Table of Contents

Important questions of fundamentals of partnership-3

1. Interest on Capital

2. Interest on drawing

3. Profit and Loss Appropriation Account

4. Profit and Loss Appropriation Account and Partners Capital Account

5. Past Adjustment

6. Guarantee of Profit

Important questions of fundamentals of partnership-3

Profit and Loss Appropriation Account:

- Profit and loss Appropriation account is a special type of account.

- Profit and loss Appropriation account is a nominal account.

- It is prepared to distribute the Net profits/Net Losses among the partners. (According to their profit sharing ratio).

- Profit and loss Appropriation account is an extension of Profit and Loss account.

- Prepared after preparing Profit and Loss Account.

- This account is prepared on the basis of the partnership deed or agreement.

- This account is prepared by partnership firms only.

- No use of this account for income tax purposes.

- This account is credited with the amount of net profit and debited with the amount of net loss.

- To prepare it, at first, the balance of the Profit and Loss Account is transferred to this account.

- All the appropriations like Interest on capital, Partner’s salaries, Partner’s fees, Partner’s commission, Partner’s bonus, transfer to reserve, etc. are recorded on the debit side of this account.

- The net profit (transfer from profit and loss account), interest on drawings, Interest on the Current Account (charged on the Debit balance of current account) are recorded on the credit side of this account.

- Reserves required for the future are created from this account.

The debit side of Profit and loss Appropriation Account records:

- Interest on Partner’s Capital

- Partner’s Salary

- Partner’s Fees

- Partners Commission

- Partners Bonus

- Transfer to General Reserves

The credit side of Profit and loss Appropriation Account records:

- Net Profit (Profit transfer from Profit and Loss Account)

- Interest on Partner’s drawings

- Interest on Current Account (Charged on debit Balance)

Important questions of fundamentals of partnership-3

PURPOSE OF PROFIT AND LOSS APPROPRIATION ACCOUNT

To know the distribution of profit among partners.

To show how much is payable to partners in the form of salary, bonus, fees, commission, interest on capital etc. these all are debited to Profit and Loss Appropriation Account.

To show how much interest on drawings Charged on partner’s drawings at the credit side of the Profit and Loss Appropriation Account.

To create reserve from the profits for future.

To distribute the profits among the partners in profit sharing ratio.

