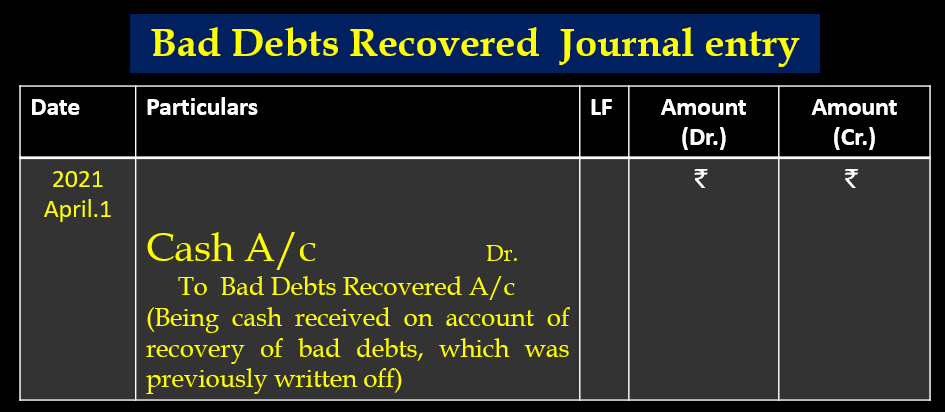

Bad Debts Recovered Journal entry

Sometimes, it so happens that the bad debts previously written off are subsequently recovered. In such a case, the cash account is debited, because the assets are increasing in cash form and if there is an increase in the assets then we debit it and the bad debts recovered account is credited because the amount so received is a gain(Revenue) to the business. In such a case, the journal entry passed is:

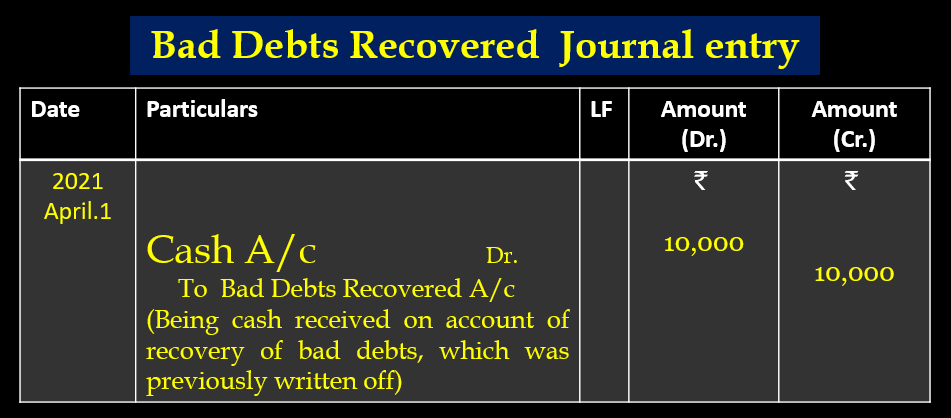

Bad Debts Recovered Journal entry Example

Example: April 1st, 2021, Received Cash from Mr. X 10,000 whose account was written off as bad debts previous year. Pass Journal Entry In the Books Of Mr. X.

Bad Debts-

When the goods are sold to a customer on credit and if the amount becomes irrecoverable due to his insolvency or for some other reason, the amount not recovered is called bad debts.

In other words, The Amount of Debt that cannot be recovered or collected from a debtor at the end of the year is called bad debts.

Cash Withdrawal from Bank Journal Entry

Cash deposit into bank journal entry

Double Column Cash Book (Cash and Bank)