Admission of a partner-Important Questions-5

1. Calculation the new profit sharing ratio and sacrificing ratio

2. Accounting treatment of goodwill;

3. Revaluation of assets and reassessment of liabilities;

4. Accounting treatment of undistributed profits and reserves;

5. Accounting treatment of Workmen Compensation Reserves;

6. Accounting treatment of Investment fluctuation Reserves;

7. Partners’ Capital Accounts and balance sheet of the reconstituted firm.

8. Adjustment of old partner’s Capital on the basis of new partner capital or New profit-sharing Ratio.

9. Calculation of New partner’s capital on the basis of the old partner’s adjusted capital.

Admission of a partner-Important Questions-5

Partners’ Capital Accounts and balance sheet of the reconstituted firm

Question 1.

On that date Sohan is admitted into the partnership for 1/5 share of profit on the following terms:

- Sohan brings in ₹ 20,000 as capital and ₹8,000 as premium for goodwill in cash.

- The value of the stock is reduced by 20% while plant and machinery is appreciated by 10%.

- Furniture is revalued at ₹9,000.

- A provision for doubtful debts is to be created on sundry debtors at 5%

- Investment worth ₹ 10,000 (not mentioned in the balance sheet) is to be taken into account.

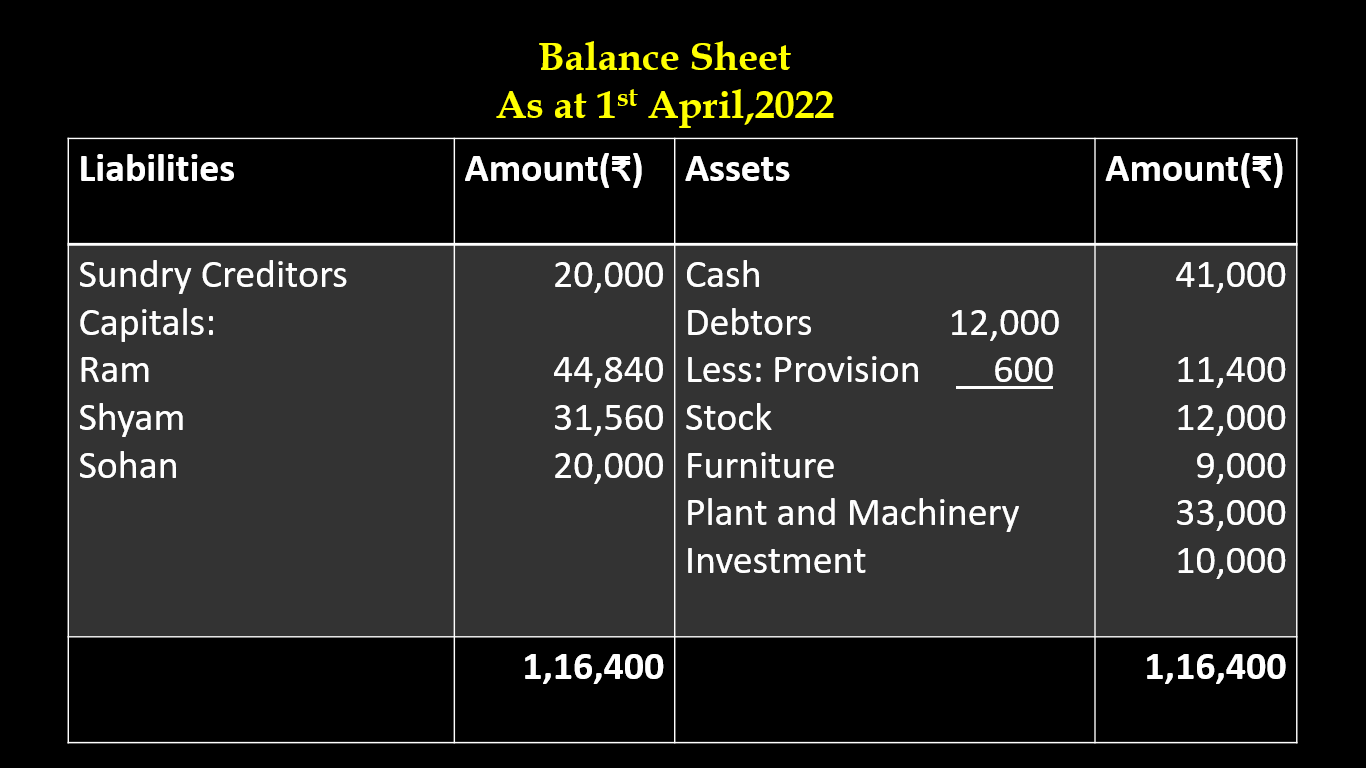

Pass journal entries in the Books of firm and prepare:

