Table of Contents

Accounting journal entries practice

Accounting journal entries practice-

Question 1. (Problems and Solution)

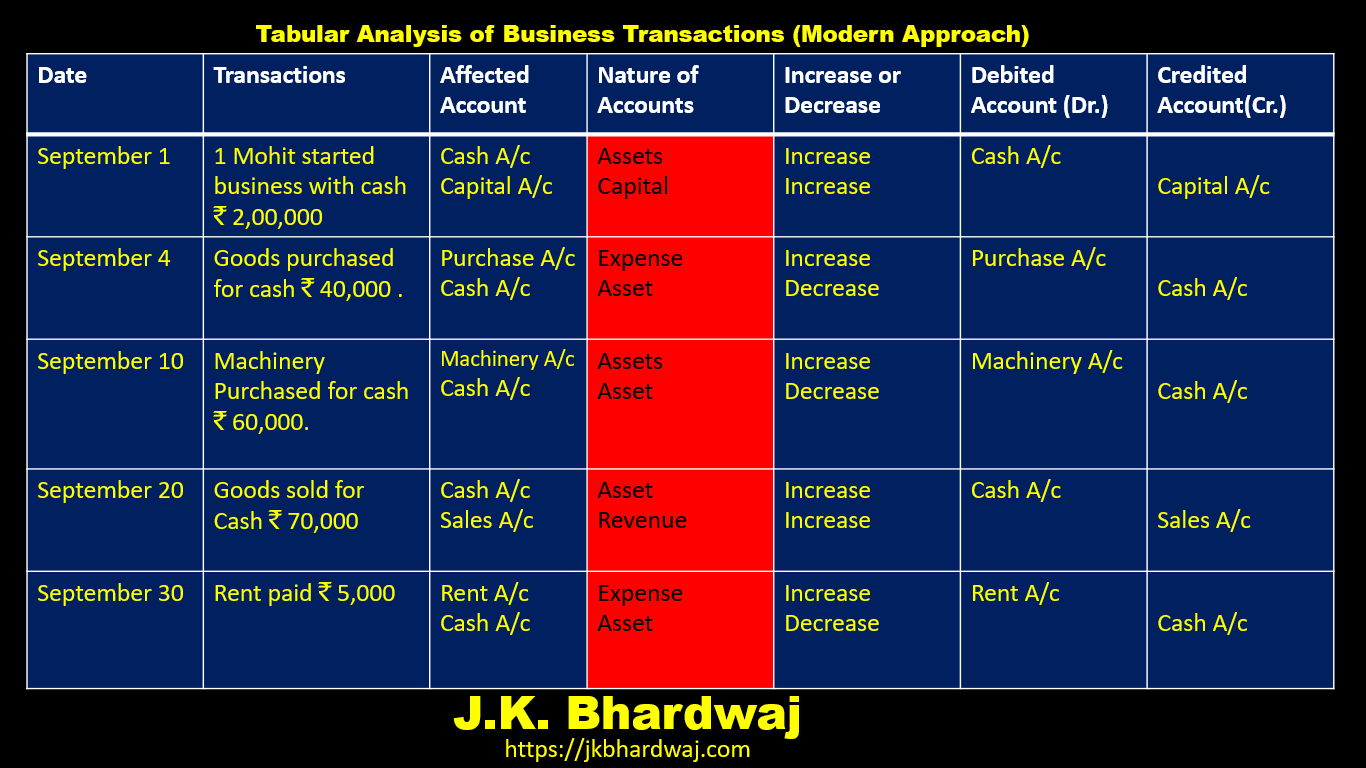

Analyse in Tabular form (In modern Approach) and Enter the following transactions in the Journal of Mohit 2021

September 1 Mohit started business with cash 2,00,000.

September 4 Goods purchased for cash 40,000 .

September 10 Machinery Purchased for cash60,000.

