by its respective number (weight) in chronological order.

The latest year will be given the highest weight and the earliest year will be given lowest weight.

Each profit figure will be multiplied by its weight and then the total of these products will be calculated.

This total will be divided by the total of weights.

Goodwill = Weighted average profit x number of years’ purchase

Example- The profit of firm for past years were as follow :

Year Profit (Rs.)

2012 8,00,000

2013 8,50,000

2014 9,00,000

2015 10,00,000

2016 11,00,000

The weight to be used are 1, 2, 3, 4, and 5 for the years from 2012 – 2016. Calculate the value of goodwill on the basis of two year’s purchase of weighted average profit.

| Year | Profit | weight | Product

(Profit × Weight) |

| 2012 | 8,00,000 | 1 | 8,00,000 |

| 2013 | 8,50,000 | 2 | 17,00,000 |

| 2014 | 9,00,000 | 3 | 27,00,000 |

| 2015 | 10,00,000 | 4 | 40,00,000 |

| 2016 | 11,00,000 | 5 | 55,00,000 |

| Total of weights

= 15 |

Total product of profit

=1,47,00,000 |

= Rs. 9,80,000

Goodwill = Weighted average profit x number of years’ purchase

Goodwill = 9,80,000 x 2

Goodwill Rs. 19,60,000

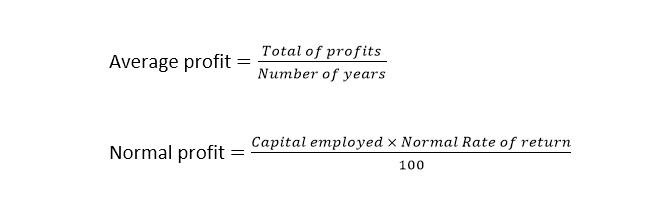

Super Profit Method

Under this method, goodwill is calculated on the basis of super profits. Super profit is the excess of average profits over normal profits. Normal rate of return on the capital employed is compared with the actual average profits to find out the super profits. Normal rate of return means similar type of business firms earns profit at a certain percentage of the capital employed.

Super profit = Average Profit – Normal profit

Goodwill = Super Profit x No. of year’s Purchase

Capital employed means capital invested in the firm to carry on firms business.

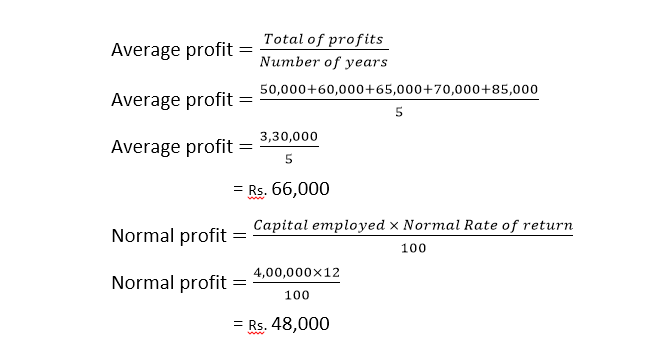

Example- 3.The books of a business showed that the capital employed on March 31, 2020, Rs. 4,00,000 and the profits for the last five years were:

March 31 2019– Rs. 50,000:

March 31 2018- Rs. 60,000;

March 31 2017- Rs. 65,000;

March 31 2016- Rs. 70,000 and

March 31 2015- Rs. 85,000. You are required to find out the value of goodwill based on 3 years purchase of the super profits of the business, given that the normal rate of return is 12%.

Super profit = Average Profit – Normal profit

Super profit = Rs. 66,000 – Rs. 48,000

Goodwill = Super Profit x No. of years’ Purchase

Goodwill = Rs. 18,000 x 3

= Rs. 54,000

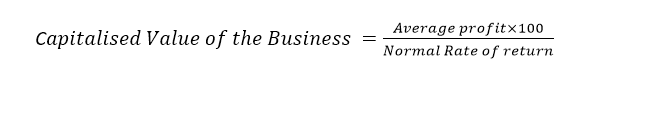

Capitalization of Average Profit Method

Under this method, the value of goodwill is ascertained by deducting the actual capital employed (net assets) in the business from the capitalized value of the average profits on the basis of a normal rate of return.