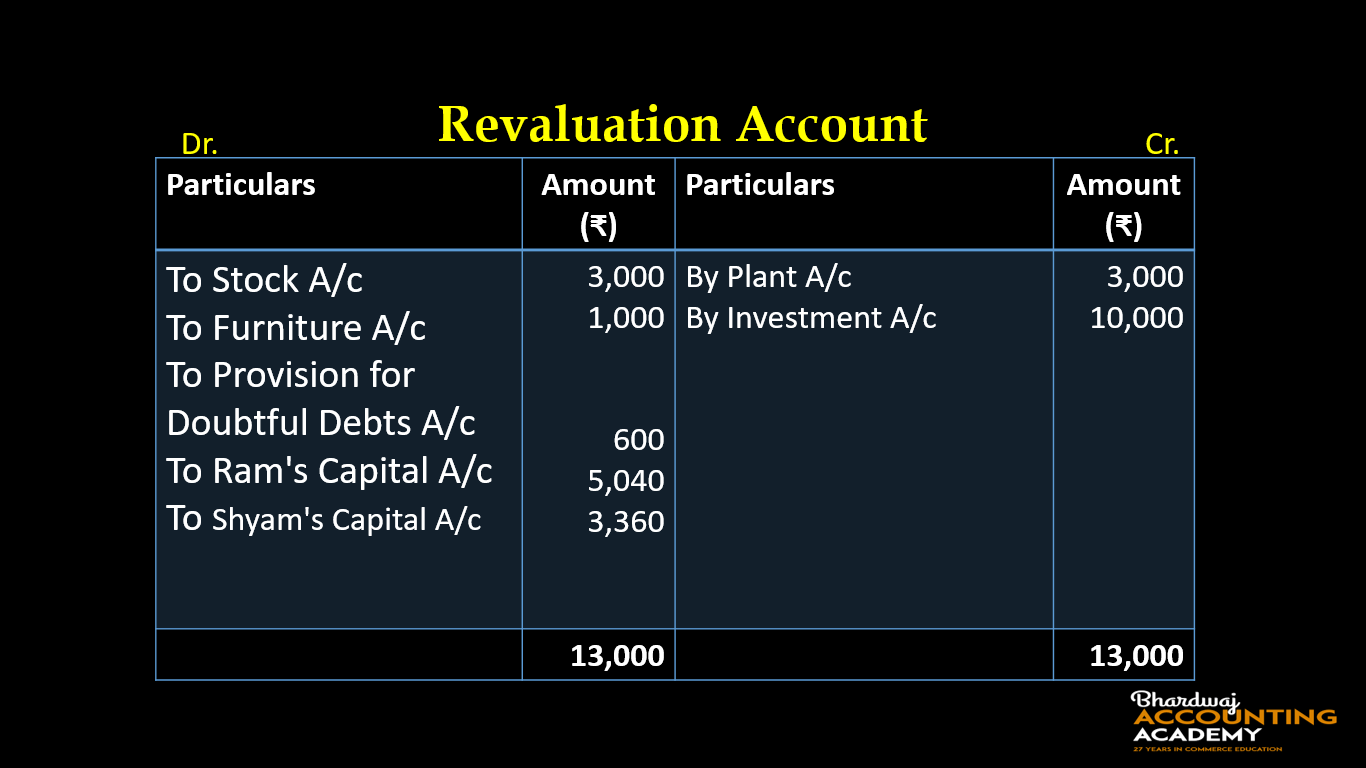

1. Revaluation account

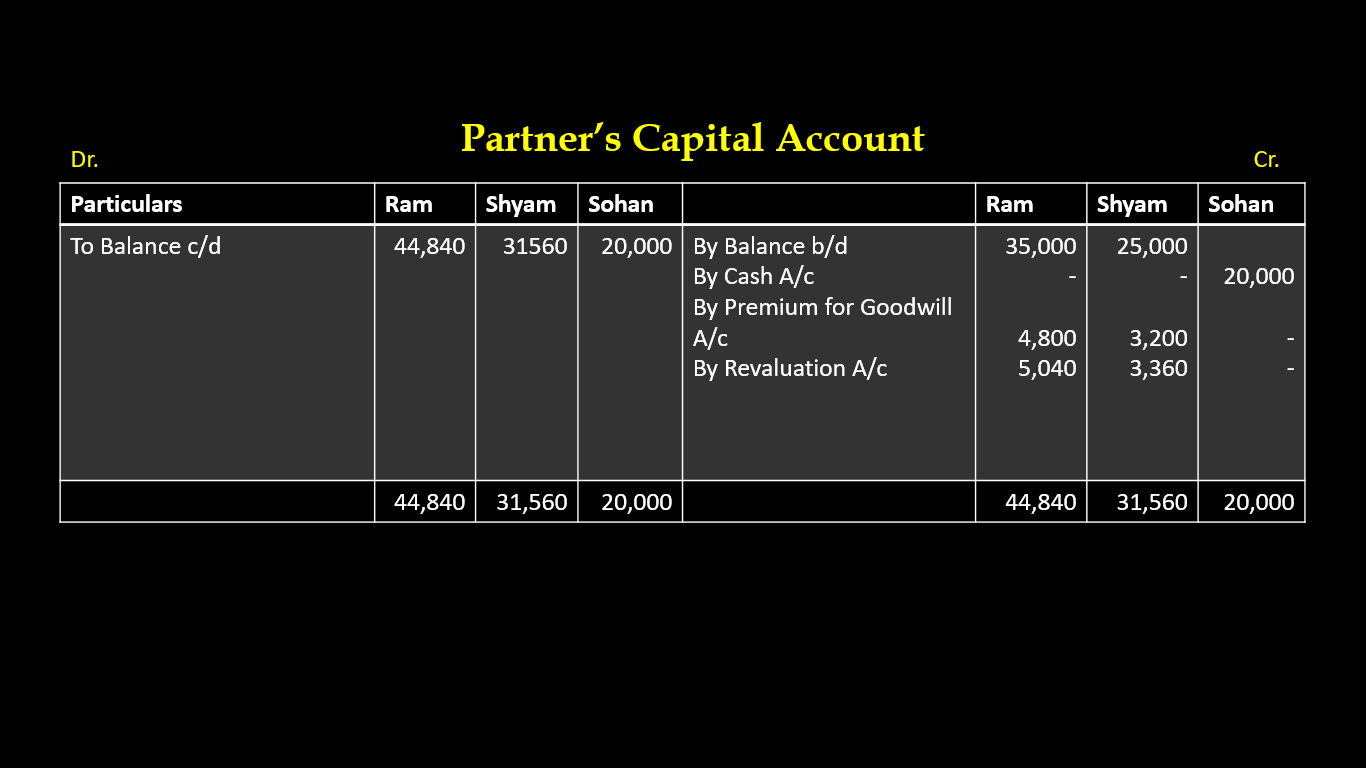

2. Partner’s Capital Account

3. Cash Account

4. Balance sheet

Solution:

Journal entries in the Books of firm

Bank A/c Dr. 28,000

To Sohan’s Capital A/c 20,000

To Premium for Goodwill A/c 8,000

(Cash brought by Sohan for his share of goodwill and capital)

Premium for Goodwill A/c A/c Dr. 8,000

To Ram’s Capital A/c 4,800

To Shyam’s Capital A/c 3,200

(Goodwill transferred to existing partner’s capital account in their sacrificing ratio 3:2)

Revaluation A/c Dr. 3,000

To Stock A/c 3,000

(Decrease in the value of stock)