To distribute the Losses among the partners in profit sharing ratio

* Format of Profit and Loss Appropriation Account*

Important questions of fundamentals of partnership-3

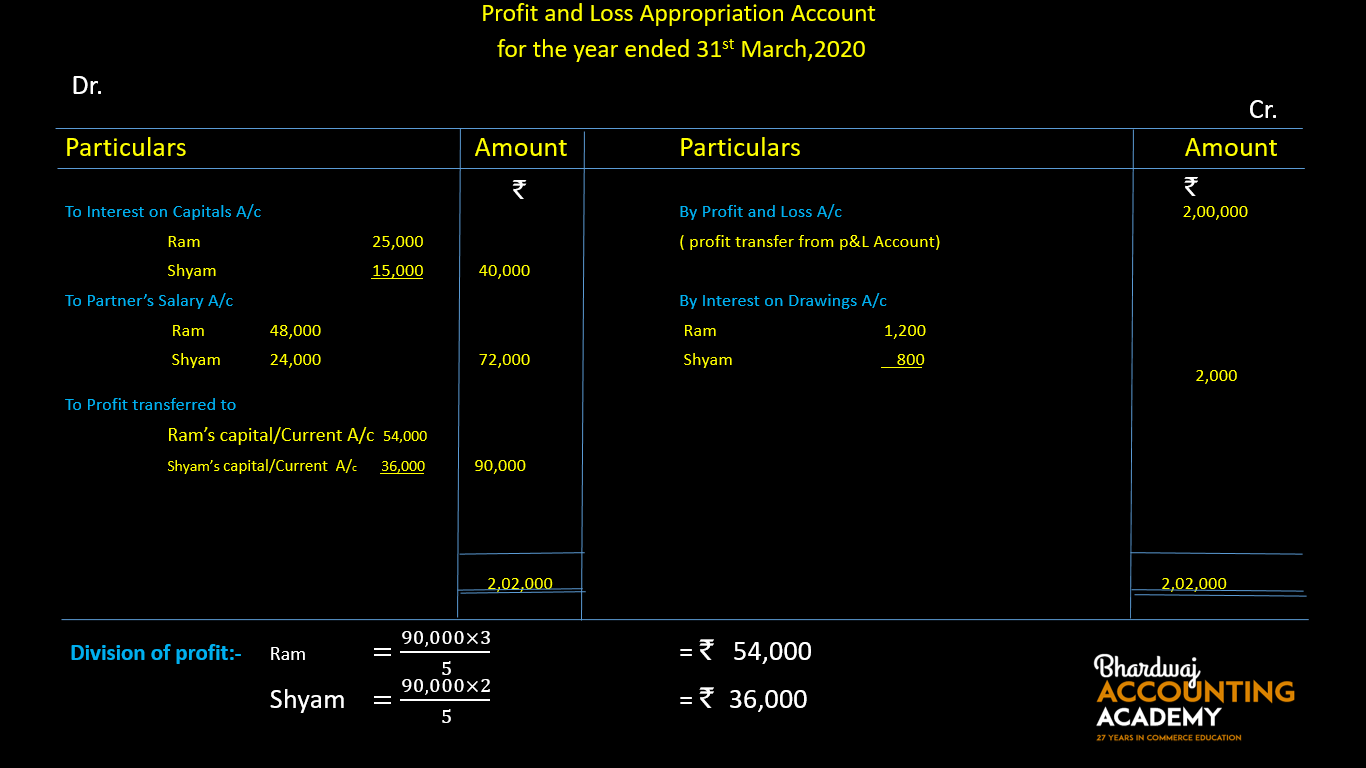

Example 1.

Ram and Shyam started a partnership business on 1st April 2019. Their capital contributions were ₹2,50,000 and ₹1,50,000 respectively. The partnership deed provided:

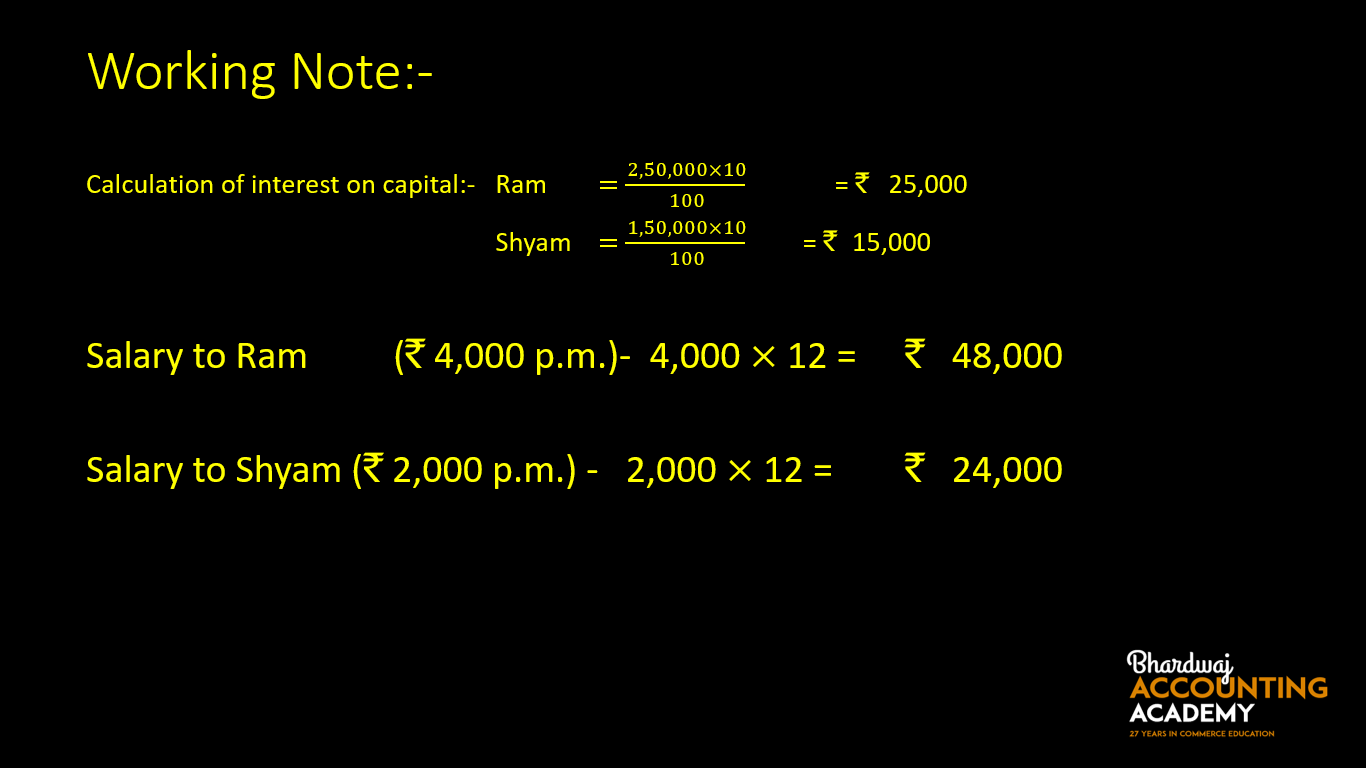

- Interest allowed on capitals @10% p.a.

- Ram, get a salary of ₹4,000 p.m. and Shyam ₹2,000 p.m.

- Profits are to be shared in the ratio of 3:2.

- Their Drawings are ₹ 30,000 and ₹20,000 respectively

- Interest charged on Drawings amounted to₹1,200 for Ram and ₹ 800 for Shyam.

The profits for the year ended 31st March 2020 before making the above appropriations were ₹ 2,00,000. The books are closed on March 31, every year.Prepare Profit and Loss Appropriation Account.

Solution:

Working Note:

Important questions of fundamentals of partnership-3

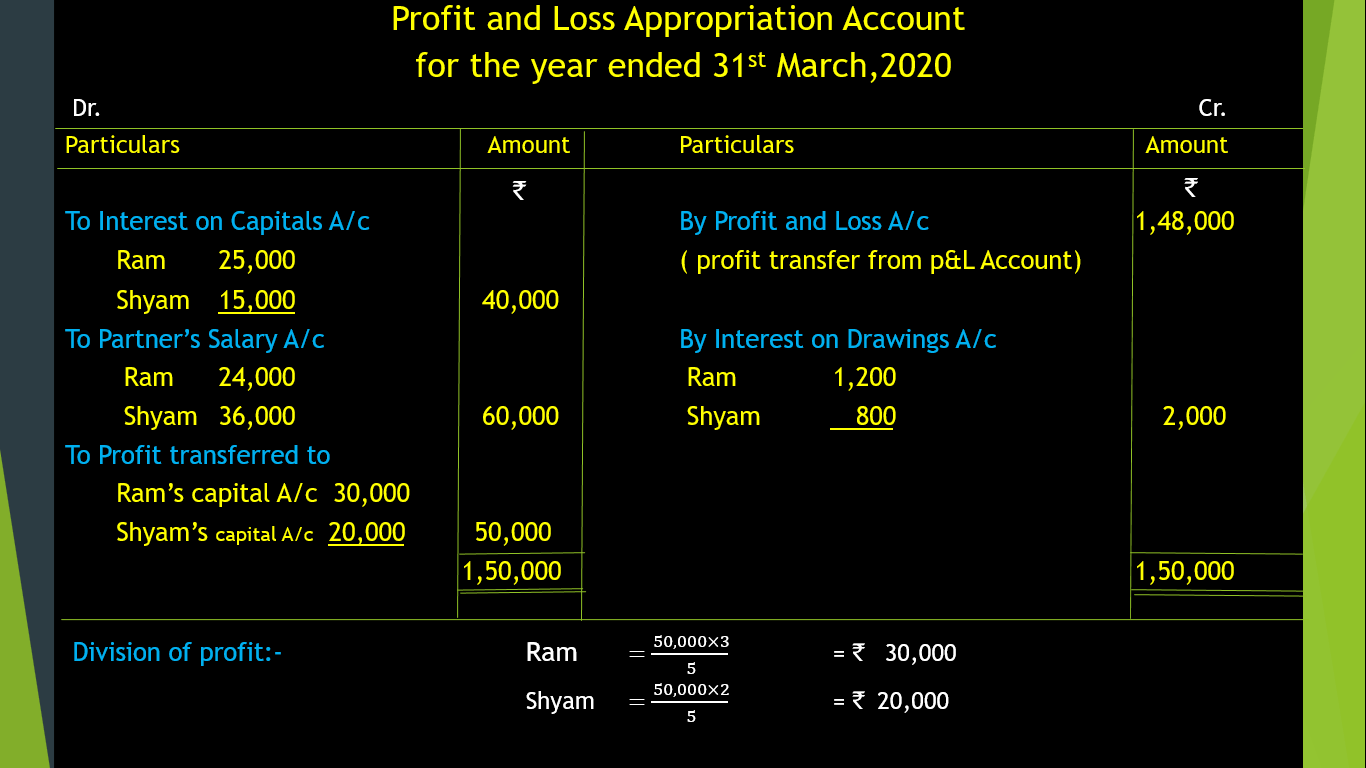

Example 2.