September 20 Goods sold for Cash 70,000

September 30 Rent paid 5,000

Solution-

Tabular Analyse of Business transactions (In modern Approach)

JOURNAL ENTRIES IN THE BOOKS OF MOHIT

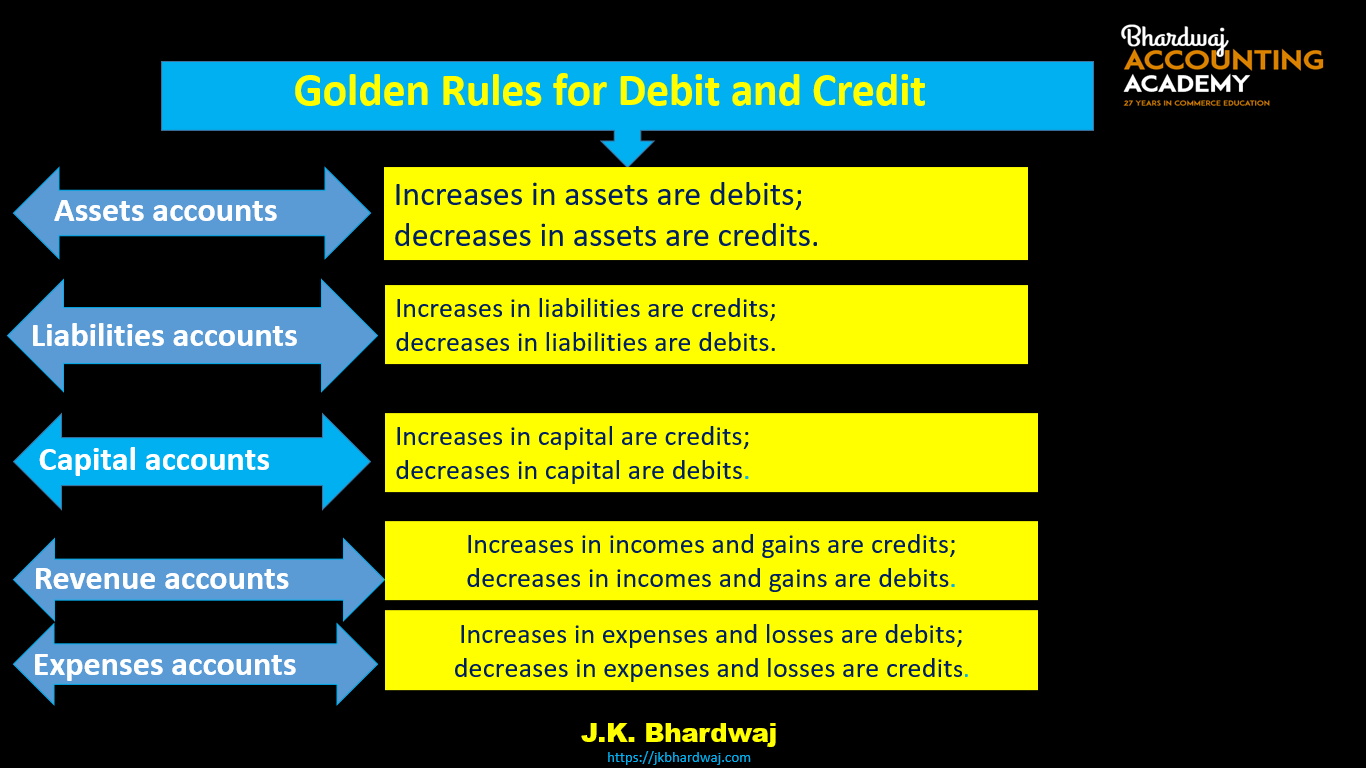

RULES OF DEBIT AND CREDIT MODERN APPROACH

Accounting journal entries practice

Question 2. (Problems and Solution)

