Admission of a partner-Important Questions-7

1. Calculation the new profit sharing ratio and sacrificing ratio

2. Accounting treatment of goodwill;

3. Revaluation of assets and reassessment of liabilities;

4. Accounting treatment of undistributed profits and reserves;

5. Accounting treatment of Workmen Compensation Reserves;

6. Accounting treatment of Investment fluctuation Reserves;

7. Partners’ Capital Accounts and balance sheet of the reconstituted firm.

8. Adjustment of old partner’s Capital on the basis of new partner capital or New profit-sharing Ratio.

9. Calculation of the New partner’s capital on the basis of the old partner’s adjusted capital.

Admission of a partner-Important Questions-7

Adjustment of old partner’s Capital on the basis of new partner capital or New profit-sharing Ratio:

Sometimes, during the admission of a new partner, old partners decide to adjust the firm’s entire capital according to the new profit-sharing ratio. In such case, the entire capital of the new firm will be determined on the basis of the new partner’s capital and his profit sharing ratio. Therefore the capital of other partners is ascertained by dividing the total capital as per his profit sharing ratio. If the old (existing) capital of the partner after adjustment is in excess of his new capital, the excess amount is withdrawn by partner or transferred to the credit of his current account. If the old(existing) capital of the partner is less than his new capital, the partner brings the short amount or makes transfer to the debit of his current account.

Adjustment of old partner’s Capital on the basis of new partner capital:

Step 1. Calculate total capital of new firm on the basis of new partner’s capital i.e.

New partner’s capital× Reciprocal of proportion of share profit of new partner.

Step 2. Calculate the new capital of old partners by dividing the total capital in their new

profit sharing ratio.

Step 3. Calculate the adjusted closing capitals of old partners (i.e. after all adjustments have

been made)

Step 4. Calculate the surplus /deficiency in each of the old partner’s capital accounts by

comparing the new capital with their adjusted old capital which is adjusted through cash or

transferred to their Current A/c.

Adjustment of Surplus/Deficiency through Cash:

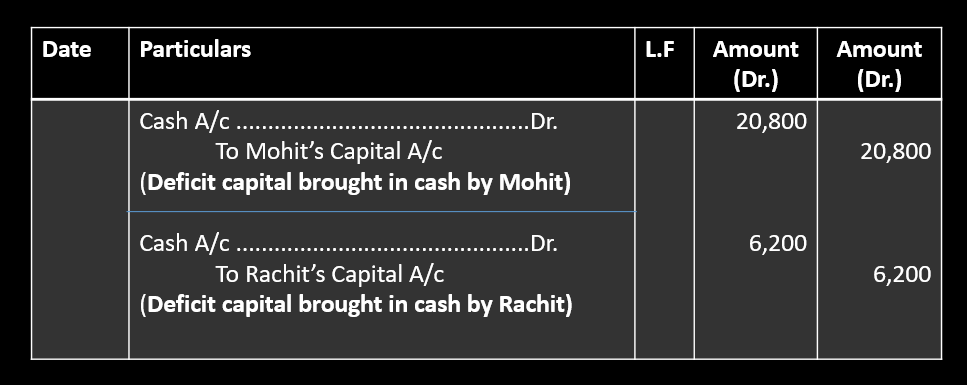

(a) If Capital of Old Partners falls short (Deficit), bring in cash:

Cash/Bank A/c ….Dr.

To Partners’ Capital A/c

(b) If capital of old partner has a surplus, withdraw cash:

Partners’ Capital A/cs ….Dr.

To Cash/Bank A/c

Adjustment of Surplus/Deficiency through Partner’s Current Account:

(a) If the existing capital is more than his required capital (surplus)

Partner’s Capital A/c ….Dr.

To Partner’s Current A/c

(b) If the existing capital is less than his required capital (deficit)

Partner’s Current A/c ….Dr.

To Partner’s Capital A/c

If Current Account shows a Credit Balance, it is taken to the Liabilities side of the Balance Sheet.

However, if Current Account shows a Debit Balance, it is placed on the Assets side of the Balance Sheet.

Admission of a partner-Important Questions-7

Question 1.

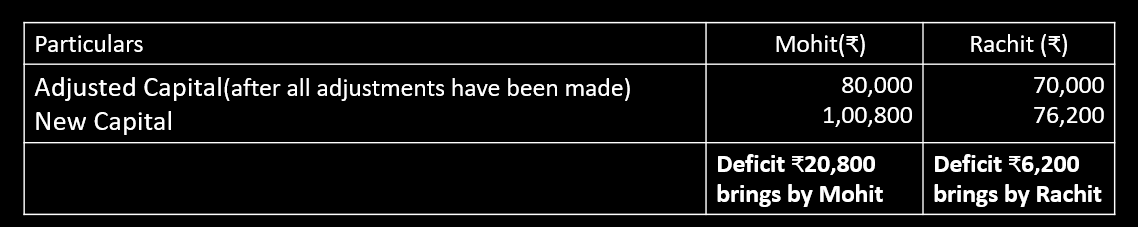

The capital accounts of Mohit and Rachit show the balance after all the adjustments and revaluation as ₹ 80,000 and ₹ 70,000 respectively. They admit Rohit as a new partner for 1/5 share in the profits. Rohit brings ₹42,000 as capital in cash. The new profit sharing ratio of Mohit, Rachit, and Rohit is 12:8:5 respectively. It is agreed that the capitals of all partner’s should be in the new profit-sharing ratio. Excess capital withdrawn or deficit capital brings by the old partners. Pass Journal Entries in the books of firms.