Ram and Shyam started a partnership business on 1st April, 2019. Their capital contributions were ₹2,50,000 and ₹1,50,000 respectively. The partnership deed provided:

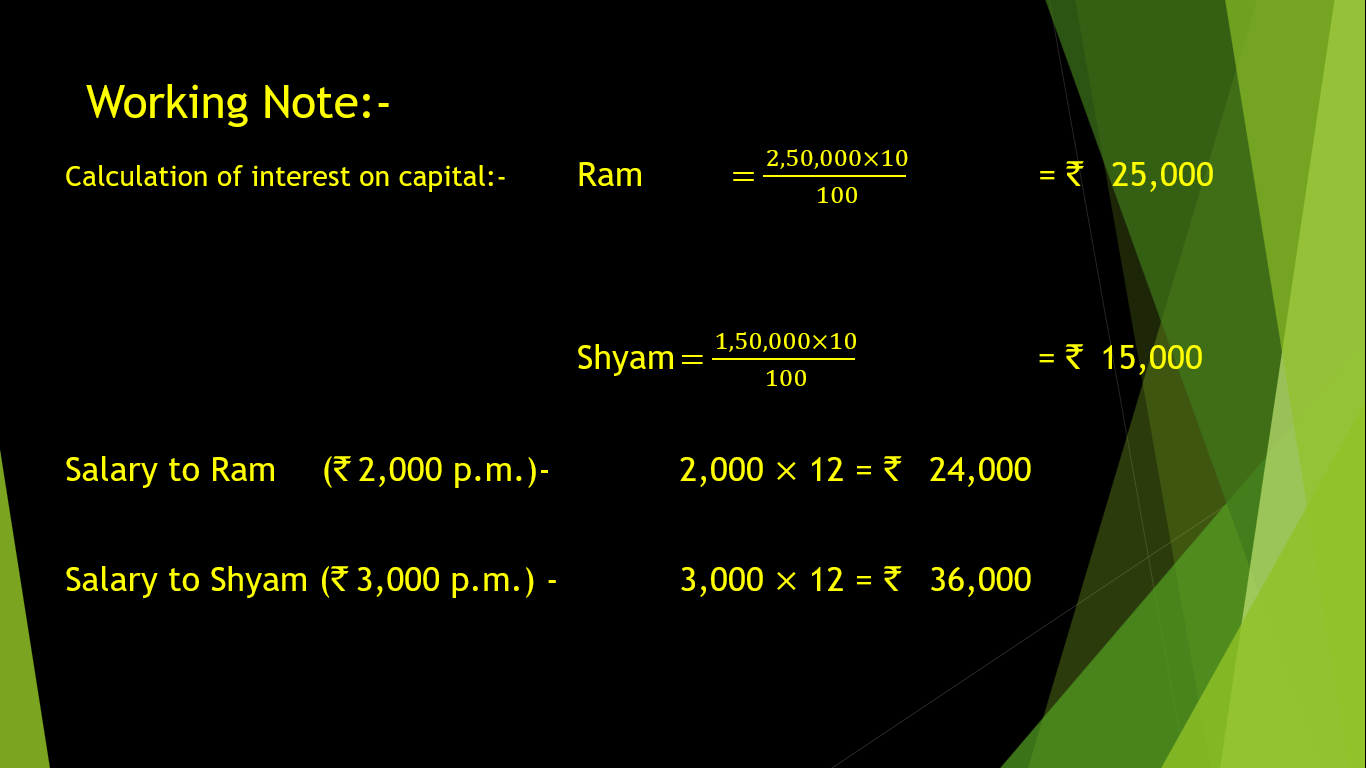

- Interest allowed on capitals @10% p.a.

- Ram, get a salary of ₹2,000 p.m. and Shyam ₹3,000 p.m.

- Profits are to be shared in the ratio of 3:2.

- Their Drawings are ₹30,000 and ₹20,000 respectively.

- Interest charged on Drawings amounted to ₹1,200 for Ram and ₹ 800 for Shyam.

The profits for the year ended 31st March, 2020 before making the above appropriations were ₹ 1,48,000. Prepare Profit and Loss Appropriation Account.