Plant and machinery A/c Dr. 3,000

To Revaluation A/c 3,000

(Increase in the value of Plant and machinery)

Revaluation A/c Dr. 1,000

To Furniture A/c 1,000

(Decrease in the value of Furniture)

Revaluation A/c Dr. 600

To Provision for doubtful debts A/c 600

(Create provision for doubtful debts on debtors)

Investment A/c Dr. 10,000

To Revaluation A/c 10,000

(Investment is to be taken into account)

Revaluation A/c Dr. 8,400

To Ram’s Capital A/c 5,040

To Shyam’s Capital A/c 3,360

(Profit on revaluation transferred to old partner’s capital Account )

Working Note:

*Calculation of New Ratio:

Old Ratio of Ram and Shyam 3:2

Let total Profit = 1

Sohan’s admitted as a new partner for 1/5 share of profit

The remaining share of Ram and Shyam = 1 – 1/5 = 4/5

Ram’s new share = 3/5 of 4/5 i.e. 12/25

Shyam’s new share = 2/5 of 4/5 i.e. 8/25

Sohan’s Share = 1/5 Or 5/25

The new profit sharing ratio of Ram, Shyam, and Mohan is :

= 12/25 : 8/25 : 5/25

= 12 : 8 : 5

*Calculation of Sacrifice Ratio:

Sacrificing ratio =Old Ratio – New Ratio

Ram Sacrificed = 3/5 – 12/25

= 15 – 12/25

= 3/25

Shyam Sacrificed = 2/5 – 8/25

= 10 – 8/25

= 2/25

Sacrificing Ratio of Ram and Shyam = 3 : 2

Admission of a partner-Important Questions-5

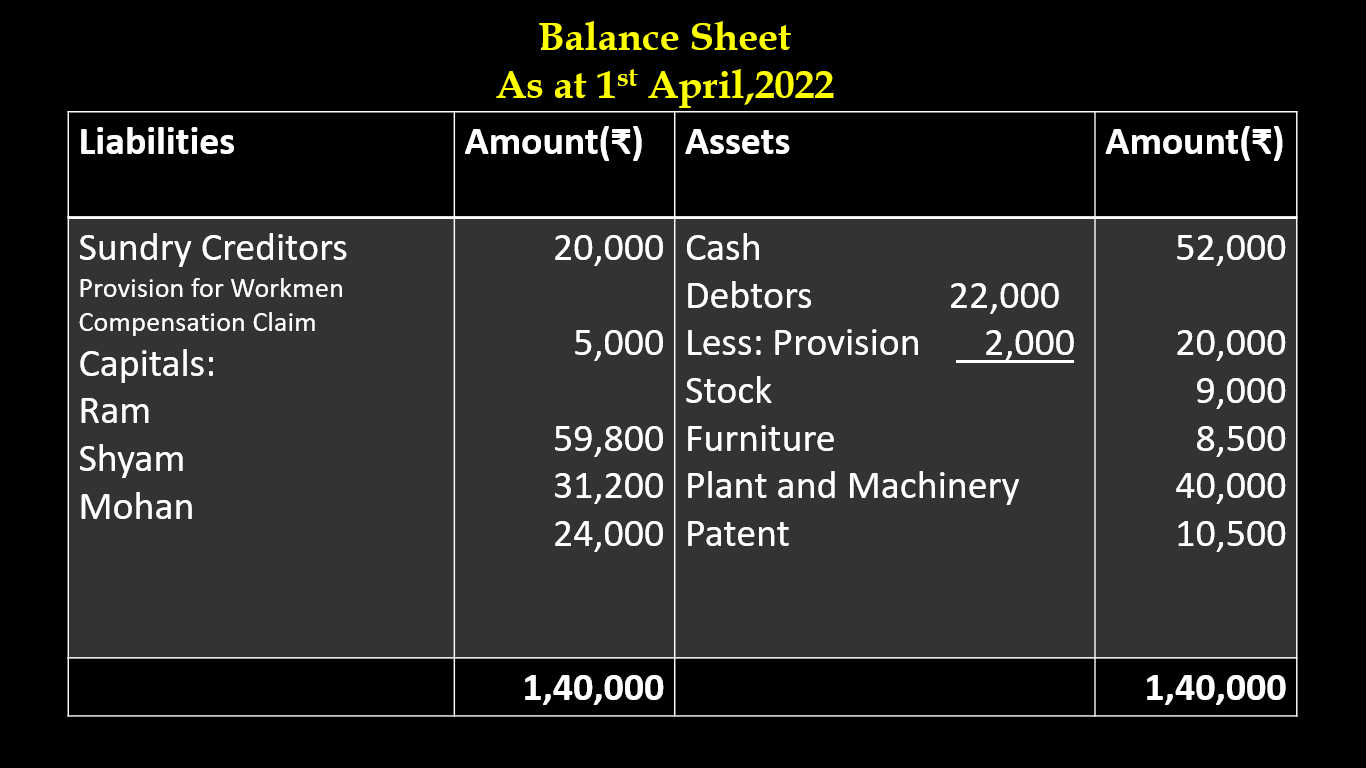

Question 2.

On that date, Mohan is admitted into the partnership for 1/4 share of profit on the following terms:

- Mohan brings ₹ 24,000 as capital and ₹ 15,000 as a premium for goodwill in cash.

- The value of the stock is reduced by₹6,000 while plant and machinery is appreciated by ₹ 10,000.

- Furniture is revalued at ₹ 8,500.

- A provision for doubtful debts is to be created on sundry debtors at ₹ 2,000.

- A patent worth ₹10,500 (not mentioned in the balance sheet) is to be taken into account.

- Provision for a workmen compensation claim ₹ 5,000.

Pass journal entries in the Books of the firm and prepare:

1. Revaluation account

2. Partner’s Capital Account

3. Cash Account

4. Balance sheet

Solution:

Journal entries in the Books of firm

Bank A/c Dr. 39,000

To Mohan’s Capital A/c 24,000

To Premium for Goodwill A/c 15,000

(Cash brought by Mohan for his share of goodwill and capital)

Premium for Goodwill A/c A/c Dr. 15,000

To Ram’s Capital A/c 12,000

To Shyam’s Capital A/c 3,000

(Goodwill transferred to existing partner’s capital account in their sacrificing ratio 4:1)

Revaluation A/c Dr. 6,000

To Stock A/c 6,000

(Decrease in the value of stock)

Plant and machinery A/c Dr. 10,000

To Revaluation A/c 10,000

(Increase in the value of Plant and machinery)

Revaluation A/c Dr. 1,500

To Furniture A/c 1,500

(Decrease in the value of Furniture)

Revaluation A/c Dr. 2,000

To Provision for doubtful debts A/c 2,000

(Create provision for doubtful debts on debtors)

Patent A/c Dr. 10,500

To Revaluation A/c 10,500

(patent is to be taken into account)

Revaluation A/c Dr. 5,000

To Provision for a workmen compensation claim A/c 5,000

(Provision for a workmen compensation claim )

Revaluation A/c Dr. 6,000

To Ram’s Capital A/c 4,800

To Shyam’s Capital A/c 1,200

(Profit on revaluation transferred to old partner’s capital Account )

General Reserve A/c Dr. 10,000

To Ram’s Capital A/c 8,000

To Shyam’s Capital A/c 2,000

(General Reserve transferred to existing partner’s capital account in their old ratio 4:1)

Working Note:

*Calculation of New Ratio:

Old Ratio of Ram and Shyam 4:1

Let total Profit = 1

Mohan’s admitted as a new partner for 1/4 share of profit

The remaining share of Ram and Shyam = 1 – 1/4 = 3/4

Ram’s new share = 4/5 of 3/4 i.e. 12/20

Shyam’s new share = 1/5 of 3/4 i.e. 3/20

Sohan’s Share = 1/4 Or 5/20

The new profit sharing ratio of Ram, Shyam, and Mohan is :

= 12/20 : 3/20 : 5/20

= 12 : 3 : 5

*Calculation of Sacrifice Ratio:

Sacrificing ratio =Old Ratio – New Ratio

Ram Sacrificed = 4/5 – 12/20

= 16 – 12/20

= 4/20

Shyam Sacrificed = 1/5 – 3/20

= 4 – 3/20

= 1/20

Sacrificing Ratio of Ram and Shyam = 4 : 1

Admission of a partner-Important Questions-5

Question 3.

