Table of Contents

Interest Coverage Ratio

Interest Coverage Ratio

Interest Coverage Ratio establishes the relationship between Net Profit before Interest and Tax. This ratio expresses the relationship between profits available for payment of interest and the amount of interest payable to Debentureholders and lenders of long-term funds.

Key Points: Interest Coverage Ratio

- The objective of this ratio is to ascertain the amount of profit available to cover the interest on long-term debts. This ratio indicates whether a firm can pay the interest due on long-term debts or not.

- A higher ratio indicates that the firm can pay interest on long-term debts without any hurdle.

- A low ratio indicates that the firm may face problems in paying the interest due on long-term debts.

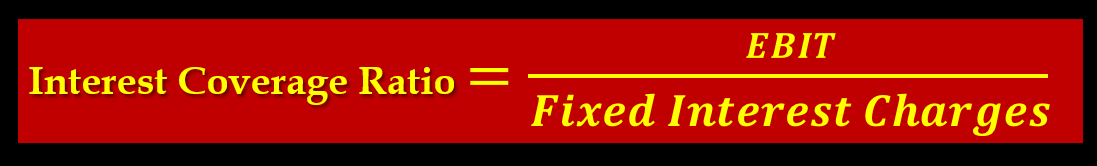

- The interest coverage ratio is calculated by dividing a company’s Profit or Earning before interest and Taxes (EBIT) by its fixed interest Charges during a given period.

- A higher interest coverage ratio is ideal. It means the company is financially stable.

- The ideal interest coverage ratio is 3 and above. Whereas 1.5 is the minimum acceptable ratio.

The formula for calculating Interest Coverage Ratio:

Or

EBIT=Earning before interest and Taxes

Example of the Interest Coverage Ratio:

1. Y Ltd. has a 10% long-term loan of ₹ 10,00,000. Its net profit before interest and tax was ₹ 12,00,000. Calculate interest coverage ratio.

Interest coverage ratio= Net Profit before Interest and Tax/ Interest on long-term loans

Interest on long-term loans= 10,00,000×10/100

Interest on long-term loans= 1,00,000

Net Profit before Interest and Tax=12,00,000

Interest coverage ratio= 12,00,000/ 1,00,000

Interest coverage ratio= 12 Times

2. Z Ltd. has a 8% long-term loan of ₹ 10,00,000 and 10 % Long term loan ₹ 15,00,000. Its net profit before interest and tax was ₹ 23,00,000. Calculate interest coverage ratio.

Interest coverage ratio= Net Profit before Interest and Tax/ Interest on long-term loans

Interest on long-term loans= 10,00,000×8/100

Interest on long-term loans= 80,000

Interest on long-term loans= 15,00,000×10/100

Interest on long-term loans= 1,50,000

Interest on long-term loans= 80,000+1,50,000

Interest on long-term loans= 2,30,000

Net Profit before Interest and Tax=23,00,000

Interest coverage ratio= 23,00,000/ 2,30,000

Interest coverage ratio= 10 Times

3. Z Ltd. has a 6% long-term loan of ₹ 5,00,000 and 10 % Long term loan ₹ 7,00,000. Its net profit after interest but before tax was ₹ 9,00,000. Calculate interest coverage ratio.

Interest coverage ratio= Net Profit before Interest and Tax/ Interest on long-term loans

Net Profit before Interest and Tax = Net profit after interest but before tax +Interest on long-term loans

Net Profit before Interest and Tax = 9,00,000 +30,000+70,000

Interest coverage ratio= 10,00,000/ 1,00,000

Interest coverage ratio= 10 Times

4. Q Ltd. has a 6% long-term loan of ₹ 5,00,000 and 10 % Long term loan ₹ 7,00,000. Its net profit after interest and tax was ₹ 4,80,000. Rate of tax 40 % Calculate interest coverage ratio.

Interest coverage ratio= Net Profit before Interest and Tax/ Interest on long-term loans

Net Profit before Tax = Net profit after tax ×100/ 100-Rate of tax

Net Profit before Tax = 4,80,000 ×100/100-40

Net Profit before Tax = 8,00,000

Interest on long-term loans= 5,00,000×6/100

Interest on long-term loans= 30,000

Interest on long-term loans= 7,00,000×10/100

Interest on long-term loans= 70,000

Interest on long-term loans= 30,000+70,000

Interest on long-term loans= 1,00,000

Net Profit before Interest and Tax= Net Profit before Tax+Interest

Net Profit before Interest and Tax= 8,00,000+1,00,000

Net Profit before Interest and Tax = 9,00,000

Interest coverage ratio= 9,00,000/ 1,00,000

Interest coverage ratio= 9 Times

5. Net profit after Income Tax: ₹39,600. Rate of Tax: 40%, ₹50,000, 6% First Mortgage debenture, ₹1,00,000, 7 % Second mortgage Debenture. Calculate interest coverage ratio.

Interest coverage ratio= Net Profit before Interest and Tax/ Interest on long-term loans

Net Profit before Tax = Net profit after tax ×100/ 100-Rate of tax

Net Profit before Tax = 39,600 ×100/100-40

Net Profit before Tax = 66,000

Interest on long-term loans= 50,000×6/100

Interest on long-term loans= 3,000

Interest on long-term loans= 1,00,000×7/100

Interest on long-term loans= 7,000

Interest on long-term loans= 3,000+7,000

Interest on long-term loans= 10,000

Net Profit before Interest and Tax= Net Profit before Tax+Interest

Net Profit before Interest and Tax= 66,000+10,000

Net Profit before Interest and Tax = 76,000

Interest coverage ratio= 76,000/ 10,000

Interest coverage ratio= 7.6 Times

Also read : Debtors Turnover Ratio (Trade Receivable Turnover Ratio)