This involves the following steps:

- Ascertain the average profits based on the past few years’ performances.

- Capitalize the average profits on the basis of the normal rate of return to ascertain the capitalized value of average profits as follows:

- Ascertain the actual capital employed (net assets) by deducting outside liabilities from the total assets (excluding goodwill).

- Net Assets = Total Assets (excluding goodwill) – Outside Liabilities

- Compute the value of goodwill by deducting net assets from the capitalized value of average profits, i.e.

- Goodwill = Capitalised Value of the Business – Net assets

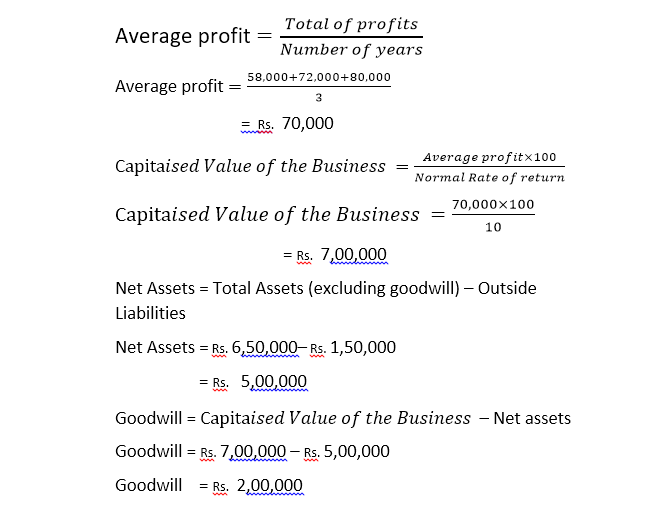

Example-Assets of the firms are Rs. 6,50,000 (excluding goodwill) and Liabilities are Rs. 1,50,000. The profits for the last three years were:

March 31 2019– Rs. 58,000:

March 31 2018- Rs. 72,000;

March 31 2017- Rs. 80,000;

normal rate of return is 10%.You are required to find out the value of goodwill On the basis of capitalisation of Average profit.

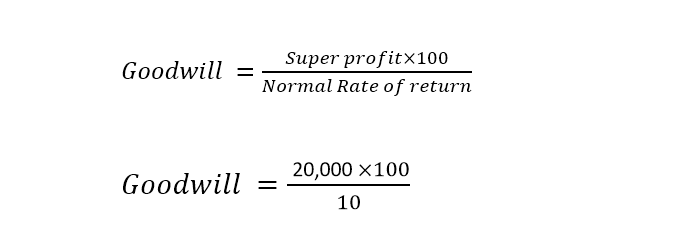

Capitalisation of Super Profit Method

Goodwill can also be ascertained by capitalising the super profit directly. Under this method goodwill is calculated by capitalising super profit at the normal rate of return. In this method there is no need to work out the capitalised value of average profits. It involves the following steps.

- Calculate capital employed of the firm, which is equal to total assets minus outside liabilities.

- Calculate normal profits on the basis of capital employed.

- Calculate average profit for past years, as specified.

- Calculate super profits by deducting normal profits from average profits.

Example –Assets of the firms are Rs. 6,50,000 (excluding goodwill) and Liabilities are Rs. 1,50,000. The profits for the last three years were:

March 31 2019– Rs. 58,000: March 31 2018- Rs. 72,000;

March 31 2017- Rs. 80,000; normal rate of return is 10%. You are required to find out the value of goodwill On the basis of capitalisation of Super profit.

Average profit= 80,000+72,000+58,000/3

Average profit = Rs. 70,000

Capital employed /Net Assets = Total Assets (excluding goodwill) – Outside Liabilities

Capital employed /Net Assets = Rs. 6,50,000– Rs. 1,50,000

Capital employed = Rs. 5,00,000

Normal profit = Rs. 50,000

Super profit = Average Profit – Normal profit

Super profit = Rs. 70,000 – Rs. 50,000

Super profit = Rs. 20,000

= Rs. 2,00,000

Goodwill questions for practice Class 12 ISC & CBSE

Thanks sir…