Solution:

Working Note:

Important questions of fundamentals of partnership-3

Example 3.

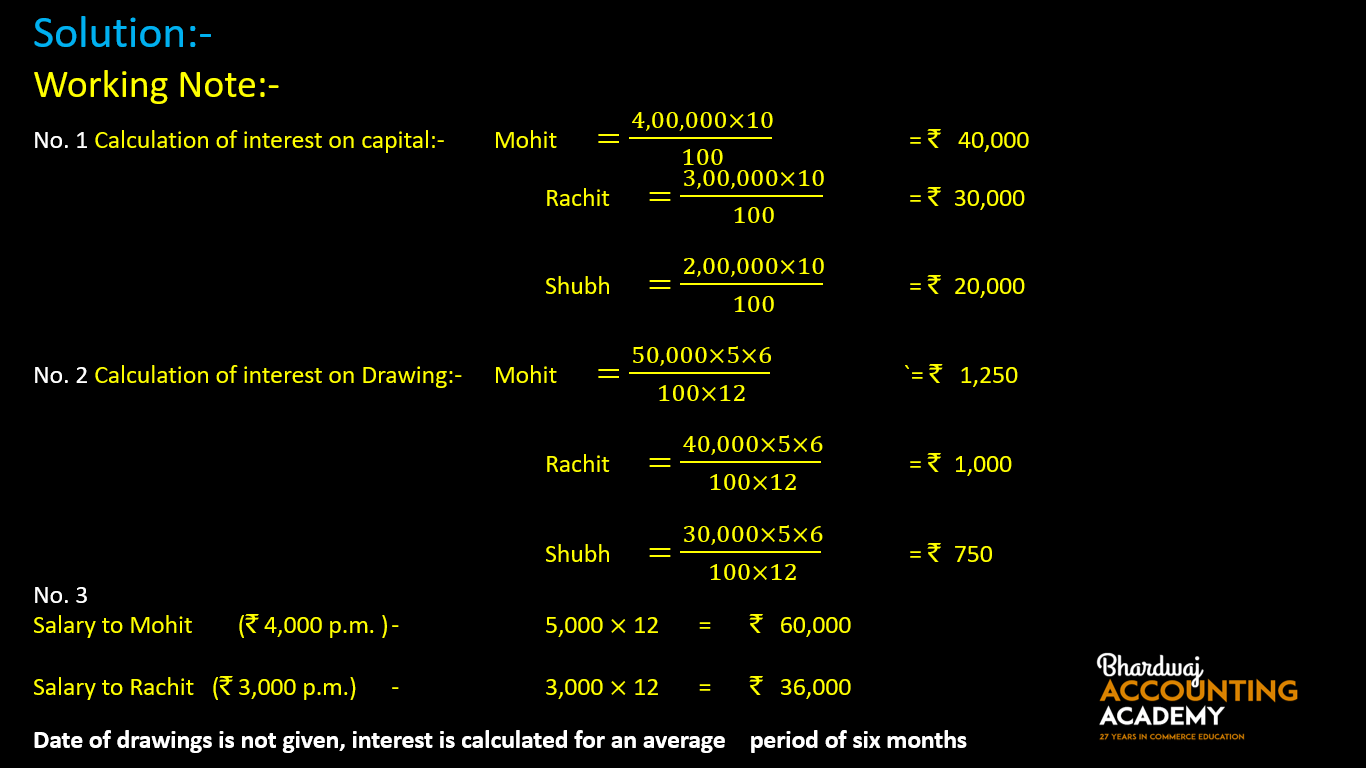

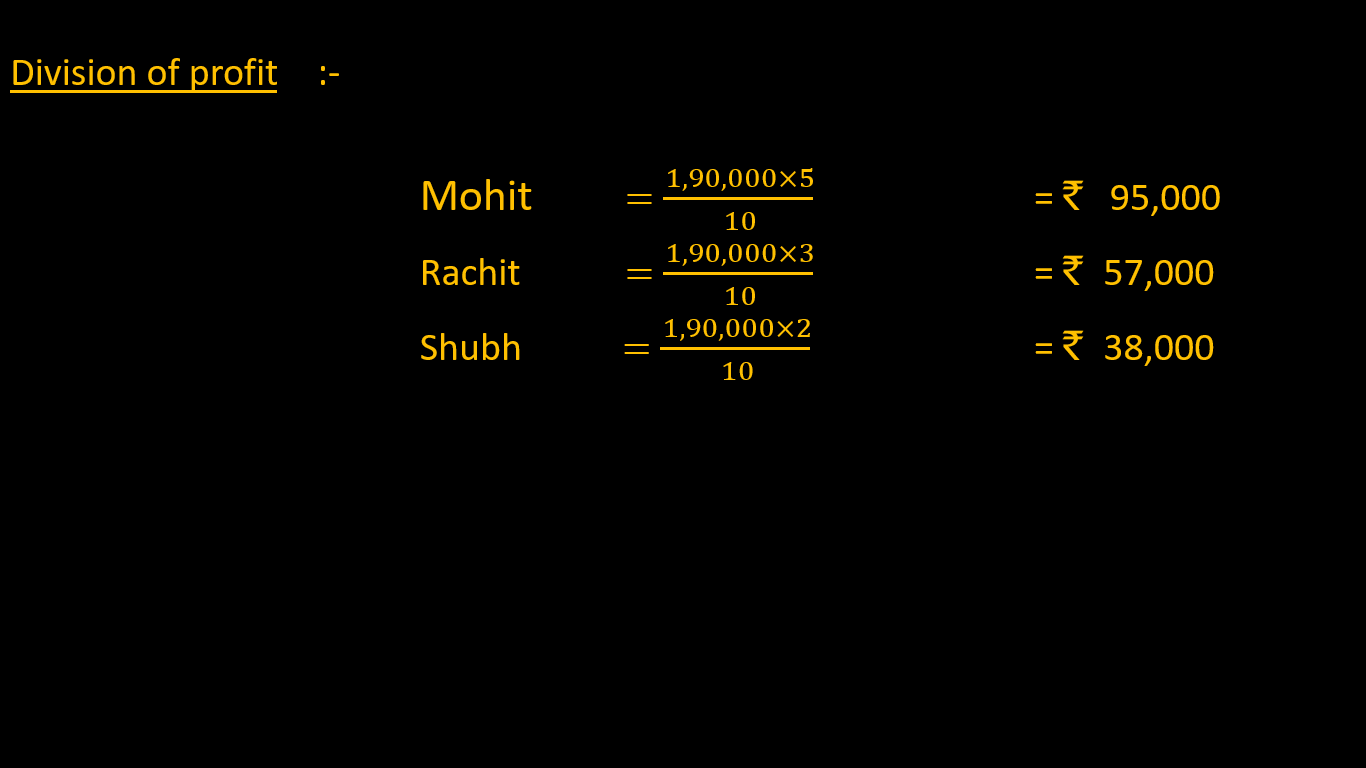

Mohit, Rachit, and Shubh started a partnership business on 1st April, 2019. Their capital contributions were ₹4,00,000 , ₹3,00,000 and ₹2,00,000 respectively. The partnership deed provided:

- Interest allowed on capitals @ 10% p.a.

- Mohit, get a salary of ₹5,000 p.m. and Rachit ₹3,000 p.m.

- Profits are to be shared in the ratio of 5:3:2.

- Their Drawings are ₹50,000, ₹40,000 and ₹30,000 respectively

- Interest charged on Drawings @ 5 % p.a.

- Shubh get a commission₹24,000.

The profits for the year ended 31st March, 2020 before making above appropriations were ₹ 3,97,000. Prepare Profit and Loss Appropriation Account.

Solution:

Working Note:

Important questions of fundamentals of partnership-3

Example 4.

Monika and Krishan are partners with a capital of ₹80,000 and ₹ 1,00,000 respectively on 1st April 2019. They agree on the followings:

(a) To share profit equally.

(b) Interest allowed on capital @ 9% p.a.

(c) Interest charged on drawing @ 6% p.a.

(d) Salary to be paid to Krishan @ ₹ 600 per month.

(e) Monika withdrew ₹8,000 and Krishan ₹ 6,000 during the year.

Profit for the year ending 31st March 2020 was ₹ 56,000 before the above appropriations. You are required to prepare Profit and Loss Appropriation account.

NOTE: Date of drawings is not given in the questions, so interest on drawing is calculated on the basis of average period of six months.

Answer: Net profit ₹33,020

Profit and loss Appropriation Account

Format of Profit and loss Appropriation Account

Hidden Goodwill at the time of Admission of A New Partner

Important questions of fundamentals of partnership

Important questions of fundamentals of partnership-2