Admission of a partner-Important Questions-3

1. Calculation the new profit sharing ratio and sacrificing ratio

2. Accounting treatment of goodwill;

3. Revaluation of assets and reassessment of liabilities;

4. Accounting treatment of undistributed profits and reserves;

5. Accounting treatment of Workmen Compensation Reserves;

6. Accounting treatment of Investment fluctuation Reserves;

7. Adjustment of Deferred revenue Expenditure

8. Prepare Revaluation Account,

9. Prepare Partners’ Capital Accounts and balance sheet of the reconstituted firm.

10. Adjustment of Capital on the basis of new partner capital or New profit-sharing Ratio.

11. Calculation of New partner’s capital on the basis of old partner’s adjusted capital.

Admission of a partner-Important Questions-3

Revaluation of assets and reassessment of liabilities;

Question 1.

A and B are partners in a firm sharing profits and losses in the ratio of 3:2. They admit C as a new partner for 1/4 share of profit. Pass Journal Entries in the Books of the firm on the admission of C:

1. Stock be valued at ₹ 11,00,000. (Book value of stock ₹ 12,00,000)

2. Machinery is to be depreciated by 10%. (Book value of Machinery ₹ 15,00,000)

3. A provision for doubtful debts is to be made on debtors @5%.(Book value of Debtors ₹ 4,00,000)

4. Building to be appreciated by 20%.(Book value of Building ₹ 20,00,000)

5. A liability for ₹ 20,000 included in sundry creditors is not likely to arise.

Solution:

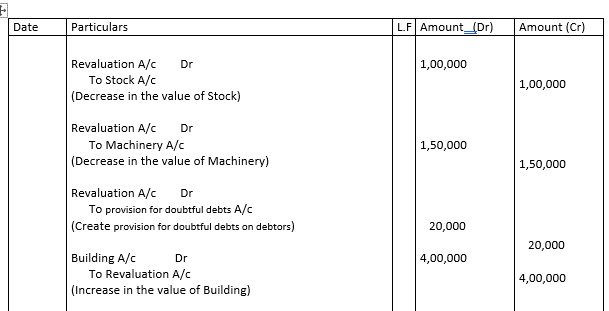

Journal Entries In the Books of Firm

Admission of a partner-Important Questions-3

Question 2.

A and B are partners in a firm sharing profits and losses in the ratio of 3:2. They admit C as a new partner for 1/4 share of profit. Pass Journal Entries in the Books of the firm on the admission of C:

1. Stock decreased by ₹ 1,00,000.

2. Machinery is to be depreciated by ₹ 1,50,000.

3. A provision for doubtful debts is to be made on debtors ₹ 20,000.

4. Building to be appreciated by ₹ 4,00,000.

5. sundry creditors decreased by ₹ 20,000.

Solution:

Journal Entries In the Books of Firm

Admission of a partner-Important Questions-3

Question 3.

X and Y are partners in a firm sharing profits and losses in the ratio of 3:2. They admit Z as a new partner for 1/5 share of profit. Pass Journal Entries in the Books of the firm on the admission of Z and Prepare Revaluation Account:

1. Stock would be increased to ₹ 5,50,000. (Book value of stock ₹ 4,50,000)

2. Machinery would be decreased to ₹ 5,50,000. (Book value of Machinery ₹ 7,00,000)

3. A provision for doubtful debts is to be made on debtors ₹ 20,000.

4. Building re-valued to ₹ 8,00,000. (Book value of Building ₹ 6,00,000)

5. A creditor of ₹ 20,000 not recorded in books to be taken into account.

Solution:

Journal Entries In the Books of Firm

1. Stock A/c Dr 1,00,000

To Revaluation A/c 1,00,000

(Increase in the value of stock)

2. Revaluation A/c Dr 1,50,000

To Machinery A/c 1,50,000

(Decrease in the value of machinery )

3.Revaluation A/c Dr 20,000

To Provision for Doubtful Debts A/c 20,000

(create Provision for Doubtful Debts on debtors)

4. Building A/c Dr 2,00,000

To Revaluation A/c 2,00,000

(Increase in the value of Building)

5. Revaluation A/c Dr 20,000

To Creditors A/c 20,000

(creditor of ₹ 20,000 not recorded in books to be taken into account)

6. Revaluation A/c Dr 1,10,000

To X’s Capital A/c 66,000

To Y’s Capital A/c 44,000

(Profit on revaluation transferred to old partner’s capital Account in their old profit sharing ratio 3:2)

Admission of a partner-Important Questions-3

Question 4.