Solution:

Adjustment of old partner’s Capital on the basis of new partner capital:

Adjusted Capital Mohit’s= 80,000

Adjusted Capital Rachit’s= 70,000

The new profit sharing ratio of Mohit, Rachit, and Rohit is 12:8:5.

Rohit admit as a new partner for 1/5 share in the profits.

Rohit Capital For 1/5 share ₹42,000.

Total capital of new firm on the basis of Rohit capital= Rohit’s capital× 5/1

= 42,000× 5/1

= 2,10,000

Mohit’s New Capital=2,10,000×12/25

=1,00,800

Rachit’s New Capital==2,10,000×8/25

=67,200

Journal Entries In the Books of Firms

Admission of a partner-Important Questions-7

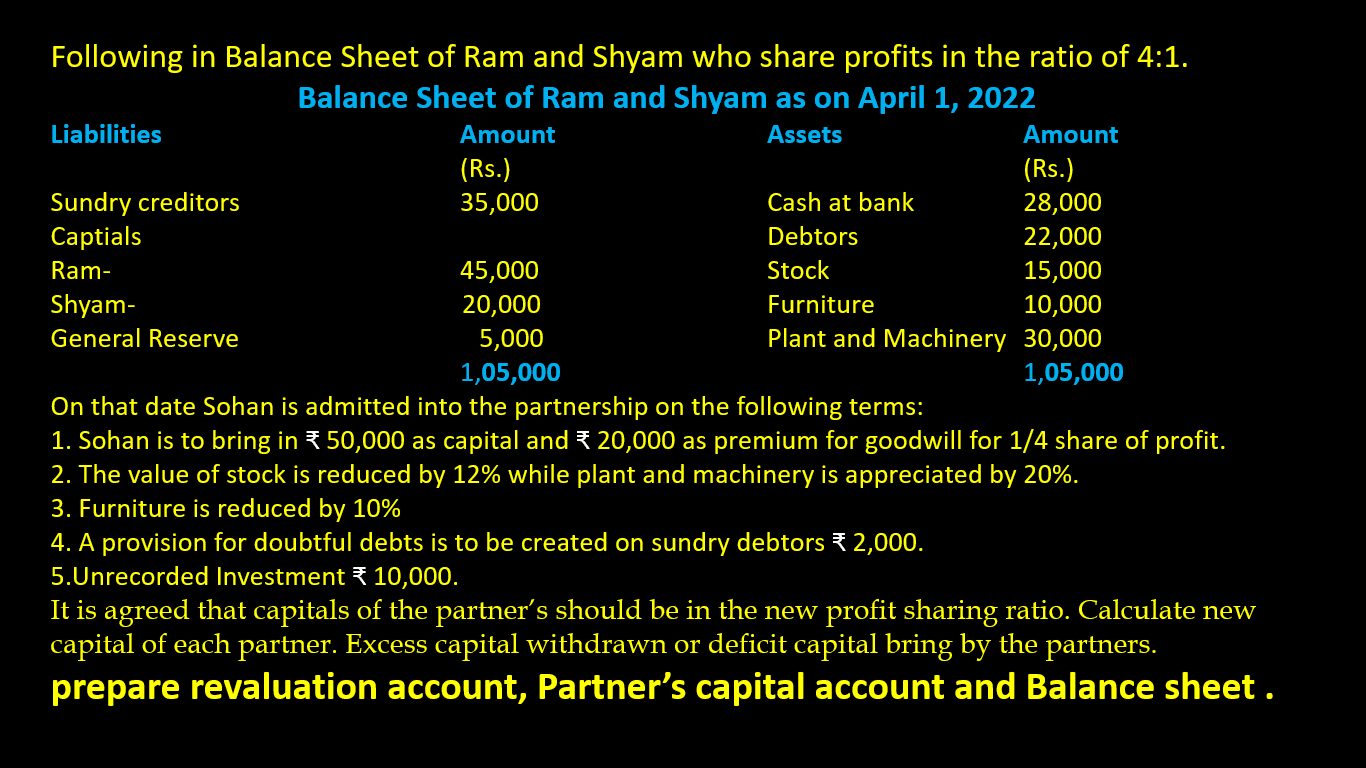

Question 2.

Rachit and Mohit are partners sharing profit in the ratio of 3:2 with capital of ₹80,000 and ₹70,000 respectively. They admit a new partner Nitin. The new profit sharing ratio of Rachit, Mohit and Nitin is 12:8:5 respectively. Nitin brings ₹60,000 as capital and ₹ 20,000 as goodwill. The profit on revaluation of assets and reassessment of liabilities is ₹10,000. General Reserve ₹40,000. It is agreed that capitals of the partner’s should be in the new profit sharing ratio. Calculate new capital of each partner. Excess capital withdrawn or deficit capital bring by the partners. Pass Journal Entries in the books of firms.

Question 3.

Admission of a partner-Important Questions-7

Admission of a partner-Important Questions-1

Admission of a partner-Important Questions-2

Important questions of fundamentals of partnership-3

Profit and loss Appropriation Account

Format of Profit and loss Appropriation Account

Hidden Goodwill at the time of Admission of A New Partner

Important questions of fundamentals of partnership

Important questions of fundamentals of partnership-2

Goodwill questions for practice Class 12 ISC & CBSE

Important questions of fundamentals of partnership-5

ACCOUNTING TREATMENT OF GOODWILL AT THE TIME OF ADMISSION OF A NEW PARTNER

Admission of a partner-Important Questions-3

Admission of a partner-Important Questions-5

Admission of a partner-Important Questions-4