Important questions of fundamentals of partnership-6

1. Interest on Capital

2. Interest on drawing

3. Profit and Loss Appropriation Account

4. Profit and Loss Appropriation Account and Partners Capital Account

5. Past Adjustment

6. Guarantee of Profit

Important questions of fundamentals of partnership-6

Guarantee of Profit:

A guarantee of profit means a minimum amount of profit to be paid to a partner.

This amount shall be given to him if his share of profit is lower than the guaranteed amount.

The deficit shall be borne either by one of the old partners or by all the old partners in a particular agreed ratio.

If there is no agreement, then in their old profit sharing ratio, if his actual share of profit is more than the guaranteed amount, then, he will be given his actual share of profit.

He gets the guaranteed amount or the actual share of profit, whichever is higher.

Step of Solution:

1. Distribute profit among all the partners in the profit-sharing ratio.

2. Work out the amount of deficiency by comparing it with the guaranteed amount and his actual share of profit.

3. The other partners will bear the deficiency in an agreed new ratio.

Important questions of fundamentals of partnership-6

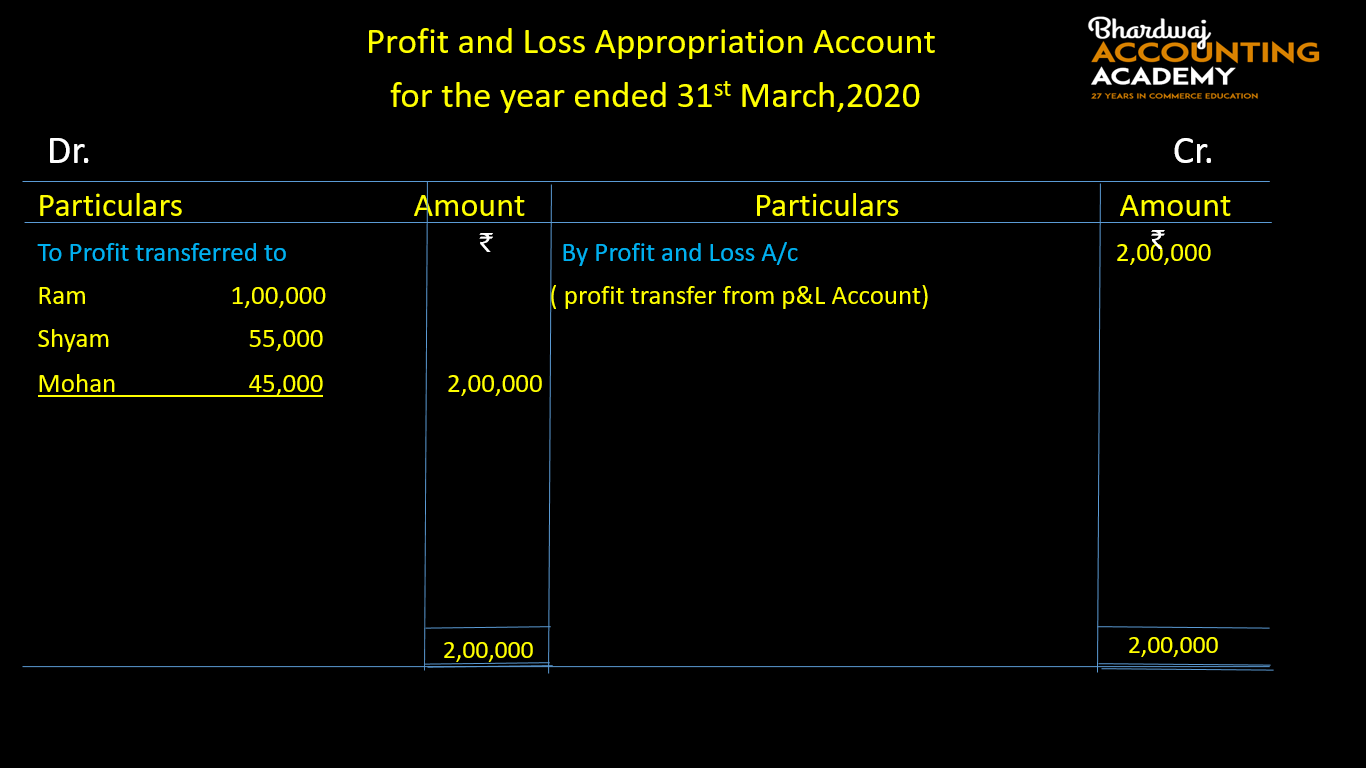

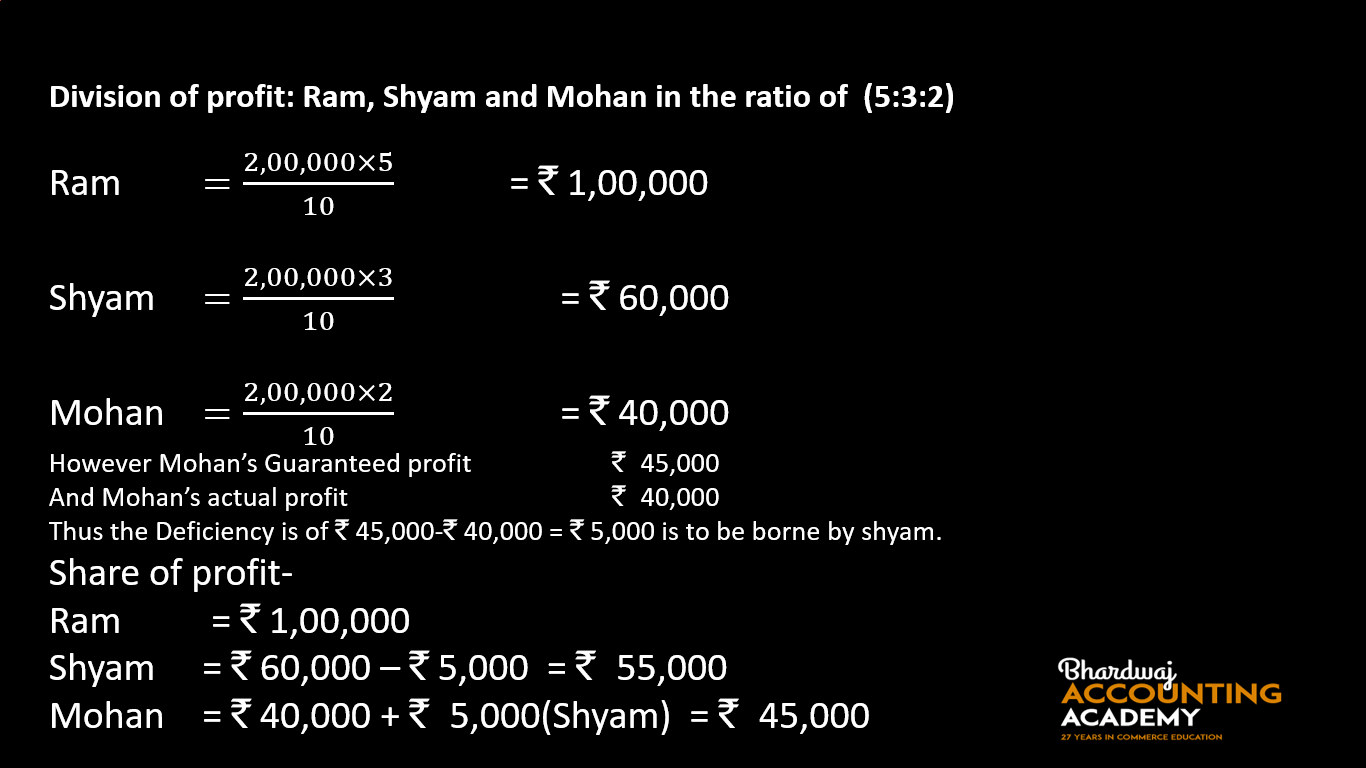

1. Ram, Shyam, and Mohan are partners in a firm. Their profit sharing ratio is 5 : 3 : 2. However, Mohan is guaranteed a minimum amount of ₹ 45,000 as share of profit every year. Any deficiency arising on that amount shall be met by Shyam. The profits for the years ended 31st March, 2020 ₹ 2,00,000. Prepare the Profit & Loss Appropriation Account.