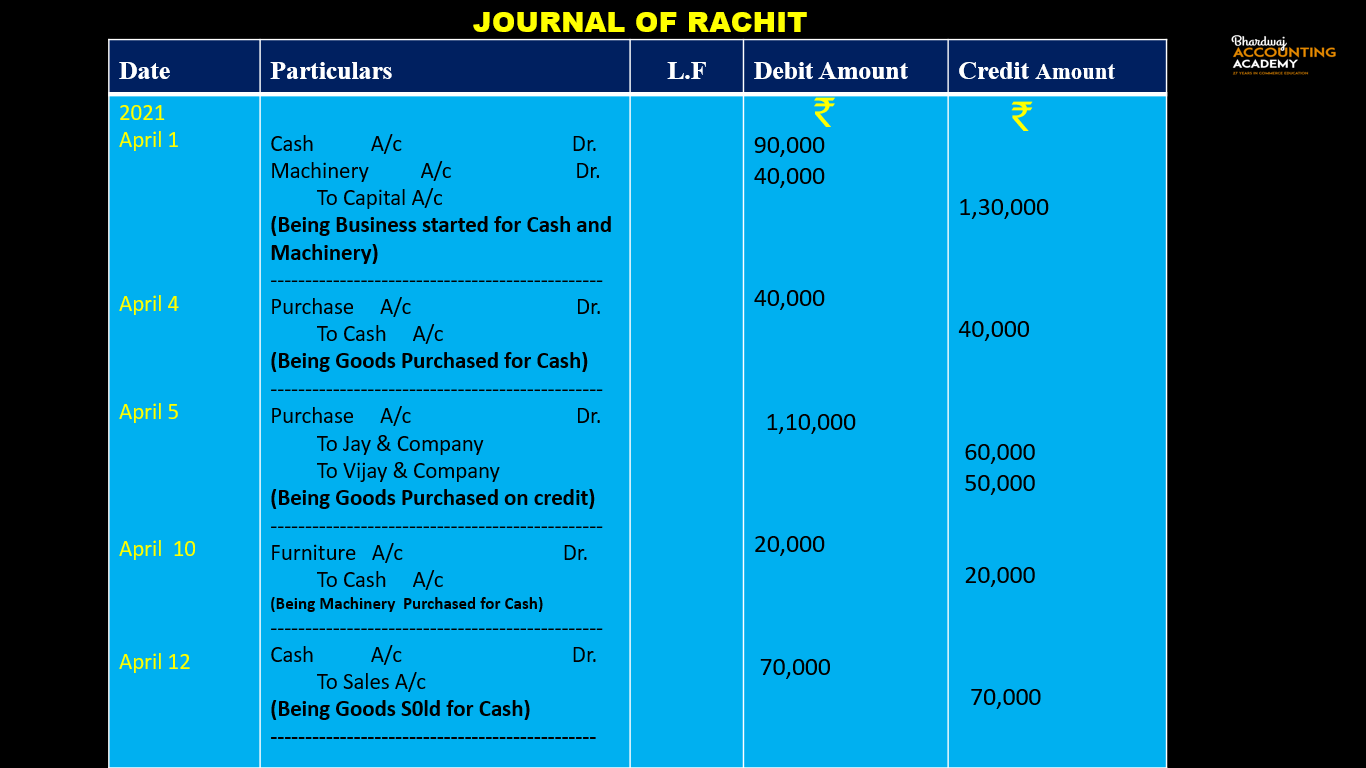

Enter the following transactions in the Journal of Rachit 2021:-

April 1 Rachit started business with cash 90,000 and Machinery 40,000.

April 4 Goods purchased for cash 40,000 .

April 5 Goods purchased on credit from –

Jay & Company 60,000 .

Vijay & Company 50,000.

April 10 Furniture Purchased for cash 20,000.

