Table of Contents

Cash Flow Statement

A Cash Flow Statement is A statement that shows the inflow and outflow of cash and cash equivalents from operating, investing, and financing activities during a specific period of time.

It shows net increase and net decrease of cash cash equivalents under each activity.

It also explains the reasons for the changes in the cash position of the firm.

In the other words, a Cash Flow Statement is a summary of sources and applications of cash during a particular period of time on the basis of operating, investing, and financing activities.

Cash Inflow:

- Transactions that increase the cash position of the entity are called inflows of cash.

Examples of cash Inflow:

- Cash Sales

- Cash received against Trade receivables

- Rent, Royalty, Commission received

- Insurance Claim received

- Cash received from sale of long term investment

- Cash received from sale of fixed assets

- Loans and Advance received

- Proceeds from issue of Equity shares

- Proceeds from issue of Preference shares

- Proceeds from issue of Debentures

Cash Outflow:

- Transactions that decrease the cash position of the entity are called outflows of cash.

Examples of cash Outflow:

- Cash Purchase

- Cash paid against Trade payables

- Operating expenses paid

- Cash purchase of Long term Investment

- Cash purchase of fixed assets

- Loans and Advance given

- Loans and Advance repaid

- Payment for Buy-back of Equity shares

- Payment for redemption of Preference shares

- Payment for redemption of Debentures

Objectives of Cash Flow Statement

1. Cash flow statement helps to ascertain the sources (receipts) of cash and cash equivalents under operating, investing, and financing activities by the enterprise.

2. It helps to ascertain applications (payments) of cash and cash equivalents under operating, investing, and financing activities by the enterprise.

3. It helps to ascertain the net change in cash and cash equivalents being the difference between sources and applications under the three activities(operating, investing, and financing) between the dates of two balance sheets.

4. It helps in efficient and effective management of cash.

5. It helps to ascertain the liquid position of the firm in a better manner.

6. Cash Flow Statement based on AS-3 (revised) presents separately cash generated and used in operating, investing, and financing activities.

Importance of Cash Flow Statement

1. Cash flow statement useful for short-term financial planning.

2. It is useful for preparing a cash budget.

3. Cash flow statement is helpful in ascertaining cash flow from various activities.

4. Cash flow statement shows the reasons for lower cash balance and higher cash balance with the business enterprise.

5. Cash flow statement is helpful in deciding how much dividend should be paid.

6. Cash flow statement helps in planning the schedule for repayment of loan

and replacement of fixed assets, etc.

7. It is very useful in the evaluation of cash position of a Business enterprise.

Limitations of Cash Flow Statement

1. Non-cash transactions are not shown.

2. It is historical in nature.

3. Not a substitute for an income statement.

4. There is a possibility of window-dressing.

5. Not substitute for a balance sheet.

Cash flow activities

According to AS-3(Revised), There are mainly three activities related to cash flow:

1. Cash Flow From Operating Activities

2. Cash Flow From Investing Activities

3. Cash Flow From Financing Activities

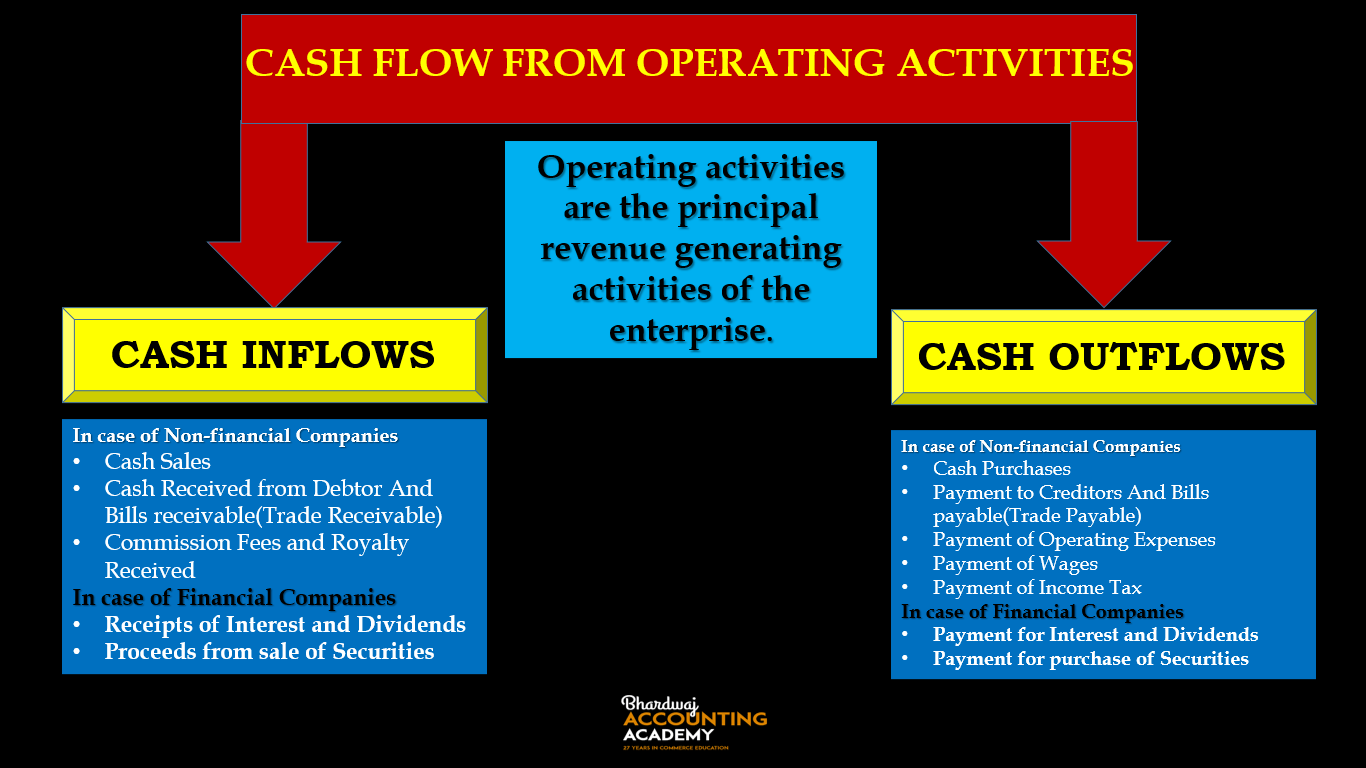

1. Cash Flow From Operating Activities:

Cash Flow from Operating activities are the cash flow from the principal revenue-generating/Producing activities of the enterprise that determine the net profit or loss.

2. Cash Flow From Investing Activities:

Cash Flow From Investing activities includes the acquisition and disposal of Non-Current assets and Non-current Investment that are not included in cash equivalents.

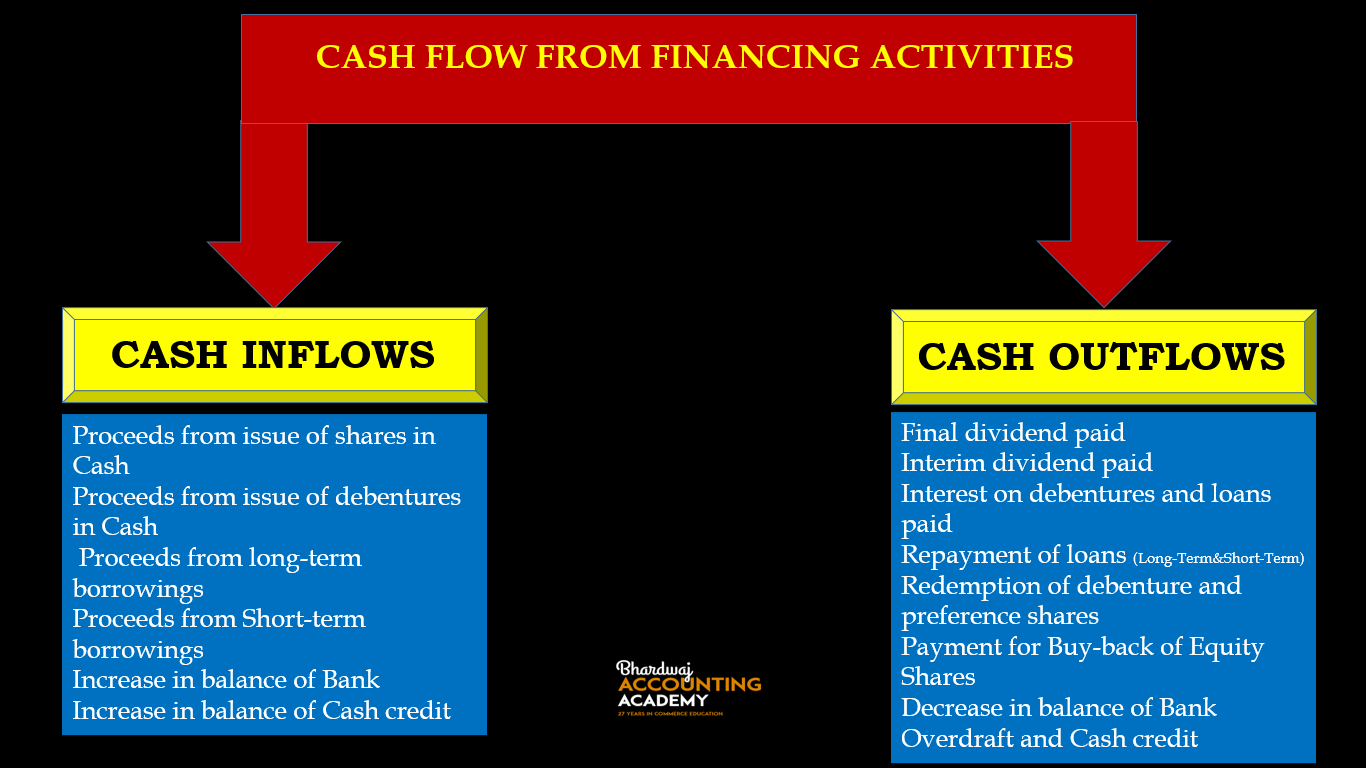

3. Cash Flow From Financing Activities:

Financing activities are activities that result in a change in the size and composition of the owner’s capital (including Equity and preference share capital in the case of a company) and borrowings of the enterprise.

STEPS IN THE PREPARATION OF CASH FLOW STATEMENT

I.Ascertain cash flows from operating activities

II.Ascertain cash flows from investing activities

III.Ascertain cash flows from financing activities

IV.Steps I, II, AND III are added and the resultant figure is net increase or decrease in cash and cash equivalents.

V.Cash and cash equivalents of the beginning are added to the cash flow arrived under step IV.

In the last, we get cash and cash equivalents at the end.

ISC ACCOUNTS Ratio Analysis MCQs with Solved Answers

Trial balance practice questions

10 Balance Sheet Questions for Practice