Solution:

Working Note:

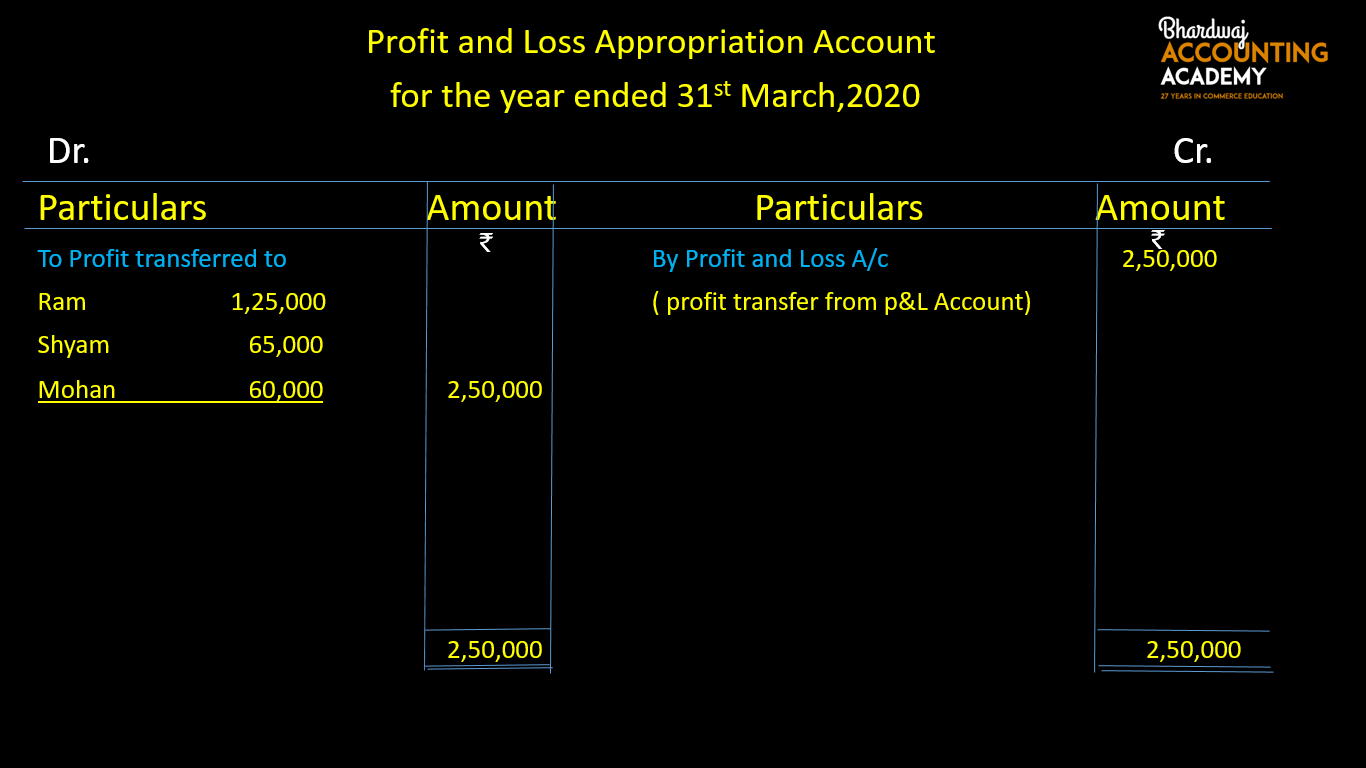

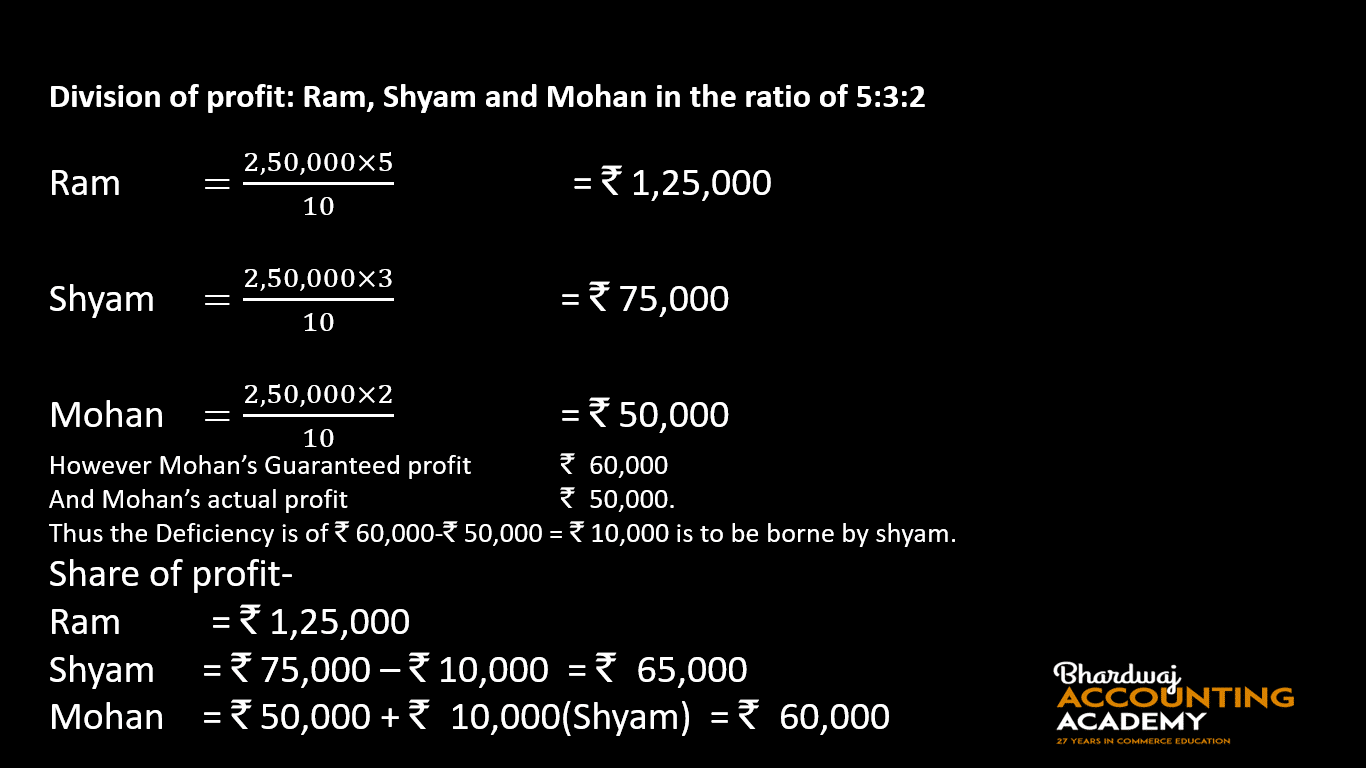

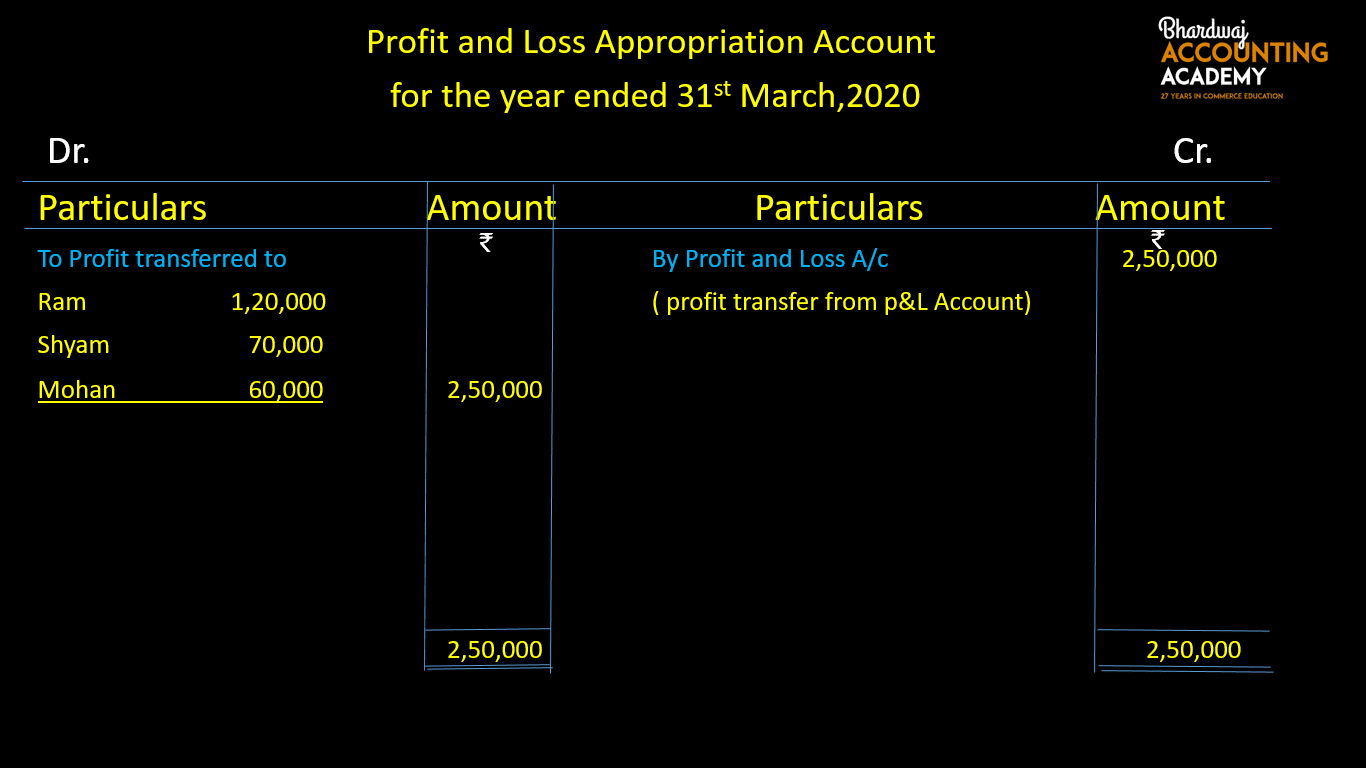

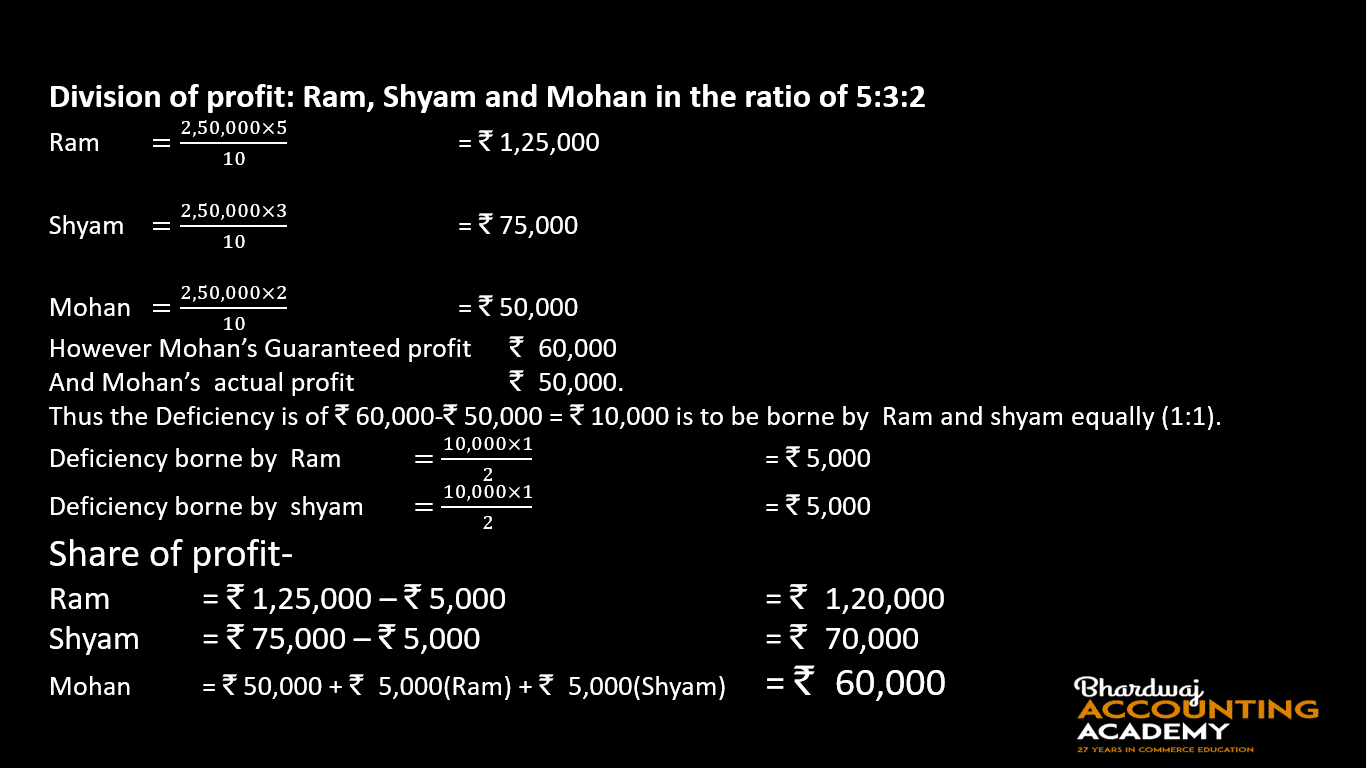

2.Ram, Shyam and Mohan are partners in a firm. Their profit sharing ratio is 5 : 3 : 2. However, Mohan is guaranteed a minimum amount of ₹ 60,000 as share of profit every year. Any deficiency arising on that amount shall be met by Shyam. The profits for the years ended 31st March, 2020 ₹ 2,50,000. Prepare the Profit & Loss Appropriation Account.

Solution:

Working Note:

Important questions of fundamentals of partnership-6

3. Ram, Shyam and Mohan are partners in a firm. Their profit sharing ratio is 5 : 3 : 2. However, Mohan is guaranteed a minimum amount of ₹ 60,000 as share of profit every year. Any deficiency arising on that amount shall be met by Ram and Shyam equally. The profits for the years ended 31st March, 2020 ₹2,50,000. Prepare the Profit & Loss Appropriation Account.

Solution:

Working Note:

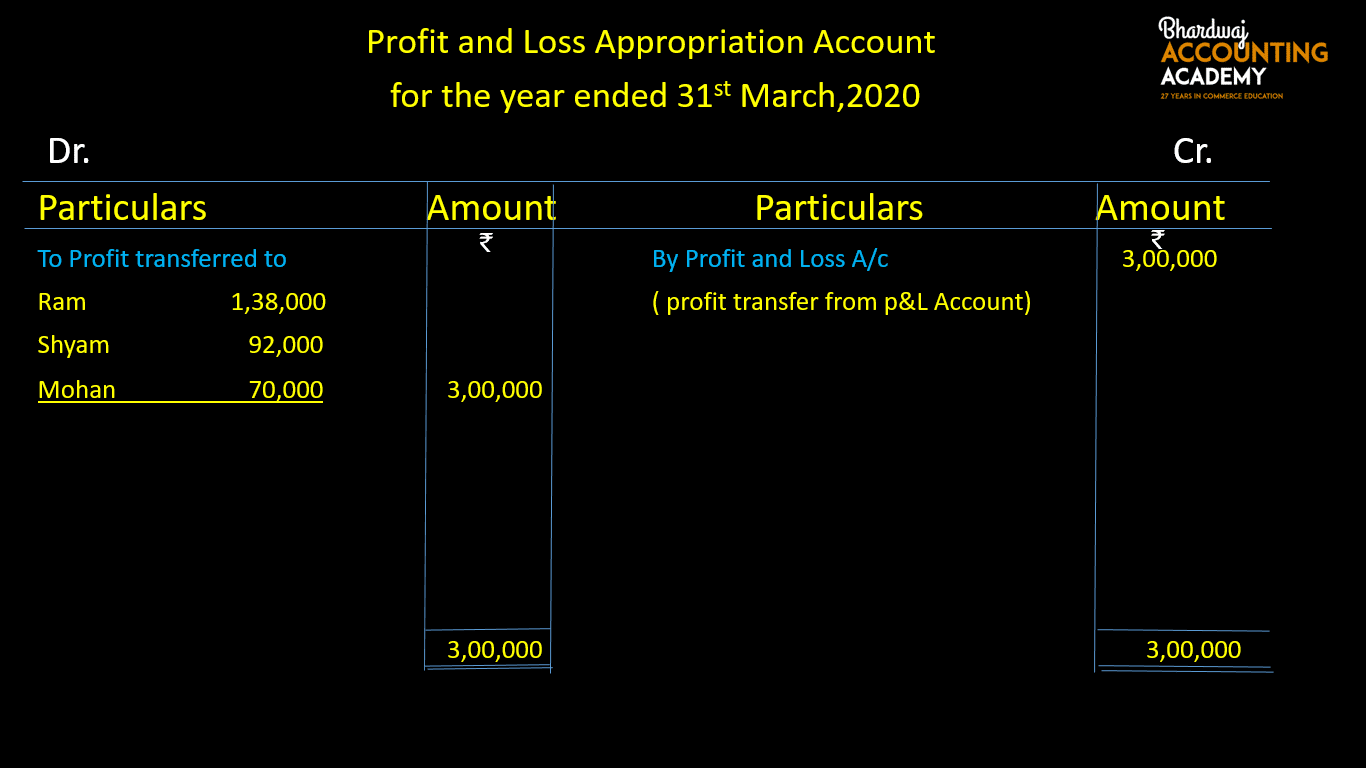

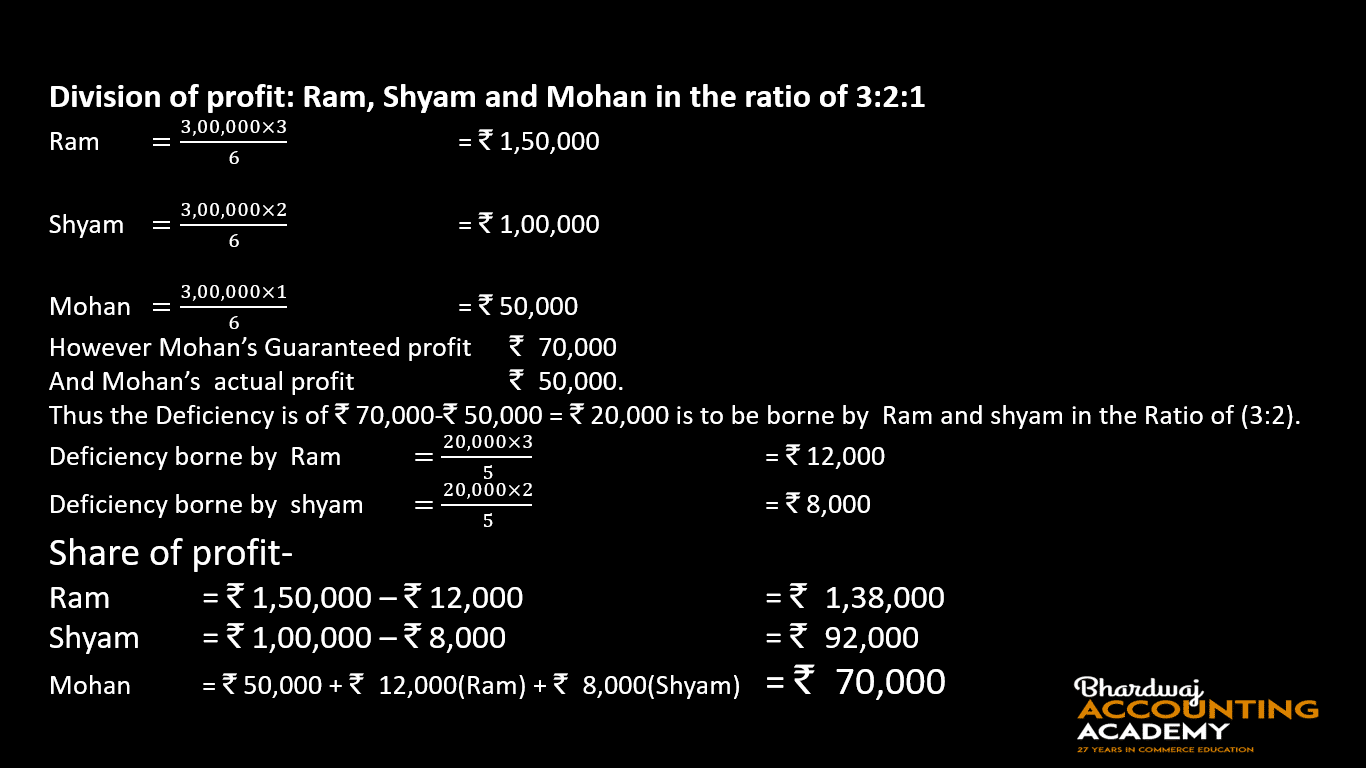

4.Ram, Shyam and Mohan are partners in a firm. Their profit sharing ratio is 3 : 2 : 1. However, Mohan is guaranteed a minimum amount of ₹70,000 as share of profit every year. Any deficiency arising on that amount shall be met by Ram and Shyam.The profits for the years ended 31st March, 2020 ₹ 3,00,000. Prepare the Profit & Loss Appropriation Account.

Solution:

Working Note:

Important questions of fundamentals of partnership-6

5.A, B, C and D are partners sharing profits and losses in the ratio of 4:3:2:1. Their capitals as on 1st April, 2019 were ₹ 3,00,000; ₹ 2,50,000; ₹ 1,50,000 and ₹ 1,00,000 respectively.

D’s share of profits excluding interest on capital has been guaranteed by the firm to be not less than ₹ 2,50,000.

C’s share of profits including interest on capital and salary guaranteed by A is not less than ₹ 2,60,000.

The profits for the year ended 31st March, 2020 were ₹ 9,00,000 before interest on capital @ 10% and salary to C @ ₹10,000 per month.

Prepare the Profit and Loss Appropriation Account for the year ended on March 31, 2020.

6. The partnership agreement of Rohit, Ali and Sneh provides that:

1. Profits will be shared by them in the ratio of 2:2:1.

2. Interest on capital to be allowed at rate of 6% per annum.

3. Interest on drawings to be charged at the rate of 3% per annum.

4. Ali to be given a salary of ₹ 500 per month.

5. Ali’s guarantee to the firm that the firm would earn a net profit of at least ₹ 80,000 per annum and any shortfall in these profits would be personally met by him.

The capitals of the partners on 1st April, 2013, were: Rohit- ₹ 1,20,000; Ali- ₹ 1,00,000; Sneh- ₹ 1,00,000. During the financial year 2013-14, all the three partners withdrew ₹ 1,000 each at the beginning of every month. The net profit of the firm for the year 2013-14 was ₹ 70,000.

Prepare the Profit and Loss Appropriation Account for the year ended on March 31, 2014.

Important questions of fundamentals of partnership-6

Important questions of fundamentals of partnership-3

Profit and loss Appropriation Account

Format of Profit and loss Appropriation Account

Hidden Goodwill at the time of Admission of A New Partner

Important questions of fundamentals of partnership

Important questions of fundamentals of partnership-2

Goodwill questions for practice Class 12 ISC & CBSE

Important questions of fundamentals of partnership-5