April 12 Goods sold for Cash 70,000

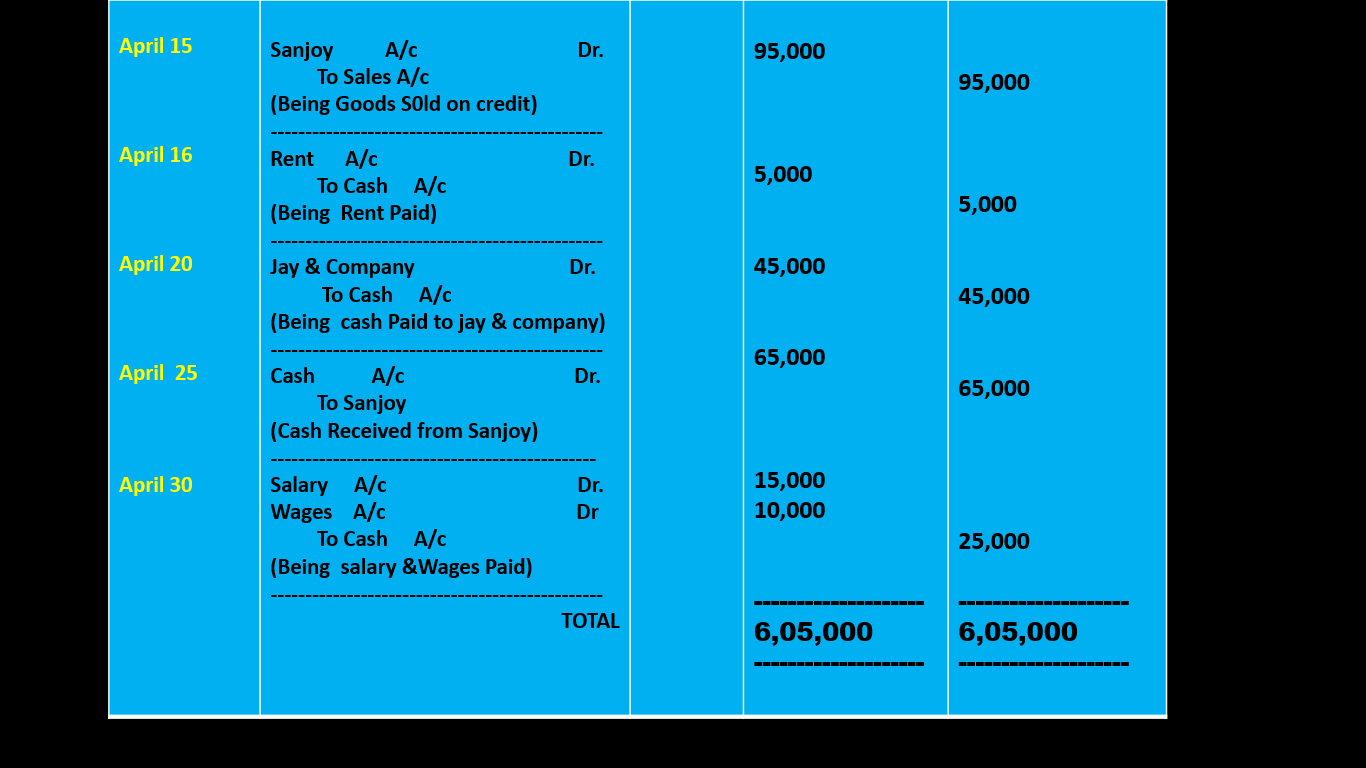

April 15 Goods sold on Credit to sanjoy 95,000

April 16 Rent paid 5,000

April 20 Cash paid to Jay & Company 45,000.

April 25 Cash Received from sanjoy 65,000.

April 30 Salary paid 15,000, Wages paid 10,000.

JOURNAL ENTRIES IN THE BOOKS OF RACHIT

Accounting journal entries practice

Question 3. (Problems and Solution)

PASS THE JOURNAL ENTRIES IN THE BOOKS Of JSMR –

On 1st March 2020 JSMR started a business with cash Rs 20,00,000.

March 3 Cash deposited into the bank Rs. 15,00,000.

March 6 Goods purchased for cash Rs 5,00,000 at 20% trade discount .

March 8 Machinery Purchased Rs.2,50,000 and installation expenses paid Rs. 50,000. Amount paid by cheque.

March 12 Computer Purchased paid by cheque Rs. 30,000.

March 16 Goods sold for Cash Rs. 6,00,000 and deposited in to the bank same day.

March 18 Carriage paid Rs. 10,000.

March 20 Goods Sold on credit to Mohit & Brother Rs.2,00,000 at 25% trade discount .

March 25 Furniture Purchased for office use paid by cheque Rs. 50,000.

March 26 Cheques received from Mohit and brother Rs 1,00,000 and deposited into Bank same day.

March 27 Cash withdrawn from bank for office use Rs.40,000.

March 28 Advertisement Expenses paid by cheque Rs. 20,000.

March 29Commission Received Rs. 10,000.

March 31 Bank charges charged by bank Rs. 5,000.

For solution, visit here:

15 Transactions With Their Journal Entries, Ledger And Trial Balance To Prepare Project

Accounting journal entries practice

Question 4 . (Problems and Solution)

PASS THE JOURNAL ENTRIES IN THE BOOKS OF RACHIT-

On 1st November, 2020 Mr.Rachit started a Readymade garments business in lalitpur Mr. Rachit invested Rs 50,00,000.

November 2 Cash deposited into the bank Rs. 30,00,000.

November 2 Goods purchased for cash Rs 8,00,000 at 25% trade discount .

November 3 Sewing Machinery Purchased for cash Rs. 5,50,000 and installation expenses paid Rs. 50,000.