X and Y are partners in a firm sharing profits and losses in the ratio of 3:2. They admit Z as a new partner for 1/5 share of profit. Pass Journal Entries in the Books of the firm on the admission of Z and Prepare Revaluation Account:

1. Stock would be increased by 10%. (Book value of stock ₹ 5,00,000)

2. Machinery would be decreased to ₹ 5,50,000. (Book value of Machinery ₹ 6,00,000)

3. A provision for doubtful debts is to be made on debtors ₹ 10,000.

4. Building would be increased to ₹ 8,00,000. (Book value of Building ₹ 7,00,000)

5. A creditor of ₹ 10,000 not recorded in books to be taken into account.

6. Market Value of Investment ₹ 1,00,000.(Book Value of Investment ₹ 80,000)

7. A patent of ₹ 20,000 not recorded in books to be taken into account.

Solution:

Journal Entries In the Books of Firm

1. Stock A/c Dr 50,000

To Revaluation A/c 50,000

(Increase in the value of stock)

2. Revaluation A/c Dr 50,000

To Machinery A/c 50,000

(Decrease in the value of machinery )

3.Revaluation A/c Dr 10,000

To Provision for Doubtful Debts A/c 10,000

(create Provision for Doubtful Debts on debtors)

4. Building A/c Dr 1,00,000

To Revaluation A/c 1,00,000

(Increase in the value of Building)

5. Revaluation A/c Dr 10,000

To Creditors A/c 10,000

(creditor of ₹ 20,000 not recorded in books to be taken into account)

6. Investment A/c Dr 20,000

To Revaluation A/c 20,000

(Increase in the value of Investment)

7. Patent A/c Dr 20,000

To Revaluation A/c 20,000

(A patent of ₹ 20,000 not recorded in books to be taken into account.)

8. Revaluation A/c Dr 1,20,000

To X’s Capital A/c 72,000

To Y’s Capital A/c 48,000

(Profit on revaluation transferred to old partner’s capital Account in their old profit sharing ratio 3:2)

Admission of a partner-Important Questions-3

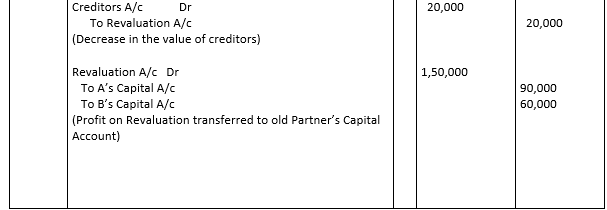

Question 5.

X and Y are partners in a firm sharing profits and losses in the ratio of 1:1. They admit Z as a new partner for 1/10 share of profit. Pass Journal Entries in the Books of the firm on the admission of Z and Prepare Revaluation Account:

1. Stock is undervalued by 10%. (Book value of stock ₹ 1,80,000)

2. Machinery would be decreased to ₹ 5,80,000. (Book value of Machinery ₹ 6,00,000)

3. A provision for doubtful debts is to be made on debtors @ 10 % (Book Value Of Debtors ₹ 80,000).

4. Building is overvalued by 10%. (Book value of Building ₹ 3,30,000)

5. A Outstanding Expense of ₹ 5,000 not recorded in books to be taken into account.

6. Market Value of Investment ₹ 75,000. (Book Value of Investment ₹ 80,000)

7. A Computer of ₹ 25,000 not recorded in books to be taken into account.

Solution:

Journal Entries In the Books of Firm

1. Stock A/c Dr 20,000

To Revaluation A/c 20,000

(Increase in the value of stock)

Actual Value of Stock= 1,80,000×100/90= 2,00,000

Book Value of Stock=1,80,000

2. Revaluation A/c Dr 20,000

To Machinery A/c 20,000

(Decrease in the value of machinery )

3. Revaluation A/c Dr 8,000

To Provision for Doubtful Debts A/c 8,000

(create Provision for Doubtful Debts on debtors)

4. Revaluation A/c Dr 30,000

To Building A/c 30,000

(Increase in the value of Building)

Actual Value of Building= 3,30,000×100/110= 3,00,000

Book Value of Building=3,30,000

5. Revaluation A/c Dr 5,000

To Outstanding Expenses A/c 5,000

(Outstanding Expenses of ₹ 5,000 not recorded in books to be taken into account)

6. Revaluation A/c Dr 5,000

To Investment A/c 5,000

(Decrease in the value of Investment)

7. Computer A/c Dr 25,000

To Revaluation A/c 25,000

(A Computer of ₹ 25,000 not recorded in books to be taken into account.)

8. X’s Capital A/c Dr 11,500

Y’s Capital A/c Dr 11,500

To Revaluation A/c 23,000

(Loss on revaluation transferred to old partner’s capital Account in their old profit sharing ratio 1:1)

Admission of a partner-Important Questions-3

Admission of a partner-Important Questions-1

Admission of a partner-Important Questions-2

Important questions of fundamentals of partnership-3

Profit and loss Appropriation Account

Format of Profit and loss Appropriation Account

Hidden Goodwill at the time of Admission of A New Partner

Important questions of fundamentals of partnership

Important questions of fundamentals of partnership-2

Goodwill questions for practice Class 12 ISC & CBSE

Important questions of fundamentals of partnership-5

ACCOUNTING TREATMENT OF GOODWILL AT THE TIME OF ADMISSION OF A NEW PARTNER