Jay and Vijay are partners in a firm sharing profits and losses in the ratio of 3:2. on 31 March 2022 their balance sheet is as under:

On 1st April 2022 they admitted Sanjay as a new partner for 1/8 share of profit on the following terms:

- Sanjay brings ₹ 50,000 as capital and ₹ 20,000 as a premium for goodwill in cash.

- Half of the goodwill withdrawn by jay and Vijay.

- The value of the stock is reduced by₹5,000 while Machinery reduced by 10 %.

- The market value of the investment is ₹ 15,000.

- Bad debts written off ₹ 1,000.

- A patent worth ₹10,000 (not mentioned in the balance sheet) is to be taken into account.

- Provision for a workmen compensation claim ₹ 15,000.

- Outstanding salary₹4,000 not appear on the balance sheet taken into account.

Pass journal entries in the Books of the firm and prepare:

1. Revaluation account

2. Partner’s Capital Account

3. Cash Account

4. Balance sheet

Admission of a partner-Important Questions-5

Question 4.

Anil and Salil are partners in a firm sharing profits and losses in the ratio of 4:1. on 31 March 2022 their balance sheet is as under:

On 1st April 2022 they admitted Kapil as a new partner for 1/6 share of profit on the following terms:

- Kapil brings ₹ 50,000 as capital in cash but unable to bring his share of goodwill in cash.

- Goodwill of the firm is to be valued at ₹ 1,20,000.

- The value of the stock is reduced by₹5,000 while Building increased by 25%.

- The market value of the investment is ₹ 15,000.

- Machinery decreased by 5%.

- Provision for doubtful debts should be @ 5% on debtors.

- A patent worth ₹10,000 (not mentioned in the balance sheet) is to be taken into account.

- Provision for a workmen compensation claim ₹ 15,000.

- Outstanding salary₹4,000 not appear on the balance sheet taken into account.

Pass journal entries in the Books of the firm and prepare:

1. Revaluation account

2. Partner’s Capital Account

3. Cash Account

4. Balance sheet

Admission of a partner-Important Questions-5

Question 5.

Anand and Mahendra are partners in a firm sharing profits and losses in the ratio of 5:3. on 31 March 2022 their balance sheet is as under:

On 1st April 2022 they admitted Surendra as a new partner for 1/5 share of profit on the following terms:

- Surendra brings ₹ 50,000 as capital in cash but unable to bring his share of goodwill in cash.

- Goodwill of the firm is to be valued at ₹ 1,00,000.

- The value of the stock is reduced by ₹10,000 while Building increased by 25%.

- The market value of the investment is ₹ 25,000.

- Machinery decreased by 5%.

- Provision for doubtful debts should be @ 10% on debtors.

- A Typewriter worth ₹12,000 (not mentioned in the balance sheet) is to be taken into account.

- Provision for a workmen compensation claim ₹ 30,000.

- Outstanding salary₹5,000 not appear on the balance sheet taken into account.

Pass journal entries in the Books of the firm and prepare:

1. Revaluation account

2. Partner’s Capital Account

3. Cash Account

4. Balance sheet

Admission of a partner-Important Questions-5

Admission of a partner-Important Questions-1

Admission of a partner-Important Questions-2

Important questions of fundamentals of partnership-3

Profit and loss Appropriation Account

Format of Profit and loss Appropriation Account

Hidden Goodwill at the time of Admission of A New Partner

Important questions of fundamentals of partnership

Important questions of fundamentals of partnership-2

Goodwill questions for practice Class 12 ISC & CBSE

Important questions of fundamentals of partnership-5

ACCOUNTING TREATMENT OF GOODWILL AT THE TIME OF ADMISSION OF A NEW PARTNER

Admission of a partner-Important Questions-3

Admission of a partner-Important Questions-5