November 5 Computer Purchased paid by cheque Rs. 50,000.

November 6 Goods sold for Cash Rs. 7,00,000.

November 10 Goods purchased from Dinesh & company Rs. 12,50,000 at 20% trade discount .

November 12 Goods Sold to Mohit & Brother Rs.20,00,000 at 40% trade discount .

November 15 amount paid to Dinesh & company by cheques Rs. 4,00,000.

November 16 Furniture Purchased paid by cheque Rs. 1,50,000.

November 18 Cheques received from Mohit and brother Rs 8,00,000 and deposited into Bank same day.

November 19 Goods purchased from Dinesh & company Rs. 10,00,000 at 20% trade discount .

November 20 Goods sold for Cash Rs. 5,00,000.

November 21 Goods Sold to Mohit & Brother Rs.10,00,000 at 20% trade discount .

November 24 Isurance premium paid Rs. 20,000 by cheque.

November 25 Cash received from Mohit and brother Rs 2,00,000.

November 26 Cash paid to Dinesh and company Rs. 1,50,000.

November 27 Commission Received Rs. 20,000.

November 29 Cash withdrawn for personal use Rs. 40,000.

November 30 Salary Rs 25,000, Rent Rs. 16,000 paid by cheque.

For solution, visit here:

20 transactions with their Journal Entries, Ledger and Trial balance to prepare project

Accounting journal entries practice

Question 5 . (Problems and Solution)

PASS THE JOURNAL ENTRIES IN THE BOOKS OF MOHIT-

On 1st March, 2020 Mr. Mohit started a Furniture business in GANDHI NAGAR Mr. Mohit invested Rs 50,00,000.

March 2 Cash deposited into the bank Rs. 30,00,000.

March 3 Goods purchased (3,000 Chairs) for cash Rs 8,00,000 at 25% trade discount .

March 4 Machinery Purchased for cash Rs.5,50,000 and installation expenses paid Rs. 50,000.

March 5 Computer Purchased paid by cheque Rs. 50,000.

March 6 Goods sold (2,000 Chairs) for Cash Rs. 7,00,000.

March 7 Carriage paid Rs. 18,000.

March 10 Goods purchased (1,000 Tables) from Dinesh & company Rs. 12,50,000 at 20% trade discount .

March 12 Goods Sold( 500 Tables to Mohit & Brother Rs.20,00,000 at 40% trade discount .

March 13 Investment purchased by cheque Rs. 2,00,000.

March 15 amount paid to Dinesh & company by cheques Rs. 4,00,000.

March 16 Furniture Purchased for office use paid by cheque Rs. 1,50,000.

March 17 Cash withdrawn for personal use Rs. 40,000.

March 18 Cheques received from Mohit and brother Rs 8,00,000 and deposited into Bank same day.

March 19 Goods purchased ( 1000 Tables) from Dinesh & company Rs. 10,00,000 at 20% trade discount .

March 20 Goods sold for Cash Rs. 5,00,000.

March 21 Goods Sold ( 500 Chairs and 500 tables) to Mohit & Brother Rs.10,00,000 at 20% trade discount .

March 22 Cash withdrawn from bank for office use Rs. 1,00,000.

March 23 Advertisement Expenses paid by cheque Rs. 1,20,000.

March 24 Insurance premium paid Rs. 20,000 by cheque.

March 25 Cash received from Mohit & brother Rs 2,00,000.

March 26 Cash paid to Dinesh & company Rs. 1,50,000.

March 27 Commission Received Rs. 20,000.

March 28 wages paid Rs.15,000.

March 29 Cash withdrawn for personal use Rs. 40,000.

March 30 Salary Rs 25,000, Rent Rs. 16,000 paid by cheque.

March 31 Depreciation charge on machinery Rs. 5,000.

March 31 Depreciation charge on Computer Rs. 2,500.

March 31 Bank charges charged by bank Rs. 5,000.

March 31. Interest received on investment Rs. 4,000.

For solution, visit here:

30 transactions with their Journal Entries, Ledger, Trial balance and Final Accounts- Project

It is very very good

I am genuinely glad to read this website posts which carries lots of useful

facts, thanks for providing such data.

I used to be very happy to seek out this web-site.I needed to thanks in your time for this excellent read!! I undoubtedly enjoying every little bit of it and I’ve you bookmarked to check out new stuff you weblog post.